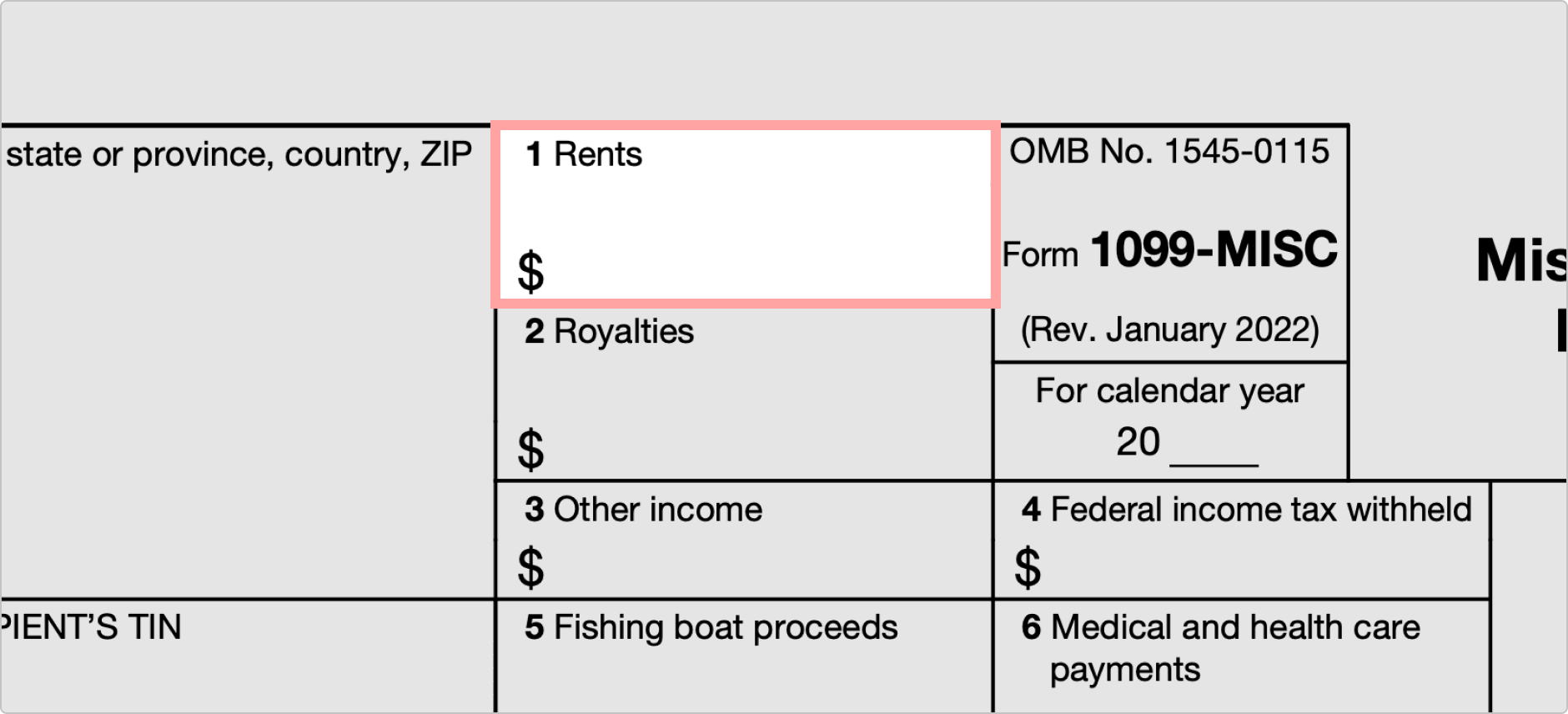

The IRS 1099 form is a crucial document for those who receive certain types of income that are not included on a traditional W-2 form. This form is used to report various types of income such as freelance earnings, rental income, and investment income. It is essential for individuals to accurately report this income to the IRS to avoid any potential penalties or fines.

For those who need to file a 1099 form for the year 2024, the IRS provides a printable PDF download on their website. This downloadable form makes it easy for individuals to fill out the necessary information and submit it to the IRS in a timely manner. It is important to ensure that all information on the form is accurate to avoid any discrepancies with the IRS.

Irs 1099 Form 2024 Printable Pdf Download

Irs 1099 Form 2024 Printable Pdf Download

When downloading the IRS 1099 form for 2024, individuals should make sure they have all the necessary information on hand. This includes their personal information, as well as the payer’s information and the amount of income received. It is also important to double-check all calculations to ensure accuracy before submitting the form to the IRS.

Once the form is completed, individuals can either mail it to the IRS or submit it electronically through their online portal. It is important to keep a copy of the completed form for personal records and to ensure that all information is readily available in case of any inquiries from the IRS.

Overall, the IRS 1099 form for 2024 is a critical document for individuals who receive various types of income outside of traditional employment. By downloading the printable PDF form from the IRS website, individuals can easily report this income and avoid any potential penalties or fines. It is important to accurately fill out the form and submit it in a timely manner to ensure compliance with IRS regulations.

In conclusion, the IRS 1099 form for 2024 is an essential document for individuals who receive non-traditional forms of income. By utilizing the printable PDF download provided by the IRS, individuals can easily report this income and avoid any potential issues with the IRS. It is important to take the time to accurately fill out the form and submit it in a timely manner to ensure compliance with IRS regulations.