When starting a new job or experiencing a major life event such as getting married or having a child, you may need to update your tax withholding information with your employer. This is where the IRS Form W-4 comes into play. This form allows you to specify how much federal income tax should be withheld from your paycheck.

It’s important to fill out the IRS Form W-4 accurately to ensure that the right amount of tax is withheld from your pay. This form helps prevent you from owing a large sum of money at tax time or receiving a hefty refund. By taking the time to complete the form correctly, you can ensure that your tax withholding aligns with your financial situation.

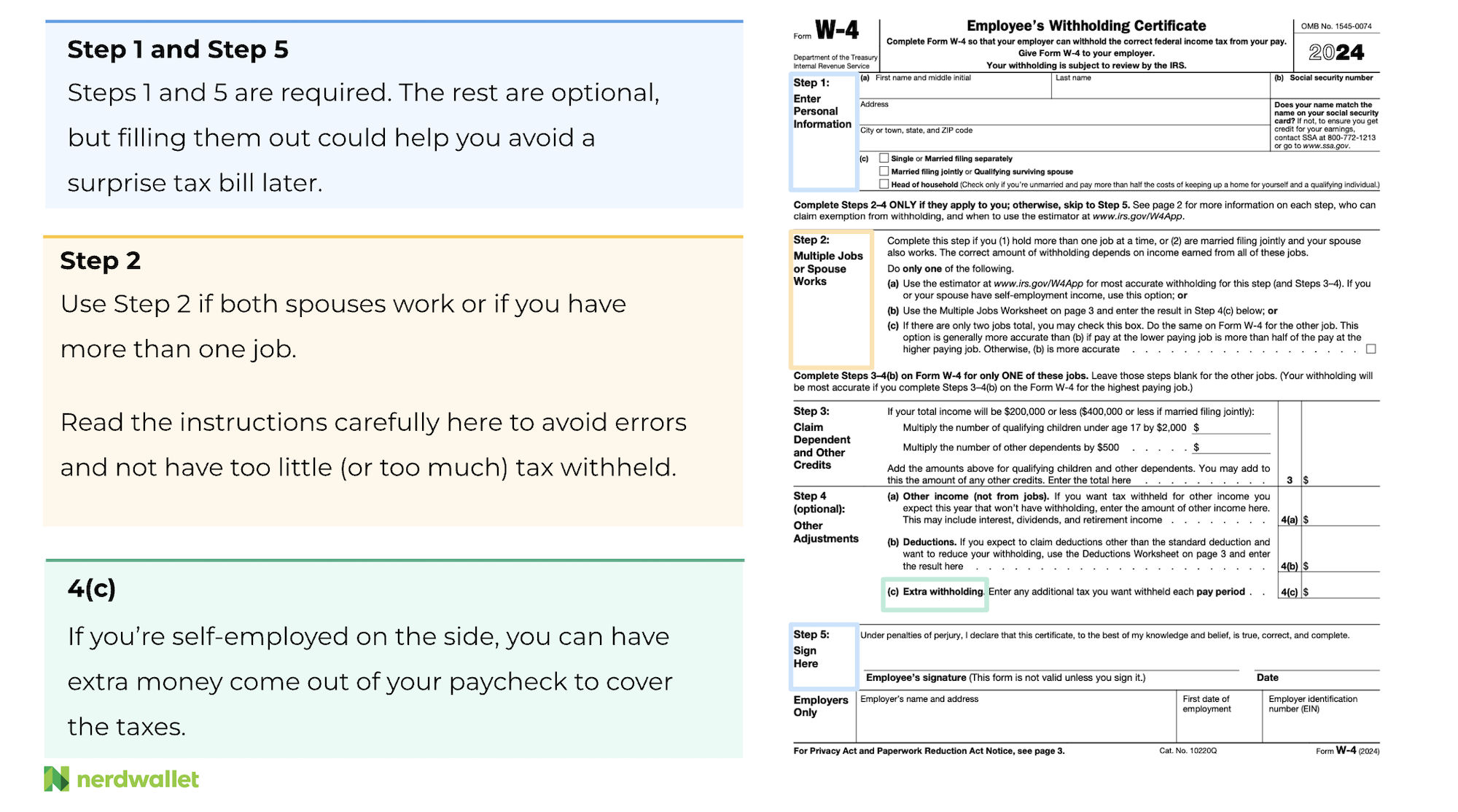

When you download the IRS Form W-4 printable version, you have the option to fill it out electronically or print it out and complete it by hand. The form includes sections for personal information, such as your name, address, and Social Security number, as well as questions about your filing status and dependents. You’ll also need to indicate any additional income, deductions, and credits that may impact your tax withholding.

After completing the IRS Form W-4, you’ll need to submit it to your employer for processing. They will use the information provided on the form to calculate the appropriate amount of federal income tax to withhold from your pay. If your financial situation changes, you can always update your withholding by completing a new Form W-4.

By staying on top of your tax withholding and making adjustments as needed, you can avoid any surprises come tax time. The IRS Form W-4 is a valuable tool that allows you to take control of your tax situation and ensure that you’re not overpaying or underpaying your taxes throughout the year.

Make sure to download the IRS Form W-4 printable version today and update your tax withholding information to reflect your current financial situation. By doing so, you can better manage your tax obligations and avoid any unnecessary penalties or fees. Take the time to fill out the form accurately and submit it to your employer promptly for a smooth tax season ahead.