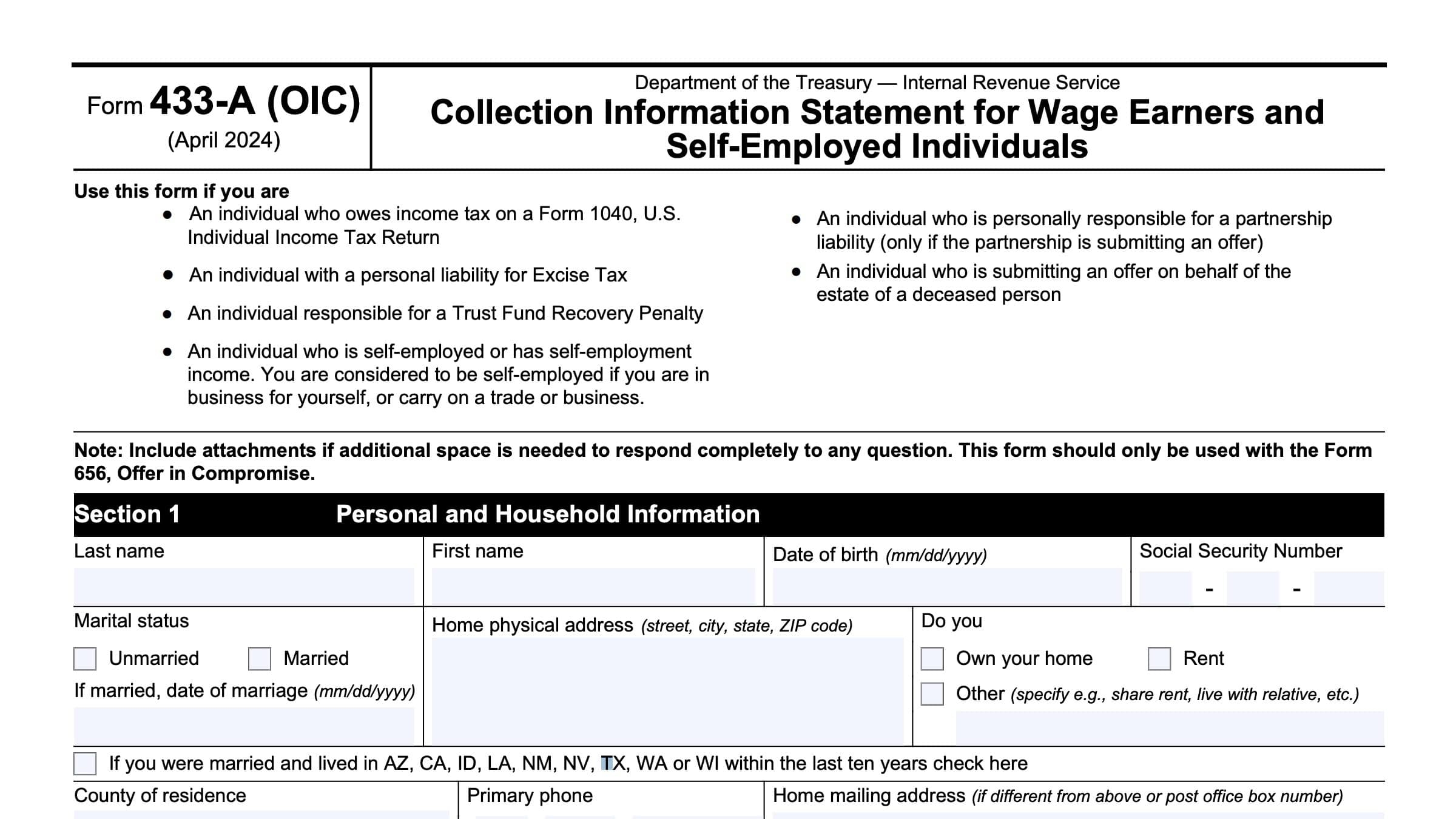

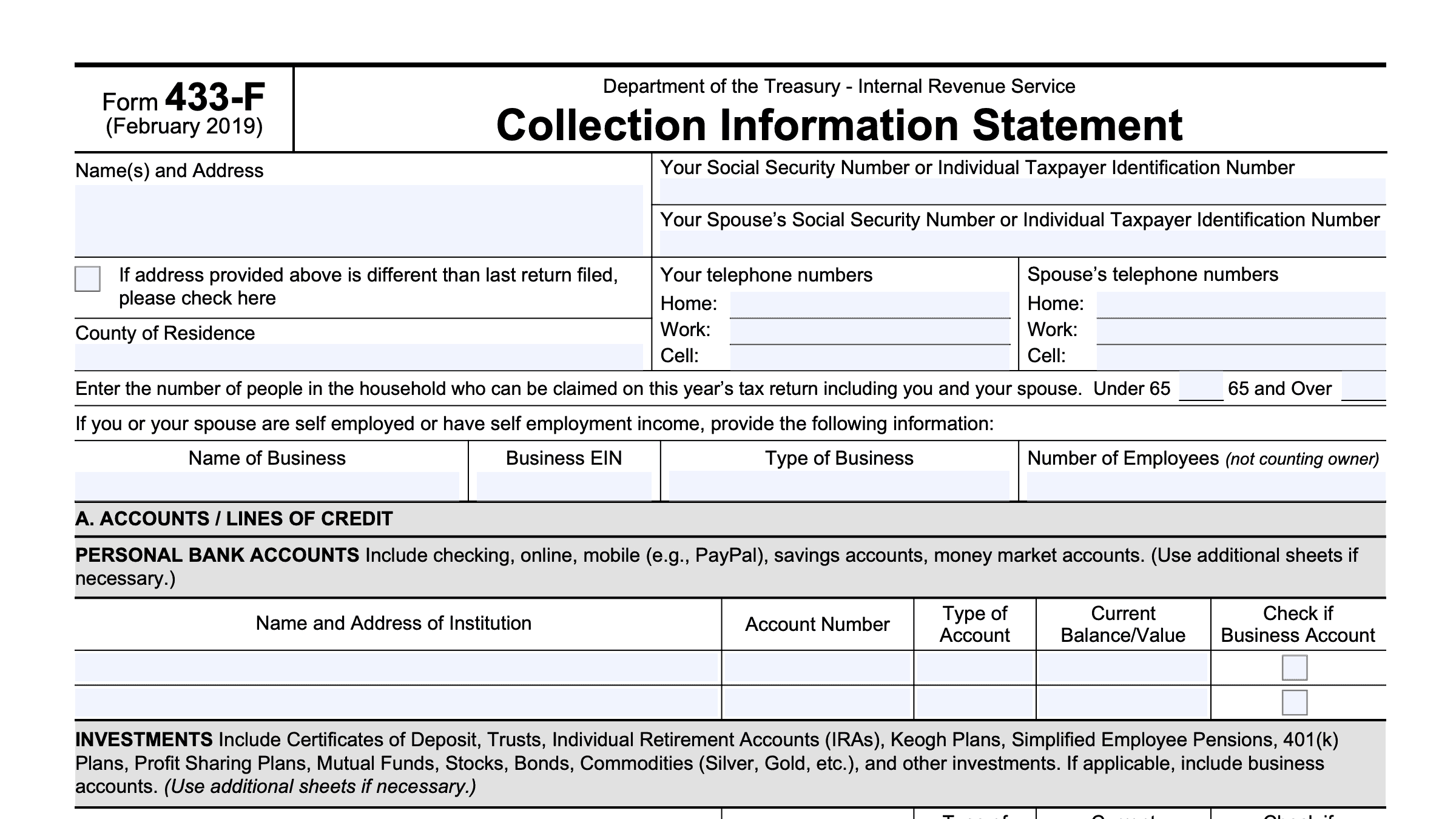

When it comes to managing your finances and dealing with the IRS, filling out the necessary forms is crucial. One such form that you may need to fill out is IRS Form 433 F. This form is used to gather information about your financial situation, including your income, assets, and expenses.

IRS Form 433 F is a printable form that can be easily accessed online. It is important to fill out this form accurately and completely to ensure that the IRS has all the information they need to assess your financial situation. This form is typically used when you are setting up a payment plan or negotiating a settlement with the IRS.

