As a small business owner, it’s crucial to stay on top of all tax requirements to ensure compliance with the IRS. One important form that must be filed annually is Form 940, also known as the Employer’s Annual Federal Unemployment (FUTA) Tax Return. This form is used to report and pay federal unemployment taxes on behalf of your employees.

Form 940 is typically due by January 31st of each year for the previous tax year. It’s important to accurately report the wages paid to employees and any unemployment tax owed to avoid penalties and interest from the IRS.

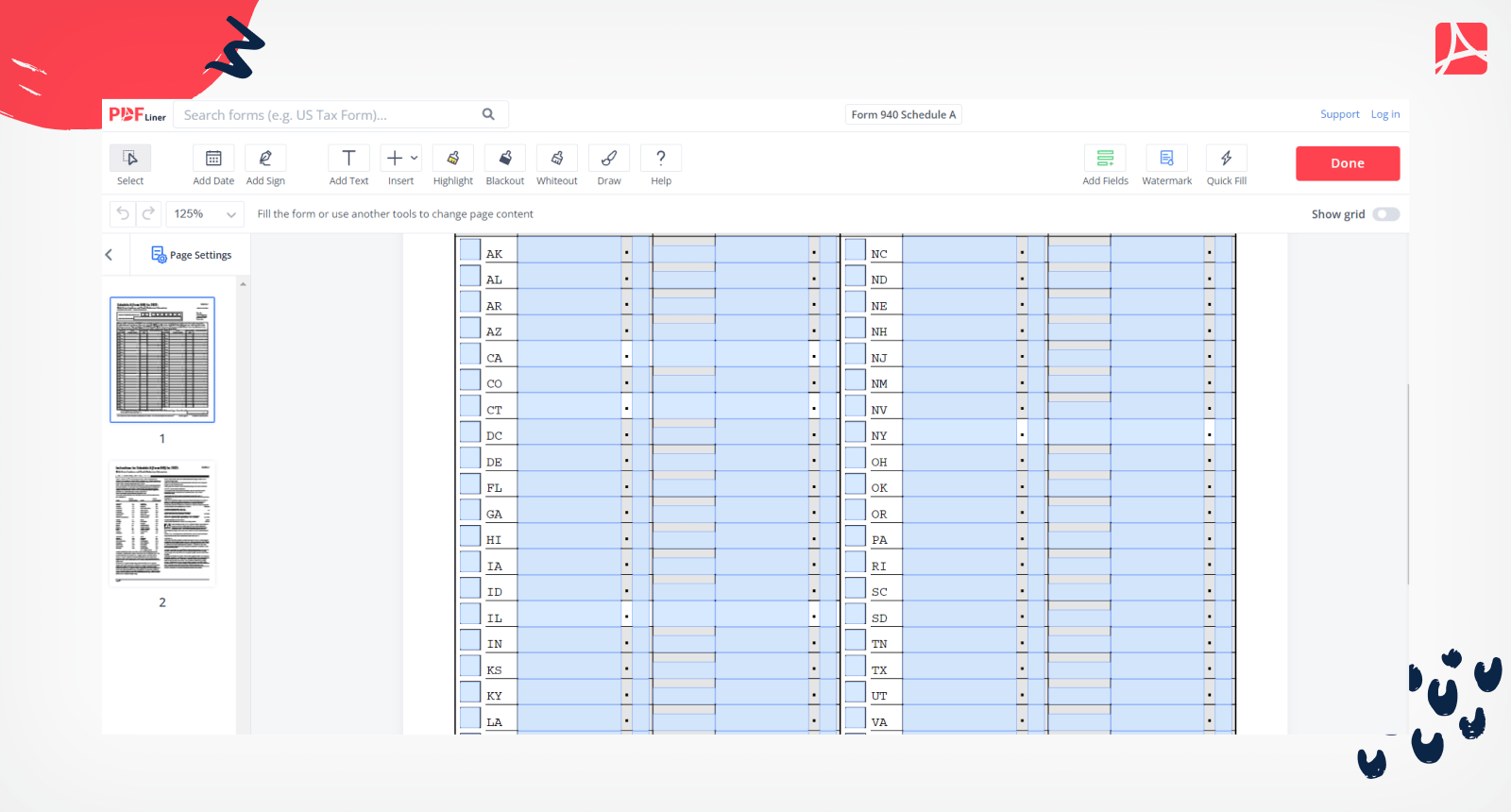

Printable IRS Form 940

Fortunately, the IRS provides a printable version of Form 940 on their website, making it easy for small business owners to access and fill out the form. The form can be downloaded as a PDF file, which can then be printed and completed manually.

When filling out Form 940, you will need to provide information about your business, including your Employer Identification Number (EIN), total wages paid to employees, and any unemployment tax due. It’s important to carefully review the instructions provided by the IRS to ensure accurate reporting.

Once you have completed Form 940, you can either mail it to the IRS or file electronically using the IRS e-file system. Filing electronically can help expedite the process and reduce the risk of errors, ensuring timely processing of your tax return.

In conclusion, staying compliant with IRS tax requirements is essential for small business owners. By utilizing the printable version of Form 940 provided by the IRS, you can easily report and pay federal unemployment taxes on behalf of your employees. Be sure to file the form accurately and on time to avoid penalties and interest from the IRS.