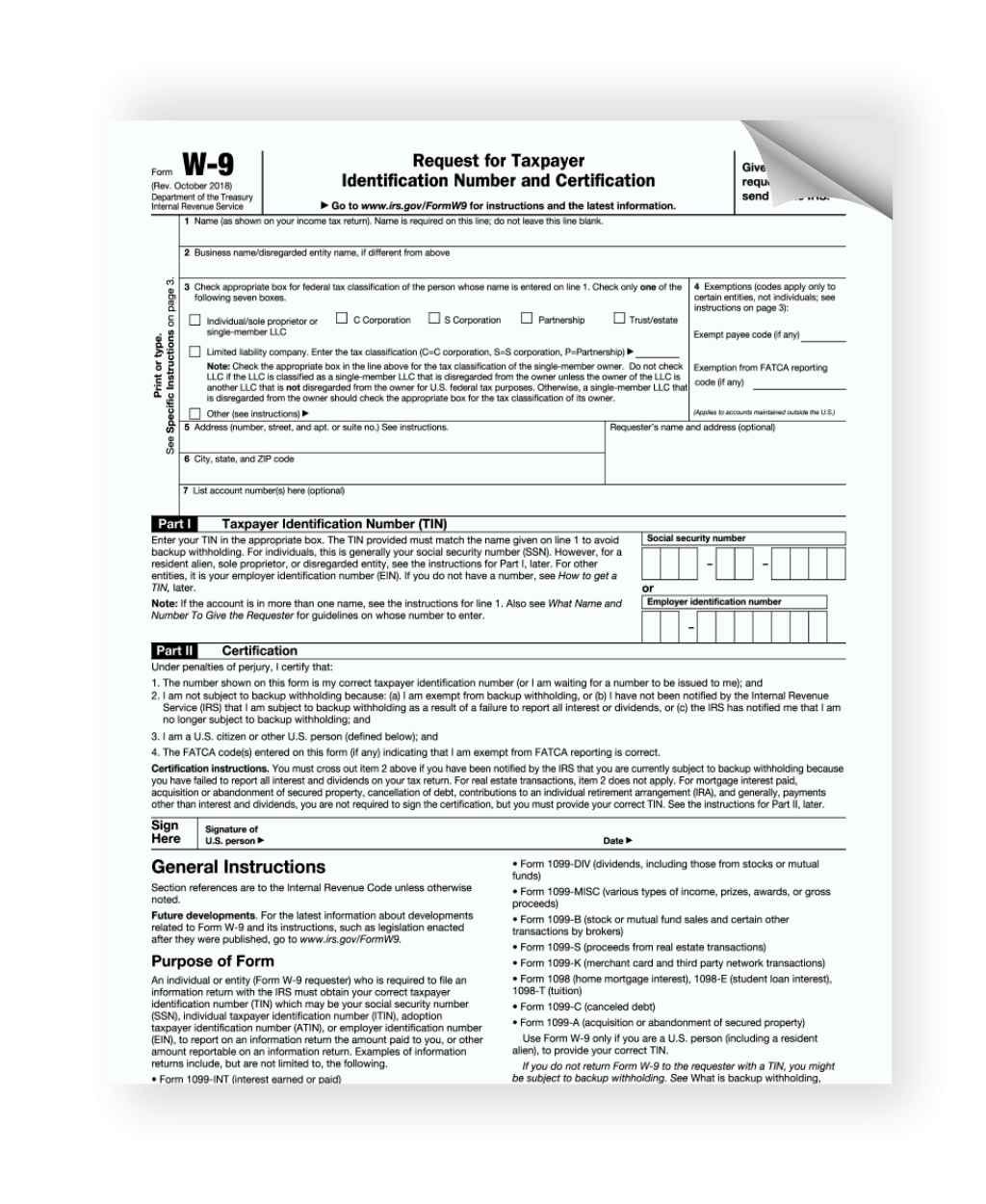

Are you in need of a W9 form for tax purposes? Look no further than the IRS website, where you can find a free printable W9 form. This form is essential for businesses to collect information from independent contractors, freelancers, and other vendors they work with. By having this form on hand, you can ensure that you have all the necessary information for tax reporting purposes.

It’s important to note that the W9 form is not filed with the IRS but rather kept on file by the business that is paying the vendor. This form collects important information such as the vendor’s name, address, and taxpayer identification number. By having this information, businesses can accurately report payments made to vendors for tax purposes.

When using the IRS free printable W9 form, be sure to fill out all the necessary fields accurately to avoid any discrepancies when it comes time to report payments. It’s also important to keep a record of all W9 forms collected in case of any questions or audits from the IRS. By staying organized and keeping accurate records, you can ensure that your tax reporting process runs smoothly.

Businesses can also use electronic versions of the W9 form to collect information from vendors. However, having a printable version on hand can be useful for situations where a physical signature is required. By having both options available, businesses can adapt to the needs of their vendors and ensure that they have all the necessary information for tax reporting purposes.

In conclusion, the IRS free printable W9 form is a valuable tool for businesses to collect important information from vendors. By using this form, businesses can ensure that they have accurate information for tax reporting purposes and stay compliant with IRS regulations. Be sure to download and use this form for your business needs to keep your tax reporting process running smoothly.