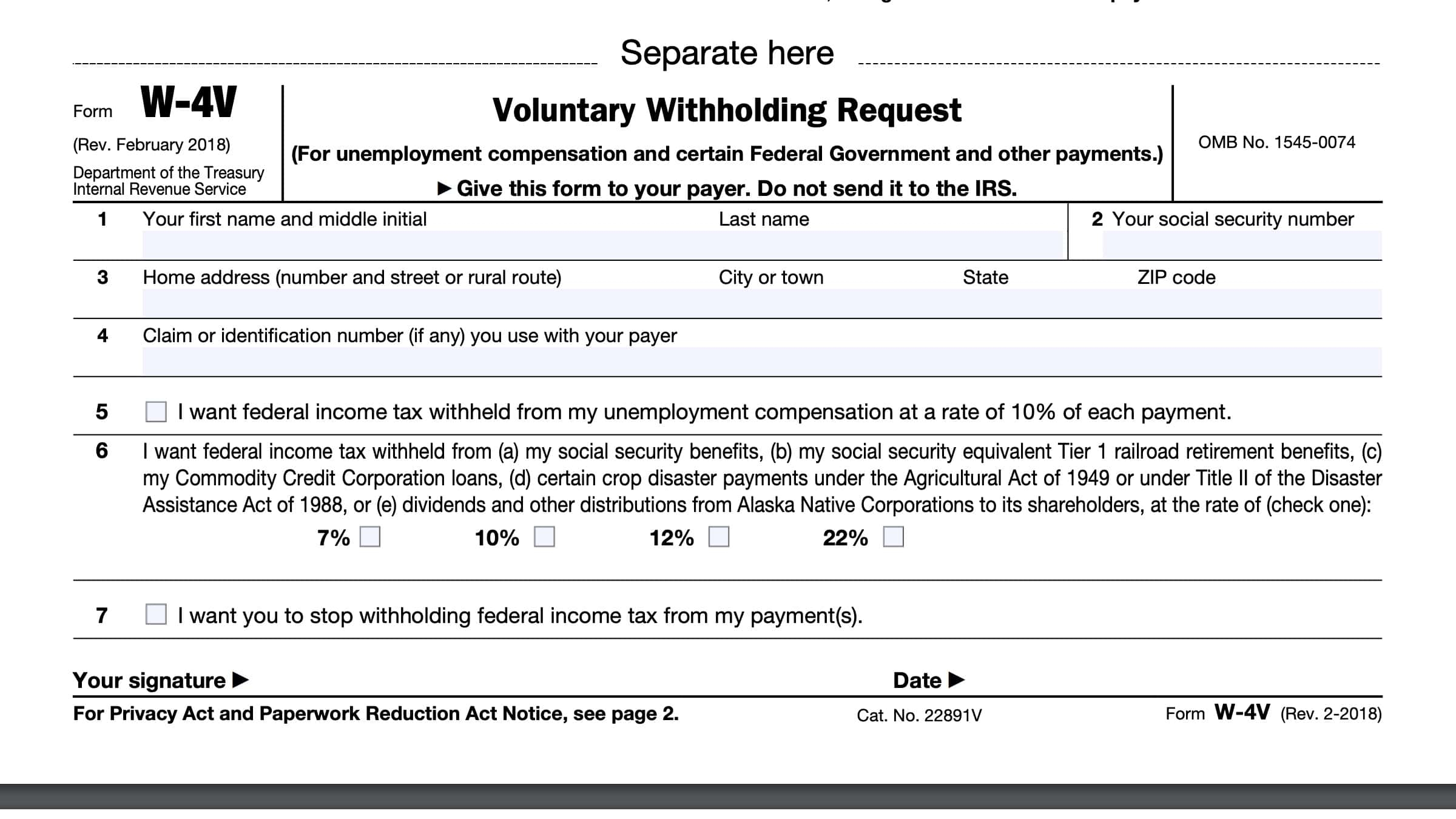

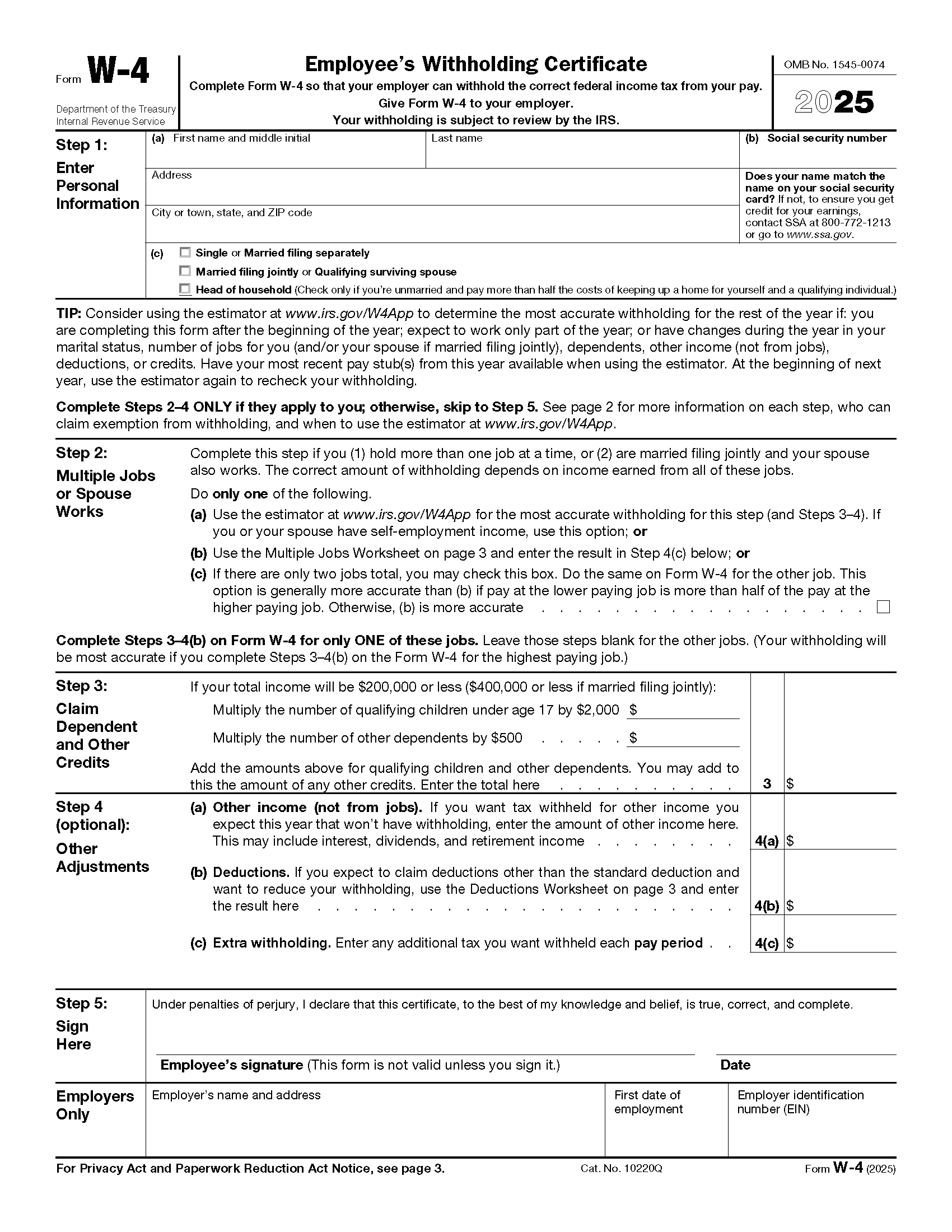

Completing tax forms can be a daunting task, but it is essential to ensure that you are withholding the correct amount of taxes from your paycheck. One important form to be familiar with is the IRS W-4 form, which determines how much federal income tax should be withheld from your pay. In 2025, the IRS has introduced a new version of the W-4 form, known as the W-4v form, which is used for voluntary withholding requests.

The IRS W-4v form is used when an individual wants to request that a specific amount of federal income tax be withheld from their paycheck. This form is typically used by individuals who have additional income outside of their regular job, such as rental income or self-employment income, and want to ensure that enough taxes are being withheld to cover their tax liability.

When completing the IRS W-4v form, you will need to provide your personal information, such as your name, address, and social security number. You will also need to indicate the amount of additional federal income tax you want withheld from each paycheck. This amount will be deducted from your paycheck and sent directly to the IRS on your behalf.

