When it comes to claiming energy efficiency tax credits, IRS Form 5695 is a crucial document to have on hand. This form allows taxpayers to claim credits for various home improvements that increase energy efficiency, such as installing solar panels or energy-efficient windows. For the year 2024, it is important to ensure you have the most up-to-date version of this form to accurately claim any credits you may be eligible for.

Form 5695 is relatively straightforward to fill out, but having a printable version can make the process even easier. By having the form in a printable format, you can easily fill it out at your convenience and have a physical copy for your records. This can be especially helpful if you prefer to have hard copies of important tax documents on hand.

Irs Form 5695 For 2024 Printable

Irs Form 5695 For 2024 Printable

Irs Form 5695 For 2024 Printable

When filling out IRS Form 5695 for the year 2024, be sure to carefully review the instructions to ensure you are claiming the correct credits and providing all necessary information. This form will require you to detail the energy-efficient improvements you have made to your home, as well as the associated costs.

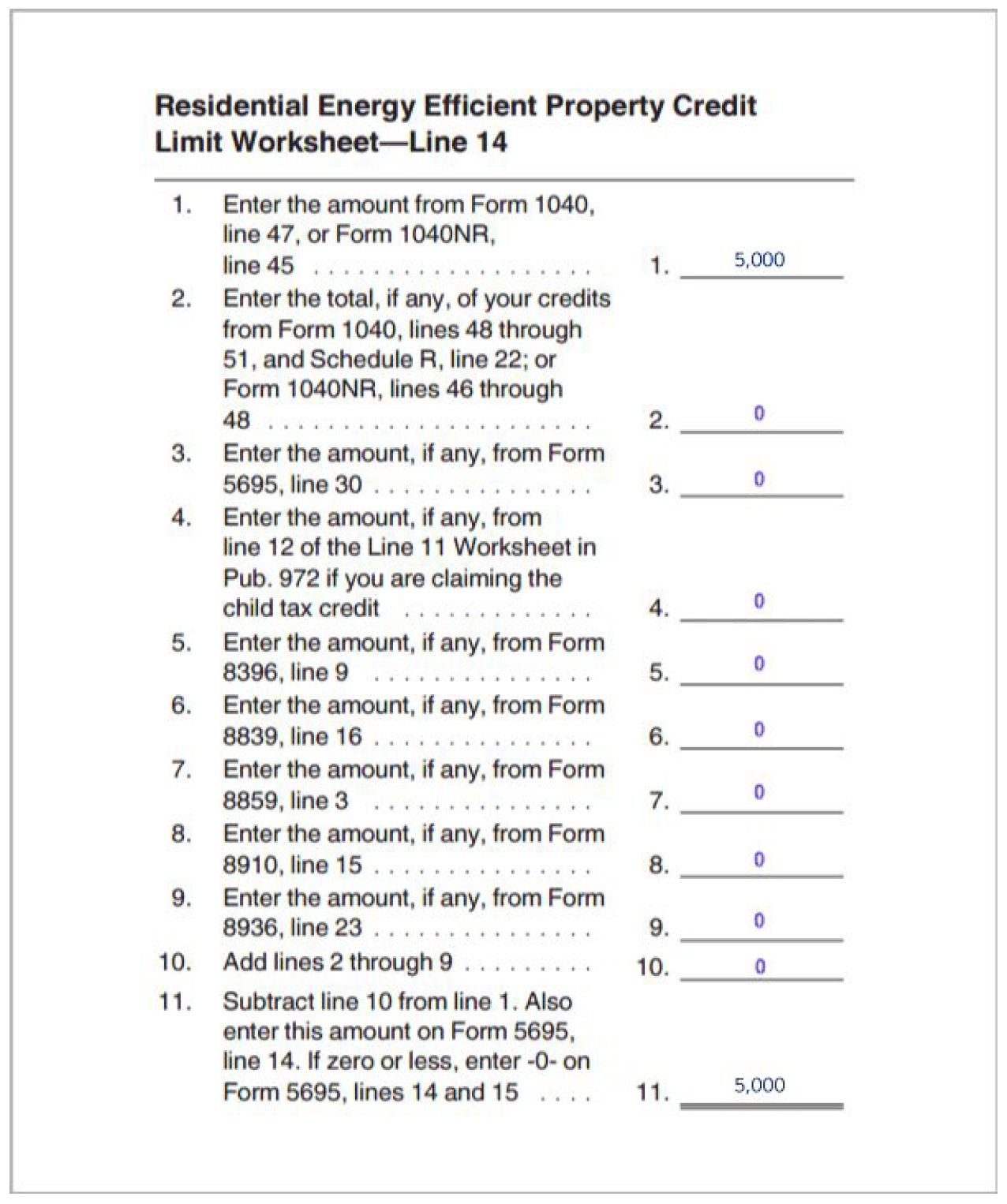

Additionally, Form 5695 will require you to calculate the total credits you are eligible for based on the improvements you have made. This may involve some basic math calculations, so be sure to double-check your work to avoid any errors on your tax return.

Once you have completed Form 5695, you can then submit it along with your other tax documents to claim any energy efficiency credits you are eligible for. Keep in mind that these credits can help offset the cost of your home improvements and potentially result in a lower tax bill.

In conclusion, IRS Form 5695 for 2024 is an important document for claiming energy efficiency tax credits. By ensuring you have a printable version of this form and carefully filling it out, you can take advantage of potential tax savings for your energy-efficient home improvements. Be sure to review the form thoroughly and seek guidance from a tax professional if needed to maximize your credits.