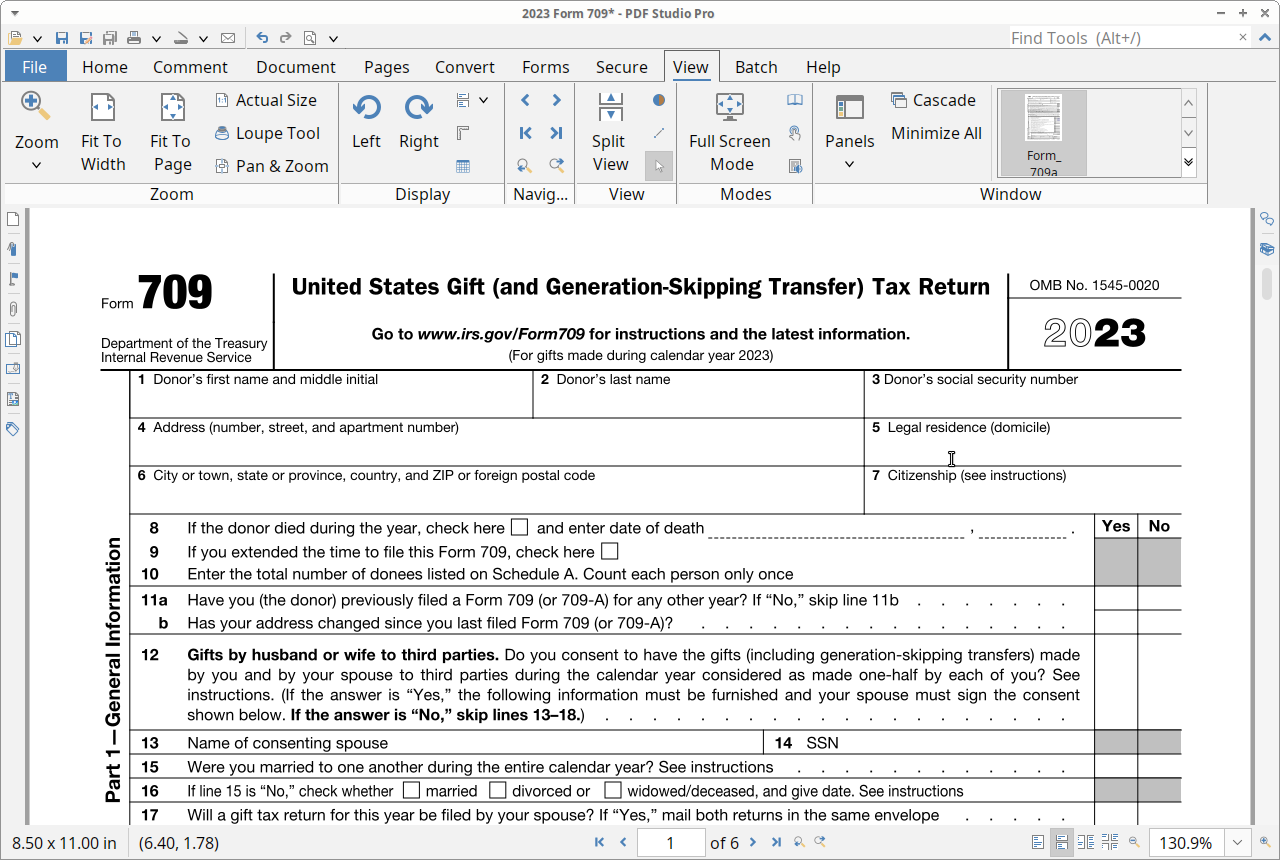

When it comes to estate planning and gift taxes, the IRS Form 709 is an essential document that individuals need to be familiar with. This form is used to report gifts that exceed the annual exclusion amount and is required to be filed by the donor each year. For the year 2025, having a printable version of the IRS Form 709 can make the process much easier for taxpayers.

Gift taxes can be a complex area of taxation, and it is crucial to ensure that all gifts are properly reported to the IRS. The IRS Form 709 for 2025 provides a clear structure for individuals to report their gifts and calculate any potential gift tax liability. By utilizing the printable version of this form, taxpayers can easily fill out the necessary information and submit it to the IRS.

