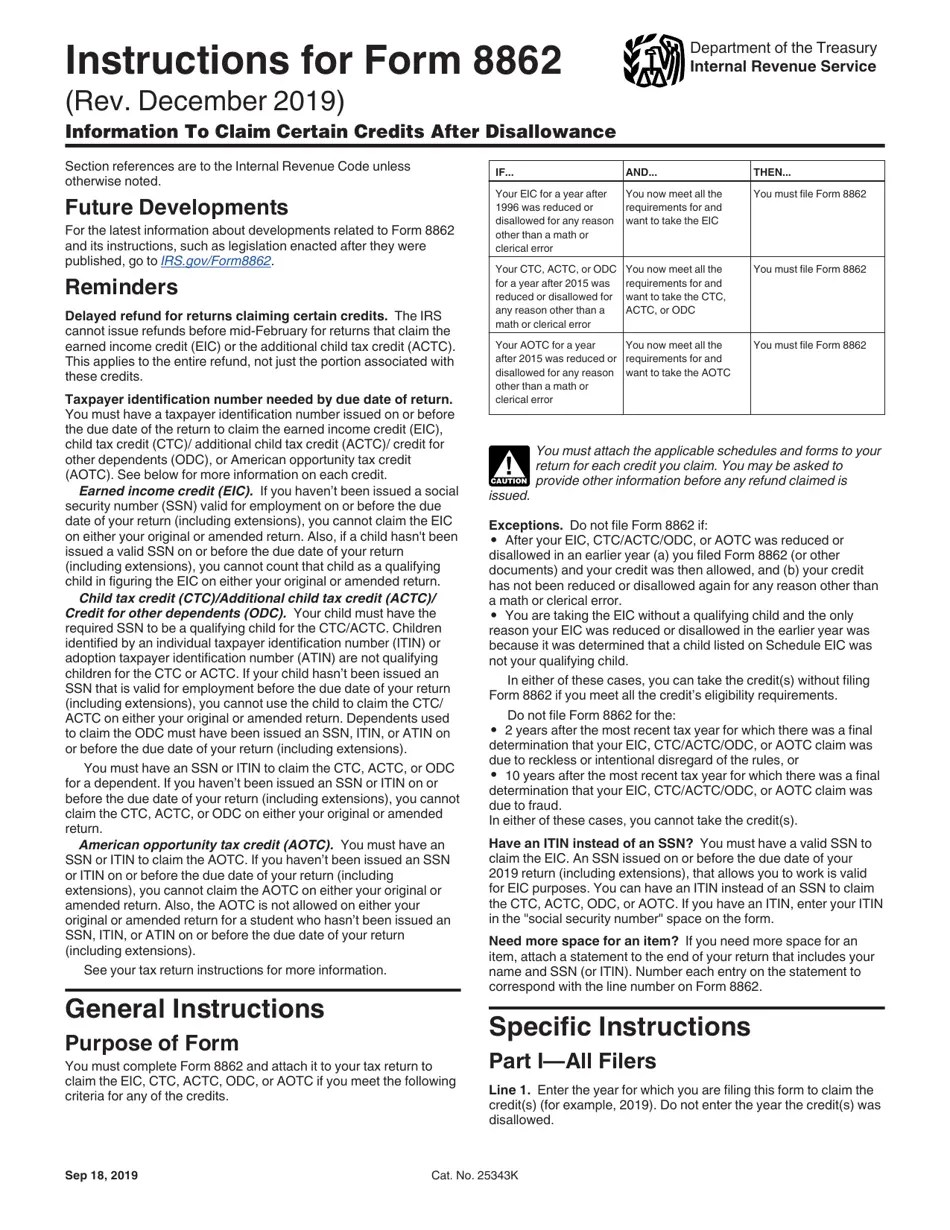

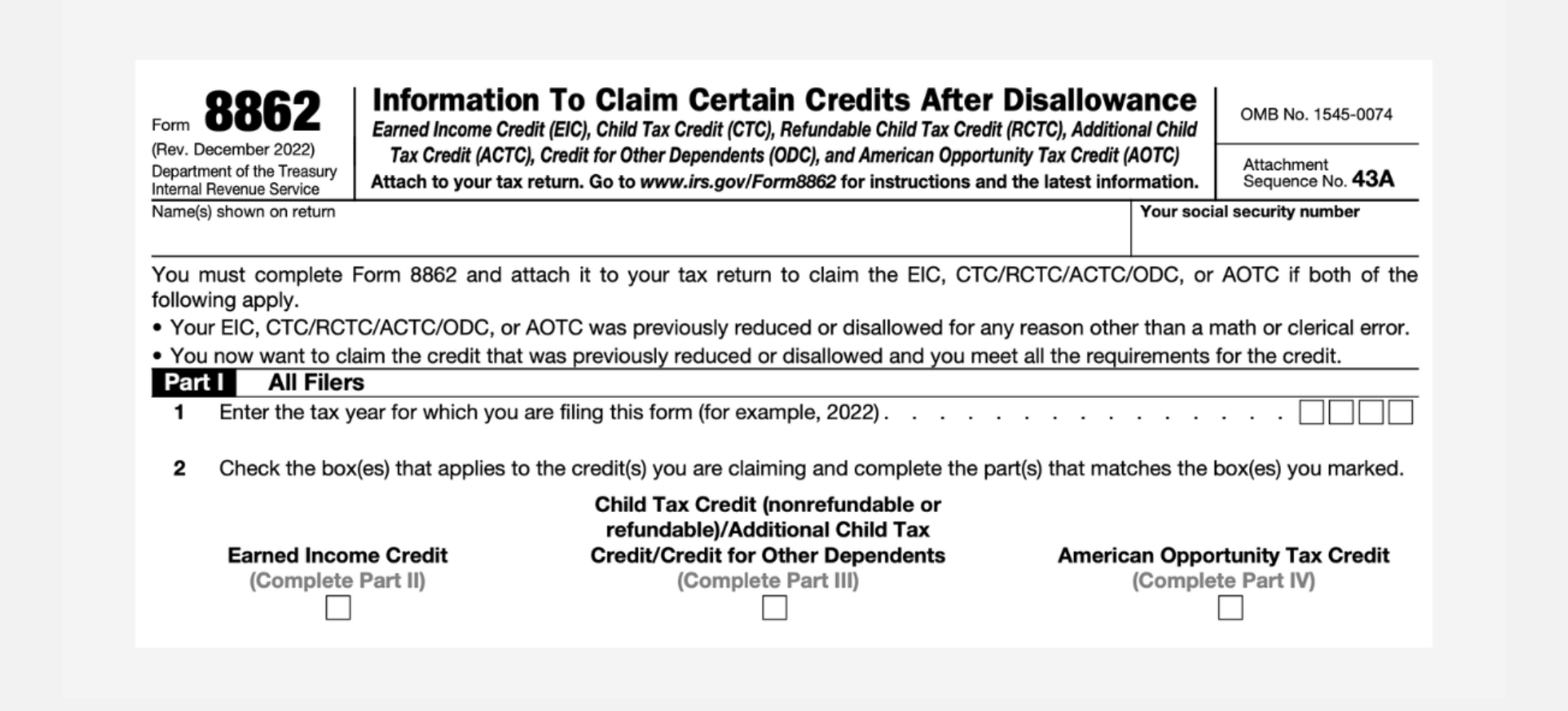

IRS Form 8862, also known as the Information to Claim Earned Income Credit After Disallowance, is a form that taxpayers use to claim the Earned Income Tax Credit (EITC) after it has been disallowed in a previous year. This form is essential for individuals who have had their EITC disallowed and are now eligible to claim it again.

It is important to note that not everyone will need to use Form 8862. This form is specifically for taxpayers who have had their EITC disallowed and are now eligible to claim it again. If you are unsure whether you need to file Form 8862, it is recommended to consult with a tax professional or the IRS.

