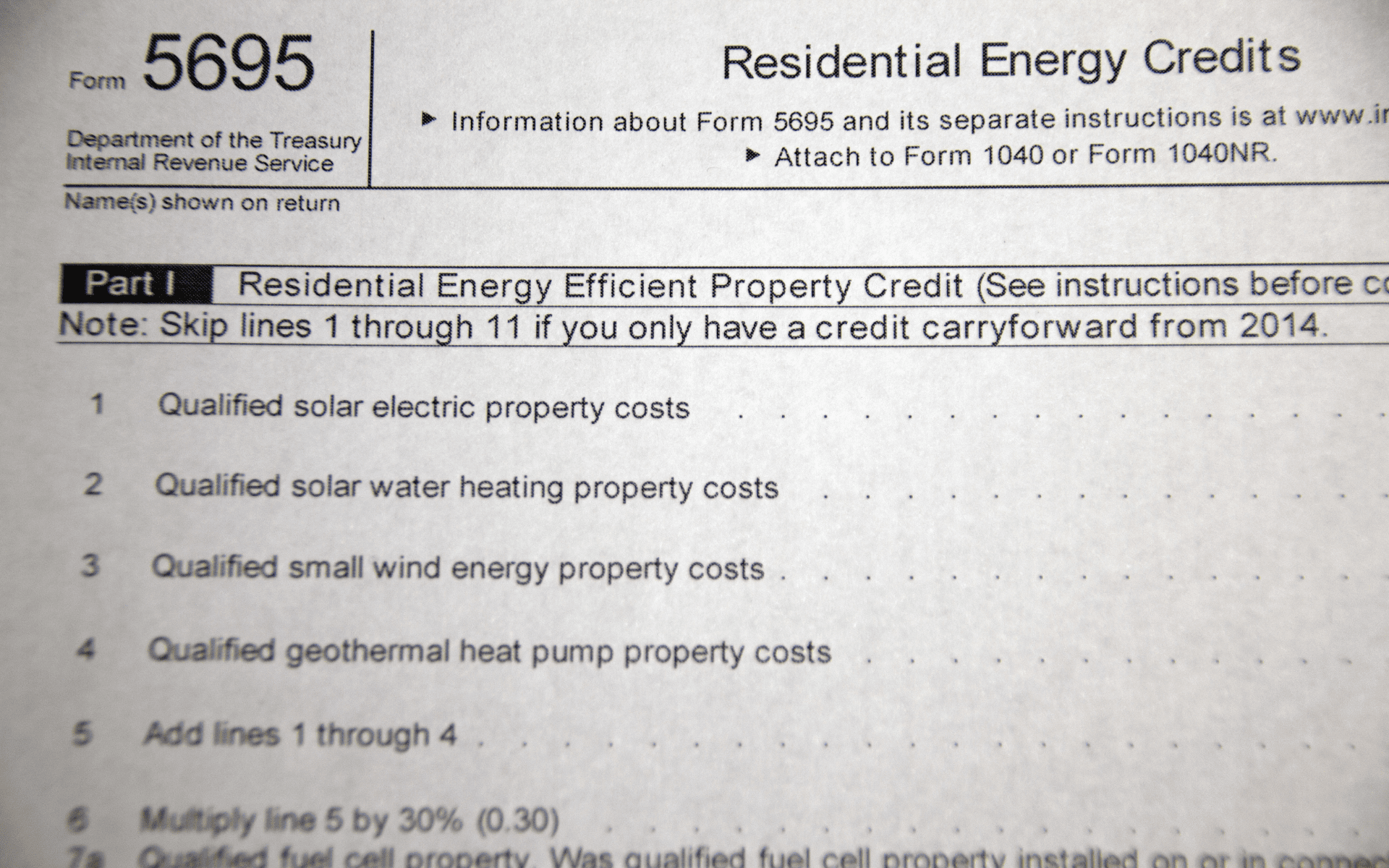

When it comes to filing your taxes, it’s important to be aware of all the forms and instructions that are necessary to ensure accuracy and compliance. One such form is IRS Form 5695, which is used to claim residential energy credits. These credits can help offset the cost of making energy-efficient improvements to your home, such as installing solar panels or energy-efficient windows.

For the year 2025, the IRS has provided printable instructions for Form 5695 to help taxpayers navigate the process of claiming these credits. These instructions outline the eligibility requirements, the types of improvements that qualify for the credits, and how to calculate the amount of credit you may be eligible for.

