When it comes to taxes, one of the most important forms that employers need to be familiar with is Form 941. This form is used to report quarterly wages, tips, and other compensation paid to employees, as well as the employer’s share of taxes such as Social Security and Medicare. It is crucial for employers to accurately complete and file Form 941 to ensure compliance with tax laws and avoid penalties.

Form 941 is typically filed by employers who withhold federal income tax, Social Security tax, and Medicare tax from their employees’ paychecks. It is important to note that Form 941 is different from Form 940, which is used to report and pay annual Federal Unemployment Tax Act (FUTA) taxes. Employers must file Form 941 quarterly, with deadlines falling at the end of April, July, October, and January.

Employers can easily access and print Form 941 from the Internal Revenue Service (IRS) website. The form is available in a printable format, making it convenient for employers to fill out and submit. It is essential to ensure that the form is filled out accurately, including providing information about the number of employees, total wages paid, and taxes withheld.

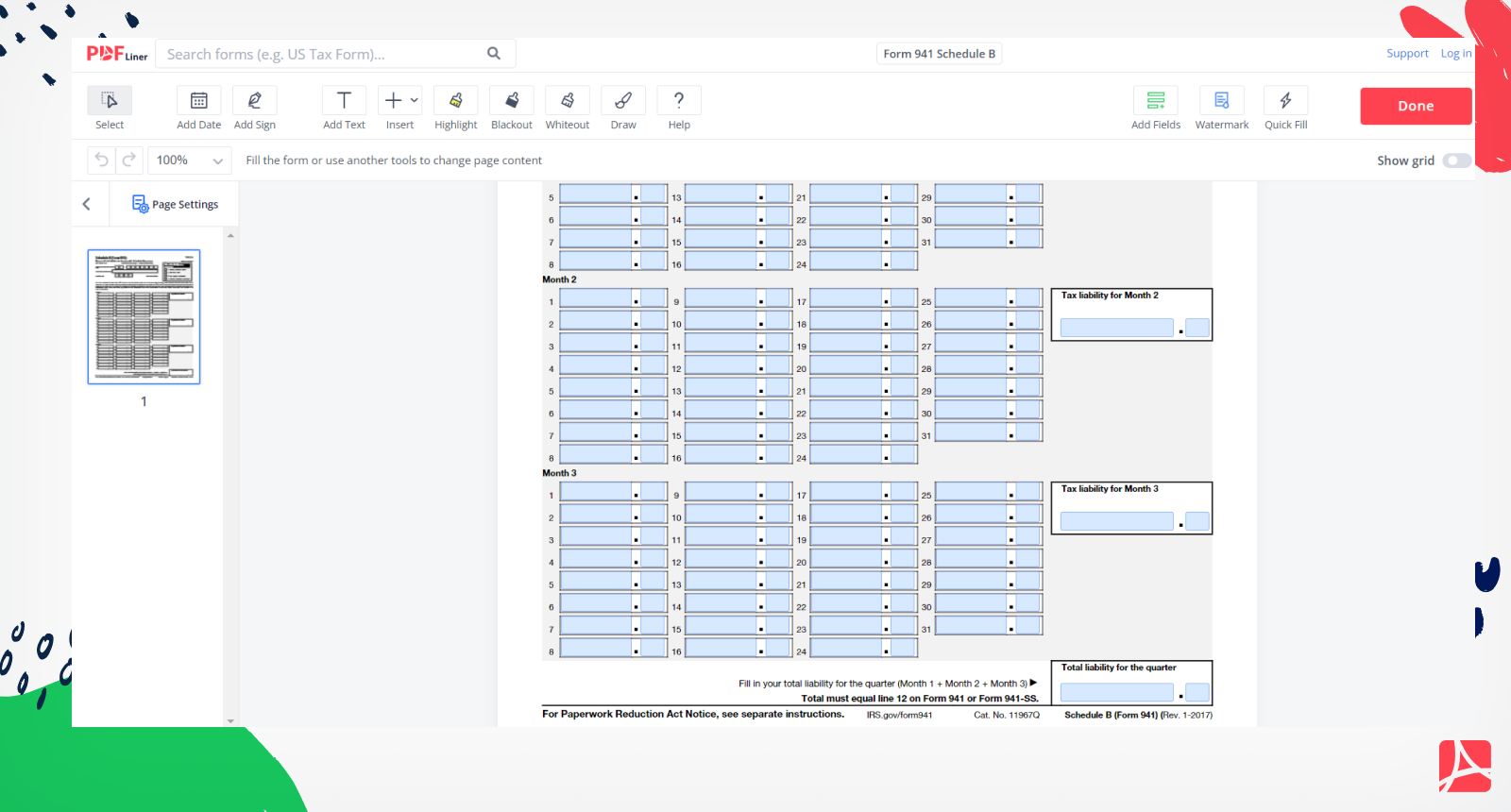

When completing Form 941, employers must also calculate their tax liability and make any necessary payments to the IRS. Failure to file Form 941 or pay the required taxes on time can result in penalties and interest charges. Employers should carefully review the instructions provided with the form to ensure compliance with all tax laws and regulations.

In conclusion, Form 941 is a vital document for employers to report wages, tips, and taxes withheld from employees’ pay. By accessing the printable version of Form 941 from the IRS website and following the instructions carefully, employers can ensure compliance with tax laws and avoid penalties. It is essential for employers to file Form 941 accurately and on time to fulfill their tax obligations.