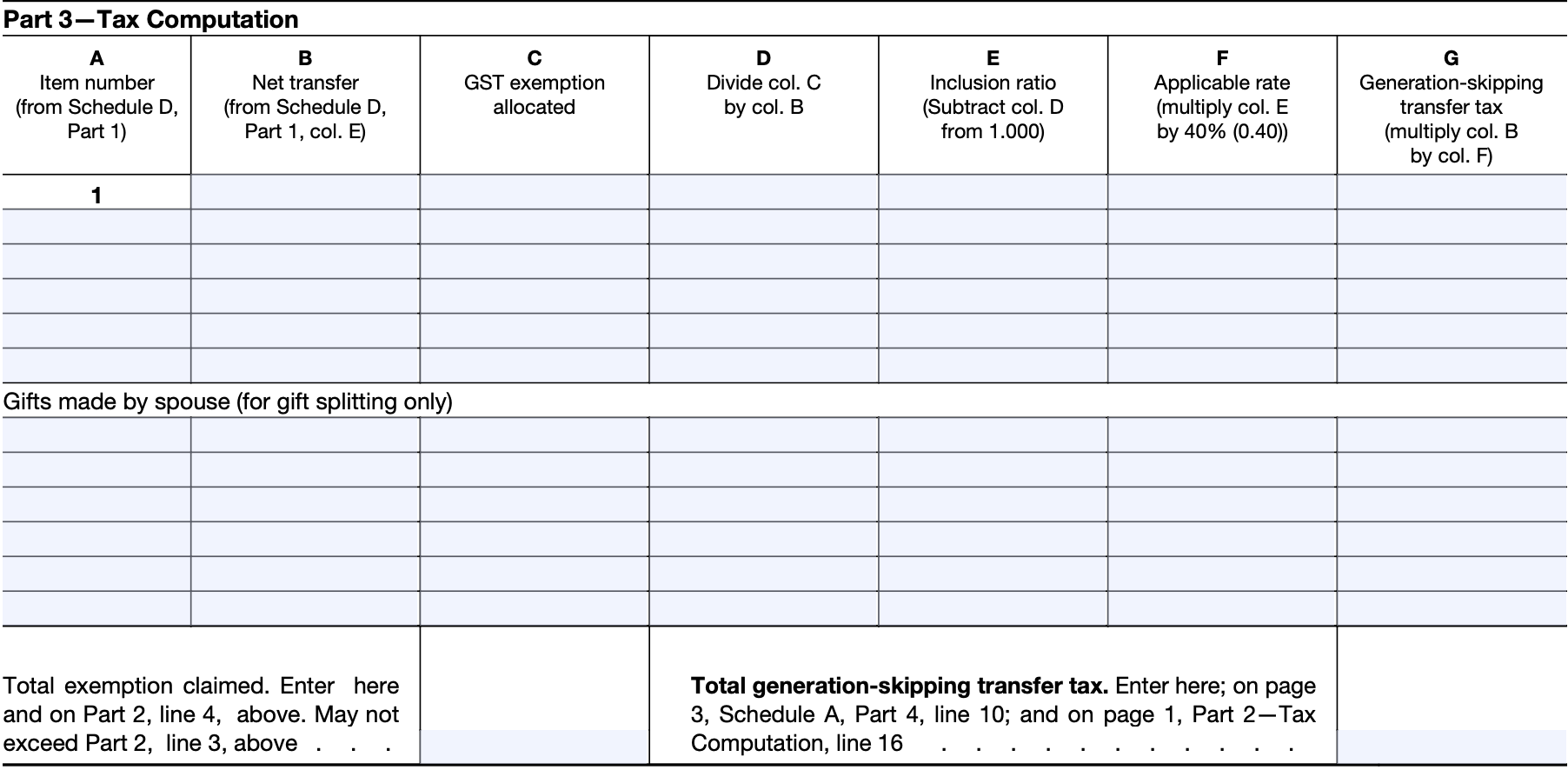

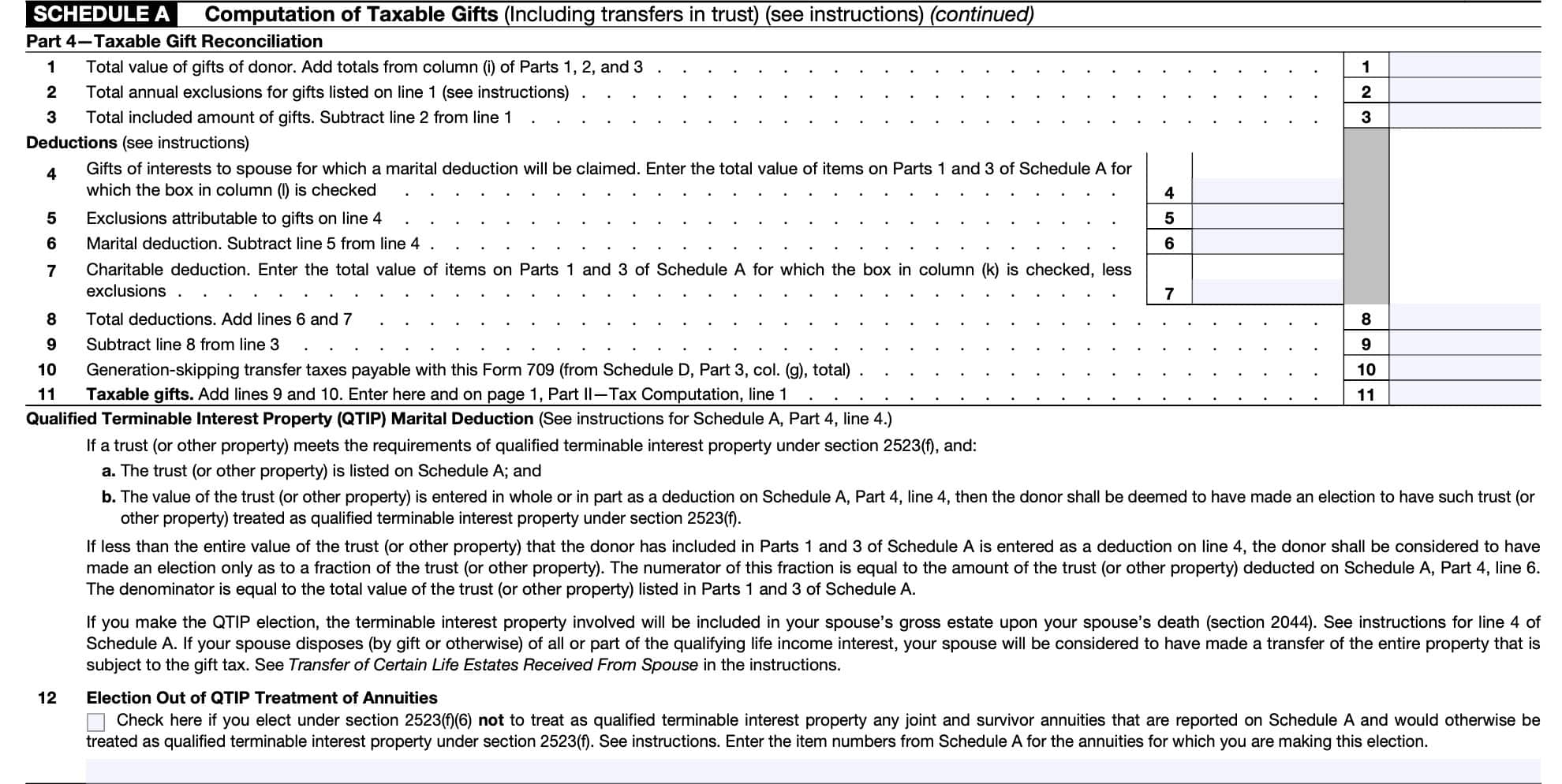

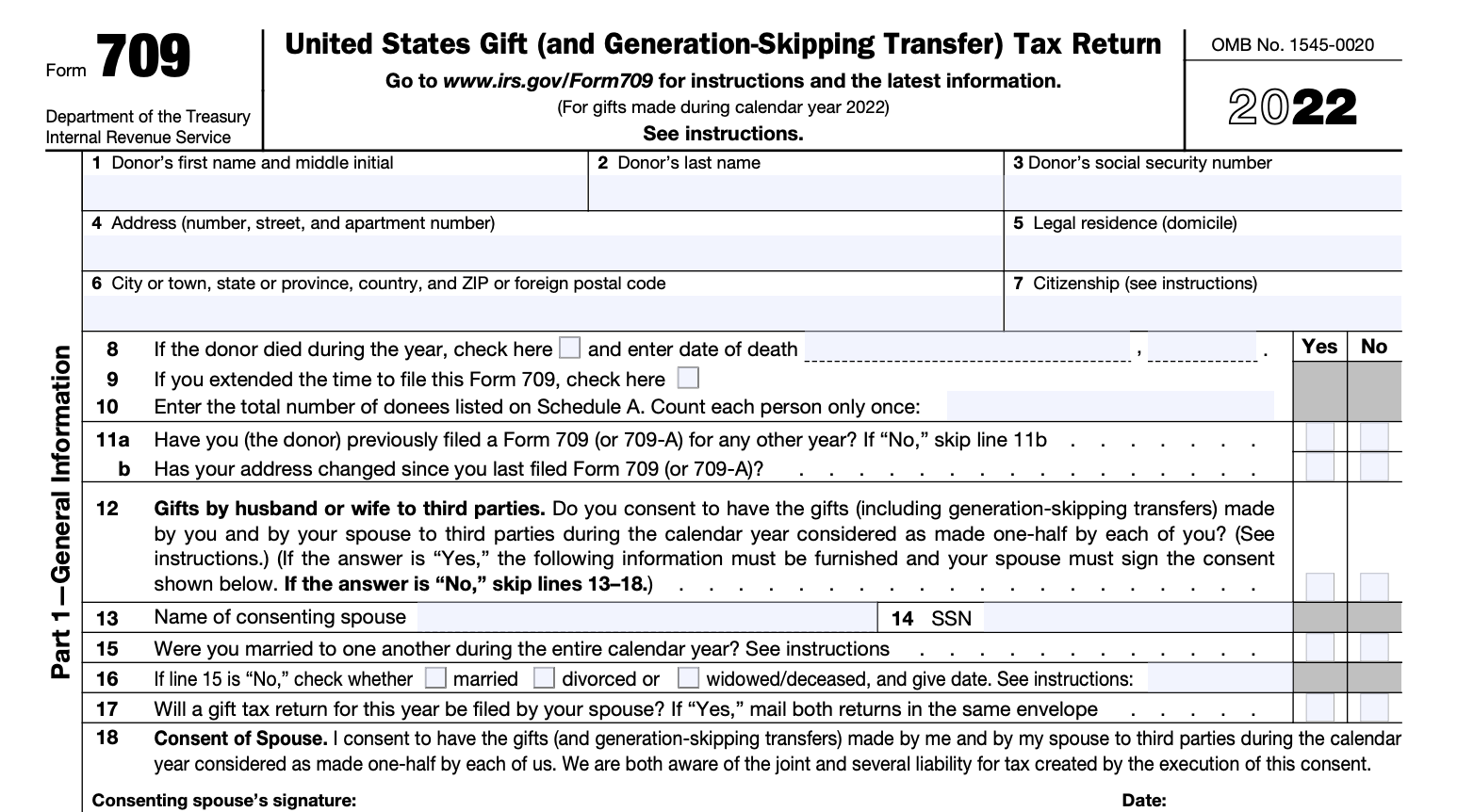

As we approach the tax season for 2024, it’s important to stay informed about any changes or updates to IRS forms. One such form that may be relevant to you is the IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return. This form is used to report gifts that exceed the annual exclusion amount, as well as generation-skipping transfers.

For the year 2024, the IRS has released a printable version of Form 709 that taxpayers can fill out and submit. This form is essential for individuals who have made gifts or transfers that are subject to gift or generation-skipping transfer tax. By accurately completing and filing Form 709, taxpayers can ensure compliance with IRS regulations and avoid potential penalties.

When filling out the 2024 IRS Form 709, taxpayers will need to provide information about the donor, the recipient of the gift, and details about the gift or transfer itself. It’s important to carefully review the instructions provided by the IRS to ensure that all necessary information is included on the form. Additionally, taxpayers may need to consult with a tax professional for guidance on complex gift or transfer situations.

One key aspect of Form 709 is the calculation of the gift tax owed on the transfer. The IRS provides a gift tax unified credit that can offset any gift tax liability, but this credit is subject to certain limitations. By accurately completing Form 709 and taking advantage of available credits and deductions, taxpayers can minimize their tax liability and maximize their gift-giving strategies.

As the tax landscape continues to evolve, it’s important for taxpayers to stay informed about changes to IRS forms and regulations. The printable 2024 IRS Form 709 is a valuable tool for individuals who are engaging in gift-giving and generation-skipping transfer activities. By understanding the requirements of Form 709 and seeking professional guidance when needed, taxpayers can navigate the complexities of gift tax laws with confidence.