Irs Form 5695 Instructions 2025 Printable

Irs Form 5695 Instructions 2025 Printable

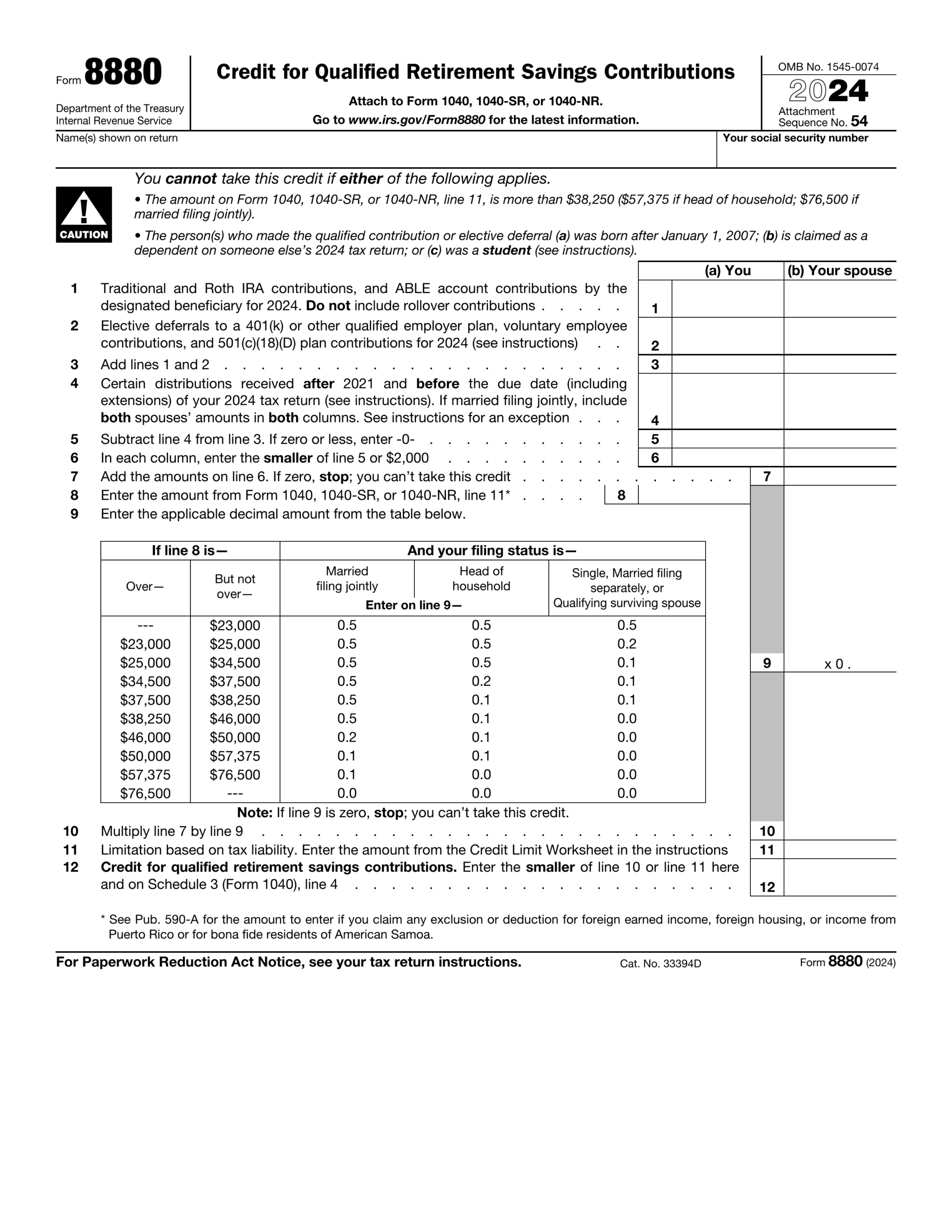

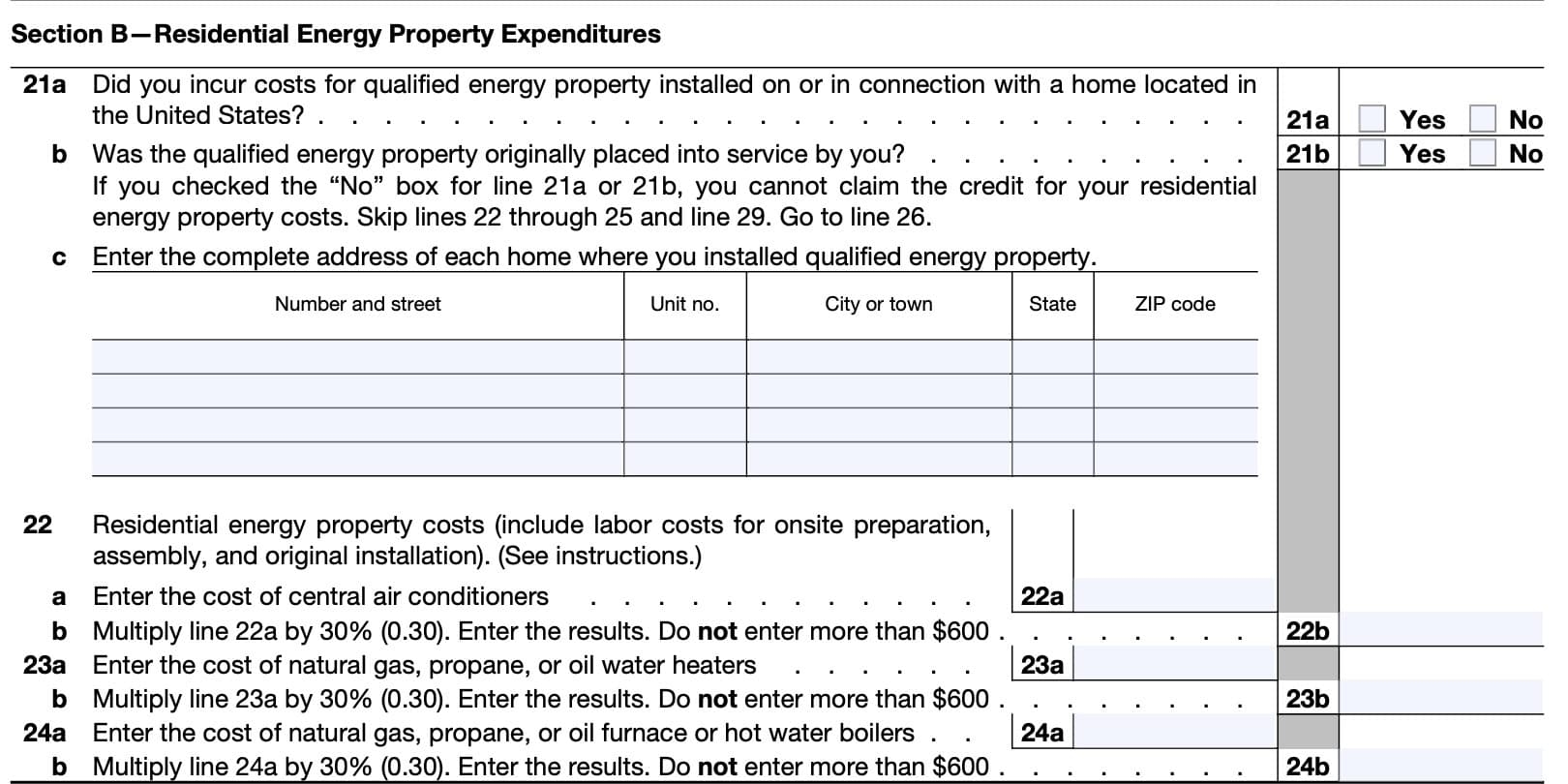

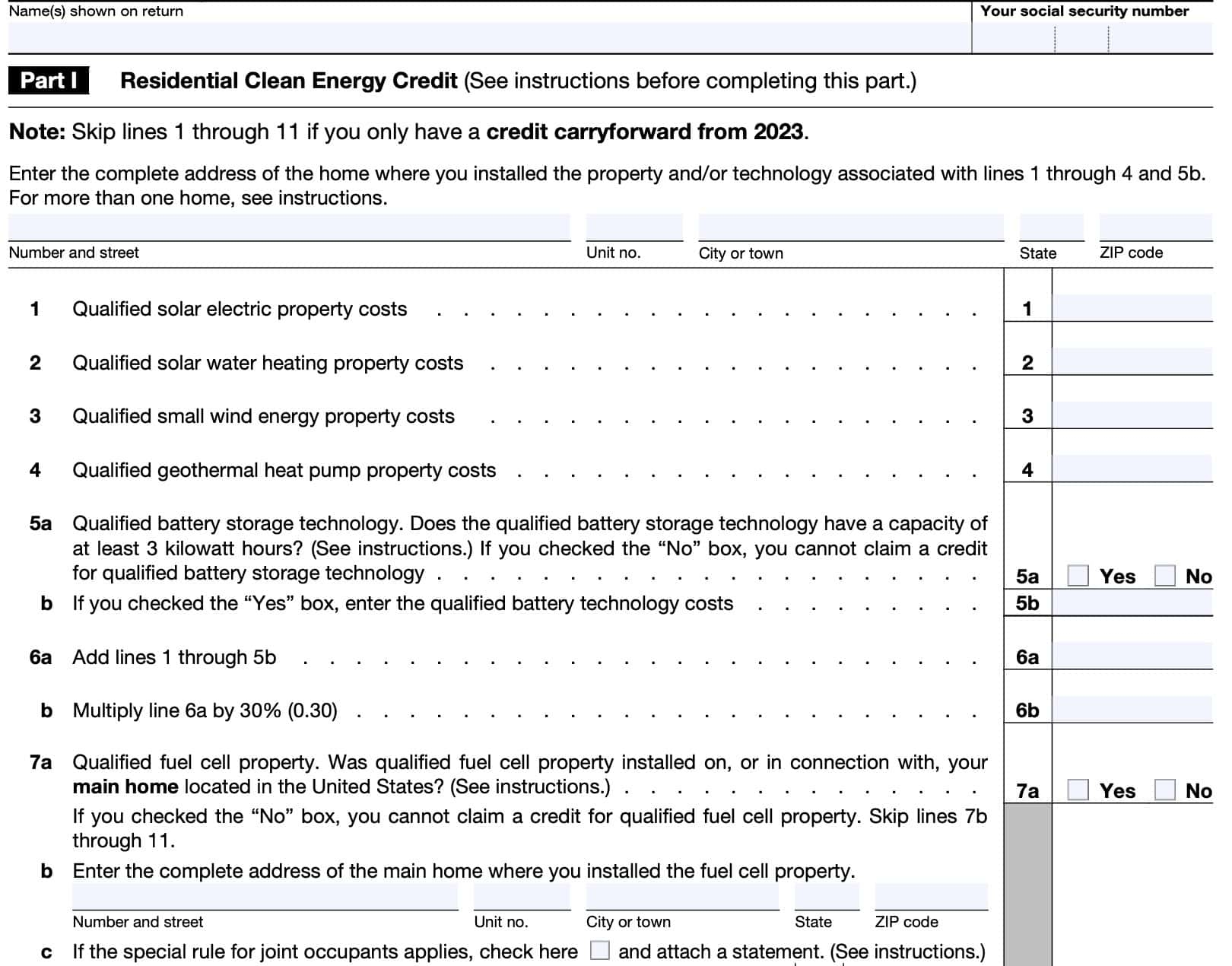

One important aspect of the instructions is understanding which improvements qualify for the credits. This can include things like solar panels, geothermal heat pumps, wind turbines, and energy-efficient heating and cooling systems. The instructions provide detailed information on each type of improvement and how to properly document and claim the credits on your tax return.

