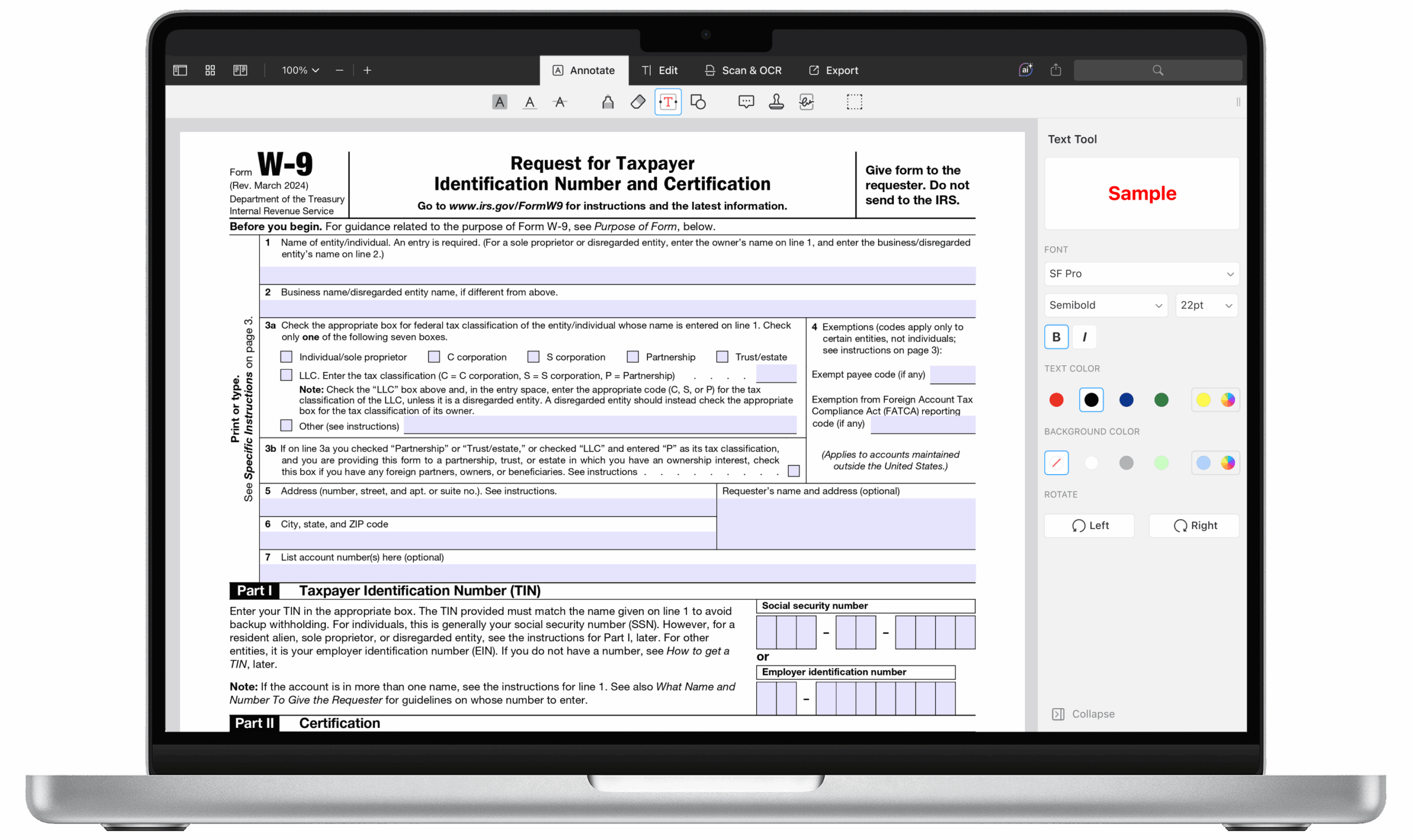

When it comes to tax documentation, the IRS W9 Form is an essential tool for businesses and individuals alike. The W9 Form is used to gather information from independent contractors, freelancers, and vendors who provide services to a business. This form helps businesses report payments made to these individuals to the IRS, ensuring compliance with tax regulations.

For the year 2025, the IRS has updated the W9 Form to include new requirements and guidelines. It is important for businesses to stay informed about these changes to ensure they are using the most up-to-date form for their tax reporting needs.

