When dealing with debt forgiveness or cancellation, it’s important to understand the tax implications that come with it. The IRS requires individuals to report canceled debt as income on their tax return. However, there is a form that can help alleviate some of the tax burden – Form 982.

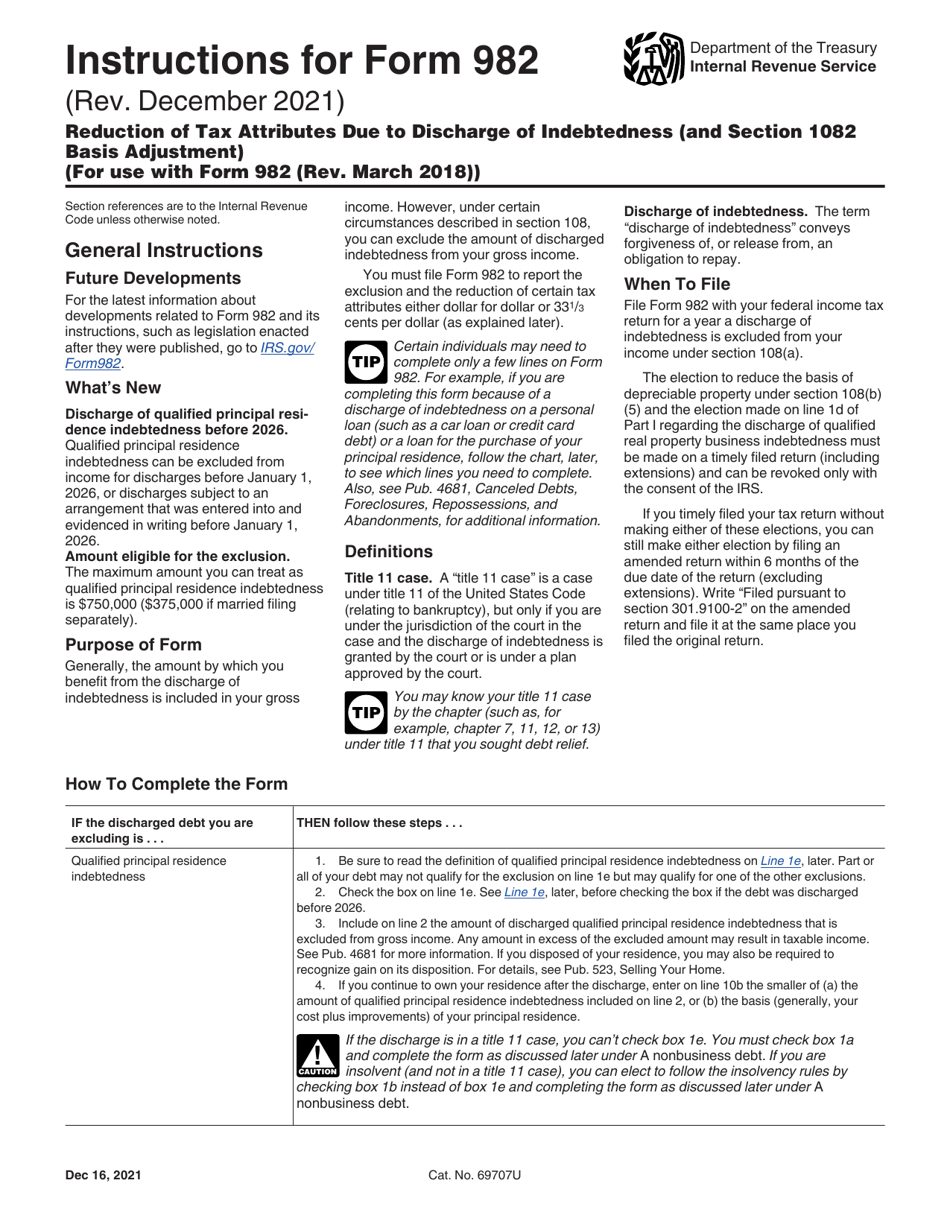

Form 982 is used to reduce or eliminate the amount of canceled debt that is considered taxable income. This form is particularly useful for individuals who have had their debts forgiven due to bankruptcy or insolvency. By properly completing and submitting Form 982, taxpayers can potentially exclude all or a portion of their canceled debt from being taxed.

