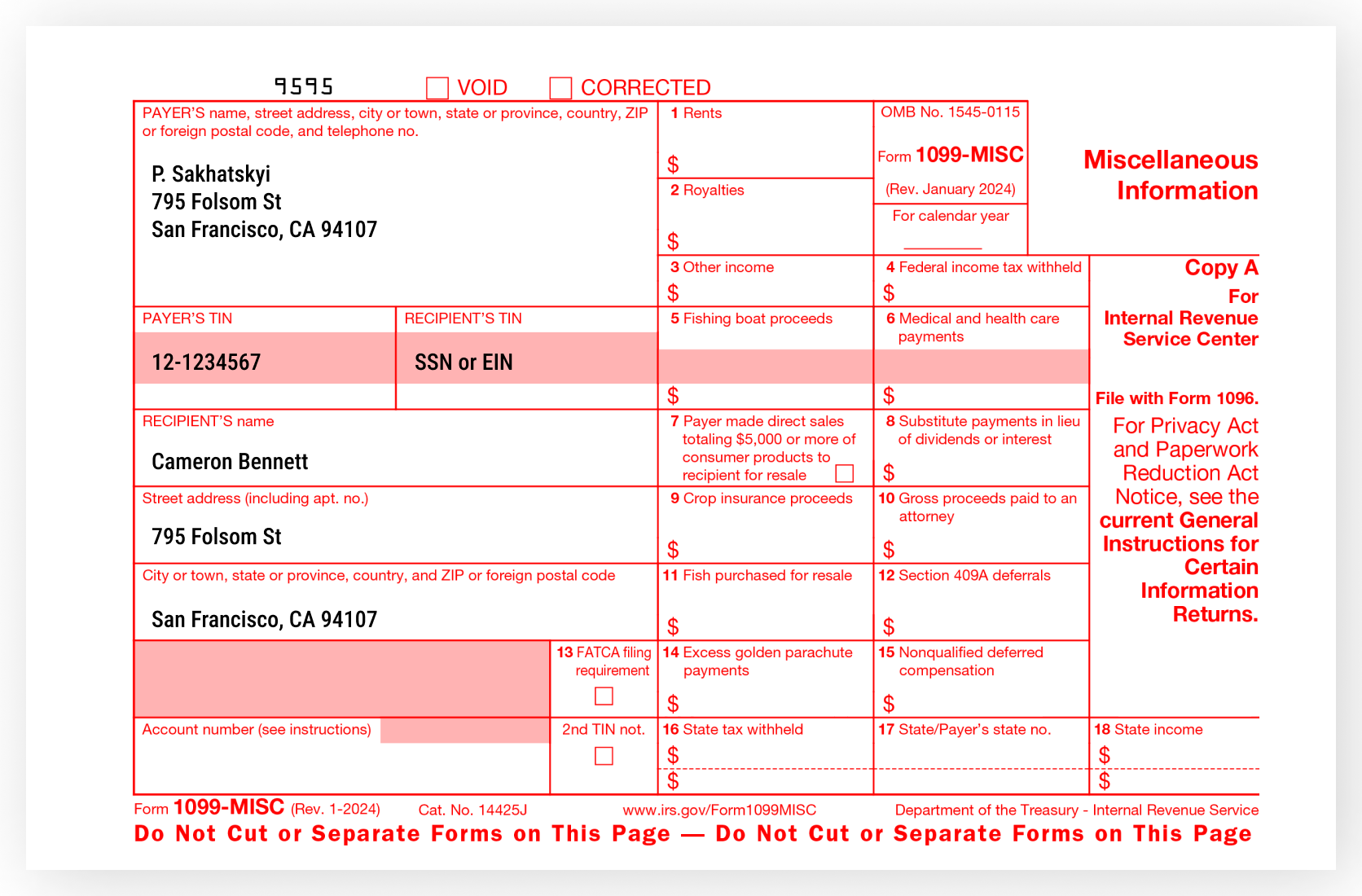

The IRS 1099 form is a crucial document used for reporting various types of income other than salaries, wages, and tips. It is essential for individuals and businesses to accurately report their income to the IRS to avoid penalties and ensure compliance with tax laws. The IRS 1099 Printable Form 2025 is a convenient tool that allows taxpayers to easily fill out and submit their income information.

Whether you are a freelancer, independent contractor, or business owner, you may receive a 1099 form from clients or businesses that have paid you more than $600 in a calendar year. It is important to report this income accurately on your tax return to avoid any discrepancies with the IRS. The IRS 1099 Printable Form 2025 provides a user-friendly platform for individuals and businesses to enter their income information and generate a printable form for submission.

With the IRS 1099 Printable Form 2025, taxpayers can easily input their income details, such as earnings from freelance work, rental income, interest, dividends, and more. The form also allows for the reporting of any taxes withheld, making it easier for taxpayers to calculate their total tax liability. By using this printable form, individuals and businesses can ensure that they are accurately reporting their income and avoiding any potential tax issues.

In addition to being a convenient tool for reporting income, the IRS 1099 Printable Form 2025 also helps taxpayers keep track of their financial records. By documenting income and tax withholdings on the form, individuals and businesses can maintain organized records for future reference. This can be especially helpful during tax season when preparing tax returns and ensuring compliance with IRS regulations.

Overall, the IRS 1099 Printable Form 2025 is a valuable resource for individuals and businesses looking to accurately report their income and stay compliant with tax laws. By utilizing this printable form, taxpayers can streamline the process of reporting income, maintain organized financial records, and avoid potential tax issues. Take advantage of this convenient tool to ensure a smooth tax filing process and peace of mind when it comes to your financial obligations.