Irs Form 709 For 2025 Printable

Irs Form 709 For 2025 Printable

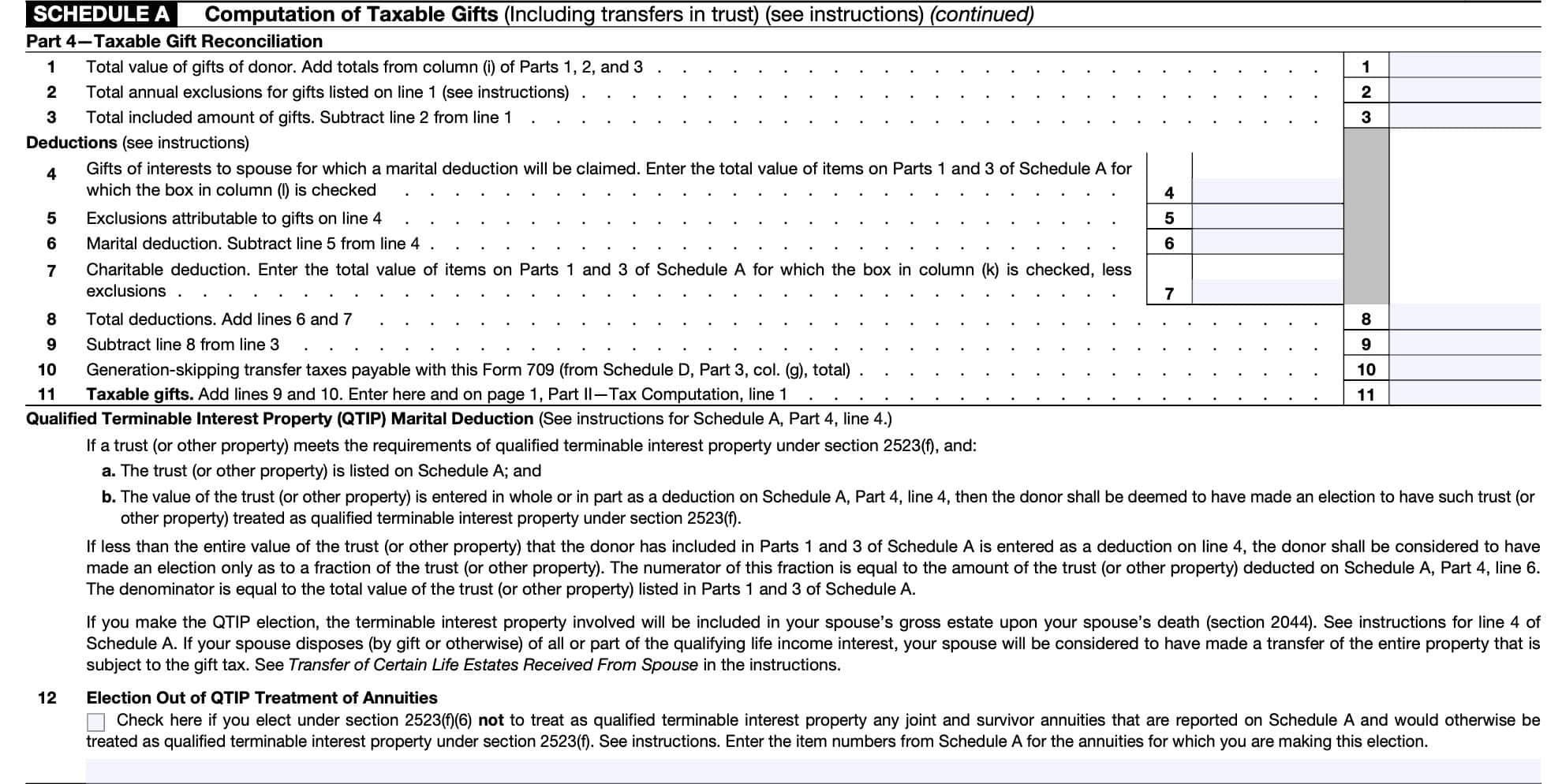

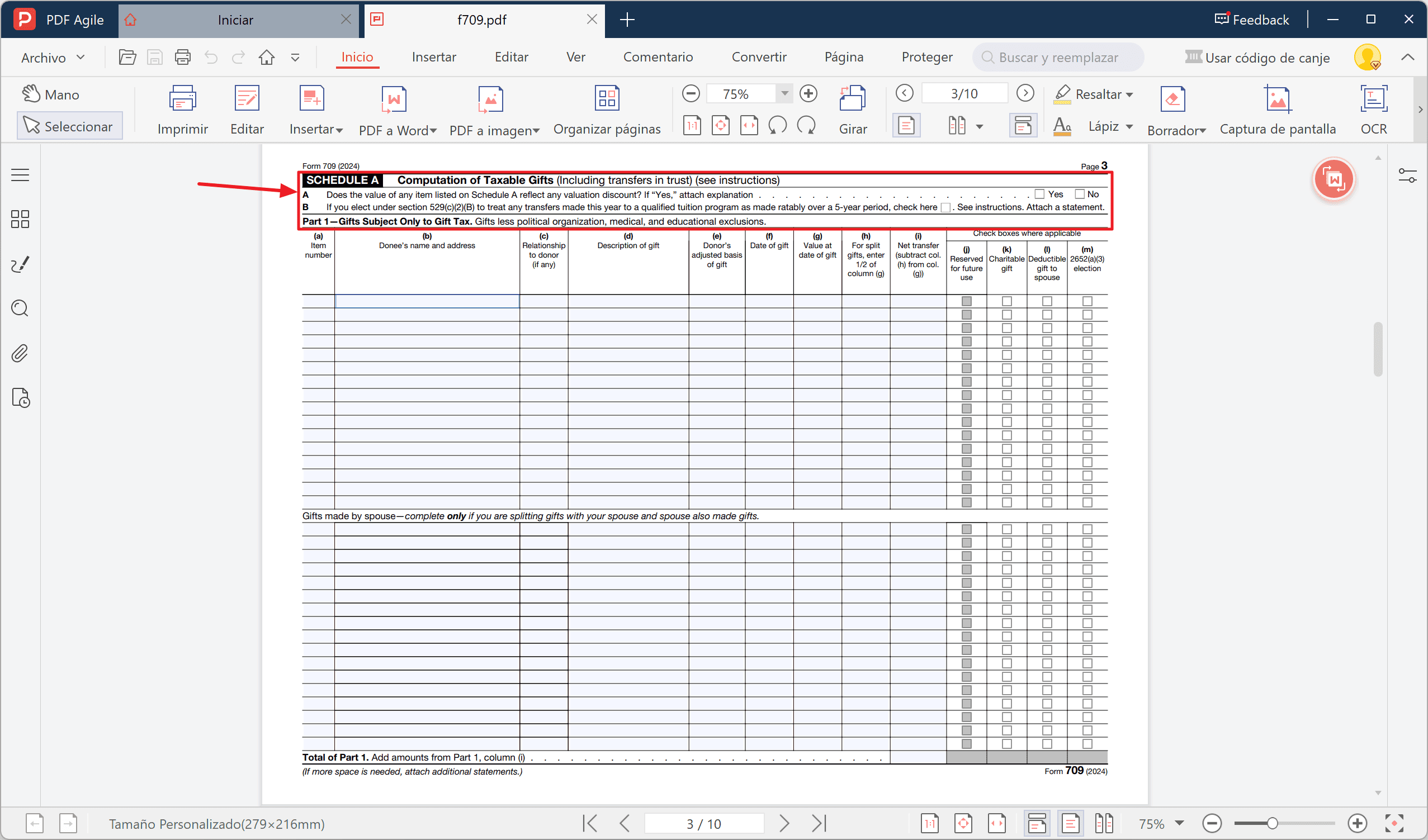

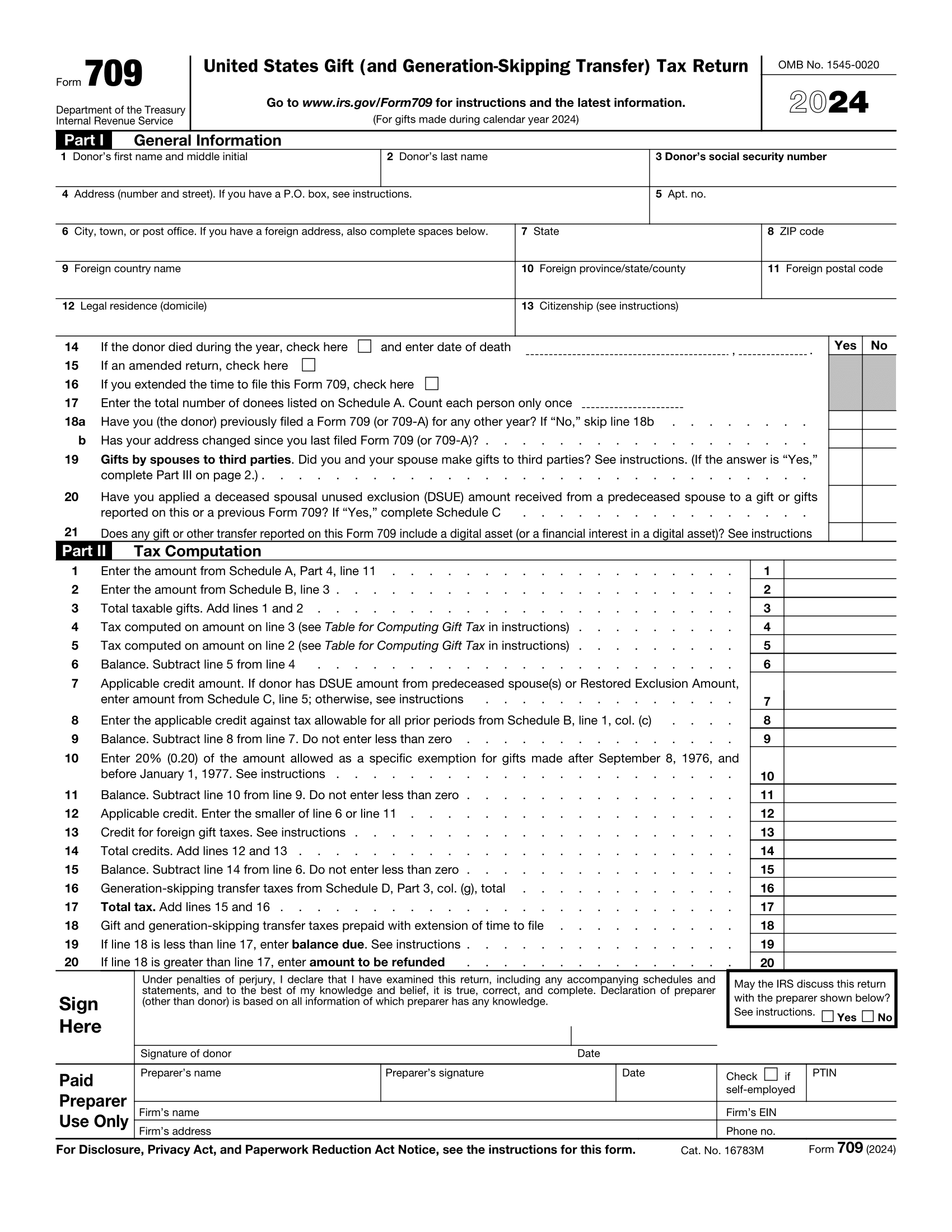

When completing the IRS Form 709 for 2025, individuals will need to provide details about the gifts they have given throughout the year. This includes information about the recipient of the gift, the value of the gift, and any applicable deductions or exclusions. By accurately reporting this information on the form, taxpayers can avoid potential penalties or audits from the IRS.

