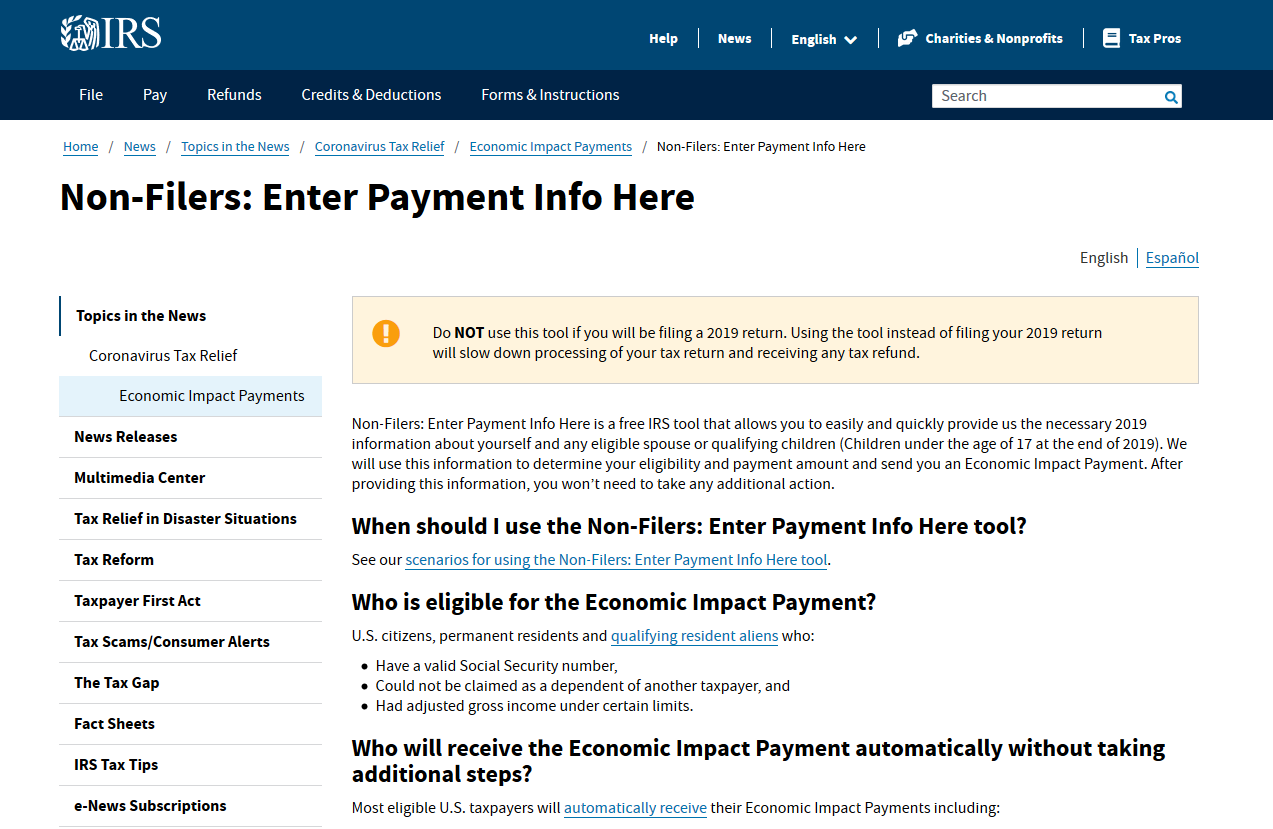

For individuals who have not filed their taxes with the Internal Revenue Service (IRS), the IRS Non Filer Form Printable provides a convenient solution. This form allows non-filers to easily submit their information to the IRS without the need for complicated paperwork or online forms.

The IRS Non Filer Form Printable is designed to simplify the process for individuals who are not required to file a tax return but still need to provide their information to the IRS. By filling out this form, non-filers can ensure that they are in compliance with IRS regulations and avoid any potential penalties or fines.

When using the IRS Non Filer Form Printable, individuals will need to provide basic information such as their name, address, social security number, and any income they may have received during the tax year. Once the form is completed, it can be mailed or submitted online to the IRS for processing.

It is important for non-filers to take advantage of the IRS Non Filer Form Printable to avoid any issues with the IRS. By providing their information in a timely manner, individuals can ensure that they are in good standing with the IRS and avoid any potential consequences for failing to file their taxes.

Overall, the IRS Non Filer Form Printable is a valuable tool for individuals who have not filed their taxes and need to submit their information to the IRS. By using this form, non-filers can easily comply with IRS regulations and avoid any penalties or fines that may result from failing to file their taxes.

In conclusion, the IRS Non Filer Form Printable is a simple and efficient way for individuals to provide their information to the IRS. By using this form, non-filers can ensure that they are in compliance with IRS regulations and avoid any potential consequences for failing to file their taxes.