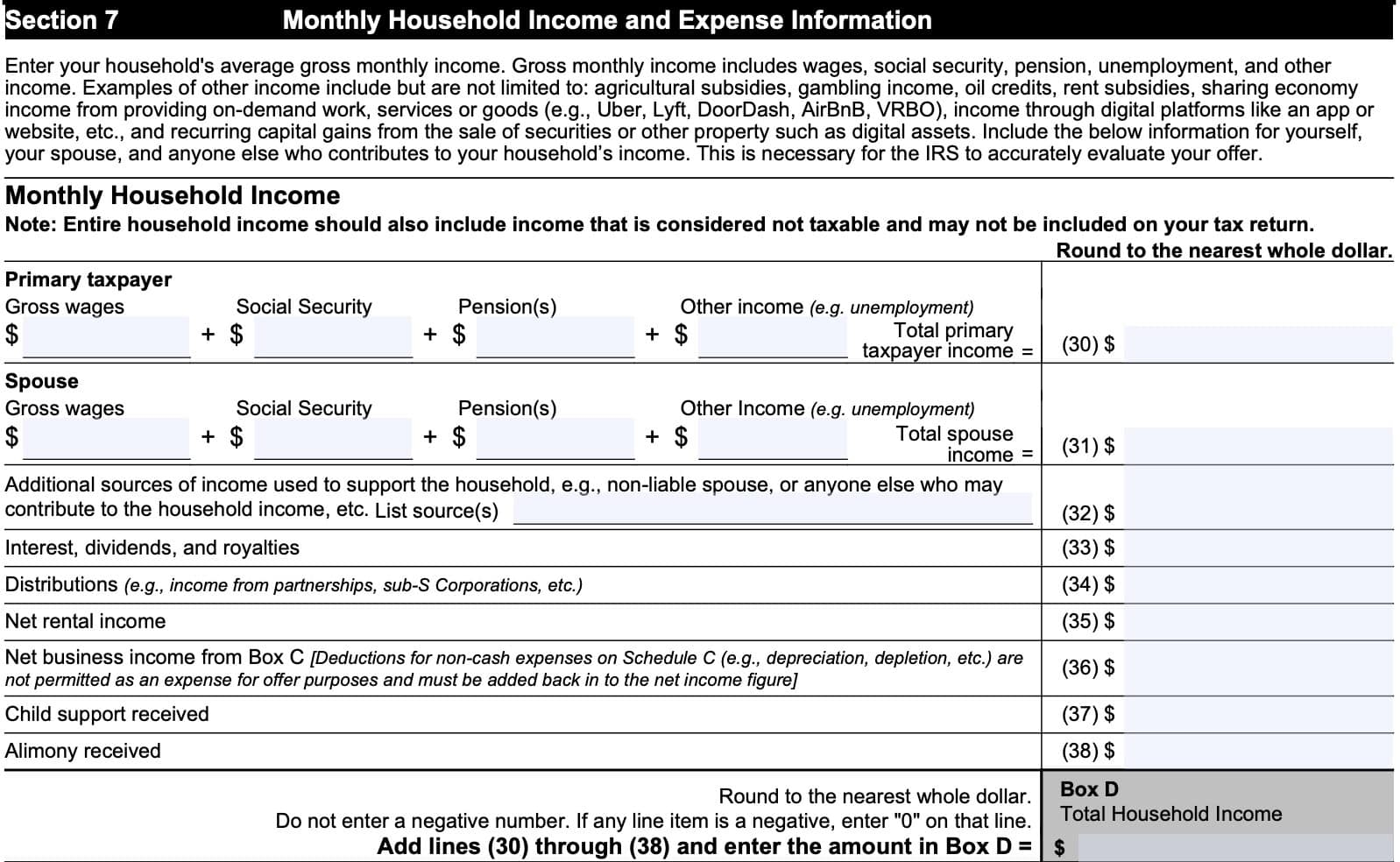

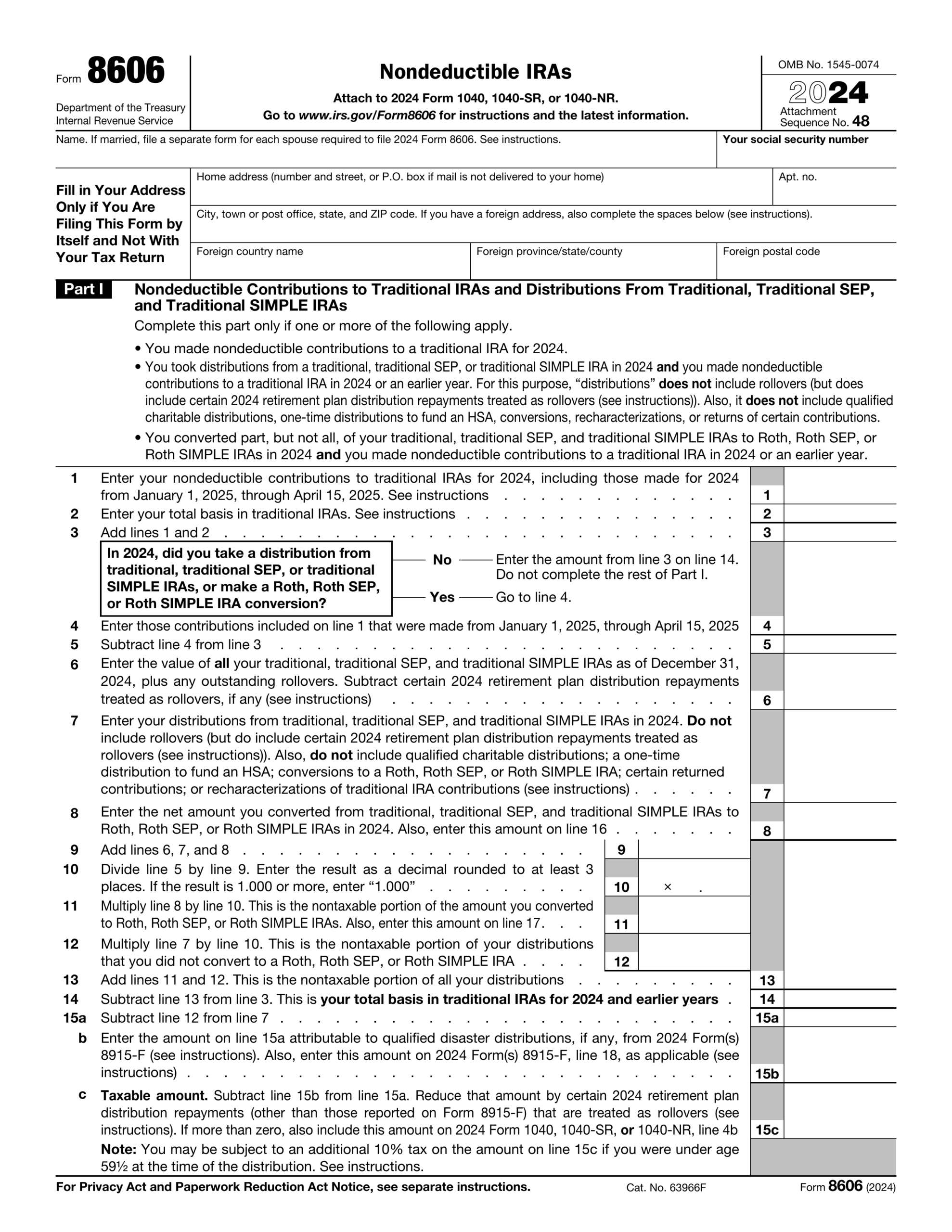

When filling out IRS Form 433 F, you will need to provide detailed information about your income, including sources of income, wages, and any other financial assets you may have. You will also need to list all of your expenses, including rent or mortgage payments, utilities, and other monthly expenses.

In addition to providing information about your income and expenses, IRS Form 433 F also requires you to list any assets you may have, such as real estate, vehicles, or investments. You will also need to provide information about any outstanding debts or loans you may have.

Once you have filled out IRS Form 433 F, you will need to submit it to the IRS for review. It is important to keep a copy of this form for your records and to ensure that all information provided is accurate. The IRS will use the information on this form to determine your eligibility for a payment plan or settlement.

In conclusion, IRS Form 433 F is an important document that may be necessary when dealing with the IRS. By filling out this form accurately and completely, you can provide the IRS with the information they need to assess your financial situation and come to a resolution. Be sure to access the printable form online and carefully follow the instructions to ensure that your form is filled out correctly.

Get and Print Irs Form 433 F Printable

