Are you a freelancer or independent contractor who received payments of $600 or more for your services during the year? If so, you will likely need to fill out a 1099 Misc form for tax purposes. This form is used to report income earned from sources other than traditional employment, such as freelance work, rental income, or royalties.

It’s important to accurately report all income earned throughout the year to avoid penalties or fines from the IRS. The 1099 Misc form is a crucial document that helps ensure you are compliant with tax laws and regulations.

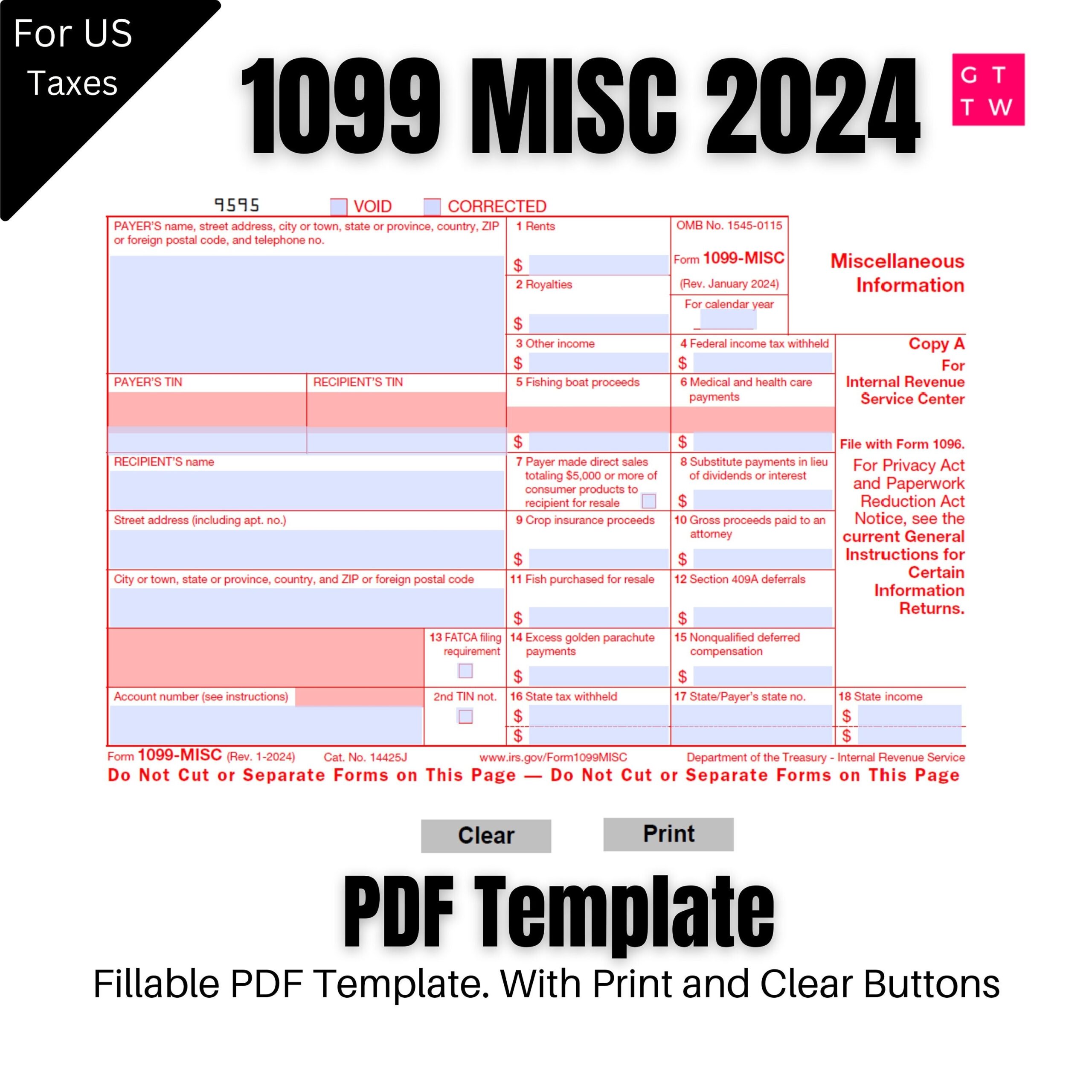

When it comes time to file your taxes, having a printable version of the IRS 1099 Misc form can make the process much easier. You can easily access the form online, fill it out with your income information, and submit it along with your tax return.

Before filling out the form, be sure to gather all necessary information, including your name, address, taxpayer identification number, and the amount of income you received from each source. Double-check your entries to ensure accuracy and avoid any discrepancies that could trigger an audit.

Once you have completed the form, you can either mail it to the IRS or submit it electronically through their website. Be sure to keep a copy of the form for your records and to reference in case of any discrepancies or questions from the IRS.

Overall, the IRS 1099 Misc form is a vital tool for freelancers and independent contractors to accurately report their income and remain compliant with tax laws. By utilizing the printable version of the form, you can streamline the filing process and ensure that you meet all necessary requirements.

Make sure to stay organized and keep detailed records of all income earned throughout the year to make tax time as smooth as possible. With the right tools and information, you can navigate the tax filing process with confidence and peace of mind.