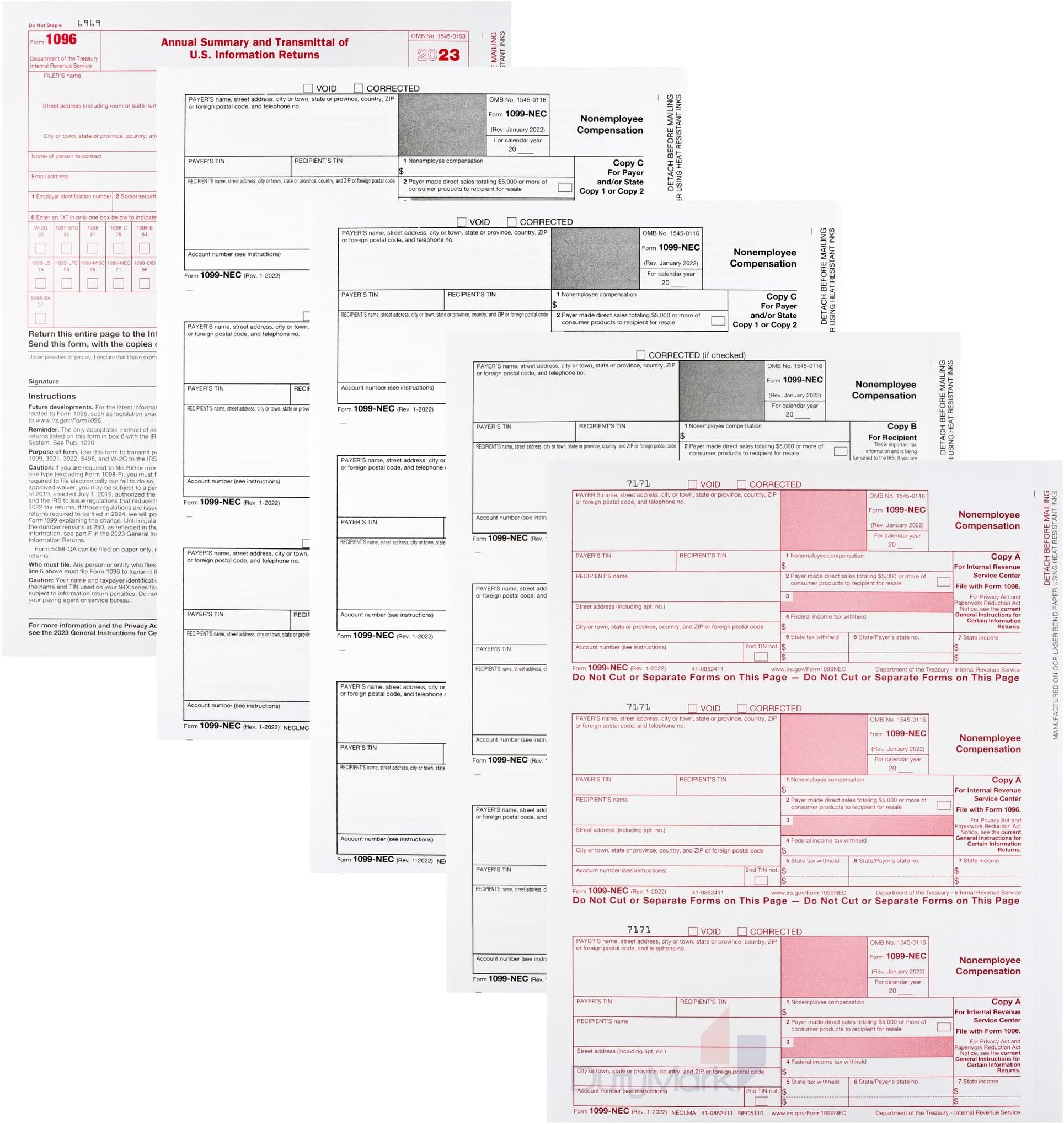

As the tax season approaches, it is important to be prepared with all the necessary forms and documents to file your taxes accurately. The IRS 2024 tax forms are essential for individuals and businesses to report their income, deductions, and credits for the year. These forms are available in printable format, making it convenient for taxpayers to fill out and submit their tax returns.

Whether you are a salaried employee, a freelancer, or a business owner, the IRS 2024 tax forms cater to various types of income and deductions. By utilizing these printable forms, you can ensure that you are complying with the tax laws and maximizing your tax savings. It is crucial to fill out these forms accurately and submit them on time to avoid any penalties or audits from the IRS.

When filling out the IRS 2024 tax forms, make sure to double-check all the information provided, including your personal details, income sources, deductions, and credits. It is recommended to use the instructions provided by the IRS to ensure that you are completing the forms correctly. By taking the time to review and verify your tax information, you can minimize the risk of errors and potential audits.

Additionally, if you are unsure about certain sections of the tax forms or need assistance with your taxes, consider seeking help from a tax professional or accountant. They can provide valuable advice and guidance on how to maximize your tax deductions and credits, as well as ensure that your tax returns are filed accurately. Remember that it is always better to seek help than to make mistakes on your tax forms.

In conclusion, the IRS 2024 tax forms printable are essential tools for individuals and businesses to report their income and deductions for the year. By utilizing these forms and filling them out accurately, you can ensure that you are complying with the tax laws and maximizing your tax savings. Take the time to review and verify your tax information, seek help if needed, and submit your tax returns on time to avoid any issues with the IRS.