When you move to a new address, it is important to notify the Internal Revenue Service (IRS) so that your tax documents and other important correspondence can be sent to the correct location. One way to update your address with the IRS is by filling out Form 8822, also known as the Change of Address form.

Form 8822 is a simple one-page document that allows you to update your mailing address with the IRS. It is important to keep your address current with the IRS to ensure that you receive any important tax documents or correspondence in a timely manner. Failure to update your address could result in missing important information or even potential penalties.

When completing Form 8822, you will need to provide your old address, new address, and your Social Security number. You can choose to mail the form to the IRS or submit it electronically. The form is available for download on the IRS website and can be printed for your convenience.

It is important to note that Form 8822 is not used to update your address for tax returns. If you need to change your address for tax filing purposes, you will need to use a different form, such as Form 1040 or Form 1040X. Form 8822 is specifically for updating your address with the IRS for other purposes.

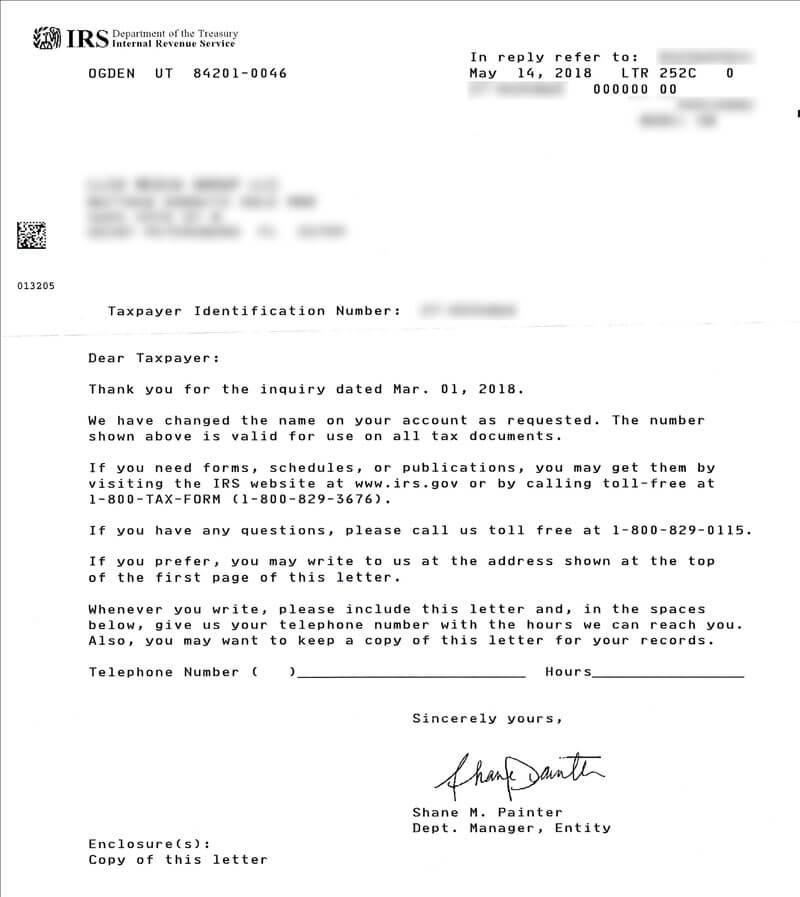

Once you have completed Form 8822 and submitted it to the IRS, be sure to keep a copy for your records. It may take some time for the IRS to process your address change, so it is important to plan ahead and notify them as soon as possible to avoid any delays in receiving important tax information.

Overall, Form 8822 is a simple and straightforward way to update your address with the IRS. By taking the time to complete this form, you can ensure that your tax documents and other important correspondence are sent to the correct location.

Whether you are moving to a new address or simply need to update your contact information with the IRS, Form 8822 is a valuable tool to help you stay organized and informed. Be sure to download the form from the IRS website and submit it promptly to keep your address current.