One of the key changes to the 2025 W9 Form is the inclusion of additional fields for contact information, such as email addresses and phone numbers. This is intended to make it easier for businesses to communicate with contractors and vendors regarding their tax documentation.

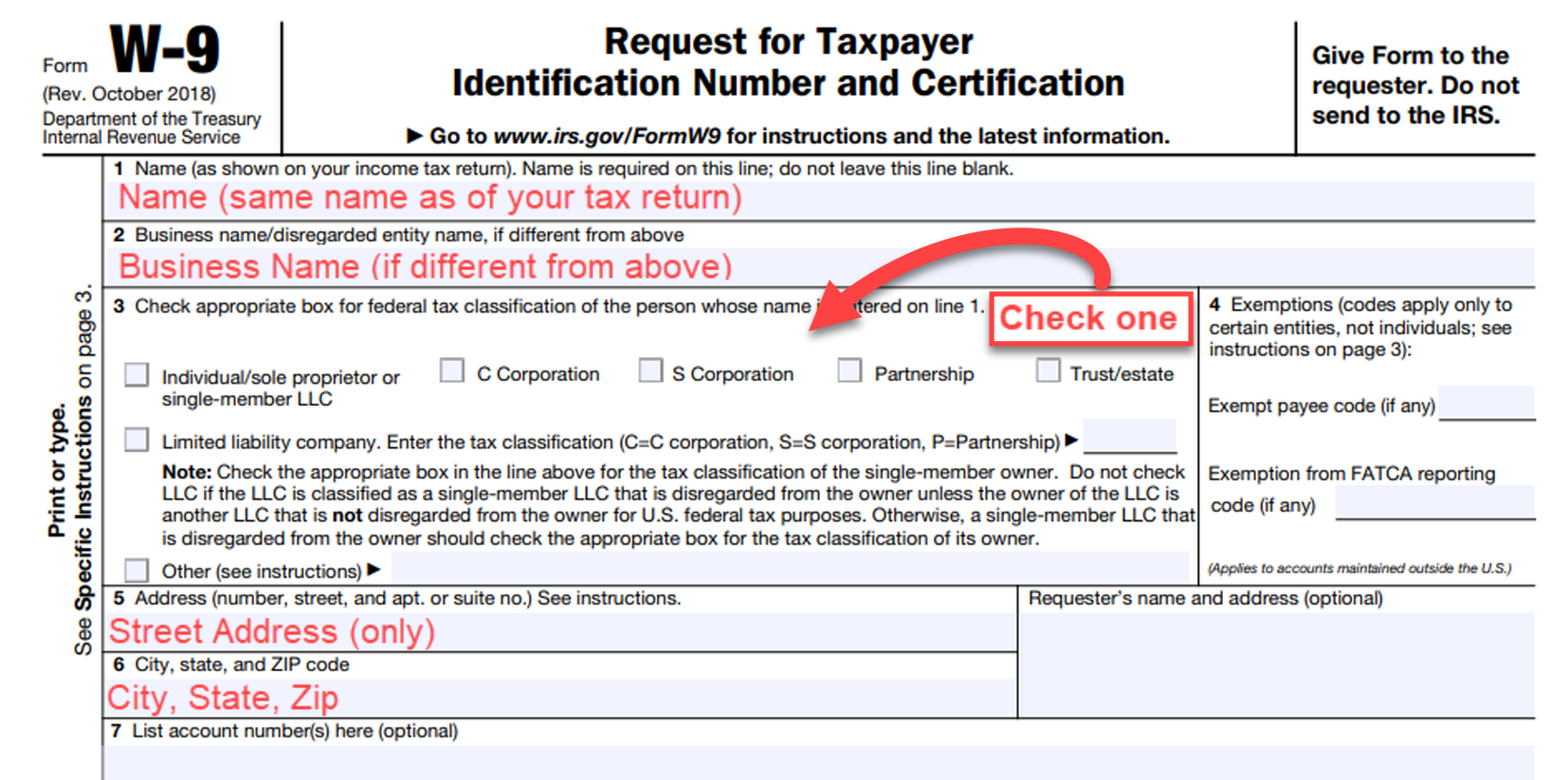

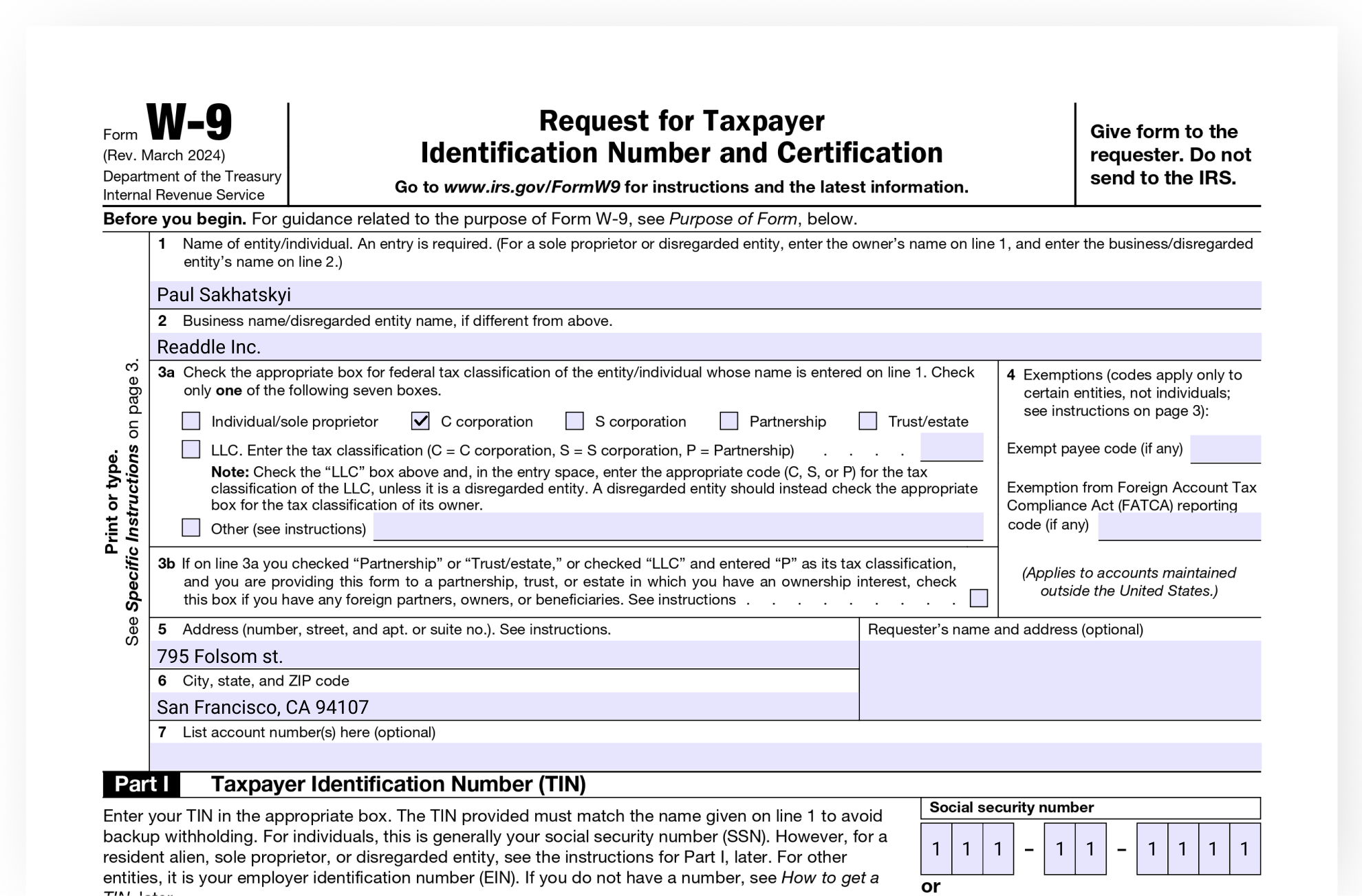

Another important update to the 2025 W9 Form is the inclusion of a checkbox for individuals to indicate their tax classification, such as sole proprietorship, corporation, or partnership. This helps businesses accurately report payments to the IRS based on the individual’s tax status.

Additionally, the 2025 W9 Form includes new instructions and guidelines for completing the form correctly. It is important for businesses to carefully review these instructions to ensure they are providing accurate information to the IRS.

