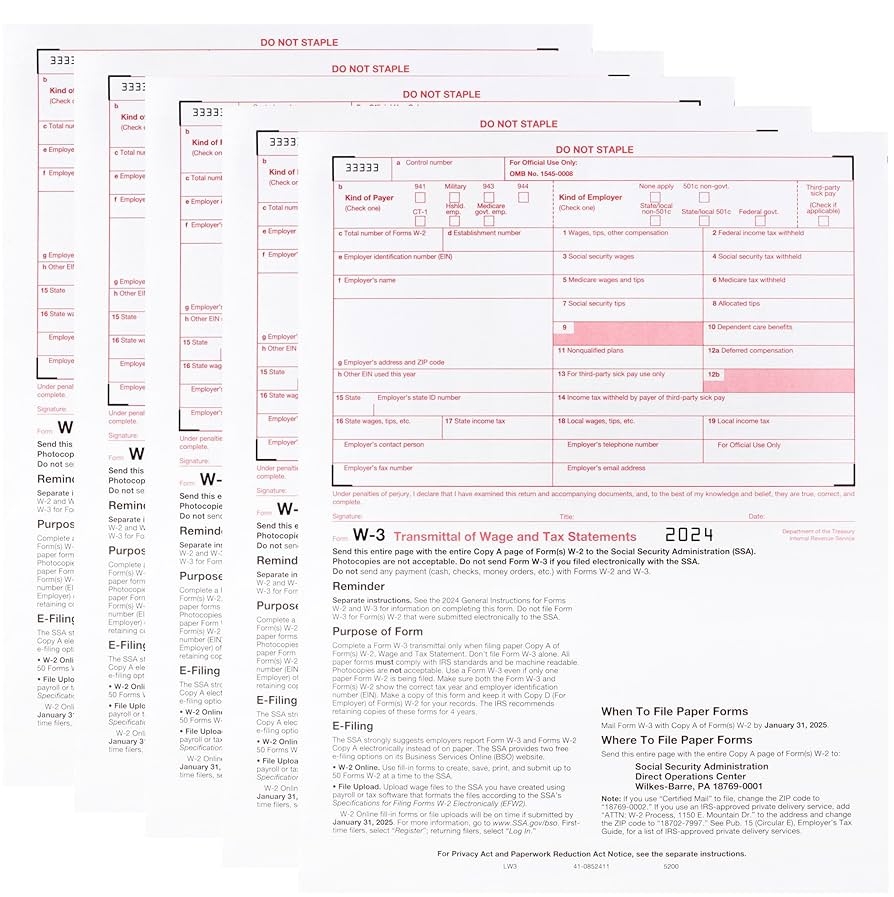

As tax season approaches, it’s important to be prepared with all the necessary forms to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides a variety of forms for individuals and businesses to report their income, deductions, and credits. One convenient option is to utilize printable 2024 IRS tax forms, which can be easily accessed and filled out from the comfort of your own home.

Whether you are self-employed, a small business owner, or an individual taxpayer, having access to printable IRS tax forms can save you time and hassle. By downloading the forms online, you can avoid the long lines at the post office or local IRS office and have the convenience of completing your taxes at your own pace.

When it comes to filing your taxes, accuracy is key. Using the correct forms and providing accurate information can help prevent delays or errors in processing your tax return. Printable 2024 IRS tax forms are updated annually to reflect any changes in tax laws or regulations, ensuring that you are using the most current version for your filing.

Before you begin filling out your tax forms, it’s important to gather all necessary documentation, such as W-2s, 1099s, and receipts for deductions. Having everything organized and ready to go will make the process smoother and help you avoid any last-minute scrambling to find information.

Once you have all your documents in order, you can start filling out the printable 2024 IRS tax forms. Be sure to double-check your entries for accuracy and completeness before submitting your return. If you have any questions or need assistance, the IRS website offers resources and guidance to help you navigate the tax filing process.

In conclusion, printable 2024 IRS tax forms are a convenient and efficient way to file your taxes. By utilizing these forms, you can save time and ensure that your tax return is submitted accurately and on time. Make sure to gather all necessary documentation and double-check your entries before filing to avoid any potential issues. With the right tools and information, you can successfully navigate the tax filing process and stay compliant with IRS regulations.