IRS 2290 Form 2025 is an essential document for truck owners and operators who need to report and pay the federal vehicle use tax. This form is used to calculate and pay the Heavy Vehicle Use Tax (HVUT) for vehicles with a gross weight of 55,000 pounds or more. Filing this form is mandatory for all qualifying vehicles, and failure to do so can result in penalties and fines.

Truck owners can now easily access and fill out the IRS 2290 Form 2025 online. This printable form simplifies the process for truck owners, allowing them to fill out the necessary information and submit it electronically to the IRS. This saves time and reduces the chances of errors that may occur when filling out a paper form.

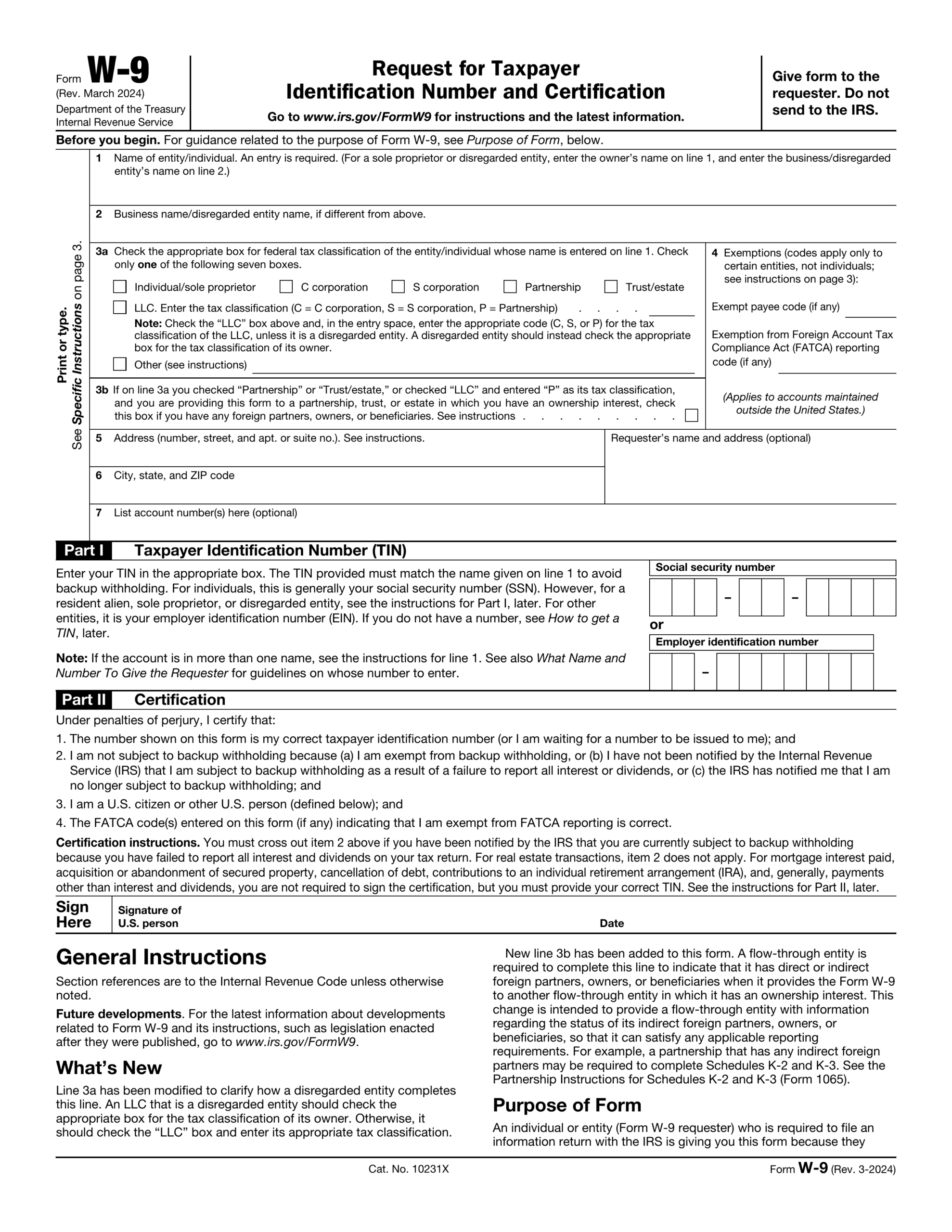

IRS 2290 Form 2025 Printable

When filling out the IRS 2290 Form 2025, truck owners will need to provide information such as their name, address, EIN (Employer Identification Number), VIN (Vehicle Identification Number), and the taxable gross weight of the vehicle. They will also need to indicate the first use month of the vehicle and calculate the amount of HVUT owed based on the weight category of the vehicle.

Once the form is filled out, truck owners can choose to pay the HVUT using various payment methods, such as electronic funds withdrawal, EFTPS, or by mailing a check or money order. The IRS will then process the form and issue a stamped Schedule 1 form as proof of payment, which must be kept in the vehicle at all times.

It is important for truck owners to file their IRS 2290 Form 2025 by the deadline, which is typically August 31st of each year. Failing to file by the deadline can result in penalties and interest charges, so it is crucial to stay on top of this requirement to avoid any unnecessary fees.

In conclusion, the IRS 2290 Form 2025 Printable is a convenient and efficient way for truck owners to fulfill their HVUT obligations. By using this form, truck owners can easily report and pay their taxes, ensuring compliance with federal regulations and avoiding potential penalties. It is important to stay informed about the filing requirements and deadlines to avoid any issues with the IRS.