As tax season approaches, it’s important to have all the necessary forms and documents ready to file your taxes accurately and on time. The IRS provides printable tax forms for individuals and businesses to make the process easier and more convenient. By utilizing these forms, taxpayers can ensure they are providing the correct information required by the IRS.

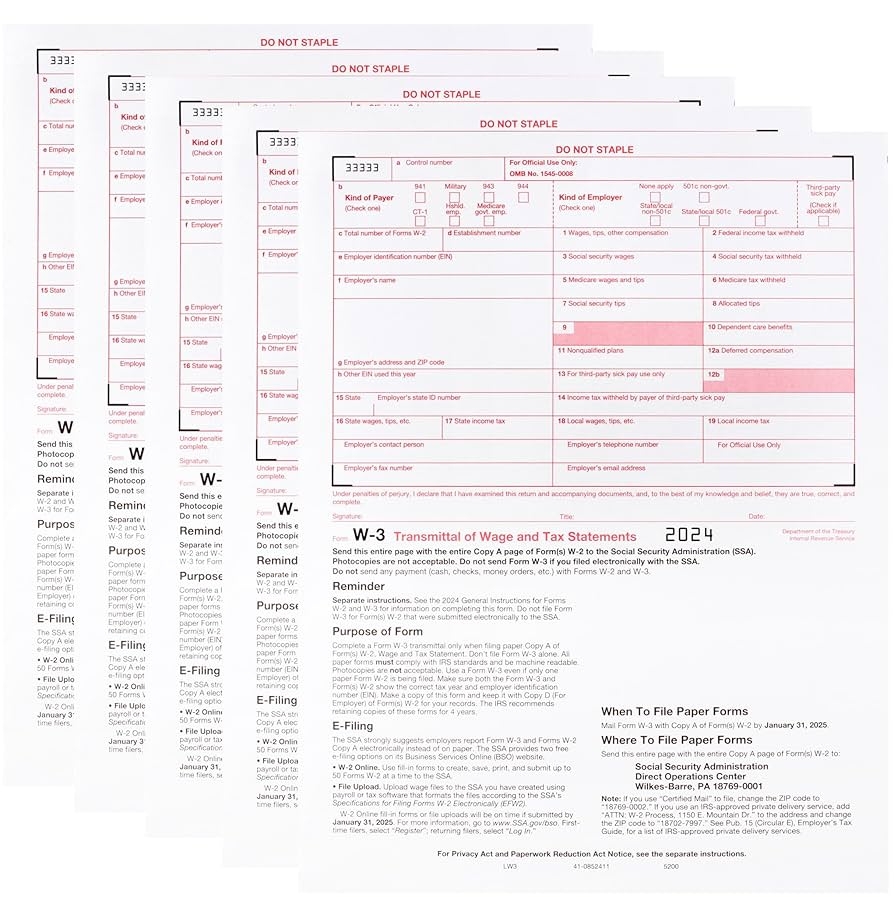

Whether you are filing as an individual, a small business owner, or a corporation, the IRS offers a variety of printable tax forms for different types of income, deductions, and credits. These forms are essential for reporting income, claiming deductions, and calculating tax liability accurately. By using the IRS 2024 printable tax forms, taxpayers can avoid errors and potential audits.

One of the most commonly used forms is the 1040 form, which is used by individuals to report their annual income and calculate their tax liability. This form includes sections for income, deductions, credits, and any taxes owed or refunded. Additionally, there are schedules and worksheets that may need to be attached depending on the taxpayer’s specific situation.

For businesses, the IRS offers printable tax forms such as the 1120 form for corporations and the 1065 form for partnerships. These forms require detailed information about the business’s income, expenses, assets, and liabilities. By accurately completing these forms, businesses can ensure they are complying with tax laws and regulations.

It’s important to note that the IRS updates tax forms and instructions annually, so it’s essential to use the most current versions for filing your taxes. By downloading and printing the IRS 2024 printable tax forms from the official IRS website, taxpayers can access the latest forms and instructions to complete their tax returns accurately and efficiently.

In conclusion, utilizing the IRS 2024 printable tax forms is essential for individuals and businesses to report their income, deductions, and credits accurately. By using these forms, taxpayers can ensure they are providing the correct information required by the IRS and avoid potential errors or audits. Be sure to download the latest forms from the official IRS website to stay up-to-date with any changes for the upcoming tax season.