In conclusion, the IRS W9 Form 2025 Printable is a crucial tool for businesses to gather necessary information from independent contractors and vendors for tax reporting purposes. By staying informed about the updates and changes to the form, businesses can ensure they are in compliance with IRS regulations and avoid any potential penalties for incorrect or incomplete reporting.

Download and Print Irs W9 Form 2025 Printable

Irs W9 Form 2025 Printable are ideal for businesses that prefer non-digital systems or need physical copies for staff files. Most forms include fields for staff name, pay period, total earnings, withholdings, and final salary—making them both complete and easy to use.

Take control of your payroll system today with a trusted payroll template. Save time, reduce errors, and maintain clear records—all while keeping your financial logs clear.

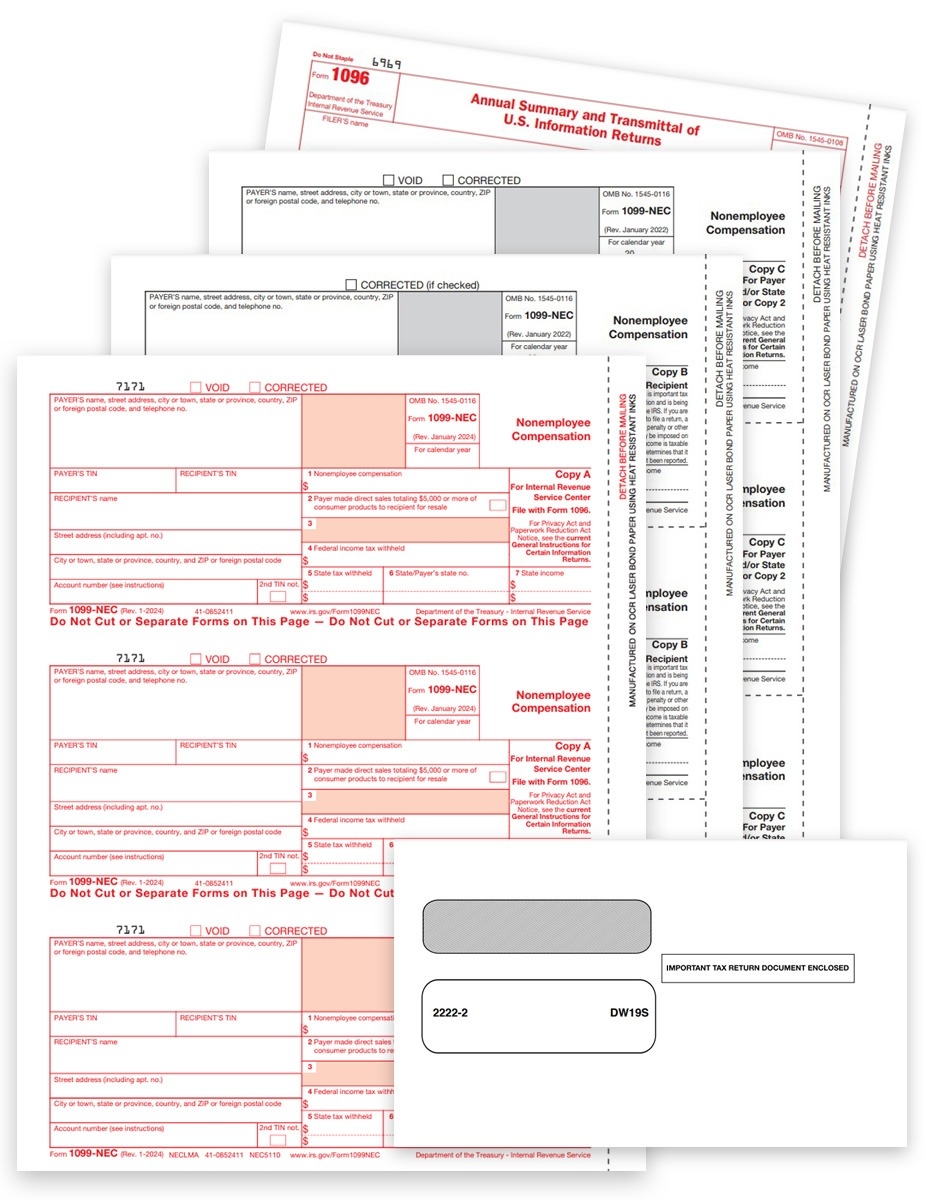

Free Printable W9 Form 2025 Printable W9 Form 2025

Free Printable W9 Form 2025 Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