It is important to note that the IRS W-4v form is only for voluntary withholding requests and is not mandatory. However, it can be a useful tool for individuals who want to ensure that they are not caught off guard by a large tax bill at the end of the year. By proactively withholding additional taxes, you can avoid owing a significant amount of money come tax time.

In conclusion, the IRS W-4v form is a valuable tool for individuals who want to take control of their tax withholding and ensure that they are not hit with a large tax bill at the end of the year. By completing this form accurately and submitting it to your employer, you can have peace of mind knowing that you are on top of your tax obligations.

Save and Print Irs W4v Form 2025 Printable

Payroll printable are ideal for companies that prefer physical records or need physical copies for staff files. Most forms include fields for employee name, date range, gross pay, withholdings, and final salary—making them both comprehensive and practical.

Start simplifying your payroll system today with a trusted printable payroll form. Reduce admin effort, reduce errors, and maintain clear records—all while keeping your financial logs clear.

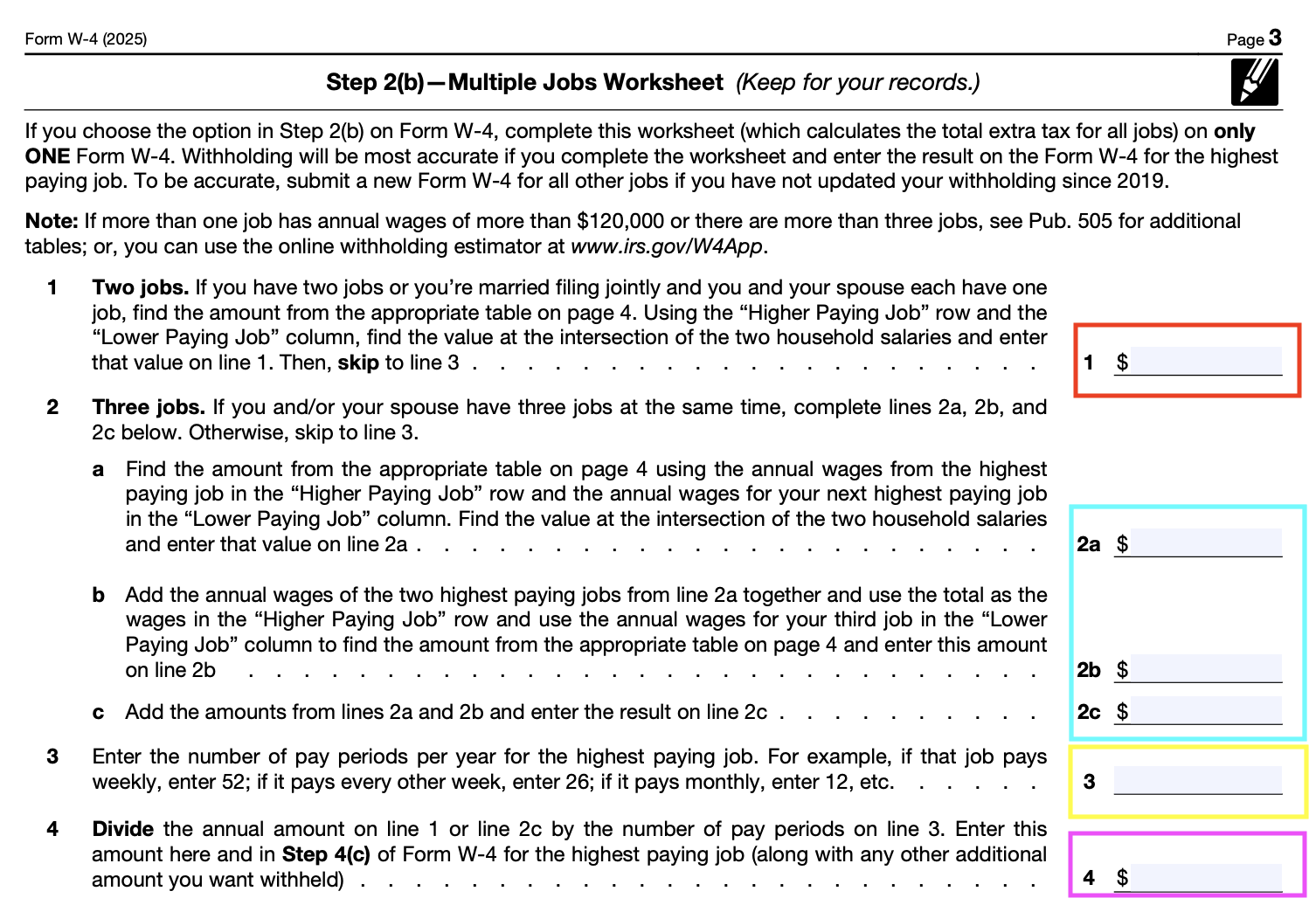

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

2025 W 4 Form Step By Step Guide To Get Your Withholding Right

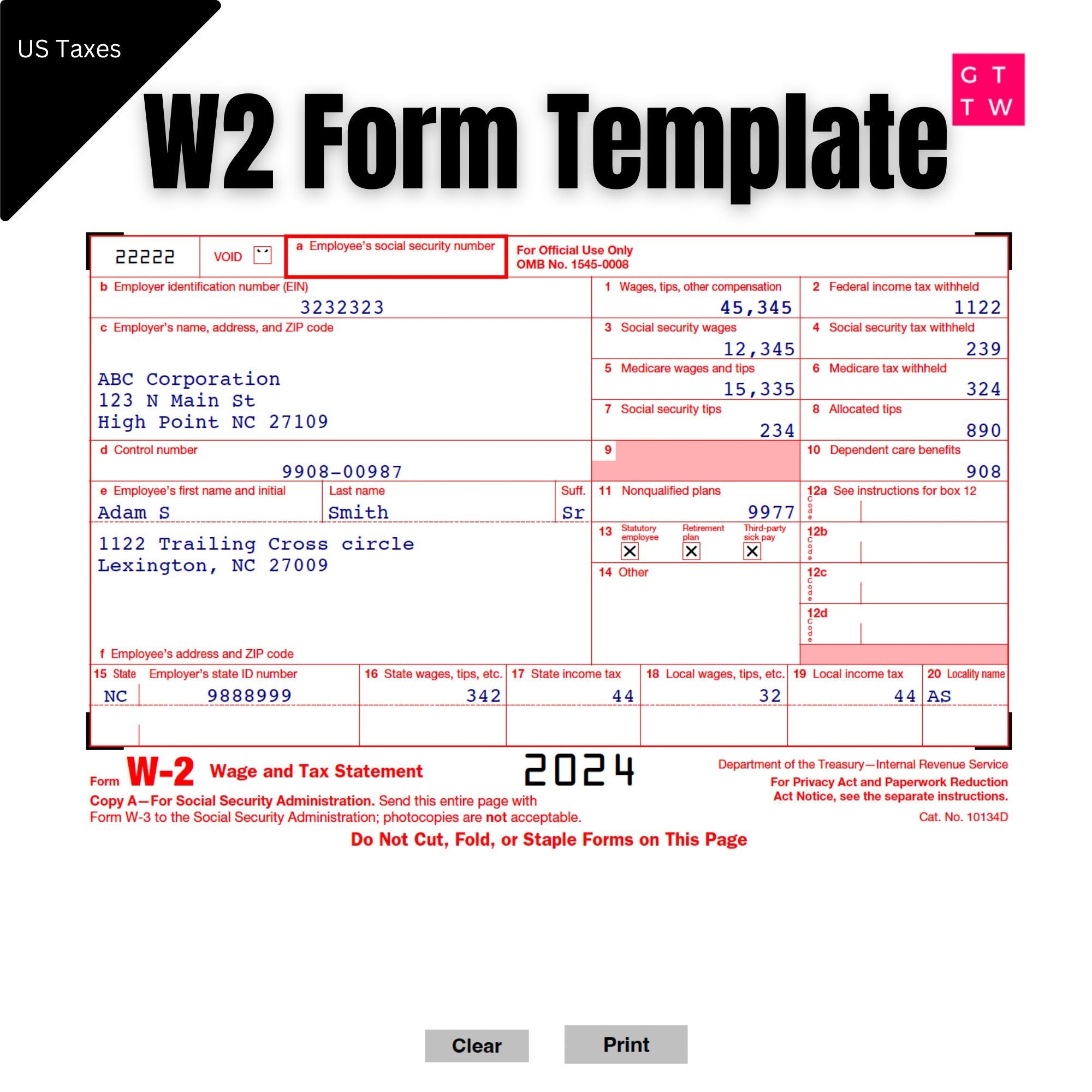

2025 IRS Form W4 PDF Template Online

2025 IRS Form W4 PDF Template Online

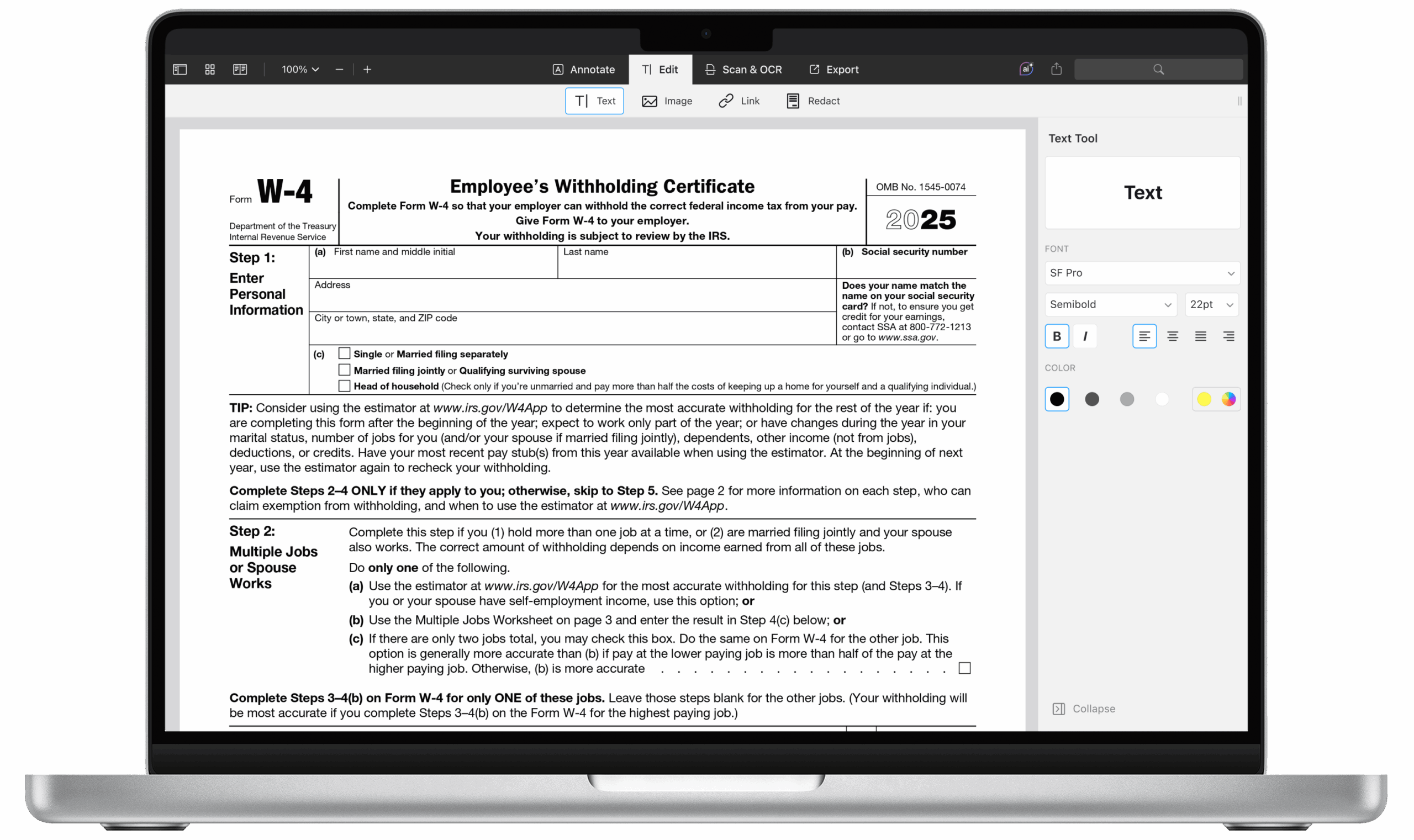

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

How To Fill Out IRS W4 Form 2025 PDF PDF Expert

IRS Form W 4V Instructions Voluntary Withholding Request

IRS Form W 4V Instructions Voluntary Withholding Request

