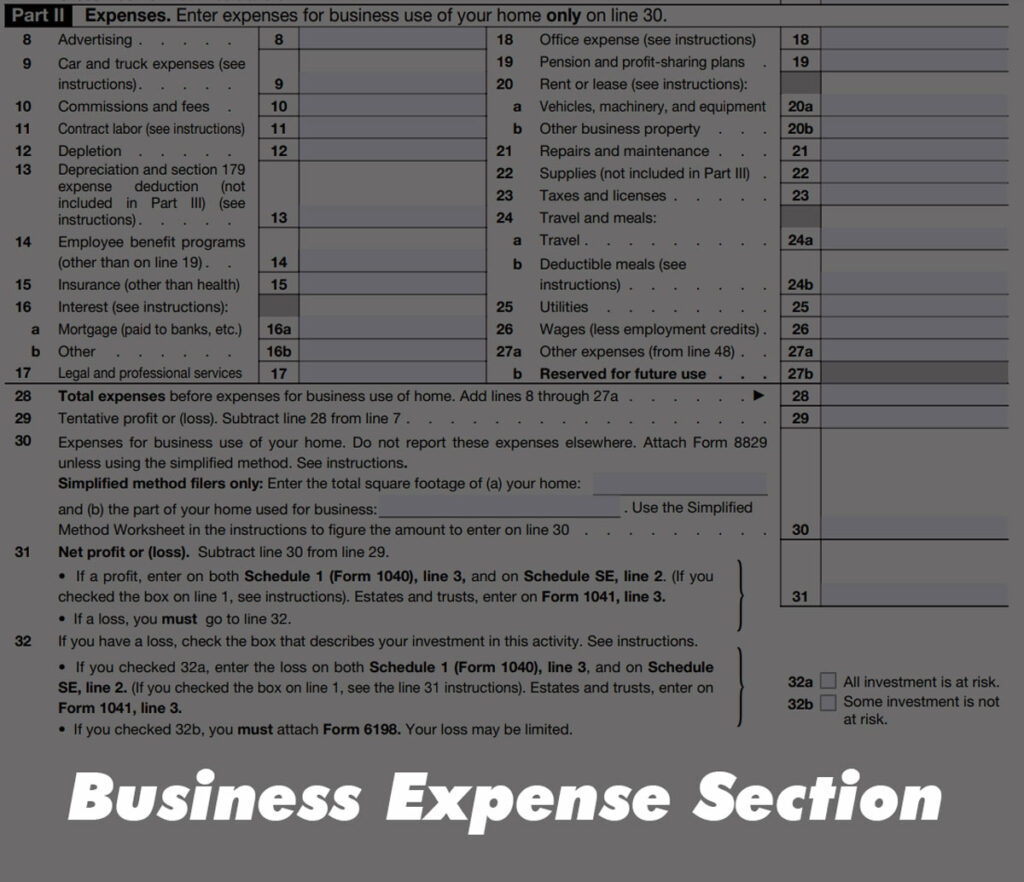

Are you a small business owner or self-employed individual looking to file your taxes? The IRS Schedule C form is an essential document that allows you to report your income and expenses for your business. This form is used to calculate your net profit or loss, which is then reported on your personal tax return.

It’s important to accurately fill out the Schedule C form to ensure you are properly reporting your business income and deductions. This form is crucial for determining your tax liability and ensuring compliance with IRS regulations.

Irs Schedule C Printable Form

The IRS Schedule C form is a relatively straightforward document that requires you to provide information about your business income and expenses. You will need to report your gross receipts, deductions, and net profit or loss on this form. It’s important to keep detailed records of your business transactions throughout the year to accurately complete this form.

When filling out the Schedule C form, be sure to include all sources of income related to your business. This may include income from sales, services, or any other business activities. You will also need to report any deductible business expenses, such as supplies, advertising, utilities, and more.

Once you have completed the Schedule C form, you can use this information to calculate your net profit or loss for the year. This amount will then be reported on your personal tax return, where it will be used to determine your tax liability. Filing an accurate Schedule C form is essential for avoiding penalties and ensuring compliance with IRS regulations.

Overall, the IRS Schedule C form is a crucial document for small business owners and self-employed individuals. By accurately reporting your income and expenses on this form, you can ensure compliance with IRS regulations and minimize your tax liability. Be sure to keep detailed records of your business transactions throughout the year to make the filing process as smooth as possible.

For more information on the IRS Schedule C form and other tax-related documents, visit the IRS website or consult with a tax professional. Filing your taxes accurately and on time is essential for maintaining good standing with the IRS and avoiding any potential penalties.