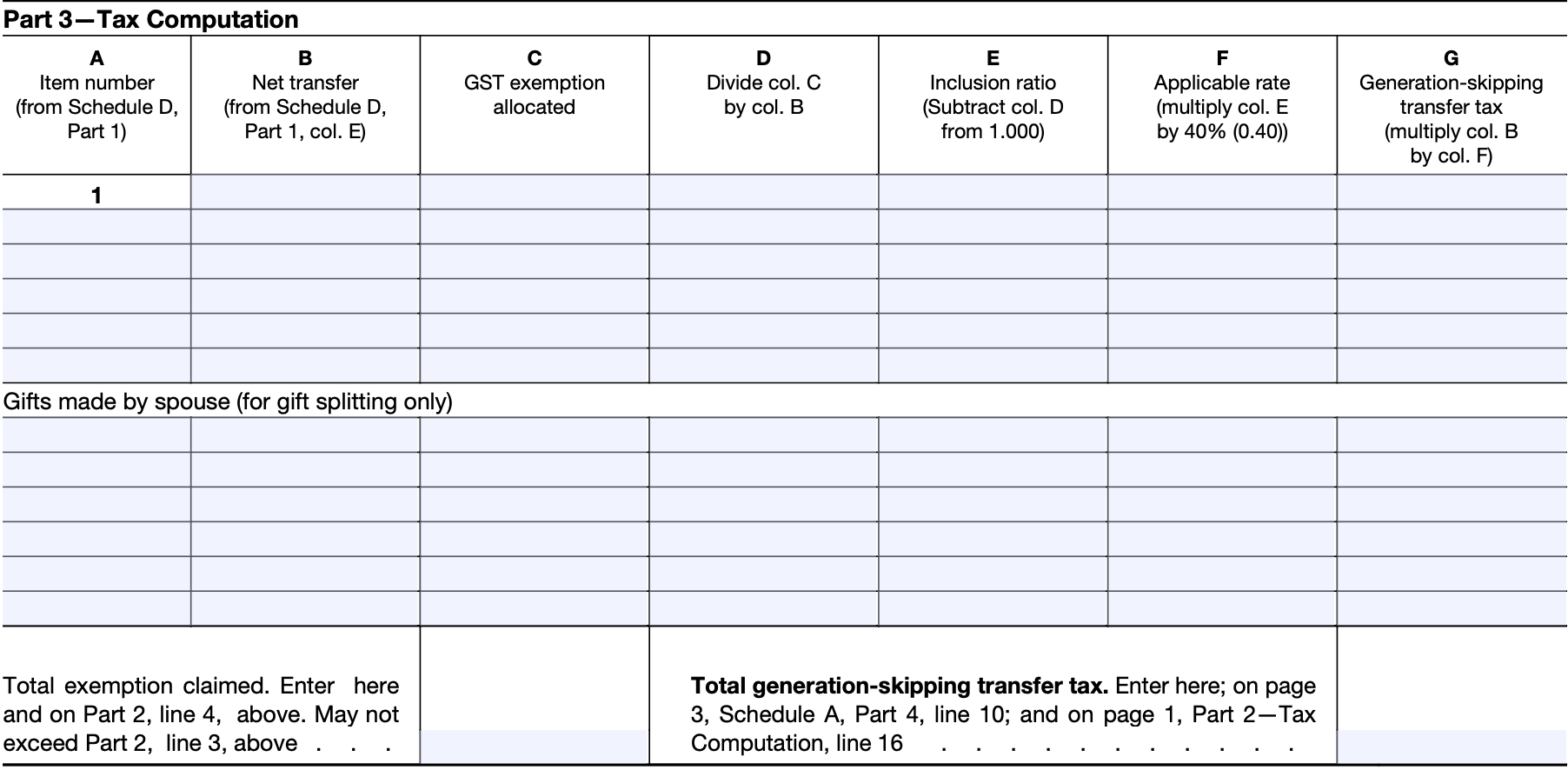

In addition to reporting gifts, the IRS Form 709 for 2025 also allows individuals to make election for gift-splitting with their spouse. This can be a valuable strategy for married couples looking to maximize their gift tax exemptions and reduce their overall tax liability. By carefully considering the options available on the form, taxpayers can make informed decisions about their gift-giving strategy.

Overall, the IRS Form 709 for 2025 is a critical document for individuals who are making gifts that exceed the annual exclusion amount. By using the printable version of this form, taxpayers can ensure that they are accurately reporting their gifts and complying with IRS regulations. Estate planning and gift taxes can be complex areas of taxation, but having the right tools and resources can help individuals navigate this process with confidence.

In conclusion, the IRS Form 709 for 2025 is an important document for individuals who are making gifts that exceed the annual exclusion amount. By utilizing the printable version of this form, taxpayers can easily report their gifts and ensure compliance with IRS regulations. Estate planning and gift taxes are essential aspects of financial planning, and having a clear understanding of the IRS Form 709 can help individuals make informed decisions about their gift-giving strategy.

Easily Download and Print Irs Form 709 For 2025 Printable

Printable payroll are ideal for businesses that prefer non-digital systems or need physical copies for staff files. Most forms include fields for staff name, pay period, total earnings, withholdings, and net pay—making them both detailed and practical.

Begin streamlining your payment tracking today with a trusted payroll template. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your employee payment data clear.

How To Fill Out Form 709 Nasdaq

How To Fill Out Form 709 Nasdaq

Do I Have File A Gift Tax Return 2024 2025 Form 709

Do I Have File A Gift Tax Return 2024 2025 Form 709

Form 709 2024 2025 Fill Edit And Download PDF Guru

Form 709 2024 2025 Fill Edit And Download PDF Guru

Managing payroll tasks doesn’t have to be overwhelming. A payroll printable offers a quick, accurate, and easy-to-use method for tracking salaries, shifts, and taxes—without the need for complicated tools.

Whether you’re a small business owner, payroll manager, or independent contractor, using apayroll template helps ensure accurate record-keeping. Simply get the template, print it, and complete it by hand or type directly into the file before printing.