The IRS I-9 Form is a crucial document that employers use to verify the identity and employment authorization of individuals hired to work in the United States. The form has been updated periodically to ensure compliance with changing regulations and requirements. The 2012 version of the IRS I-9 Form is available for download as a printable document, making it easy for employers to complete and maintain accurate records for their employees.

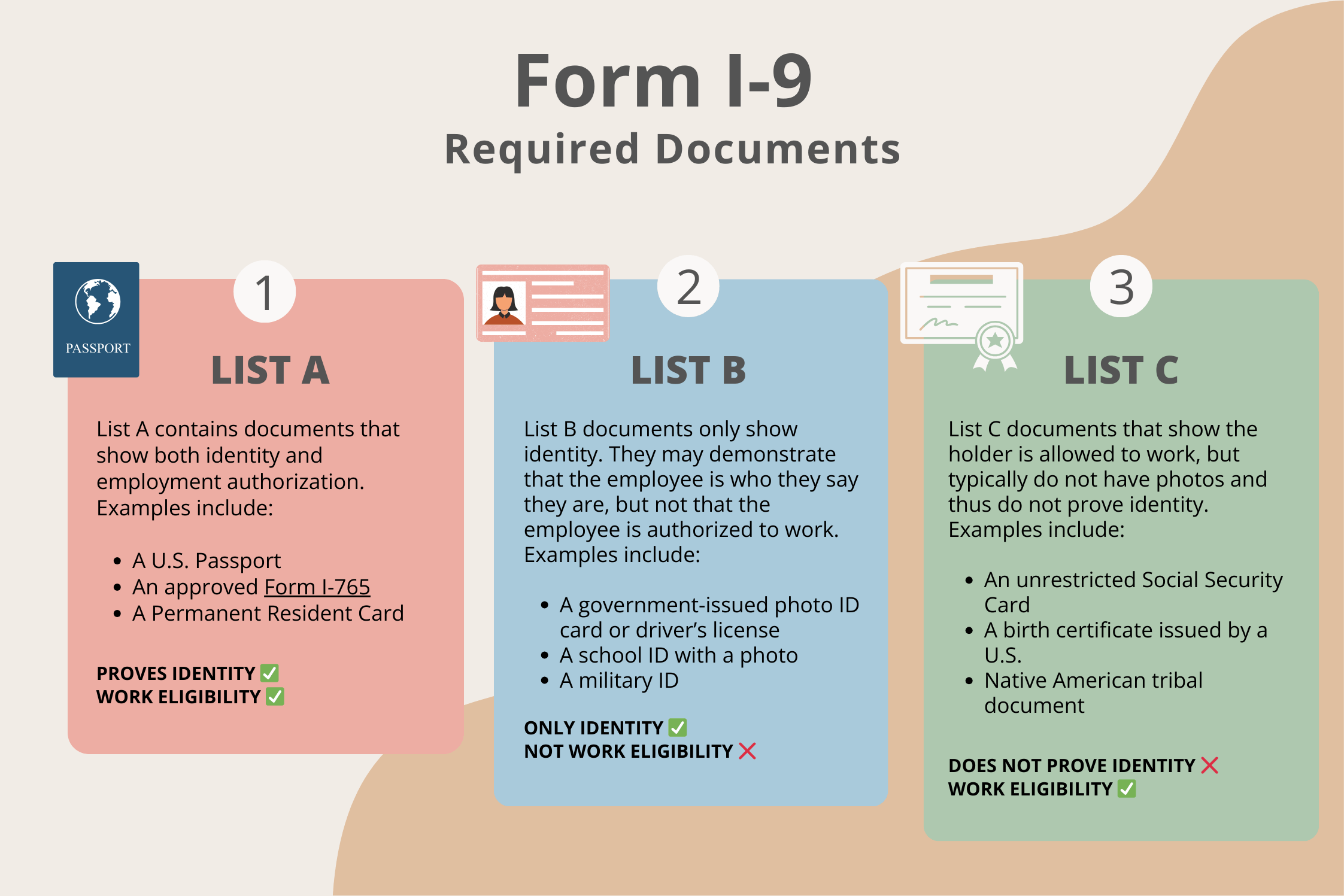

Employers must ensure that all new hires complete the IRS I-9 Form within three days of starting work. This form requires individuals to provide specific documents to establish their identity and eligibility to work in the U.S. Employers must review the documents provided and attest to their authenticity by signing the form. Failure to comply with I-9 requirements can result in penalties and fines for employers.

