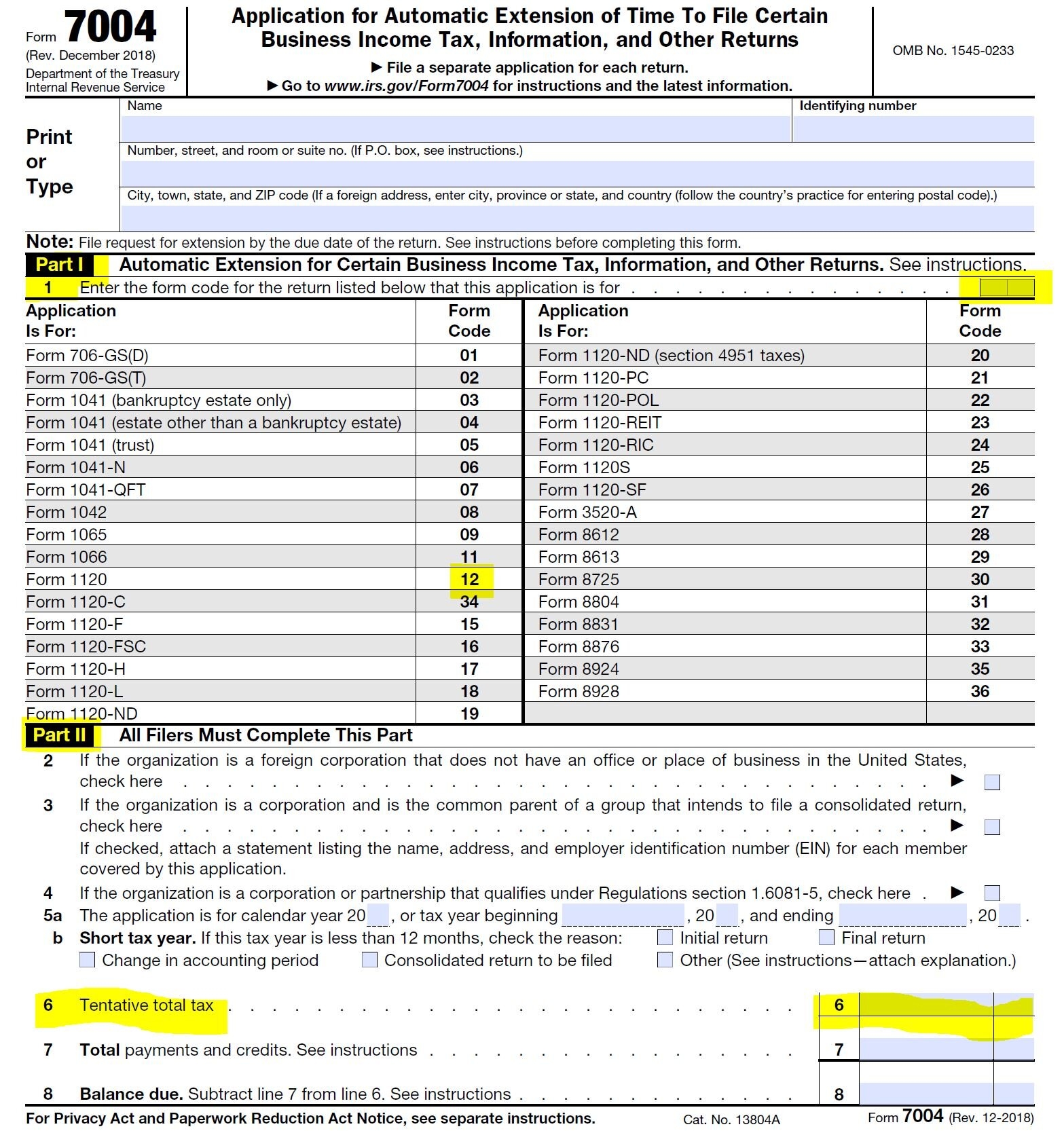

For businesses and corporations looking to extend their tax filing deadline, Form 7004 is a crucial document. This form allows entities to request an automatic extension of time to file certain business income tax, information, and other returns. By filling out Form 7004, businesses can avoid penalties for late filing and ensure they have enough time to gather all necessary documentation.

One of the key benefits of Form 7004 is that it is available as a printable document on the IRS website. This means businesses can easily access and complete the form without the need for specialized software or tools. The printable version of Form 7004 allows for a hassle-free extension request process, saving time and effort for busy business owners.

When filling out Form 7004, businesses will need to provide basic information such as their name, address, and Employer Identification Number (EIN). They will also need to indicate the type of return for which they are requesting an extension, along with the new due date they are seeking. Once the form is complete, it can be mailed to the appropriate IRS address listed on the form.

It’s important for businesses to keep in mind that Form 7004 only extends the time to file a return, not the time to pay any taxes owed. If a business anticipates owing taxes, they should estimate the amount and include it with their extension request to avoid penalties and interest. Additionally, businesses should be aware of the specific deadlines for the returns they are filing, as the extension granted by Form 7004 may vary depending on the type of return.

In conclusion, Form 7004 is a valuable tool for businesses seeking additional time to file their tax returns. By utilizing the printable version of the form, businesses can easily request an extension and avoid potential penalties for late filing. With the convenience and accessibility of Form 7004, businesses can ensure they meet their tax obligations in a timely manner.

Don’t wait until the last minute to file your business tax returns – take advantage of Form 7004 and the printable version available on the IRS website to secure the extension you need. Make sure to carefully follow the instructions and deadlines outlined on the form to ensure a smooth and successful filing process.

Save and Print Irs Form 7004 Printable

Irs Form 7004 Printable are ideal for businesses that prefer non-digital systems or need printed versions for employee records. Most forms include fields for staff name, date range, gross pay, withholdings, and net pay—making them both detailed and easy to use.

Take control of your payroll process today with a trusted payroll template. Save time, reduce errors, and maintain clear records—all while keeping your payroll records clear.

Free 7004 Form Generator Fillable 7004 By Jotform

Free 7004 Form Generator Fillable 7004 By Jotform

Free 7004 Form Generator Fillable 7004 By Jotform

Free 7004 Form Generator Fillable 7004 By Jotform

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Startup Tax How To DIY Company Tax Extension 2020 Advisori Finance CPAs For Startups

Startup Tax How To DIY Company Tax Extension 2020 Advisori Finance CPAs For Startups

Processing payroll tasks doesn’t have to be difficult. A printable payroll offers a quick, reliable, and straightforward method for tracking wages, shifts, and withholdings—without the need for complicated tools.

Whether you’re a freelancer, administrator, or sole proprietor, using aprintable payroll helps ensure proper documentation. Simply get the template, print it, and complete it by hand or edit it digitally before printing.