As tax season approaches, many individuals are gearing up to file their annual taxes with the IRS. One of the most commonly used forms for individual tax returns is the IRS Form 1040. This form is used to report an individual’s income, deductions, and credits for the year, and ultimately determine whether they owe taxes or are eligible for a refund.

While filing taxes can be a daunting task for some, having access to printable IRS Forms 1040 can make the process a bit easier. These forms can be easily downloaded from the IRS website or obtained from various tax preparation services. By having the form in a printable format, individuals can fill it out at their own pace and ensure that all necessary information is included.

When filling out the IRS Form 1040, individuals will need to provide information such as their income, deductions, and credits. This includes details on wages, investments, self-employment income, and any deductions or credits they may be eligible for. Having a printable form on hand can help individuals organize their information and ensure that they are accurately reporting their financial situation to the IRS.

Once the IRS Form 1040 is completed, individuals can either file their taxes electronically or mail the form to the IRS. If filing by mail, it is important to double-check that all information is accurate and that any required documentation is included. By using a printable form, individuals can easily make corrections or updates before submitting their tax return.

Overall, having access to printable IRS Forms 1040 can streamline the tax filing process for individuals. By having the form in a printable format, individuals can easily fill it out, organize their information, and ensure that they are accurately reporting their financial situation to the IRS. Whether filing electronically or by mail, having a printable form on hand can make the process easier and less stressful for taxpayers.

In conclusion, printable IRS Forms 1040 are a valuable resource for individuals preparing to file their annual taxes. By having the form in a printable format, individuals can easily fill it out, organize their information, and ensure that they are accurately reporting their financial situation to the IRS. Whether filing electronically or by mail, having a printable form on hand can make the process easier and less stressful for taxpayers.

Download and Print Printable Irs Forms 1040

Payroll printable are ideal for businesses that prefer physical records or need printed versions for employee records. Most forms include fields for employee name, date range, gross pay, withholdings, and final salary—making them both complete and easy to use.

Take control of your payroll process today with a trusted payroll printable. Save time, reduce errors, and maintain clear records—all while keeping your financial logs professional.

