When it comes to filing taxes, staying organized is key. One important form that taxpayers may need to use is IRS Form 5564. This form, also known as a Notice of Deficiency, is used by the Internal Revenue Service to inform taxpayers of additional taxes owed. It is crucial to understand how to properly fill out and submit this form to avoid any potential issues with the IRS.

IRS Form 5564 is typically sent to taxpayers when the IRS believes that there are discrepancies in the information provided on their tax return. This could be due to unreported income, incorrect deductions, or other errors that may have resulted in an underpayment of taxes. It is important for taxpayers to carefully review the information provided on the form and respond promptly to avoid any further penalties or interest charges.

When completing Form 5564, taxpayers will need to provide their personal information, including their name, address, and Social Security number. They will also need to indicate whether they agree or disagree with the IRS’s findings and provide any supporting documentation to back up their claims. Once the form is completed, it should be submitted to the IRS within the specified timeframe to ensure that the matter is resolved in a timely manner.

It is important to note that taxpayers have the right to appeal the IRS’s findings if they believe that they have been assessed additional taxes in error. By filling out and submitting Form 5564, taxpayers can begin the process of resolving any discrepancies and working towards a resolution with the IRS. It is crucial to keep accurate records and stay informed throughout the process to ensure a successful outcome.

In conclusion, IRS Form 5564 is a valuable tool for taxpayers who find themselves facing additional tax liabilities. By understanding how to properly fill out and submit this form, taxpayers can take the necessary steps to address any discrepancies and come to a resolution with the IRS. Staying organized and proactive throughout the process is key to ensuring a smooth and successful outcome.

Easily Download and Print Printable Irs Form 5564

Printable payroll are ideal for teams that prefer non-digital systems or need hard copies for employee records. Most forms include fields for employee name, date range, total earnings, taxes, and net pay—making them both comprehensive and practical.

Begin streamlining your payroll system today with a trusted Printable Irs Form 5564. Save time, reduce errors, and stay organized—all while keeping your financial logs professional.

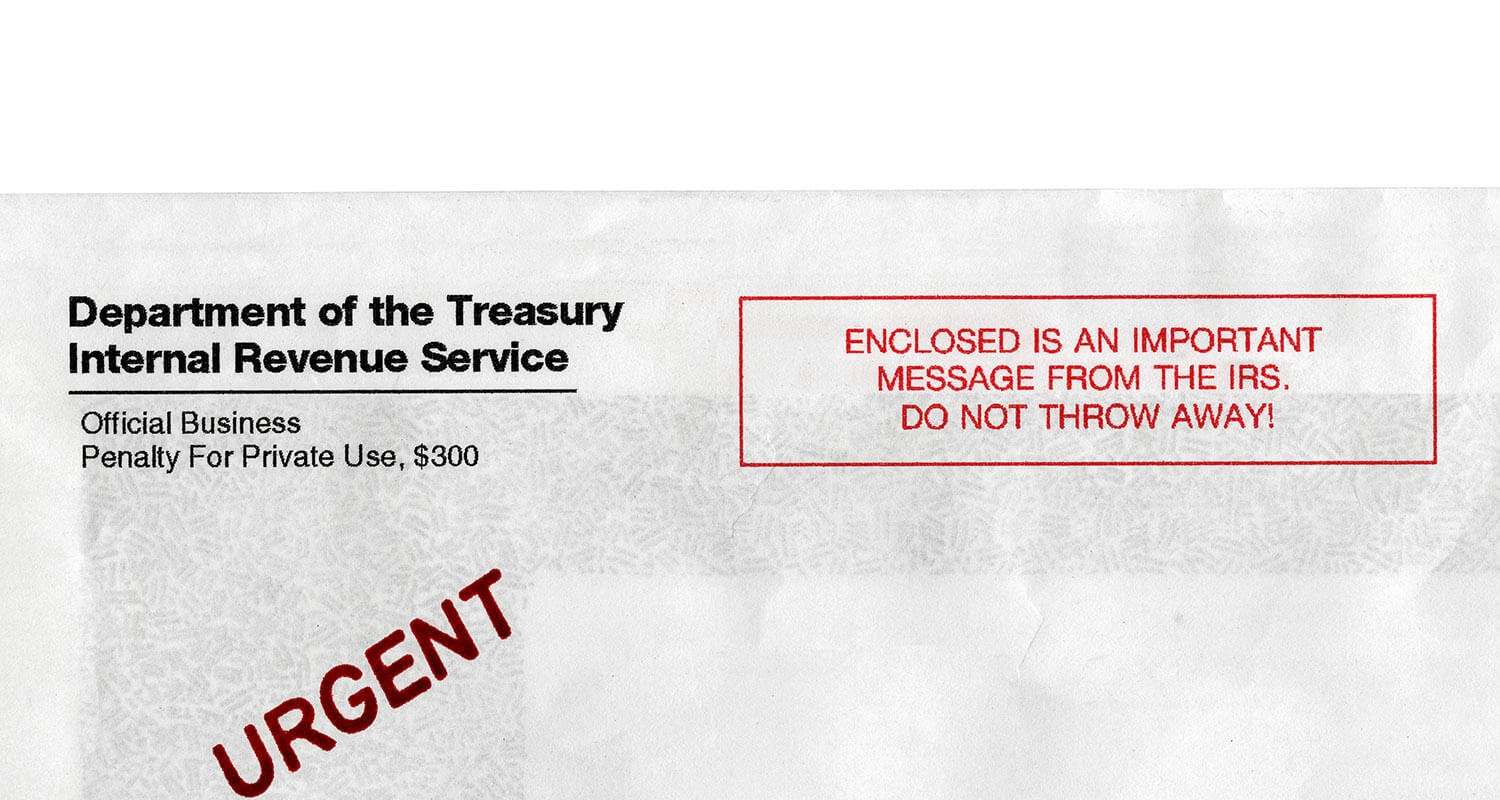

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 10 72 Receiving Extracting And Sorting Internal Revenue Service

3 8 45 Manual Deposit Process Internal Revenue Service

3 8 45 Manual Deposit Process Internal Revenue Service

Handling staff wages doesn’t have to be overwhelming. A printable payroll offers a speedy, dependable, and easy-to-use method for tracking salaries, work time, and withholdings—without the need for complex software.

Whether you’re a freelancer, payroll manager, or independent contractor, using apayroll template helps ensure accurate record-keeping. Simply access the template, print it, and complete it by hand or edit it digitally before printing.