When it comes to filing your taxes, Form 1040 is one of the most important documents you’ll need. This form is used by individuals to report their income, deductions, and credits to the IRS. It’s essential to fill out this form accurately to ensure you’re paying the correct amount of taxes and receiving any refunds you may be entitled to.

IRS Gov provides a printable version of Form 1040 on their website for individuals to download and fill out. This printable form makes it easy for taxpayers to complete their tax return at their convenience, whether they prefer to file online or by mail.

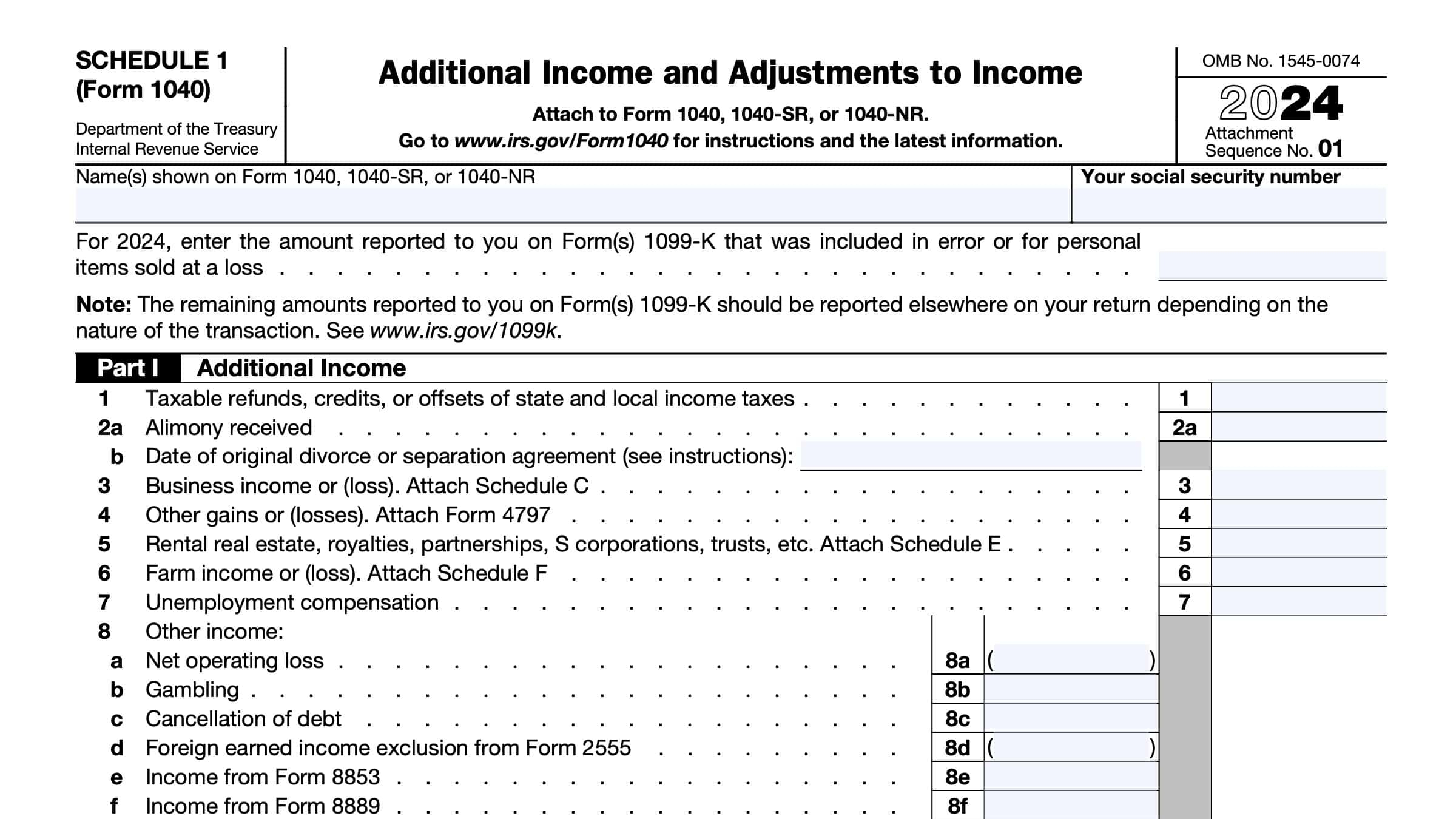

Form 1040 consists of several sections, including personal information, income, deductions, and credits. It’s important to carefully review each section and provide accurate information to avoid any errors or delays in processing your tax return. You may also need to attach additional forms or schedules depending on your individual tax situation.

One of the key benefits of using the IRS Gov printable Form 1040 is that it provides clear instructions on how to fill out each section correctly. This can help individuals navigate the tax filing process more easily and ensure they’re meeting all necessary requirements. Additionally, the printable form allows taxpayers to keep a copy for their records and reference in case of any future audits or inquiries from the IRS.

Before submitting your completed Form 1040, it’s important to double-check all the information you’ve provided to ensure its accuracy. Any mistakes or omissions could result in penalties or delays in receiving any refunds you may be owed. If you’re unsure about how to fill out any section of the form, it’s always a good idea to seek guidance from a tax professional or the IRS.

In conclusion, IRS Gov’s printable Form 1040 is a valuable resource for individuals looking to file their taxes accurately and efficiently. By following the instructions provided on the form and reviewing your information carefully, you can ensure a smooth tax filing process and avoid any potential issues with the IRS.