W9 Tax Form 2025 Printable Printable W9 Form 2025

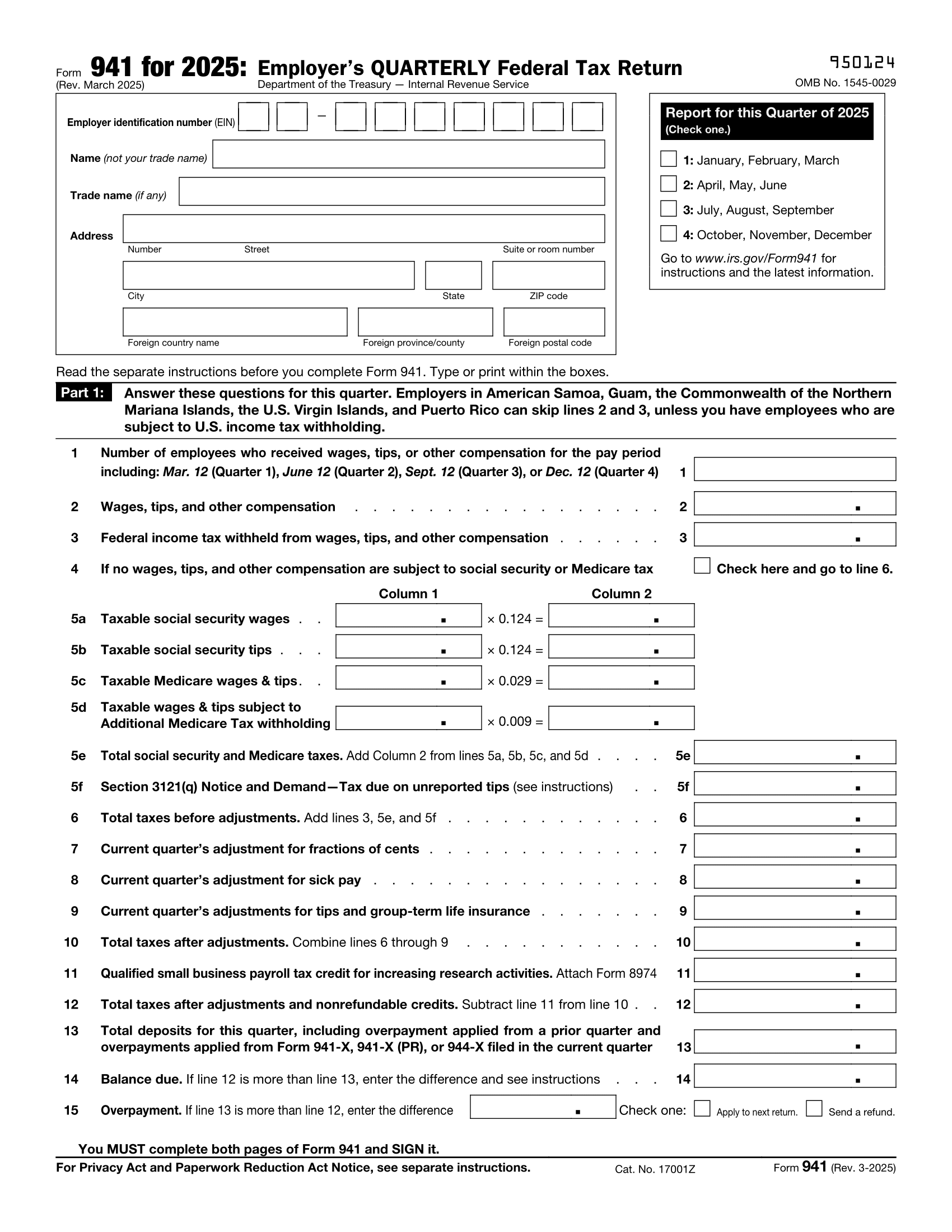

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

How To Fill Out IRS W9 Form 2024 2025 PDF PDF Expert

Processing employee payments doesn’t have to be overwhelming. A payroll template offers a fast, reliable, and easy-to-use method for tracking wages, shifts, and withholdings—without the need for digital systems.

Whether you’re a freelancer, HR professional, or sole proprietor, using apayroll template helps ensure compliance with regulations. Simply get the template, print it, and complete it by hand or edit it digitally before printing.