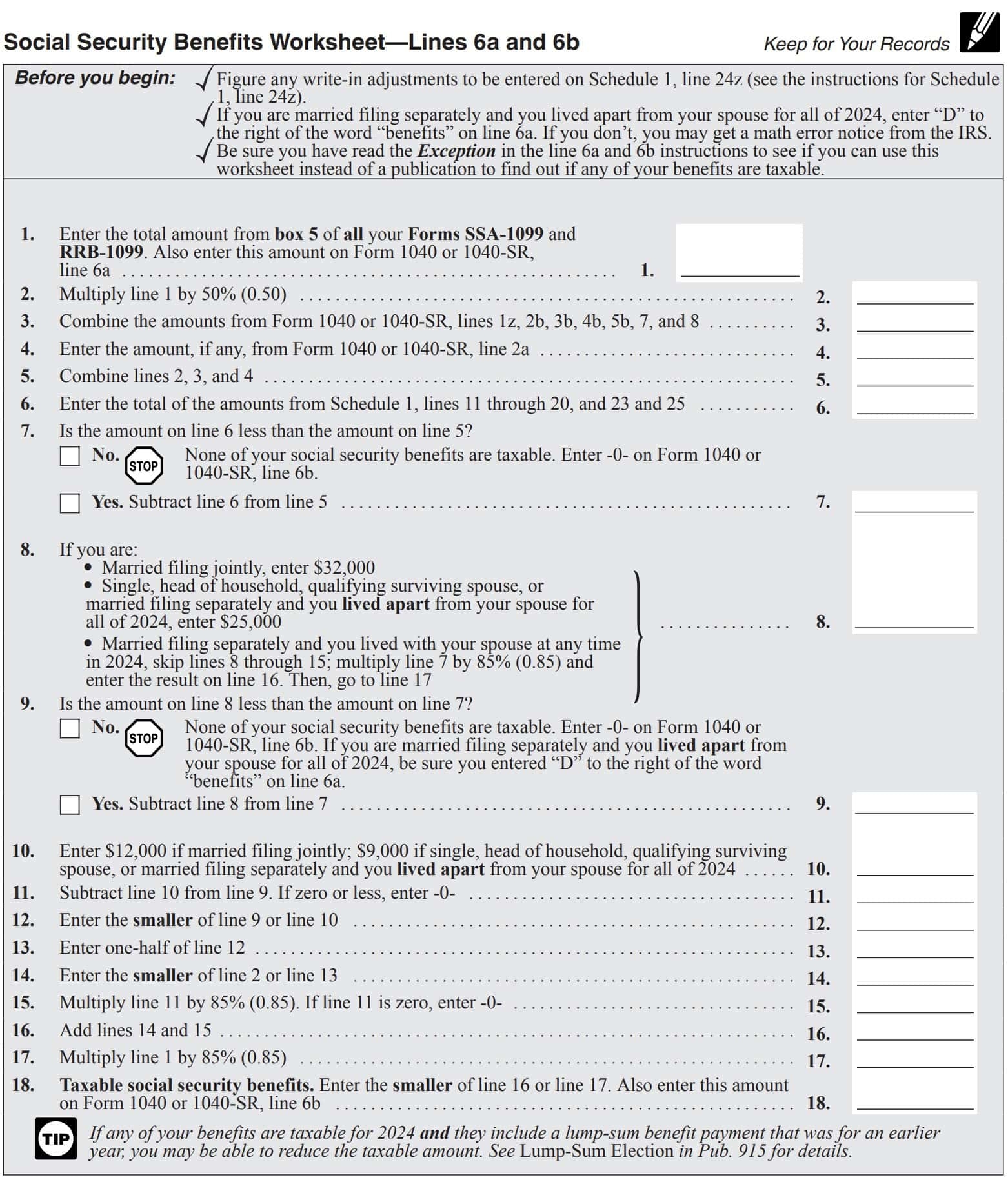

IRS Form 1040 SR Instructions Tax Return For Seniors

IRS Form 1040 SR Instructions Tax Return For Seniors

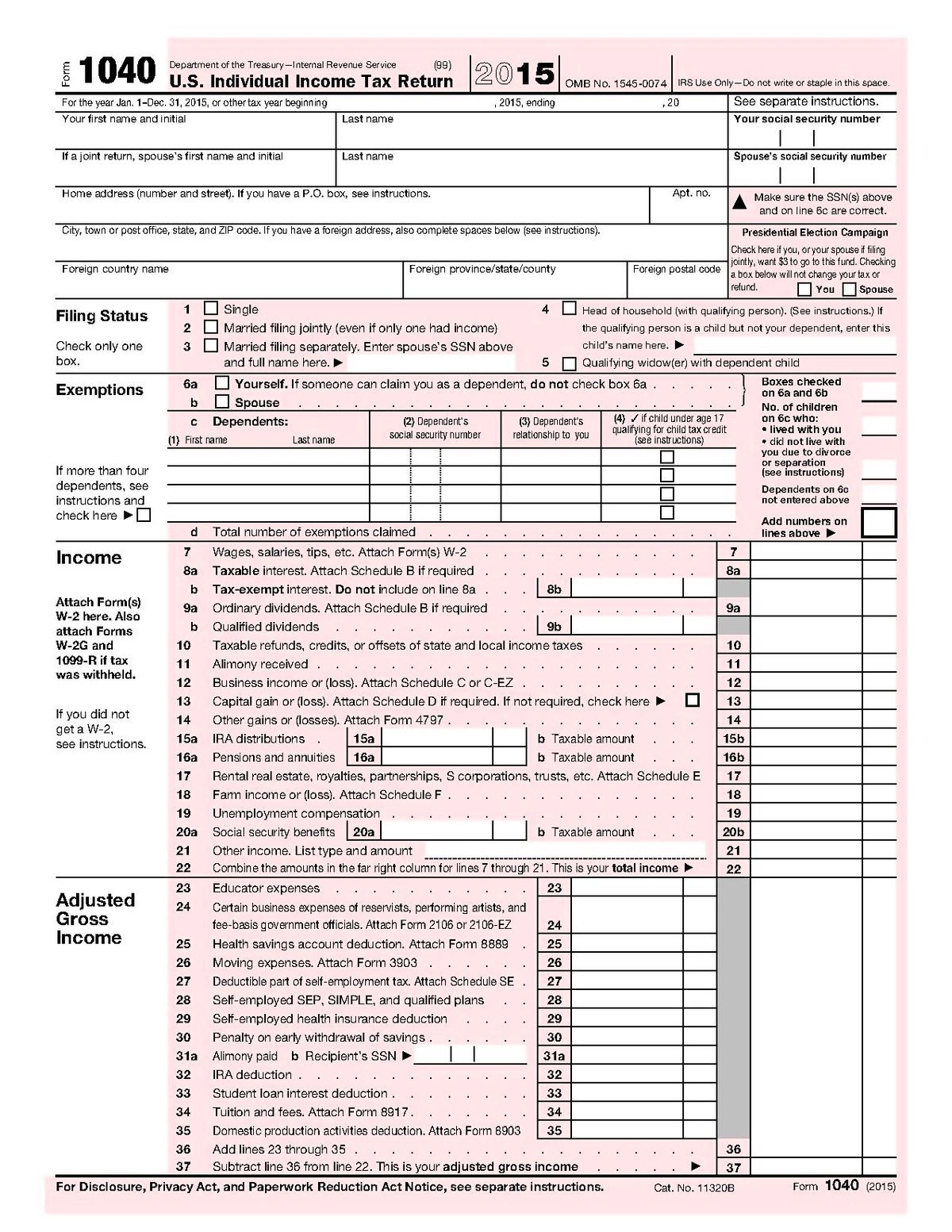

2015 IRS 1040 Form Irs Tax Forms Income Tax Return

