As tax season approaches, it’s essential to stay ahead of the game when it comes to filing your taxes. One essential form to be aware of is the IRS Form 1040 ES, also known as the Estimated Tax for Individuals form. This form is used to calculate and pay estimated tax payments on income that is not subject to withholding, such as self-employment income, dividends, and interest.

By utilizing the IRS Form 1040 ES Printable, individuals can easily calculate and pay their estimated taxes throughout the year. This form helps taxpayers avoid penalties for underpayment of taxes and ensures that they stay compliant with tax regulations. It is crucial for individuals who expect to owe at least $1,000 in taxes when they file their annual return.

IRS Form 1040 ES Printable

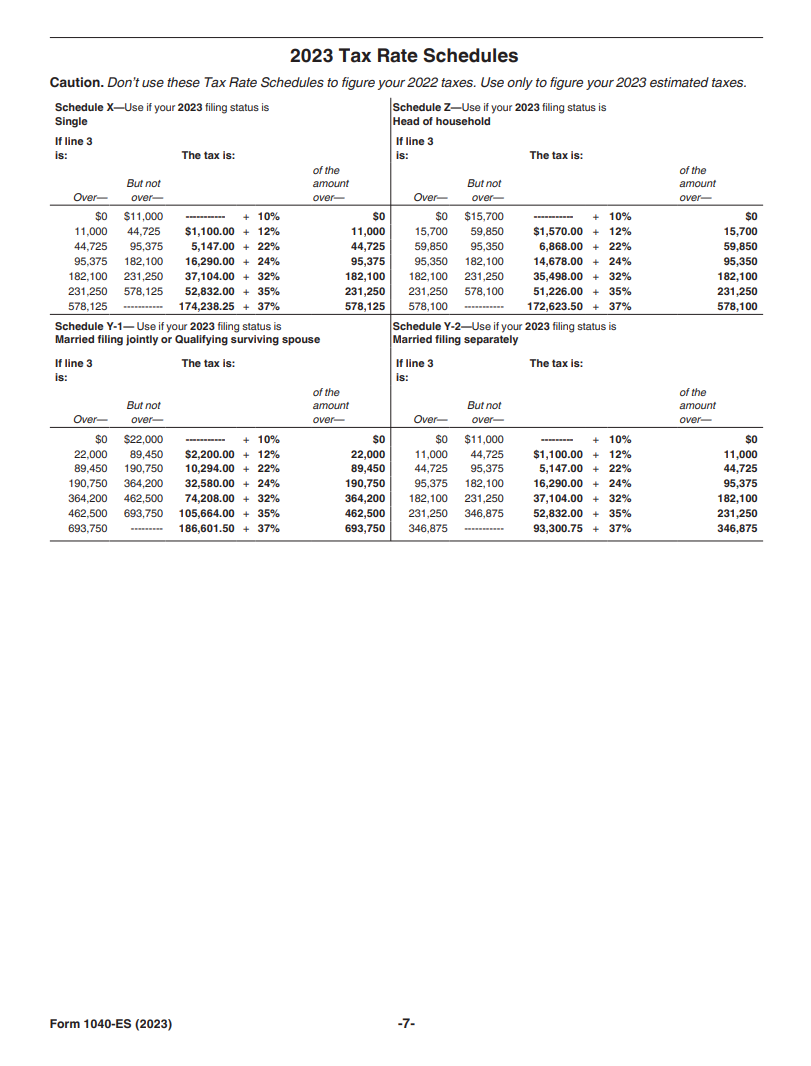

The IRS Form 1040 ES Printable is a convenient tool that allows individuals to estimate their tax liability and make quarterly payments to the IRS. This form includes sections for taxpayers to input their income, deductions, credits, and tax liability for the year. By using this form, taxpayers can stay organized and on track with their tax payments.

When filling out the IRS Form 1040 ES Printable, individuals will need to calculate their expected income for the year, deductions, and credits to determine their estimated tax liability. It is essential to review this form carefully and make accurate calculations to avoid any potential tax penalties. Taxpayers can then make quarterly payments based on the amount calculated on this form.

It is important to note that the IRS Form 1040 ES Printable must be submitted by specific deadlines throughout the year. Failure to make timely payments can result in penalties and interest charges. By staying on top of these quarterly payments, individuals can avoid any surprises come tax season and ensure that they are in compliance with tax laws.

In conclusion, understanding and utilizing the IRS Form 1040 ES Printable is crucial for individuals who have income not subject to withholding. By accurately estimating and paying their taxes throughout the year, taxpayers can avoid penalties and stay compliant with tax regulations. Be sure to take advantage of this helpful tool to stay organized and on track with your tax payments.