IRS Form SS-4 is an important document that is used to apply for an Employer Identification Number (EIN). This number is required for businesses, trusts, estates, non-profit organizations, and other entities to file taxes, open a bank account, and hire employees. It is essential to have this form filled out correctly and submitted to the IRS in order to obtain an EIN.

Obtaining an EIN is a crucial step for any business or organization that wants to establish itself as a legitimate entity in the eyes of the government. Without an EIN, it can be difficult to conduct business activities such as hiring employees, opening a business bank account, or applying for business licenses. The IRS Form SS-4 is the first step in the process of obtaining this important identification number.

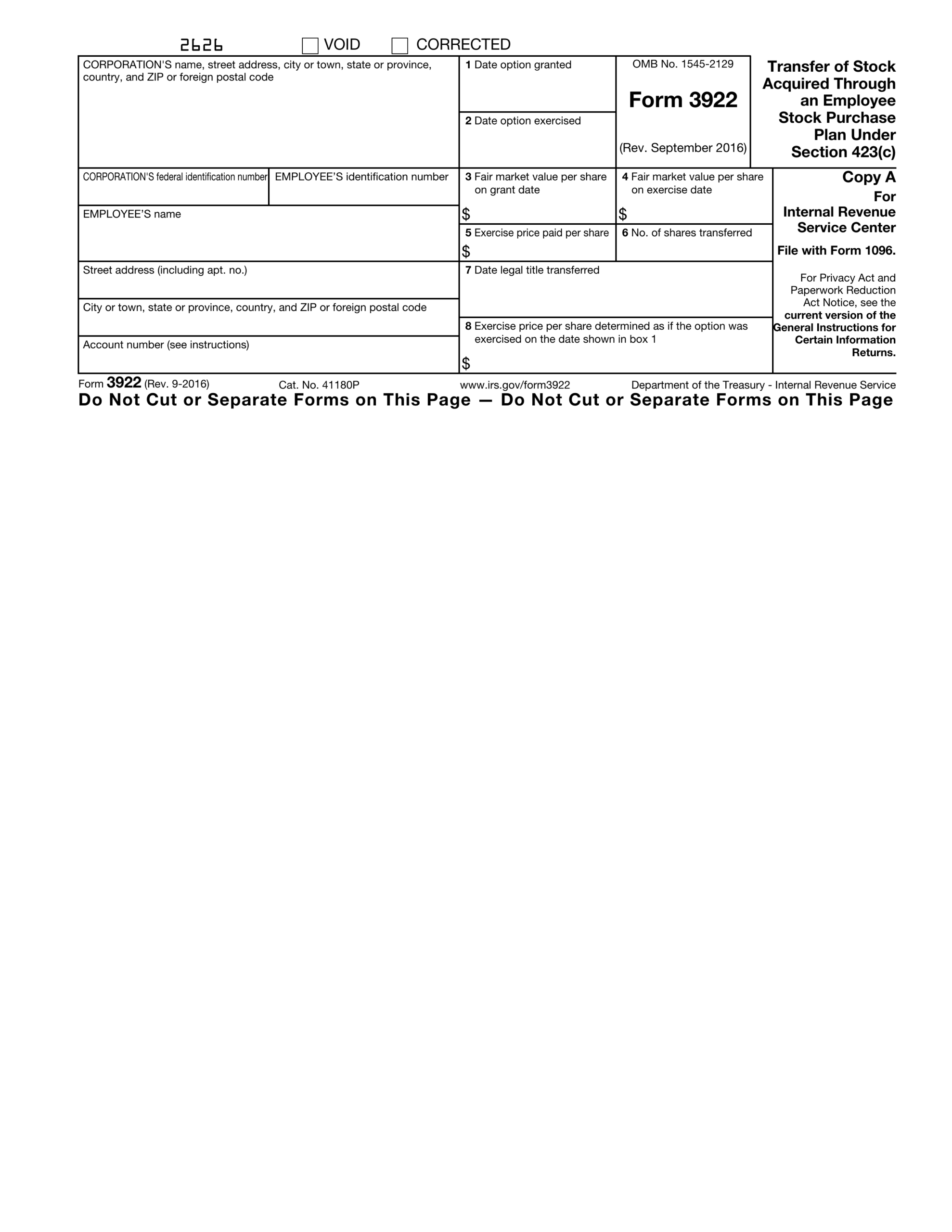

When filling out the IRS Form SS-4, it is important to provide accurate and complete information. The form requires details such as the legal name of the entity, the type of entity, the reason for applying for an EIN, and the responsible party’s name and address. It is crucial to double-check all information before submitting the form to the IRS to avoid any delays or issues with obtaining an EIN.

One convenient option for obtaining an IRS Form SS-4 is to use the printable version available on the IRS website. This form can be downloaded, printed, and filled out manually before being submitted to the IRS. This option is ideal for those who prefer to fill out the form by hand or do not have access to a computer to fill out the form online.

After completing the IRS Form SS-4, it can be submitted to the IRS either online, by fax, or by mail. The processing time for obtaining an EIN can vary depending on the method of submission, but typically ranges from a few days to a few weeks. Once the EIN is assigned, it will be sent to the entity via mail or provided online, depending on the method of application.