2015 IRS 1040 Form Irs Tax Forms Income Tax Return

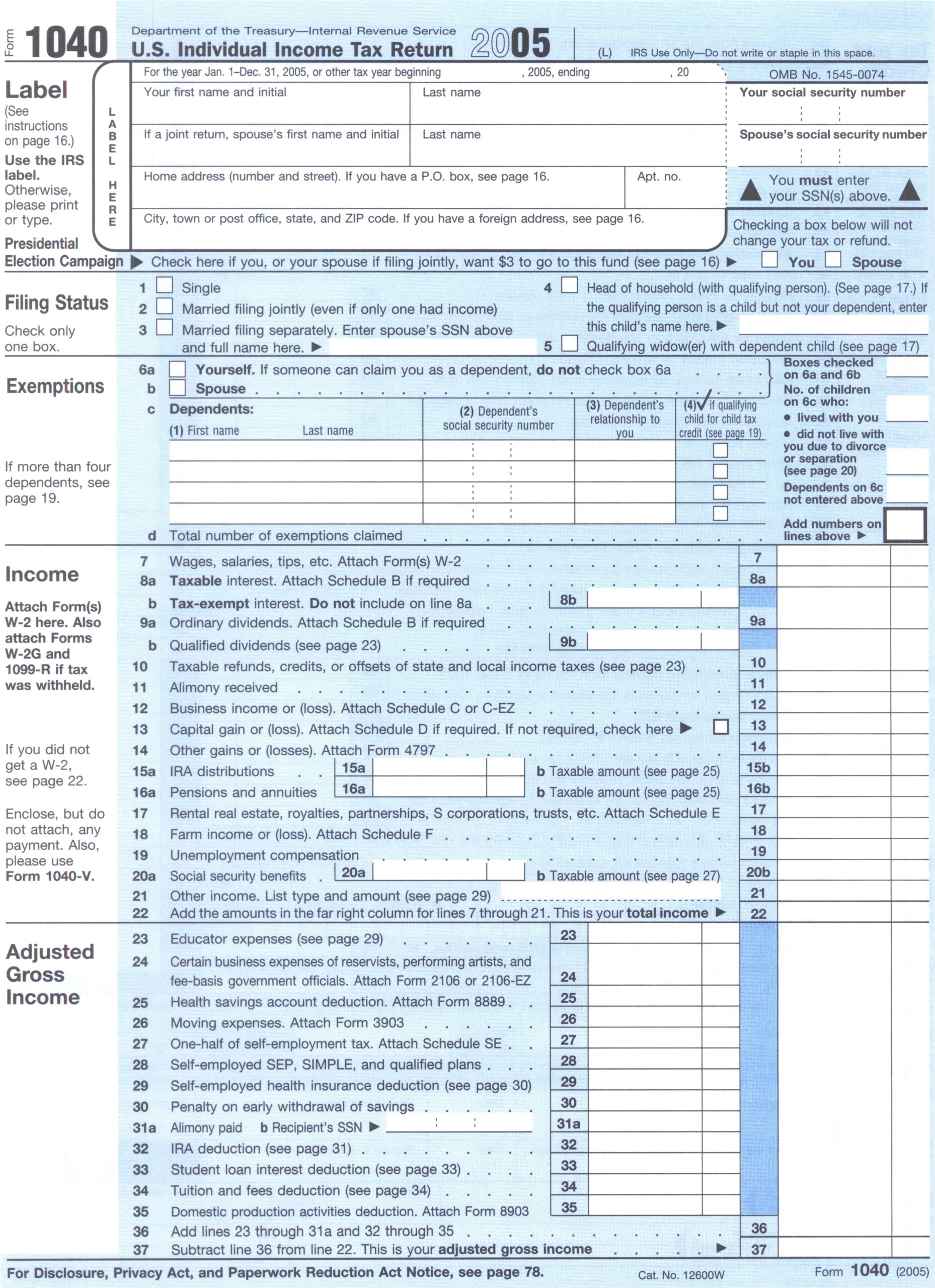

File Form 1040 2005 Jpg Wikimedia Commons

File Form 1040 2005 Jpg Wikimedia Commons

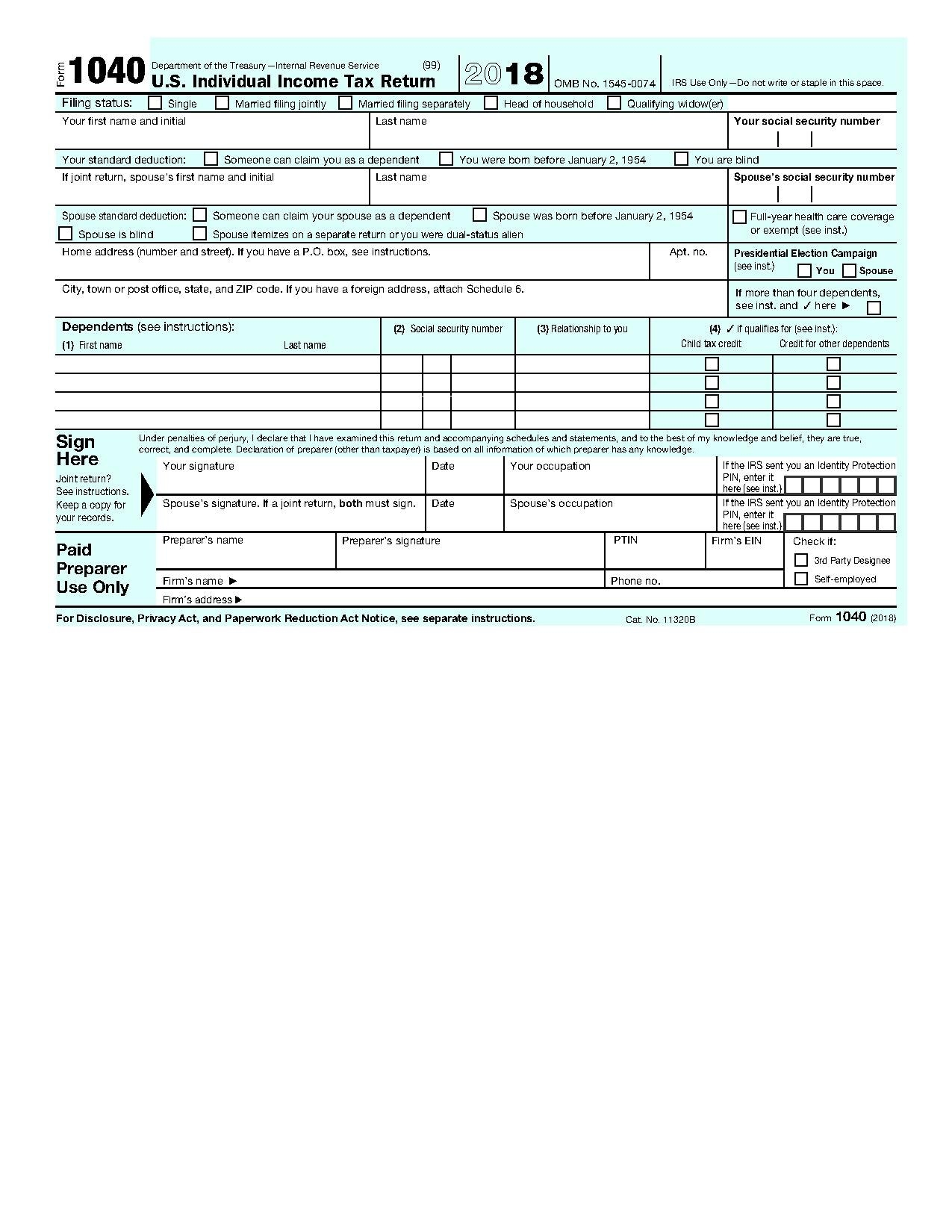

