When it comes to managing your taxes, it’s important to stay organized and keep accurate records. One way to do this is by using IRS Form W-4P, which is used to withhold federal income tax from certain payments, such as pension distributions or annuities. This form allows you to specify how much tax you want to have withheld from these payments, helping you avoid any surprises come tax season.

Printable IRS Form W-4P can be easily accessed online and filled out according to your specific needs. By taking the time to complete this form accurately, you can ensure that the right amount of tax is being withheld from your payments, helping you avoid underpayment penalties or overpaying the IRS.

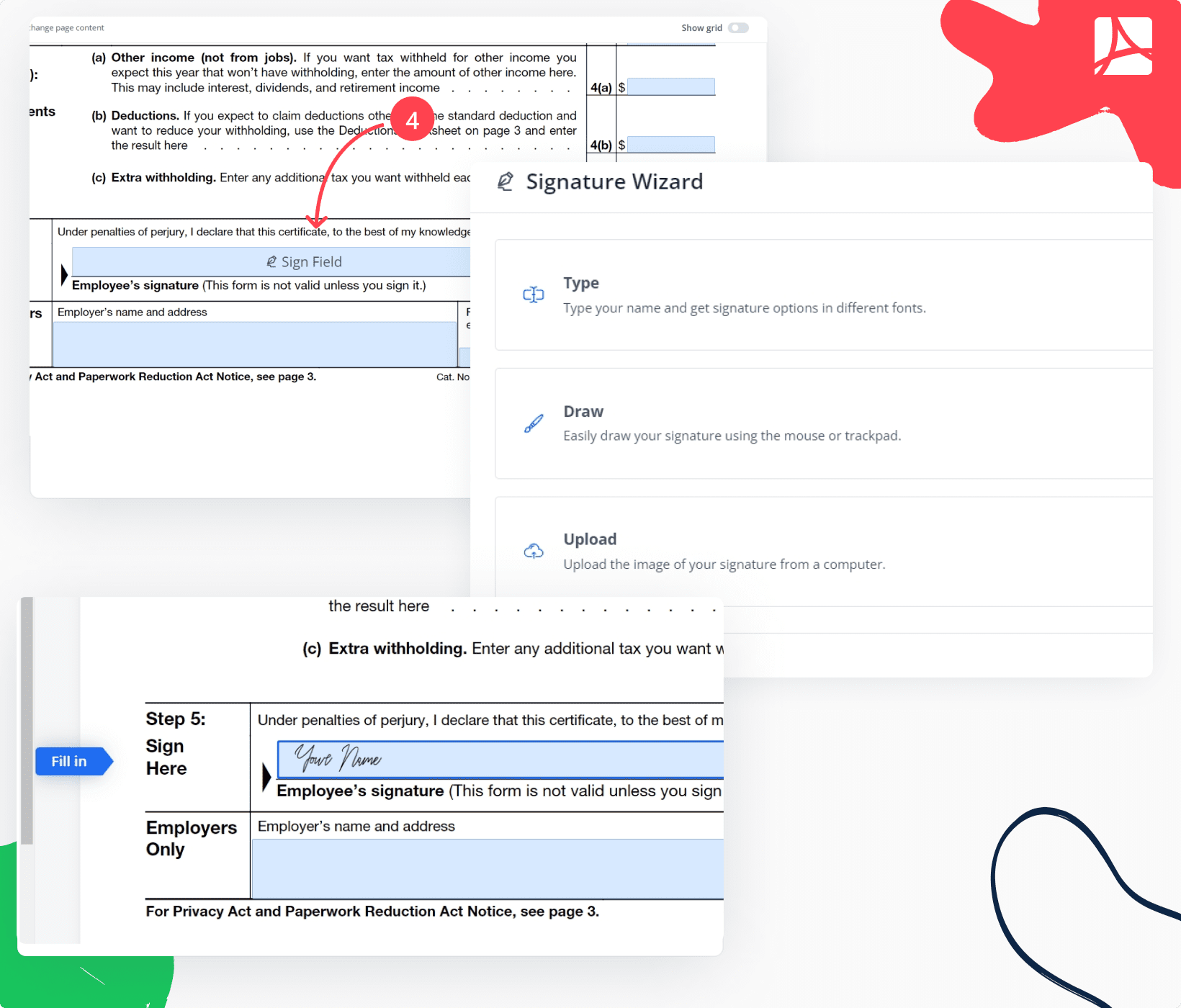

Instructions for Completing IRS Form W-4P

When filling out Printable IRS Form W-4P, it’s important to carefully follow the instructions provided. You will need to provide your personal information, such as your name, address, and Social Security number, as well as information about your payment recipient and the amount of tax you want withheld.

Additionally, you may need to provide information about any additional income or deductions that could affect your tax withholding. By accurately completing this form, you can ensure that the right amount of tax is being withheld from your payments, helping you avoid any potential tax issues in the future.

Once you have completed the form, you can submit it to the payer of your pension or annuity payments. They will then use the information provided to withhold the appropriate amount of tax from your payments. By staying on top of your tax withholding, you can avoid any potential surprises when it comes time to file your taxes.

Overall, Printable IRS Form W-4P is a useful tool for managing your tax withholding and ensuring that you are meeting your tax obligations. By taking the time to complete this form accurately, you can help avoid any potential tax issues and stay on top of your finances. Make sure to consult with a tax professional if you have any questions or concerns about completing this form.

Stay organized and informed when it comes to your taxes by utilizing Printable IRS Form W-4P. By taking the time to complete this form accurately, you can ensure that the right amount of tax is being withheld from your payments, helping you avoid any potential tax issues in the future.