Printable payroll are ideal for companies that prefer non-digital systems or need printed versions for audit purposes. Most forms include fields for employee name, date range, total earnings, taxes, and final salary—making them both detailed and user-friendly.

Take control of your payroll system today with a trusted printable payroll template. Reduce admin effort, minimize mistakes, and stay organized—all while keeping your employee payment data organized.

Form 433 F 2024 2025 Fill Edit And Download PDF Guru

Form 433 F 2024 2025 Fill Edit And Download PDF Guru

IRS Form 433 A Overview Paladini Law

IRS Form 433 A Overview Paladini Law

IRS Form 433 A Instructions Collection Information Statement

IRS Form 433 A Instructions Collection Information Statement

Form 433 F Printable Form 433 F Blank Sign Forms Online PDFliner

Form 433 F Printable Form 433 F Blank Sign Forms Online PDFliner

IRS Form 433 F Instructions The Collection Information Statement

IRS Form 433 F Instructions The Collection Information Statement

Handling employee payments doesn’t have to be difficult. A printable payroll template offers a quick, accurate, and straightforward method for tracking employee pay, work time, and taxes—without the need for complicated tools.

Whether you’re a freelancer, HR professional, or independent contractor, using aprintable payroll form helps ensure accurate record-keeping. Simply get the template, print it, and fill it out by hand or type directly into the file before printing.