File IRS Form 1040 2018 Pdf Wikimedia Commons

File IRS Form 1040 2018 Pdf Wikimedia Commons

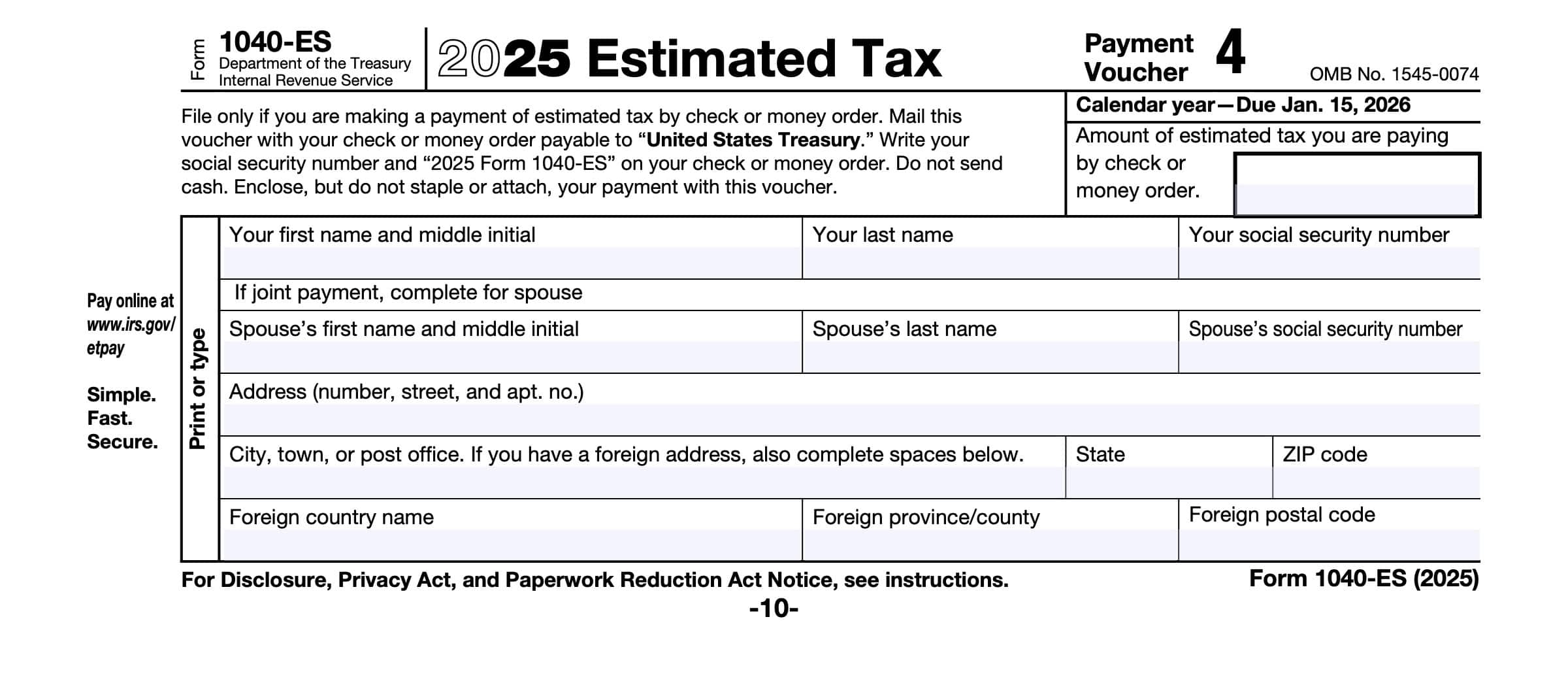

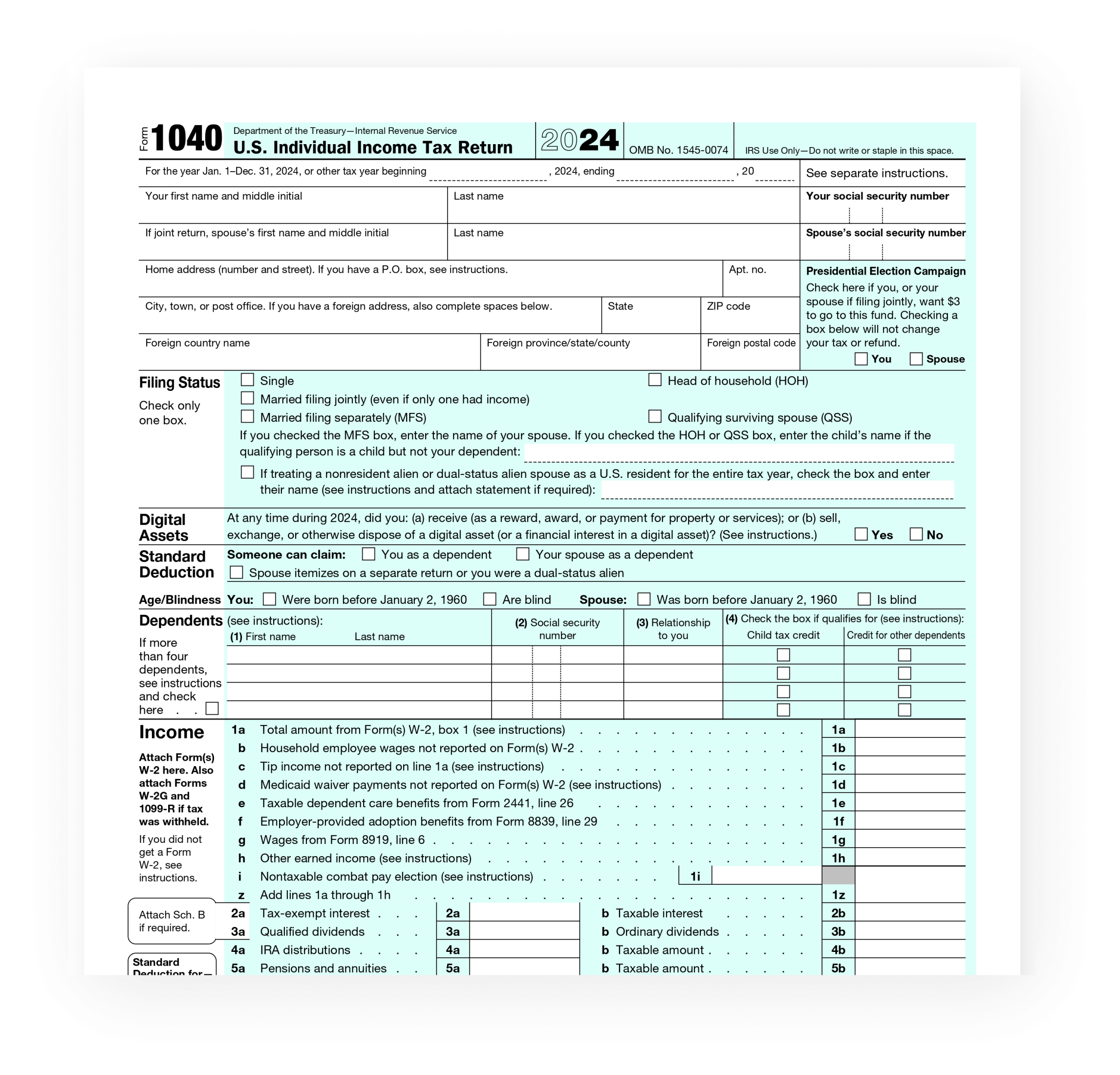

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

How To Fill Out IRS Form 1040 What Is IRS Form 1040 ES

Handling payroll tasks doesn’t have to be difficult. A printable payroll template offers a quick, reliable, and easy-to-use method for tracking employee pay, work time, and deductions—without the need for digital systems.

Whether you’re a small business owner, HR professional, or independent contractor, using apayroll printable helps ensure accurate record-keeping. Simply get the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.