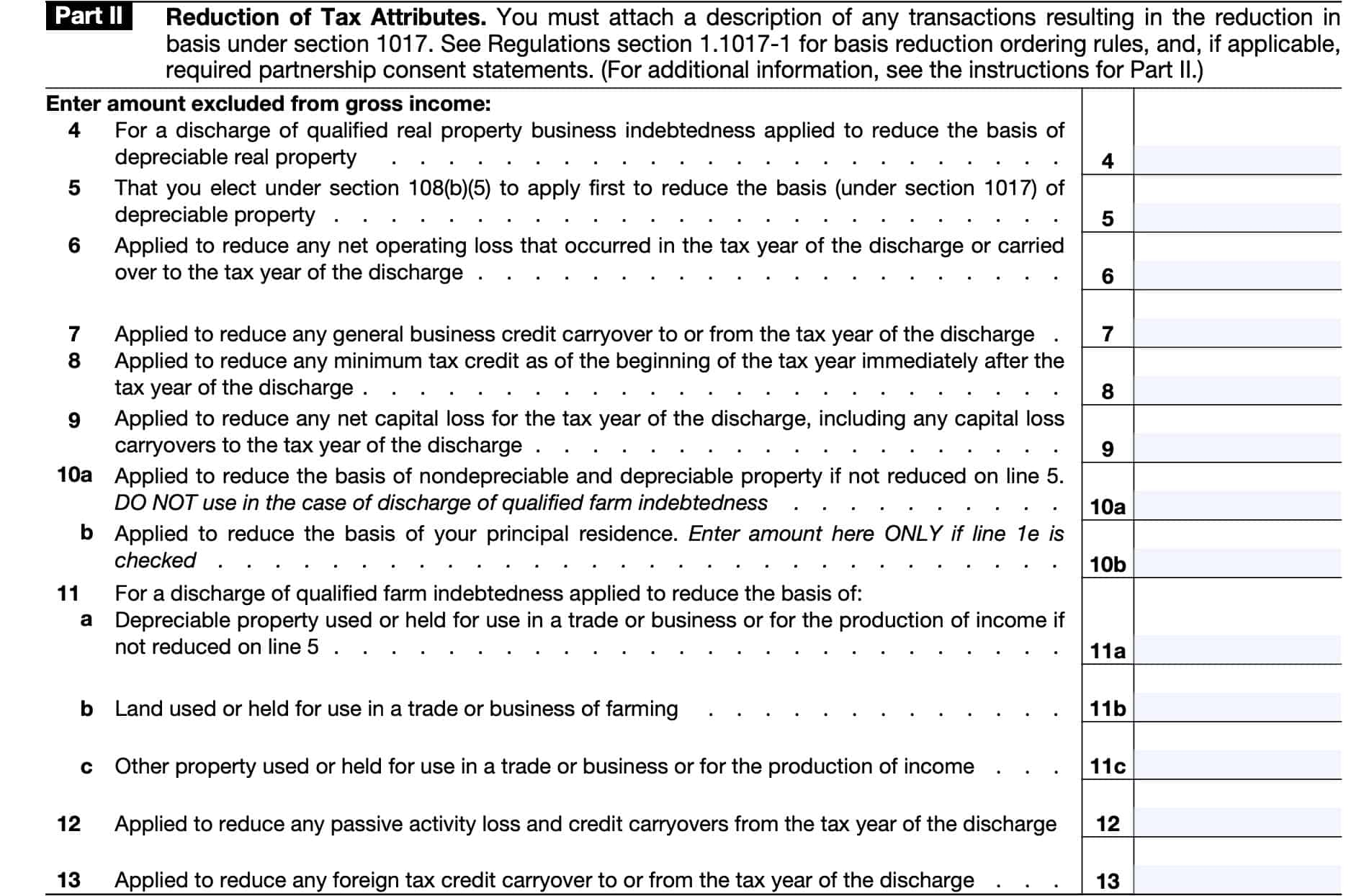

There are several sections on Form 982 that taxpayers need to carefully fill out. These sections include information about the type of canceled debt, the amount of debt canceled, and the reason for the debt cancellation. It’s important to provide accurate and detailed information to ensure that the IRS processes the form correctly.

One important thing to note is that not all canceled debt can be excluded from taxable income using Form 982. For example, debts that are forgiven as a gift or as part of a purchase price reduction cannot be excluded. Additionally, debts that are canceled as a result of services rendered cannot be excluded either. It’s crucial to consult with a tax professional to determine if you qualify for exclusion under Form 982.

Overall, Form 982 is a valuable tool for individuals who are facing canceled debt and want to minimize the tax consequences. By understanding how to properly complete and submit this form, taxpayers can potentially save a significant amount of money on their taxes. It’s always a good idea to seek guidance from a tax professional to ensure that you are taking full advantage of the options available to you when it comes to canceled debt and tax obligations.

In conclusion, Form 982 is a helpful resource for individuals dealing with canceled debt and the associated tax implications. By utilizing this form correctly, taxpayers can potentially reduce or eliminate the amount of canceled debt that is considered taxable income. It’s important to provide accurate information and seek guidance from a tax professional to maximize the benefits of Form 982.

Save and Print Irs Form 982 Printable

Payroll printable are ideal for teams that prefer paper documentation or need hard copies for employee records. Most forms include fields for employee name, date range, total earnings, withholdings, and final salary—making them both comprehensive and user-friendly.

Take control of your payment tracking today with a trusted printable payroll form. Save time, minimize mistakes, and stay organized—all while keeping your payroll records clear.

Form 982 Fill Out Printable PDF Forms Online Worksheets Library

Form 982 Fill Out Printable PDF Forms Online Worksheets Library

Form 982 For 2024 2025 Fill And Edit Accurately PDF Guru

Form 982 For 2024 2025 Fill And Edit Accurately PDF Guru

IRS Form 982 Reduction Of Attributes Due To Discharge Of Worksheets Library

IRS Form 982 Reduction Of Attributes Due To Discharge Of Worksheets Library

IRS Form 982 Instructions Discharge Of Indebtedness

IRS Form 982 Instructions Discharge Of Indebtedness

Download Instructions For IRS Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness And Section 1082 Basis Adjustment PDF 2018 2025 Templateroller

Download Instructions For IRS Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness And Section 1082 Basis Adjustment PDF 2018 2025 Templateroller

Processing employee payments doesn’t have to be complicated. A printable payroll offers a speedy, accurate, and straightforward method for tracking salaries, shifts, and taxes—without the need for complex software.

Whether you’re a startup founder, administrator, or sole proprietor, using apayroll printable helps ensure compliance with regulations. Simply download the template, produce a hard copy, and complete it by hand or type directly into the file before printing.