When it comes to obtaining tax transcripts or other financial information from the Internal Revenue Service (IRS), one of the forms you may need to use is Form 4506t. This form is used to request a transcript of your tax return or other tax information from the IRS. It can be a crucial document for various purposes, such as applying for a mortgage or loan, verifying income for a job application, or resolving tax-related issues.

Form 4506t is available in a printable format, making it easy for individuals to fill out and submit to the IRS. By using the printable version of the form, you can conveniently access and complete it at your own pace, without the need for specialized software or online tools.

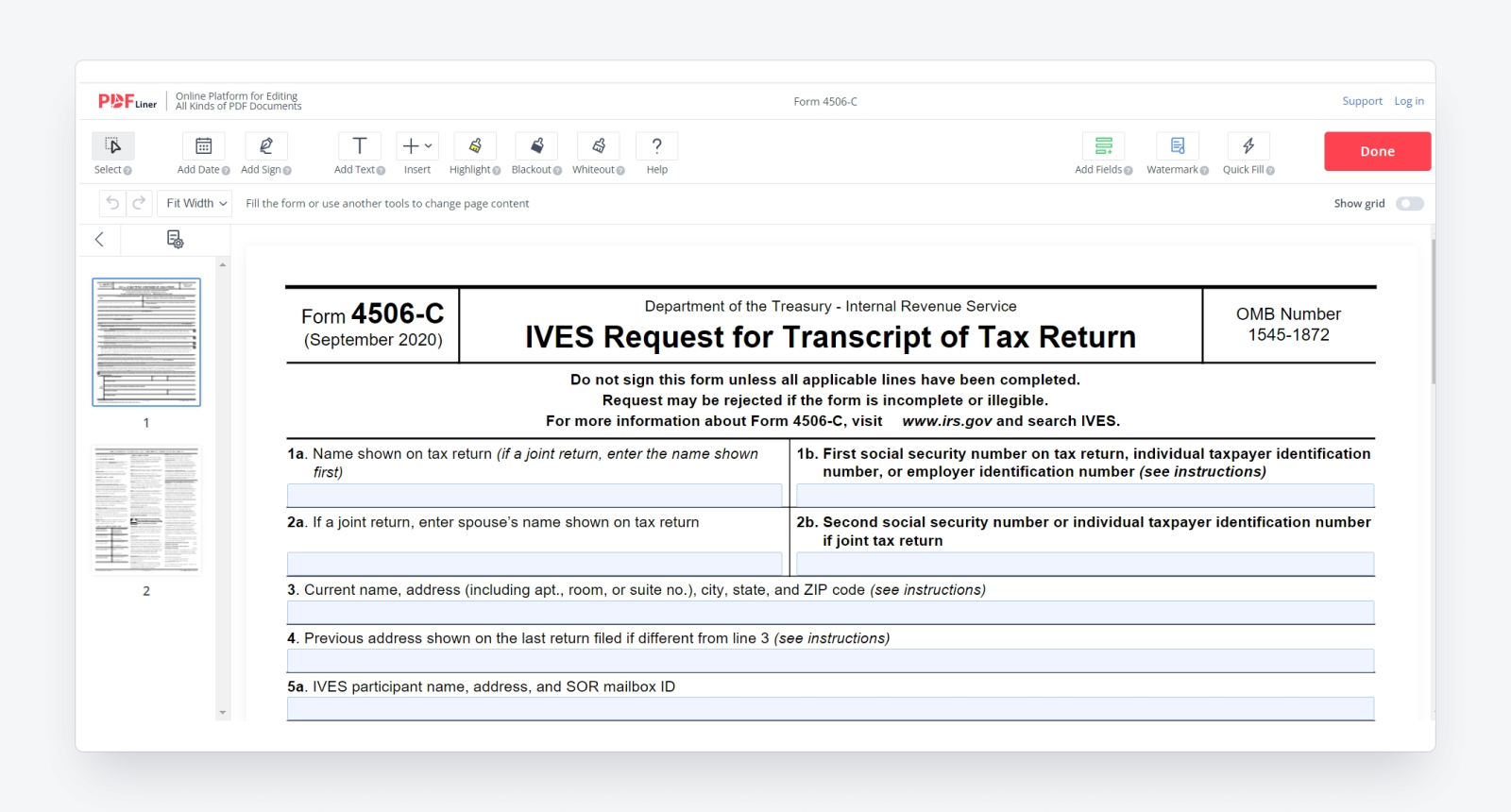

When filling out Form 4506t, you will need to provide your personal information, including your name, address, Social Security number, and the tax year(s) you are requesting transcripts for. You will also need to specify the type of transcript you need, such as a return transcript, account transcript, or wage and income transcript.

Once you have filled out the form, you can mail it to the address provided on the form or fax it to the IRS. It is important to double-check your information and ensure that all required fields are completed accurately to avoid any delays in processing your request.

Keep in mind that there may be a fee associated with requesting transcripts using Form 4506t. The IRS typically charges a fee for each transcript requested, so be sure to check the current fee schedule on the IRS website before submitting your form.

In conclusion, IRS Form 4506t is a valuable tool for obtaining tax transcripts and other financial information from the IRS. By using the printable version of the form, you can easily request the documents you need for various purposes. Make sure to carefully fill out the form and submit it promptly to avoid any delays in processing your request.