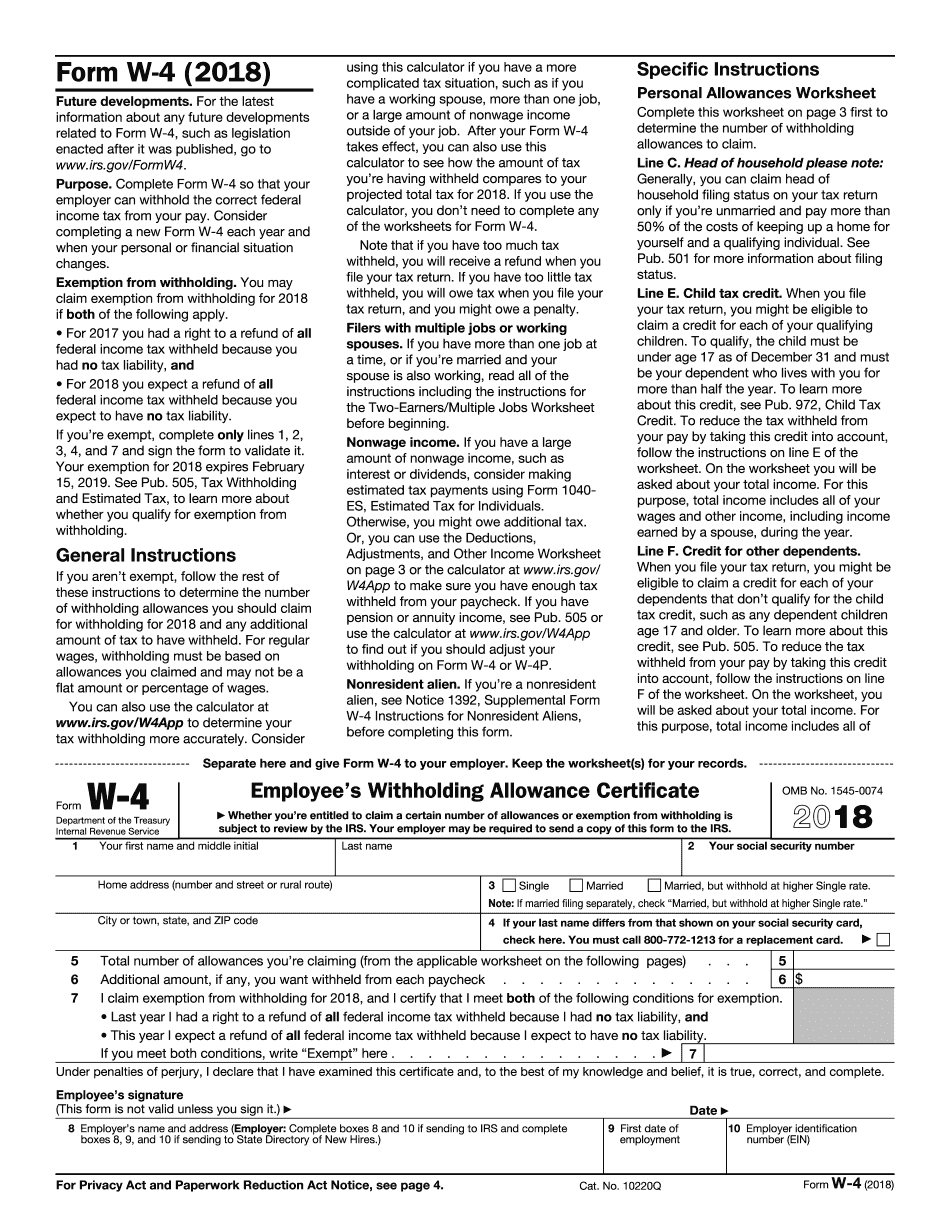

Free IRS Form W4 2024 PDF EForms

Free IRS Form W4 2024 PDF EForms

Processing staff wages doesn’t have to be overwhelming. A payroll template offers a fast, dependable, and user-friendly method for tracking salaries, hours, and taxes—without the need for complicated tools.

Whether you’re a startup founder, administrator, or independent contractor, using aprintable payroll template helps ensure compliance with regulations. Simply access the template, produce a hard copy, and complete it by hand or edit it digitally before printing.