When it comes to filing your federal taxes, having access to printable IRS tax forms can make the process much easier. Instead of having to wait for forms to arrive in the mail or visit a local IRS office, you can simply download and print the forms you need right from the comfort of your own home.

Whether you are an individual filer, a small business owner, or a tax professional, having access to printable IRS tax forms can save you time and hassle during tax season.

Irs Federal Tax Forms Printable

Irs Federal Tax Forms Printable

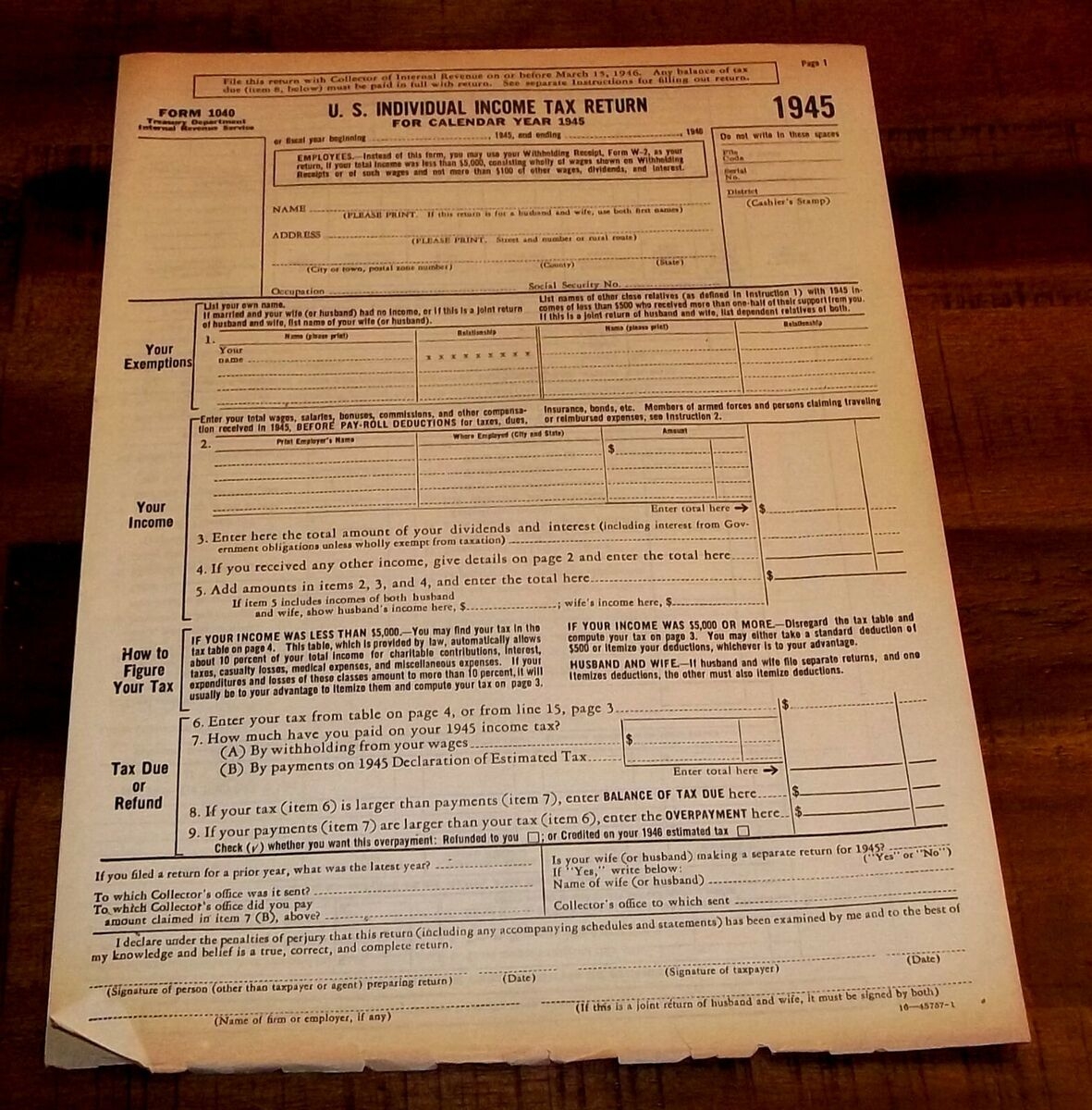

There are a variety of IRS tax forms available for download and printing, including Form 1040 for individual income tax returns, Form 1099 for reporting various types of income, and Form W-2 for reporting wages and taxes withheld by an employer.

In addition to federal tax forms, the IRS website also offers a range of instructions and publications to help taxpayers understand how to properly fill out their forms and maximize their deductions and credits.

It’s important to note that while many tax forms can be filed electronically, some taxpayers may still prefer to file by mail using printed forms. Having access to printable IRS tax forms ensures that you have all the necessary documents on hand to file your taxes accurately and on time.

So, whether you prefer to file your taxes online or by mail, having access to printable IRS tax forms can make the process smoother and more convenient. Be sure to visit the official IRS website to download the forms you need for this tax season.