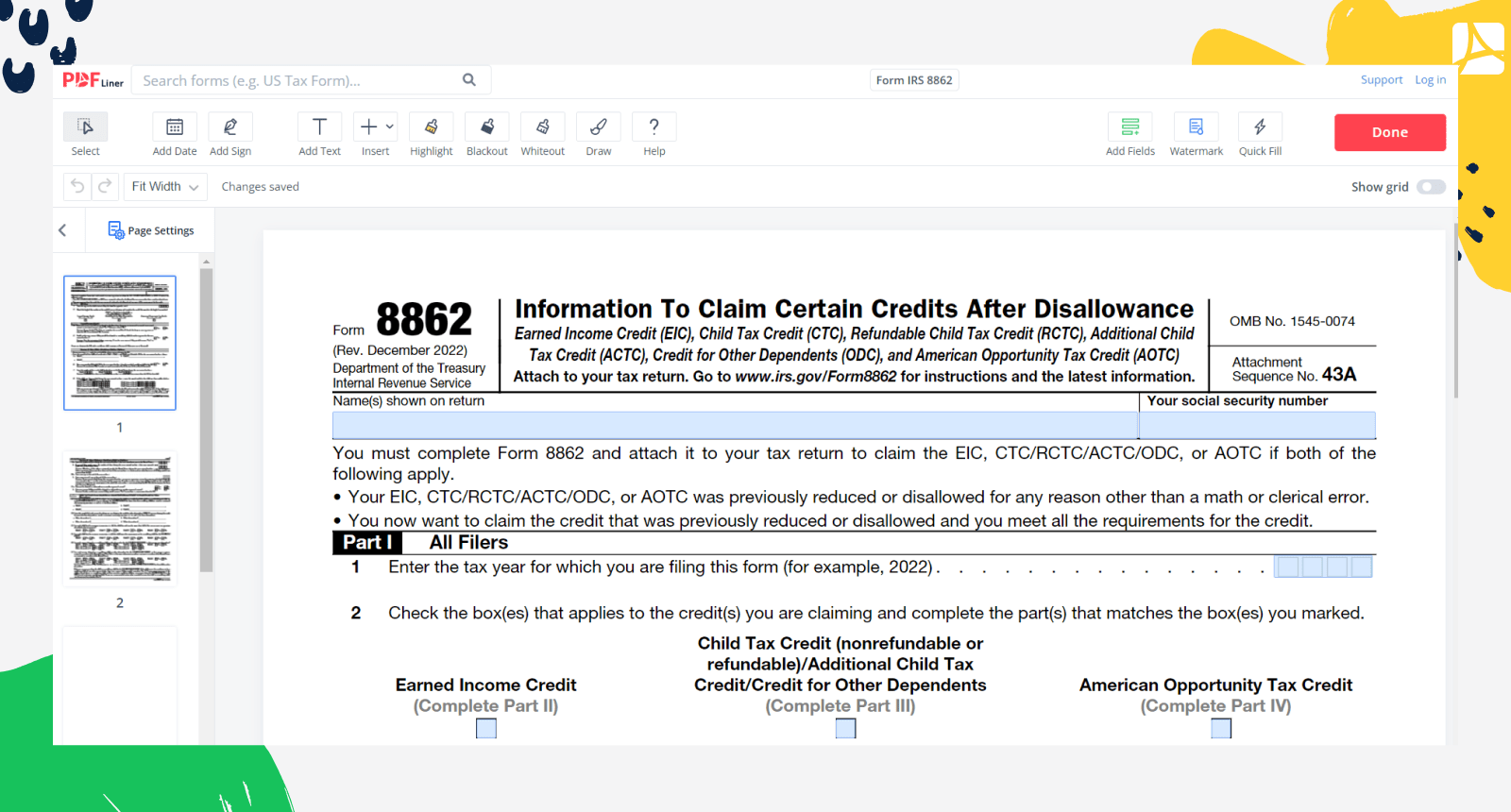

When filling out Form 8862, taxpayers will need to provide information such as their name, social security number, and the tax year for which they are claiming the EITC. Additionally, taxpayers will need to provide details about why their EITC was disallowed in the previous year and any changes in their circumstances that now make them eligible to claim the credit.

Once the form is completed, taxpayers can file it along with their tax return. It is important to ensure that Form 8862 is filled out accurately and completely to avoid any delays in processing the EITC claim. Taxpayers should also keep a copy of the form for their records in case the IRS requests additional information.

Overall, IRS Form 8862 is a crucial document for individuals who have had their Earned Income Tax Credit disallowed in a previous year and are now eligible to claim it again. By providing the necessary information and submitting the form along with their tax return, taxpayers can potentially receive a valuable tax credit that can help alleviate financial burdens.

In conclusion, IRS Form 8862 is a valuable tool for taxpayers who have had their EITC disallowed and are now eligible to claim it again. By accurately completing and submitting this form, individuals can potentially access a valuable tax credit that can provide much-needed financial relief. It is important to consult with a tax professional or the IRS if you are unsure whether you need to file Form 8862.

Save and Print Irs Form 8862 Printable

Printable payroll template are ideal for companies that prefer paper documentation or need physical copies for audit purposes. Most forms include fields for staff name, pay period, total earnings, taxes, and net pay—making them both comprehensive and easy to use.

Begin streamlining your payroll system today with a trusted printable payroll. Reduce admin effort, reduce errors, and stay organized—all while keeping your payroll records organized.