The IRS I-9 Form 2012 Printable is a convenient tool for employers to use when onboarding new employees. The form can be downloaded from the IRS website and printed for easy completion. Employers should keep completed I-9 forms on file for each employee for a designated period to comply with recordkeeping requirements.

It is essential for employers to stay up to date on changes to immigration laws and regulations that may impact the completion of the IRS I-9 Form. Employers should regularly review the instructions for the form and seek assistance from legal counsel or human resources professionals if they have questions about the proper completion of the form.

By using the IRS I-9 Form 2012 Printable, employers can streamline the process of verifying the employment eligibility of their workforce. This form helps employers maintain compliance with federal regulations and ensures that they are hiring authorized workers. Employers should take the time to familiarize themselves with the requirements of the form and ensure that they are following proper procedures to avoid potential penalties.

In conclusion, the IRS I-9 Form 2012 Printable is a valuable resource for employers to use when verifying the identity and employment eligibility of their workforce. By following the instructions provided and keeping accurate records, employers can demonstrate compliance with federal regulations and avoid potential penalties. Employers should make it a priority to understand the requirements of the I-9 form and utilize the printable version to simplify the onboarding process for new hires.

Quickly Access and Print Irs I-9 Form 2012 Printable

Printable payroll are ideal for teams that prefer physical records or need hard copies for employee records. Most forms include fields for staff name, date range, gross pay, taxes, and final salary—making them both comprehensive and easy to use.

Start simplifying your payroll system today with a trusted printable payroll. Reduce admin effort, reduce errors, and stay organized—all while keeping your payroll records organized.