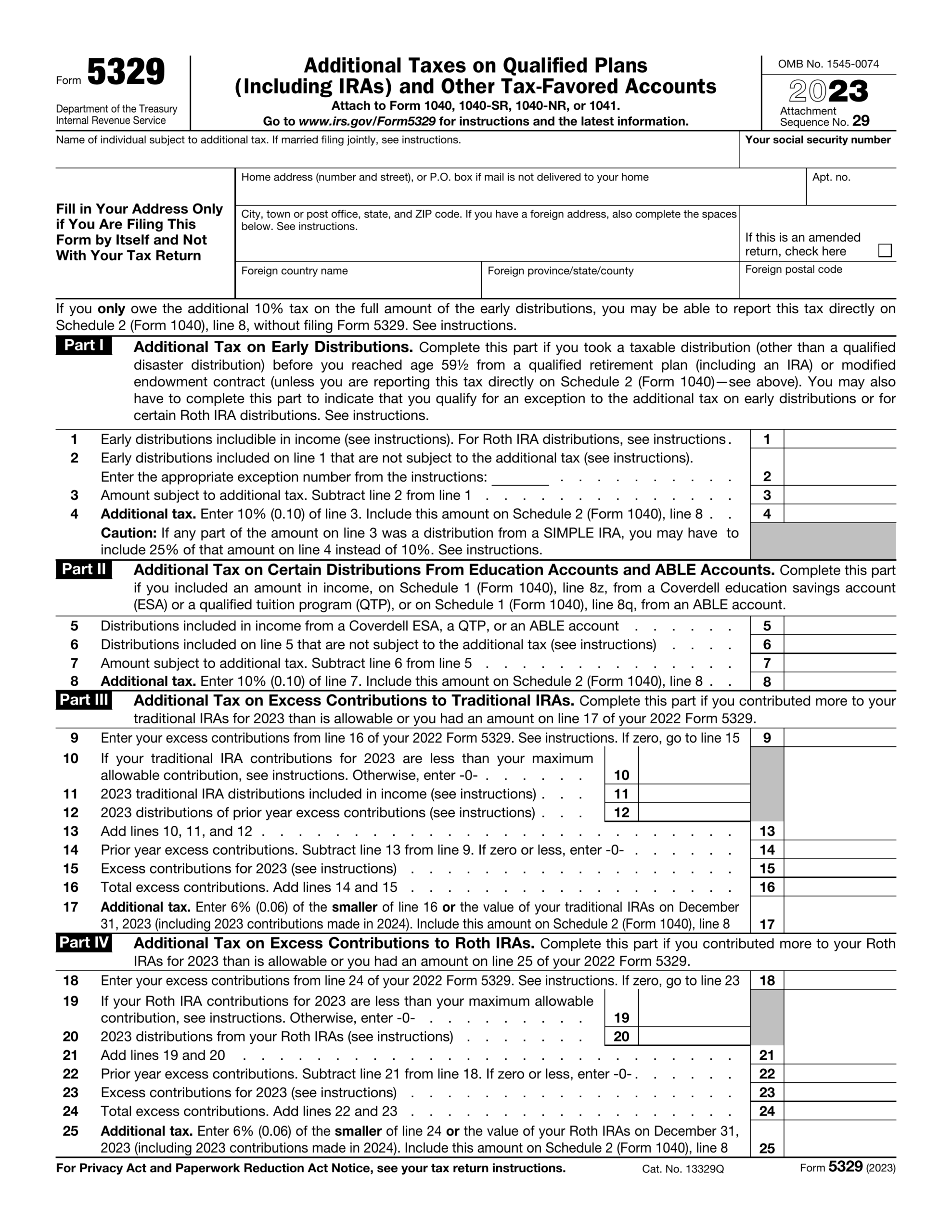

Additionally, the instructions outline the limitations and restrictions on claiming these credits. For example, there are maximum credit amounts for each type of improvement, and there may be income limitations that could affect your eligibility. It’s important to carefully review the instructions to ensure you are following the guidelines set forth by the IRS.

Finally, the instructions provide step-by-step guidance on how to complete Form 5695 and include any necessary documentation to support your claims. This may include receipts, invoices, and other proof of the improvements made to your home. By following the instructions carefully, you can ensure that you are properly claiming the credits and maximizing your tax savings.

In conclusion, IRS Form 5695 Instructions for 2025 Printable are a valuable resource for taxpayers looking to claim residential energy credits on their tax returns. By familiarizing yourself with the instructions and following them closely, you can ensure that you are taking full advantage of these credits and potentially saving money on your taxes. Be sure to consult with a tax professional if you have any questions or need assistance with completing the form.

Quickly Access and Print Irs Form 5695 Instructions 2025 Printable

Payroll printable are ideal for teams that prefer physical records or need hard copies for audit purposes. Most forms include fields for staff name, date range, gross pay, withholdings, and net pay—making them both detailed and practical.

Begin streamlining your payroll system today with a trusted Irs Form 5695 Instructions 2025 Printable. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your payroll records professional.

How To Draft Form 5695 Best Guide With Free Template

How To Draft Form 5695 Best Guide With Free Template

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Instructions Residential Energy Credits

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

Form 5695 2024 2025 Fill Out U0026 Download PDF Guru

IRS Form 5695 Instructions Residential Energy Credits

IRS Form 5695 Instructions Residential Energy Credits

Handling employee payments doesn’t have to be complicated. A printable payroll offers a speedy, reliable, and straightforward method for tracking employee pay, work time, and taxes—without the need for digital systems.

Whether you’re a startup founder, HR professional, or independent contractor, using aprintable payroll template helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.