Are you a freelancer or independent contractor who has received income from various sources throughout the year? If so, you may be familiar with IRS Form 1099-MISC. This form is used to report income earned from sources other than employment, such as freelance work, rental income, or royalties. It is important to accurately report this income on your tax return to avoid any potential penalties or audits from the IRS.

One of the easiest ways to ensure that you are reporting your income accurately is by using IRS Form 1099-MISC printable. This form can be easily accessed online and printed out for your convenience. By filling out this form correctly, you can avoid any potential errors or discrepancies in your tax return.

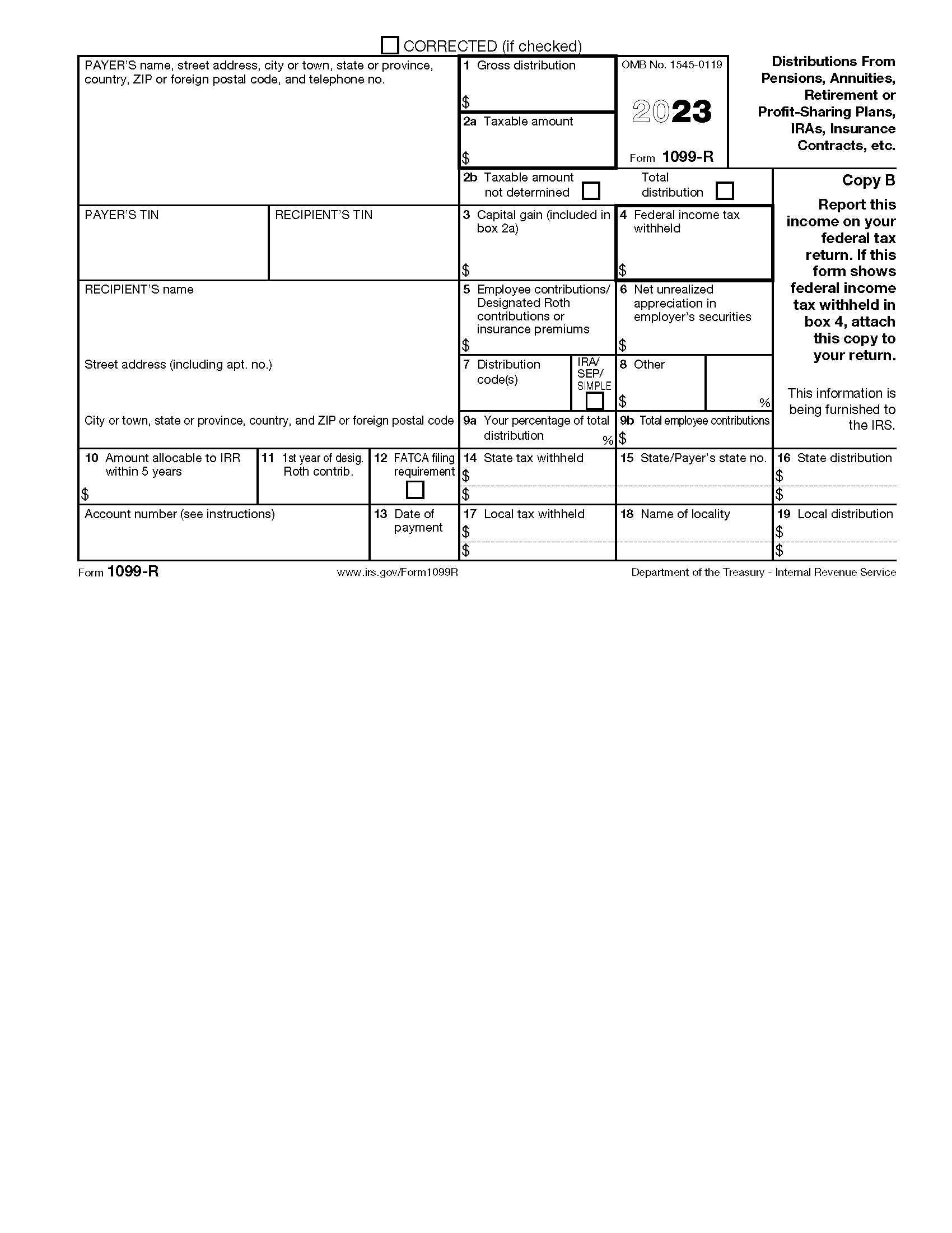

When using the IRS Form 1099-MISC printable, make sure to carefully enter all the necessary information, including your name, address, and social security number. Additionally, you will need to report the income you received from each payer, as well as any expenses or deductions related to that income. By accurately reporting this information, you can ensure that you are in compliance with IRS regulations.

It is important to note that not all income received as a freelancer or independent contractor will be reported on Form 1099-MISC. For example, if you received less than $600 from a payer, they are not required to issue a 1099-MISC form. However, you are still required to report all income earned, regardless of whether or not you received a 1099-MISC.

Overall, using IRS Form 1099-MISC printable can make the process of reporting your freelance income much easier and more streamlined. By accurately reporting your income, you can avoid any potential issues with the IRS and ensure that you are in compliance with tax laws. So, be sure to utilize this form when reporting your freelance income this tax season.

In conclusion, IRS Form 1099-MISC printable is a valuable tool for freelancers and independent contractors to accurately report their income. By using this form, you can ensure that you are in compliance with IRS regulations and avoid any potential penalties or audits. So, make sure to utilize this form when reporting your income this tax season.