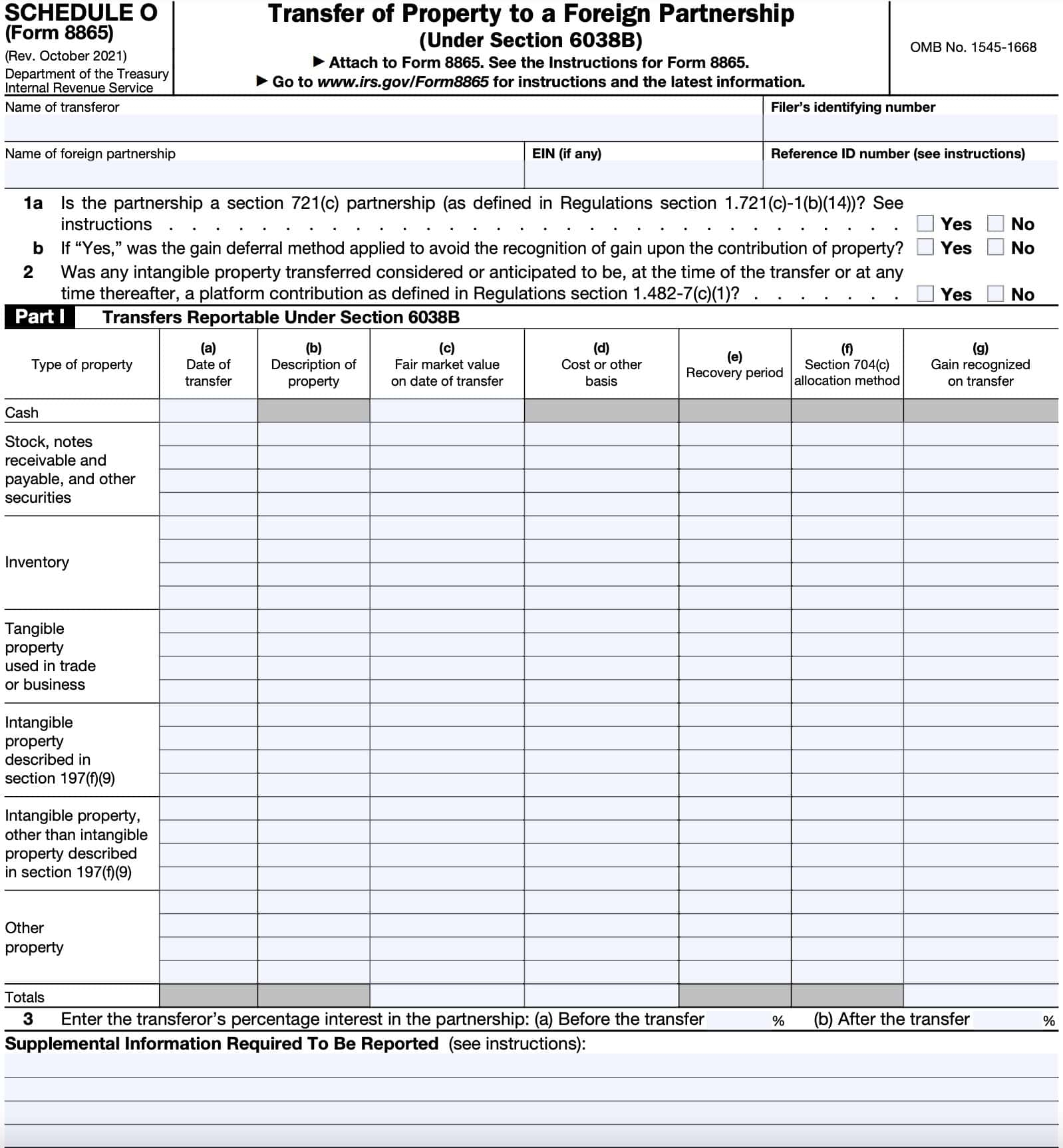

IRS Form 8865 Instructions Foreign Partnership Returns

IRS Form 8865 Instructions Foreign Partnership Returns

8862 Form 2024 2025 How To Fill Out Correctly PDF Guru

8862 Form 2024 2025 How To Fill Out Correctly PDF Guru

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

8862 Form Reclaiming The Earned Income Credit PdfFiller Blog

Form IRS 8862 Printable And Fillable Forms Online PDFliner

Form IRS 8862 Printable And Fillable Forms Online PDFliner

Managing staff wages doesn’t have to be complicated. A printable payroll form offers a speedy, reliable, and easy-to-use method for tracking employee pay, work time, and taxes—without the need for digital systems.

Whether you’re a small business owner, administrator, or independent contractor, using aIrs Form 8862 Printable helps ensure compliance with regulations. Simply get the template, print it, and complete it by hand or type directly into the file before printing.