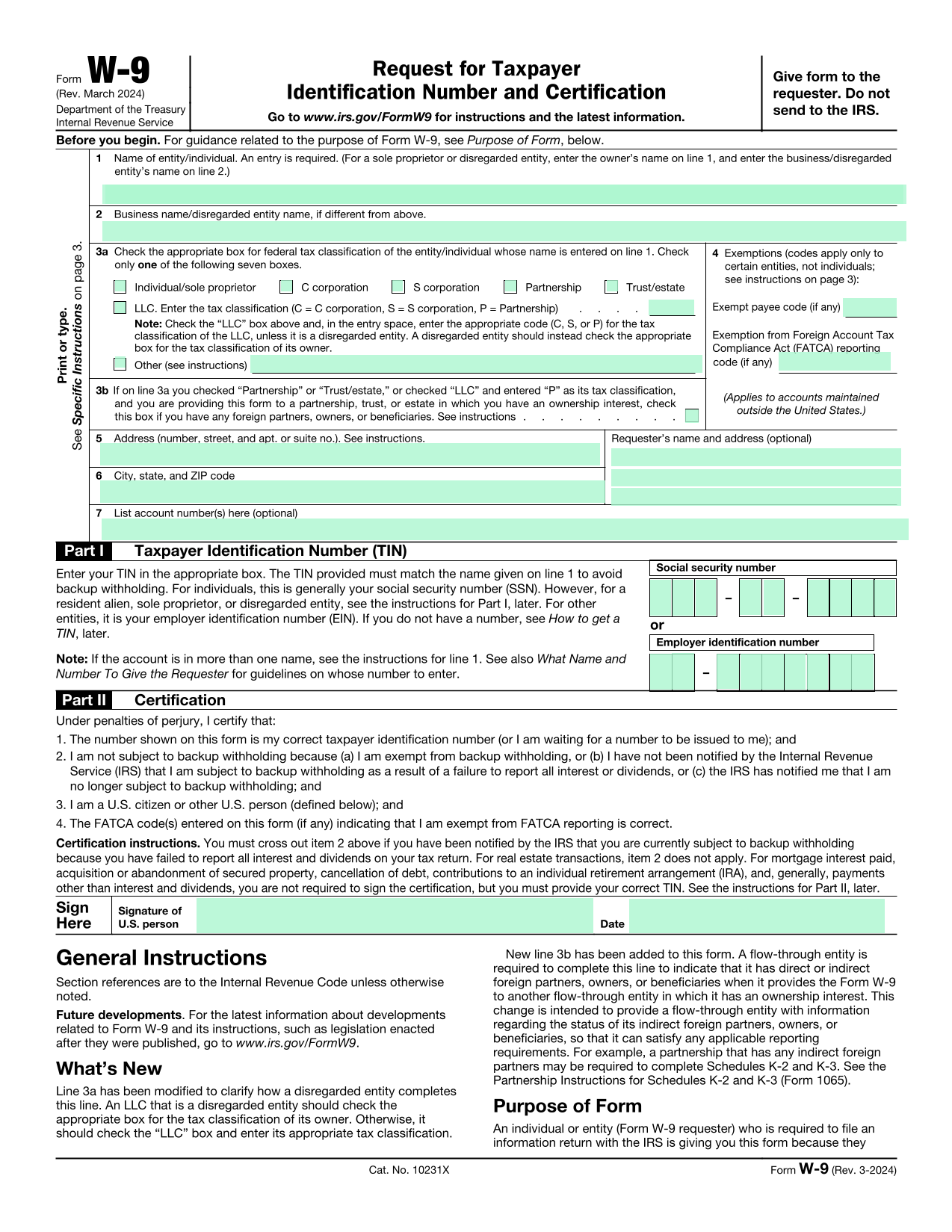

Free IRS Form W9 2025 PDF EForms

Free IRS Form W9 2025 PDF EForms

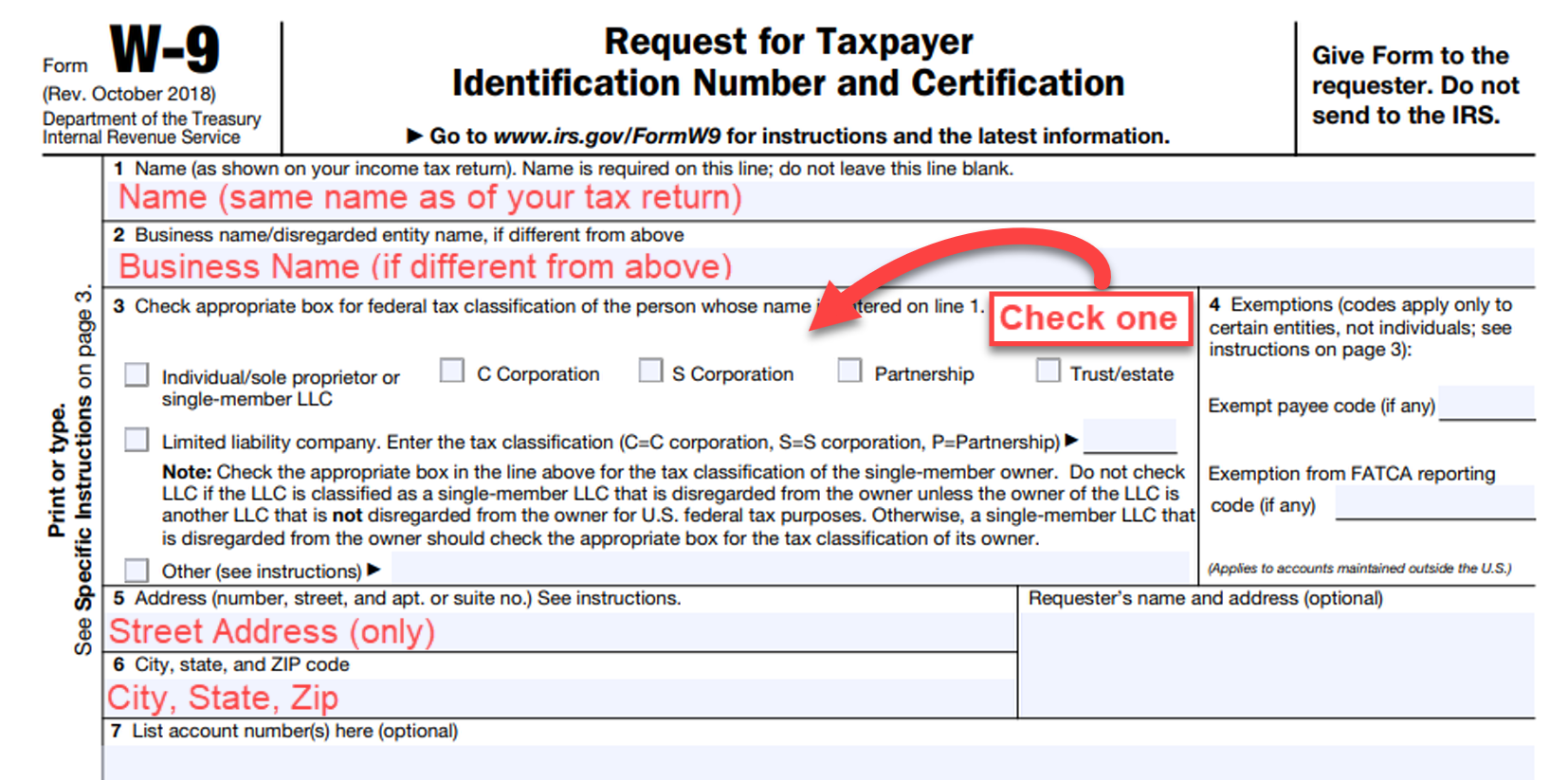

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

How To Fill Out A W 9 Form Online Dropbox Sign Dropbox

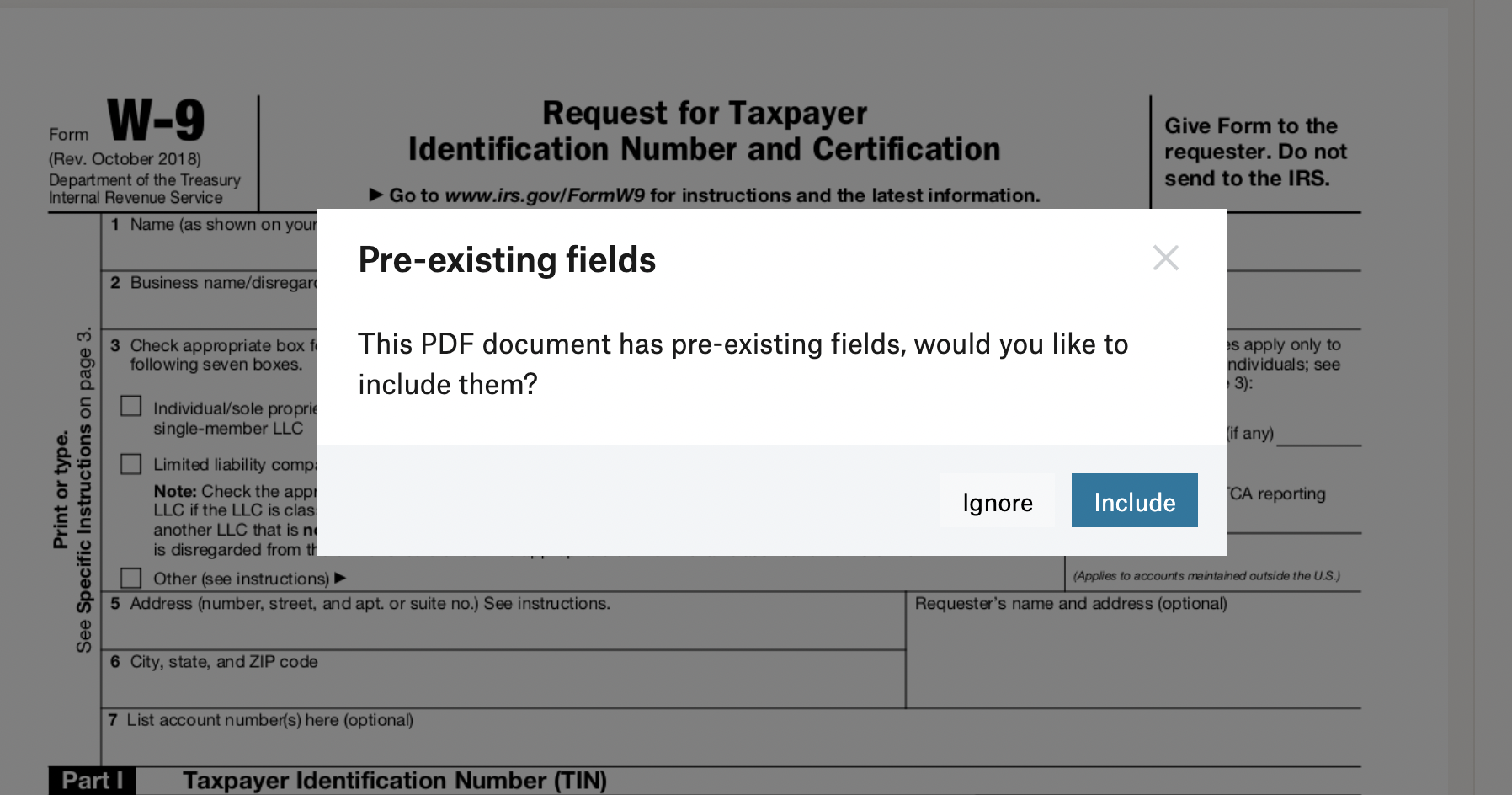

I 9 Form 2024 2025 Fill Edit And Download PDF Guru

I 9 Form 2024 2025 Fill Edit And Download PDF Guru

Managing employee payments doesn’t have to be complicated. A printable payroll form offers a fast, reliable, and easy-to-use method for tracking salaries, work time, and taxes—without the need for complicated tools.

Whether you’re a startup founder, payroll manager, or independent contractor, using apayroll printable helps ensure proper documentation. Simply access the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.