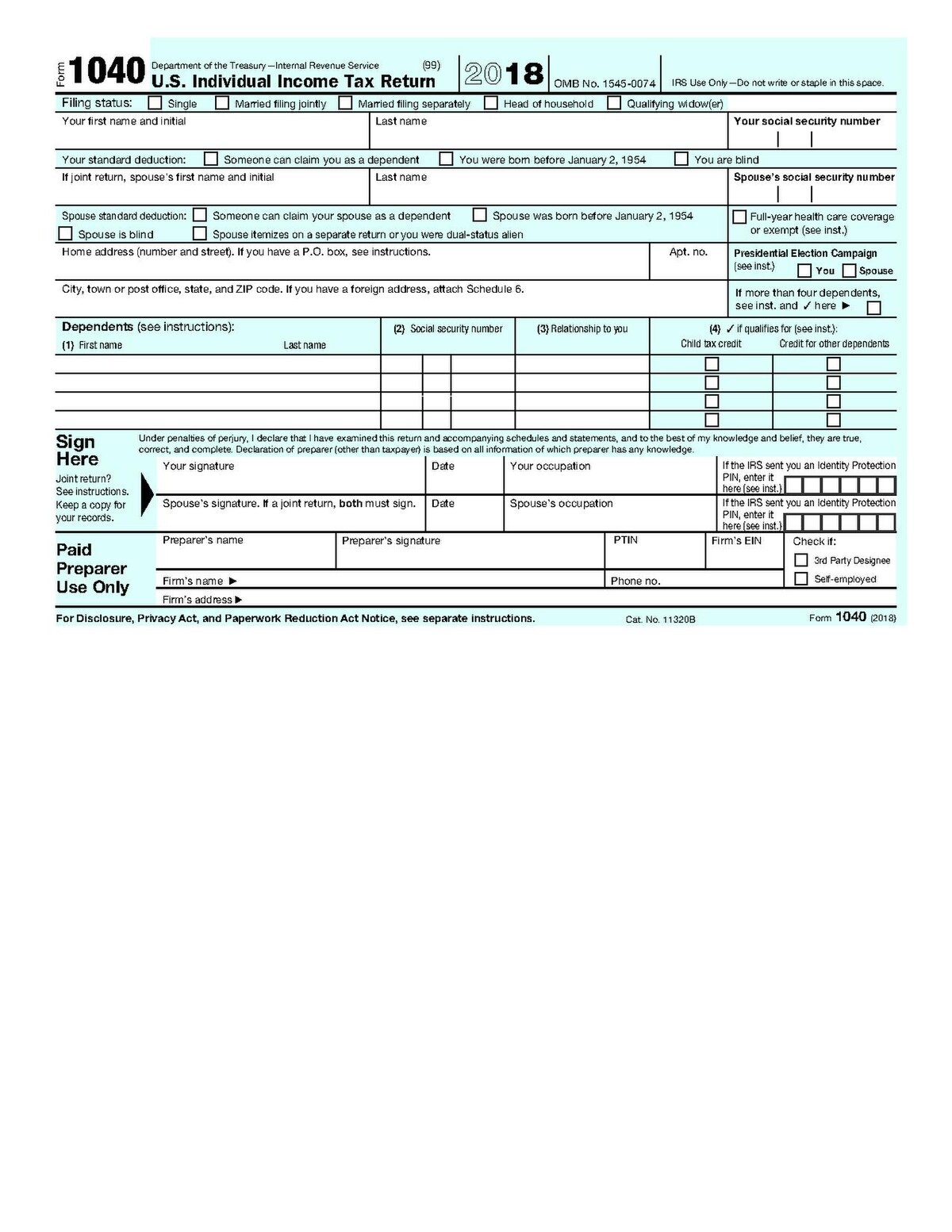

As we approach the tax season in 2024, many individuals and businesses are gearing up to file their tax returns. One of the most commonly used forms is the IRS Tax Form 1040, which is used by individuals to report their income, deductions, and credits to determine the amount of tax they owe or the refund they can expect.

It is essential for taxpayers to stay informed about any updates or changes to the tax forms to ensure accurate and timely filing. The IRS provides printable versions of the tax forms on their website, making it convenient for taxpayers to access and fill out the necessary documents.

2024 Irs Tax Forms 1040 Printable

2024 Irs Tax Forms 1040 Printable

When accessing the 2024 IRS Tax Form 1040 printable, taxpayers should carefully review the instructions provided by the IRS to ensure they are completing the form accurately. The form will require information such as income sources, deductions, and credits, which will determine the taxpayer’s tax liability or refund amount.

It is important for taxpayers to gather all relevant documents, such as W-2s, 1099s, and receipts for deductions, before filling out the form. By being organized and thorough in their reporting, taxpayers can avoid errors and potential audits by the IRS.

Once the taxpayer has completed the 2024 IRS Tax Form 1040 printable, they can either file electronically through e-file or mail the form to the IRS. Electronic filing is generally faster and more convenient, with the option to receive refunds via direct deposit.

As the tax deadline approaches, it is crucial for taxpayers to file their returns on time to avoid penalties and interest charges. By utilizing the 2024 IRS Tax Form 1040 printable and following the instructions provided, taxpayers can navigate the tax filing process with confidence and accuracy.

Stay informed and up to date on any changes to the tax laws and forms to ensure a smooth filing process and accurate reporting of income and deductions. The IRS website is a valuable resource for accessing printable forms and instructions to help taxpayers meet their obligations and claim any eligible credits or deductions.