When tax season rolls around, it’s important to have all the necessary forms ready to go. One such form that many businesses and individuals may need is IRS Form 1096. This form is used to summarize and transmit information returns such as 1099s, W-2s, and more to the IRS. Filing this form ensures that the IRS receives all the necessary information to process tax returns accurately.

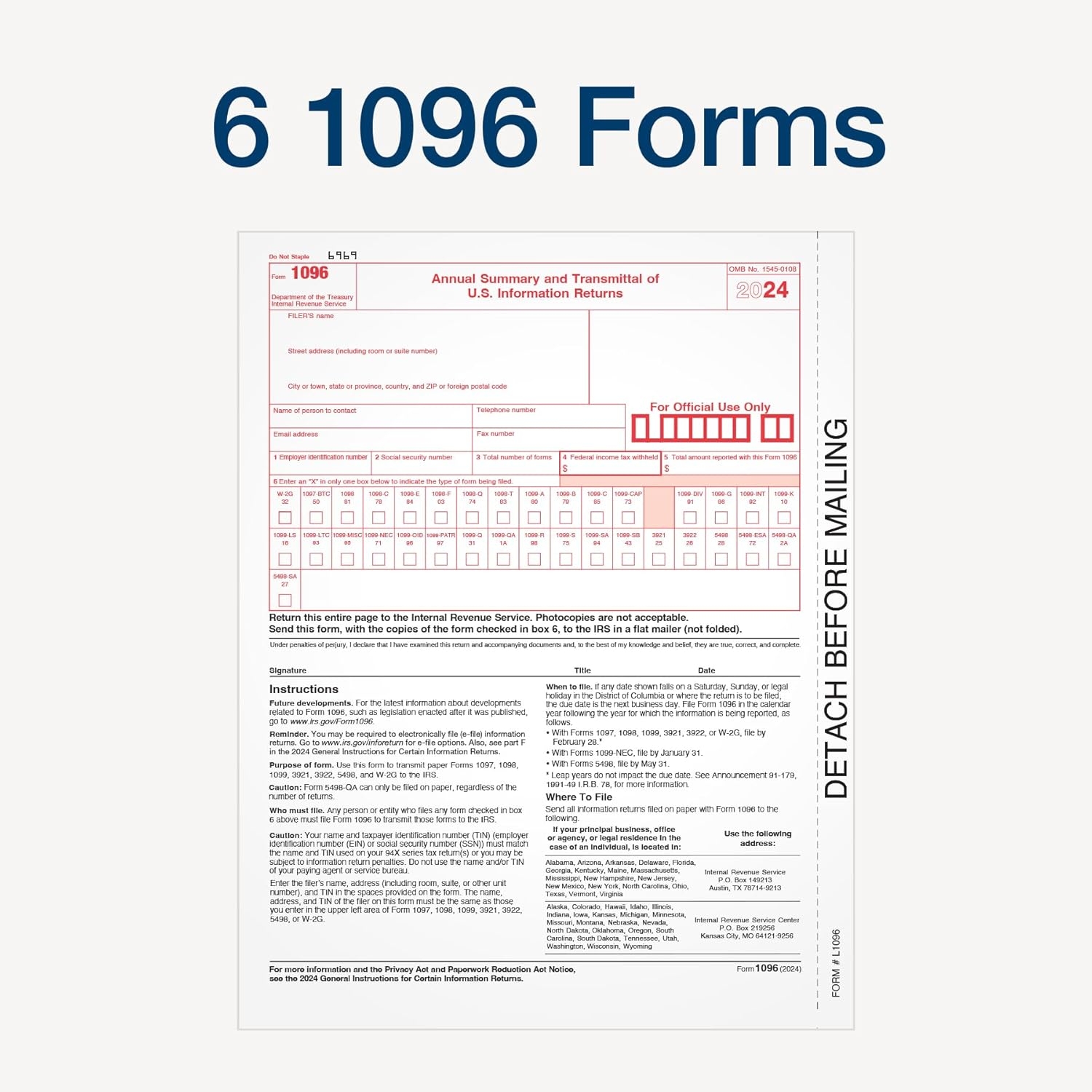

Printable IRS Form 1096 is readily available online for businesses and individuals to easily access and fill out. This form is typically used to accompany physical copies of information returns that are being sent to the IRS. The form includes important details such as the payer’s name, address, TIN, total amount of forms being submitted, and more. Having a printable version of this form makes it convenient for taxpayers to complete and submit their information accurately and on time.

When filling out IRS Form 1096, it’s essential to ensure that all the information provided is accurate and matches the corresponding information returns being submitted. Any discrepancies or errors could lead to delays in processing tax returns or potential penalties from the IRS. Additionally, it’s important to keep a copy of the completed form for your records in case it is needed for future reference or audits.

Submitting IRS Form 1096 is typically required when filing information returns with the IRS, such as 1099s for independent contractors or W-2s for employees. This form acts as a cover sheet for the information returns being submitted and helps the IRS match them to the correct taxpayer accounts. By including Form 1096 with your information returns, you can ensure that the IRS has all the necessary information to process tax returns accurately and efficiently.

In conclusion, having access to a printable version of IRS Form 1096 is crucial for businesses and individuals during tax season. This form plays a vital role in summarizing and transmitting information returns to the IRS, ensuring that tax returns are processed accurately and efficiently. By filling out and submitting Form 1096 along with your information returns, you can help streamline the tax filing process and avoid potential penalties from the IRS. Be sure to download and complete this form accurately to stay compliant with IRS regulations.