In conclusion, obtaining an EIN is a crucial step for any business or organization, and the IRS Form SS-4 is the key document needed to apply for this identification number. By filling out the form accurately and completely, and submitting it to the IRS in a timely manner, businesses can ensure a smooth process for obtaining an EIN and establishing themselves as a legitimate entity in the eyes of the government.

Save and Print Irs Form Ss-4 Printable

Irs Form Ss-4 Printable are ideal for businesses that prefer physical records or need physical copies for audit purposes. Most forms include fields for staff name, date range, total earnings, withholdings, and net pay—making them both complete and easy to use.

Take control of your payment tracking today with a trusted printable payroll template. Save time, minimize mistakes, and stay organized—all while keeping your payroll records organized.

SS 4 Form 2024 2025 How To Fill And Edit Online PDF Guru

SS 4 Form 2024 2025 How To Fill And Edit Online PDF Guru

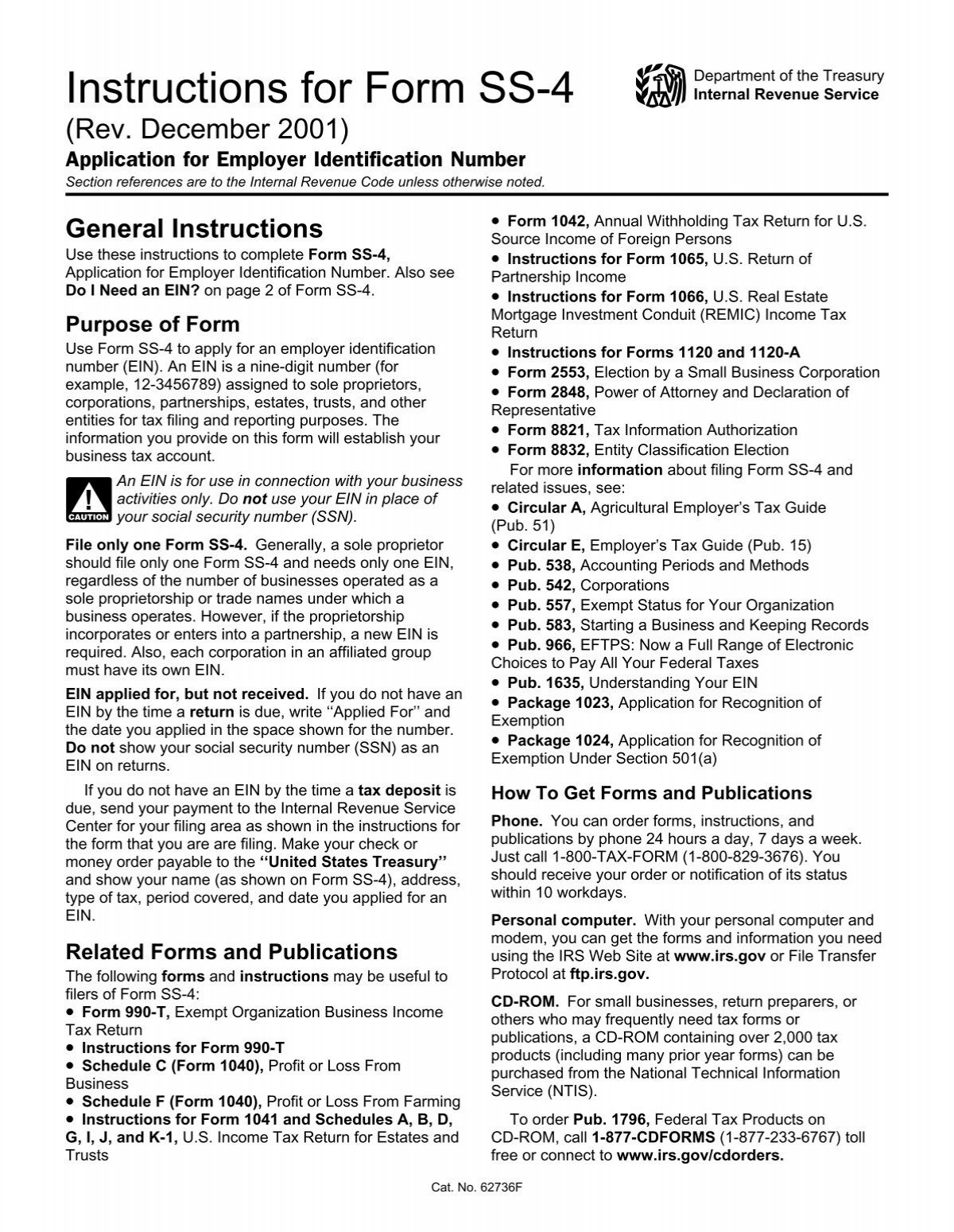

Instructions For Form SS 4 Internal Revenue Service

Instructions For Form SS 4 Internal Revenue Service

Download IRS SS 4 Confirmation Letter Sample Word Format

Download IRS SS 4 Confirmation Letter Sample Word Format

Managing payroll tasks doesn’t have to be difficult. A printable payroll offers a quick, accurate, and user-friendly method for tracking wages, work time, and taxes—without the need for digital systems.

Whether you’re a freelancer, HR professional, or independent contractor, using apayroll template helps ensure compliance with regulations. Simply access the template, print it, and fill it out by hand or edit it digitally before printing.