In conclusion, the 2024 IRS Form 709 Printable is a crucial document for individuals who are making gifts or transfers that are subject to gift or generation-skipping transfer tax. By accurately completing and submitting this form, taxpayers can ensure compliance with IRS regulations and optimize their tax planning strategies. Stay informed and prepared for the upcoming tax season by utilizing the resources provided by the IRS, including the printable Form 709.

Save and Print 2024 Irs Form 709 Printable

Printable payroll are ideal for companies that prefer paper documentation or need hard copies for employee records. Most forms include fields for staff name, pay period, gross pay, taxes, and net pay—making them both comprehensive and easy to use.

Begin streamlining your payroll system today with a trusted printable payroll form. Save time, reduce errors, and maintain clear records—all while keeping your employee payment data clear.

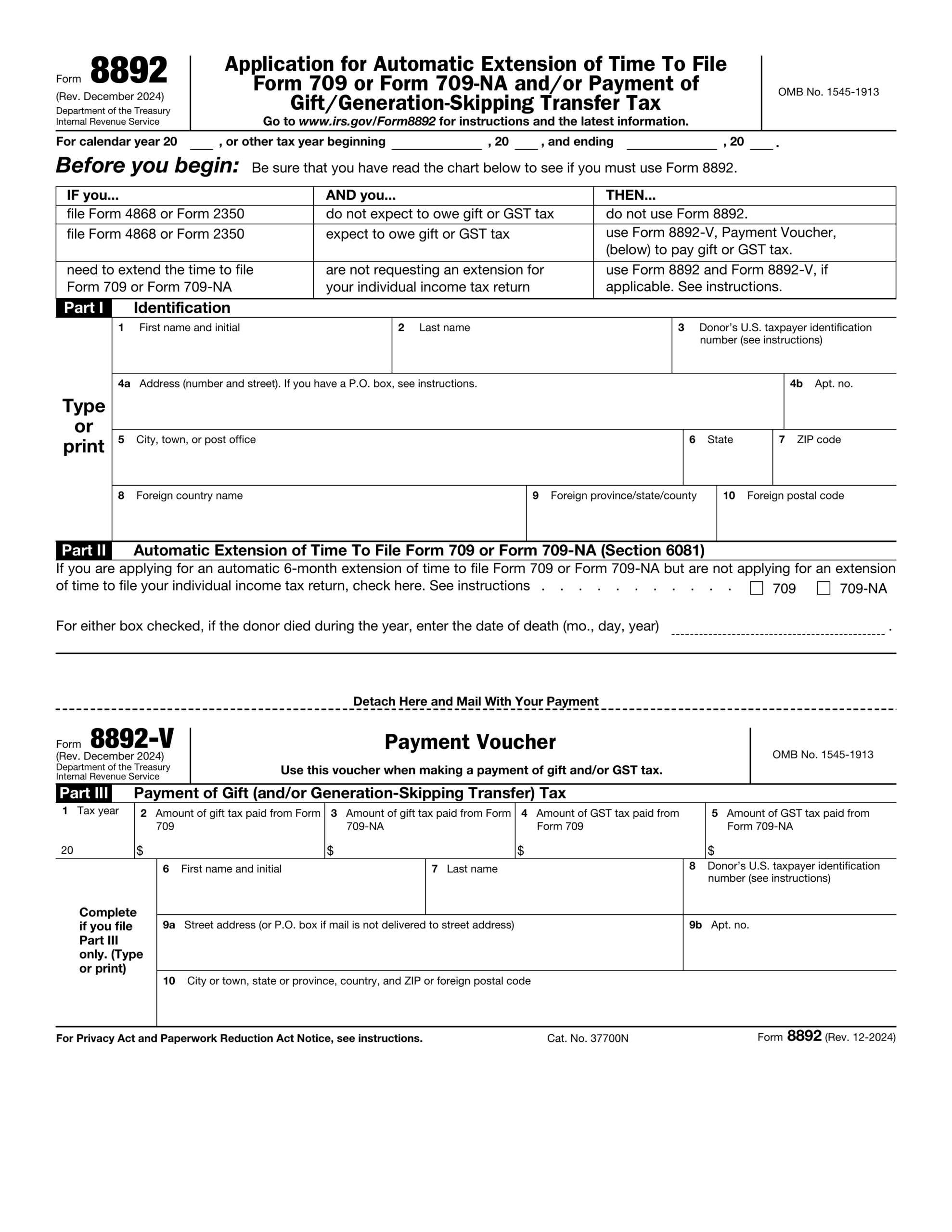

Fill Form 8892 2024 2025 Application For Extension Of Time To File

Fill Form 8892 2024 2025 Application For Extension Of Time To File

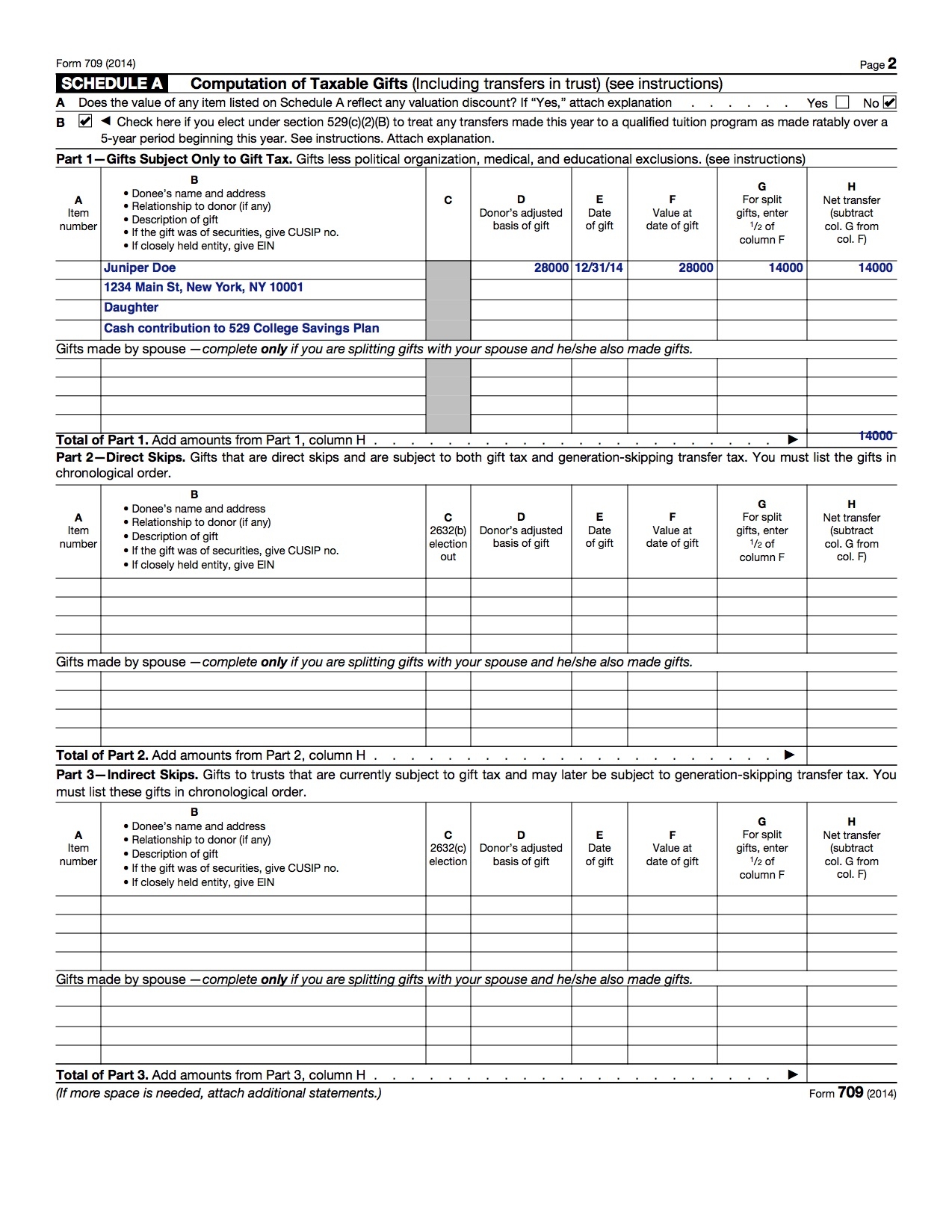

Completed Sample IRS Form 709 Gift Tax Return For 529 Superfunding Front Loading My Money Blog

Completed Sample IRS Form 709 Gift Tax Return For 529 Superfunding Front Loading My Money Blog

Processing employee payments doesn’t have to be complicated. A 2024 Irs Form 709 Printable offers a fast, reliable, and straightforward method for tracking wages, shifts, and withholdings—without the need for digital systems.

Whether you’re a freelancer, payroll manager, or independent contractor, using apayroll printable helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and complete it by hand or edit it digitally before printing.