As a truck owner or operator, it is essential to stay compliant with IRS regulations, including filing Form 2290. This form is used to report and pay the Heavy Vehicle Use Tax (HVUT) for vehicles with a gross weight of 55,000 pounds or more. Failing to file this form can result in penalties and fines, so it is crucial to fill it out correctly and on time.

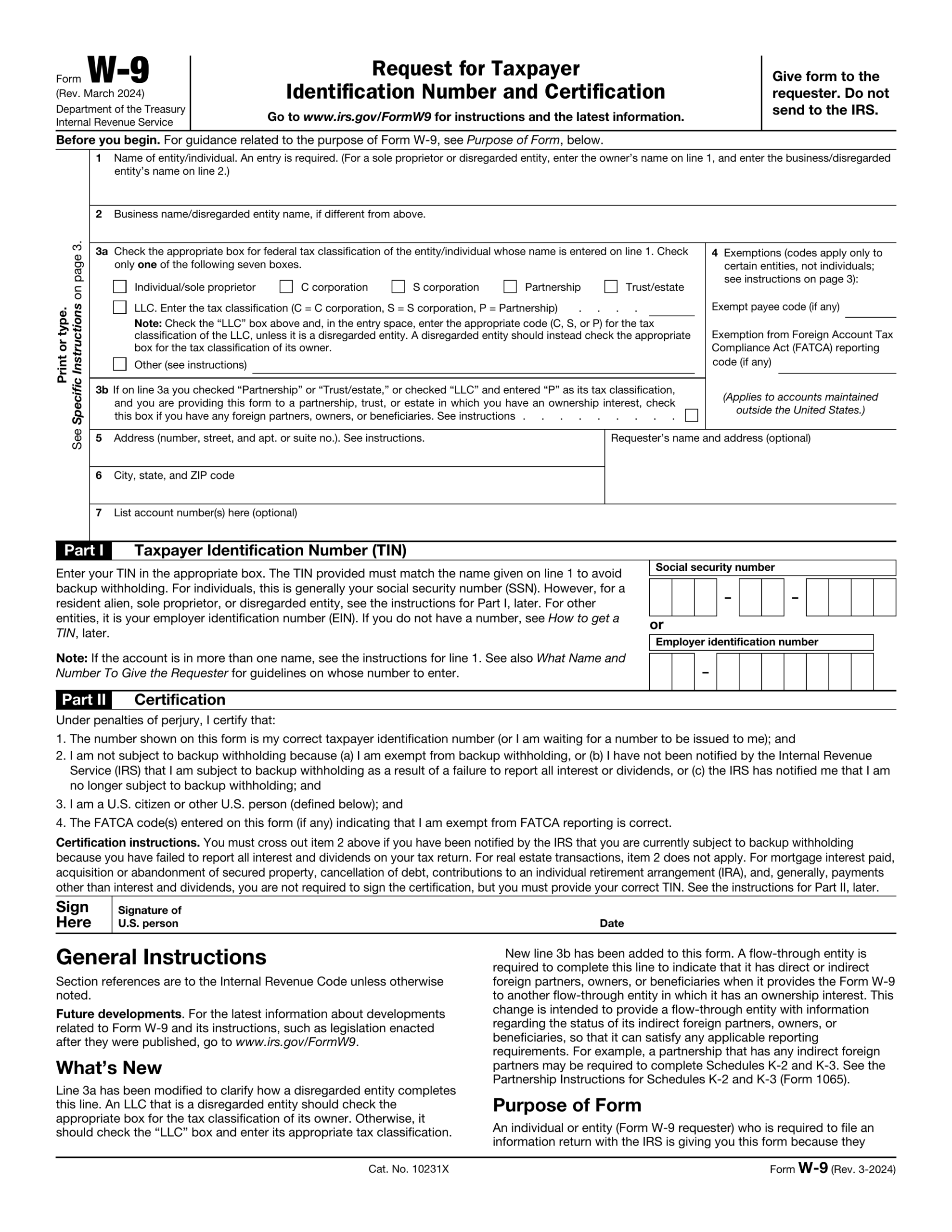

One way to make the process easier is to utilize the IRS 2290 Form 2025 Printable. This printable version of the form allows you to easily fill it out by hand or type in the information before printing it. This can save you time and ensure that your form is legible and error-free, reducing the chances of delays or penalties.

IRS 2290 Form 2025 Printable

When filling out the IRS 2290 Form 2025 Printable, make sure to have all the necessary information on hand, including your Employer Identification Number (EIN), vehicle details, and payment information. Double-check all the information before submitting the form to avoid any mistakes that could lead to penalties.

It is also important to note that the deadline for filing Form 2290 is typically August 31st of each year. However, if you purchase a new vehicle during the tax year, you will need to file by the last day of the month following the month of first use. Using the IRS 2290 Form 2025 Printable can help you stay organized and ensure you meet all deadlines.

By utilizing the IRS 2290 Form 2025 Printable, truck owners and operators can streamline the process of filing their HVUT and avoid costly mistakes. This printable version of the form makes it easier to fill out and submit your information accurately and on time, helping you stay compliant with IRS regulations.

In conclusion, staying compliant with IRS regulations is essential for truck owners and operators, and filing Form 2290 is a crucial part of that compliance. By using the IRS 2290 Form 2025 Printable, you can make the process easier and more convenient while ensuring that your form is accurate and error-free. Take advantage of this printable form to stay on top of your tax obligations and avoid any potential penalties or fines.