As tax season approaches, it’s important for individuals and businesses to be aware of the various forms they may need to file with the IRS. One such form is the 1099, which is used to report income other than wages, salaries, and tips. The IRS 1099 Form 2025 is a crucial document for individuals who have received income from sources such as freelance work, rental income, or investment dividends.

It’s essential to have an accurate and up-to-date version of the IRS 1099 Form 2025 in order to properly report your income to the IRS. The form can be downloaded in PDF format, making it easy to print and fill out. Having a printable version of the form ensures that you can easily access it when needed and have a physical copy for your records.

Irs 1099 Form 2025 Pdf Printable

Irs 1099 Form 2025 Pdf Printable

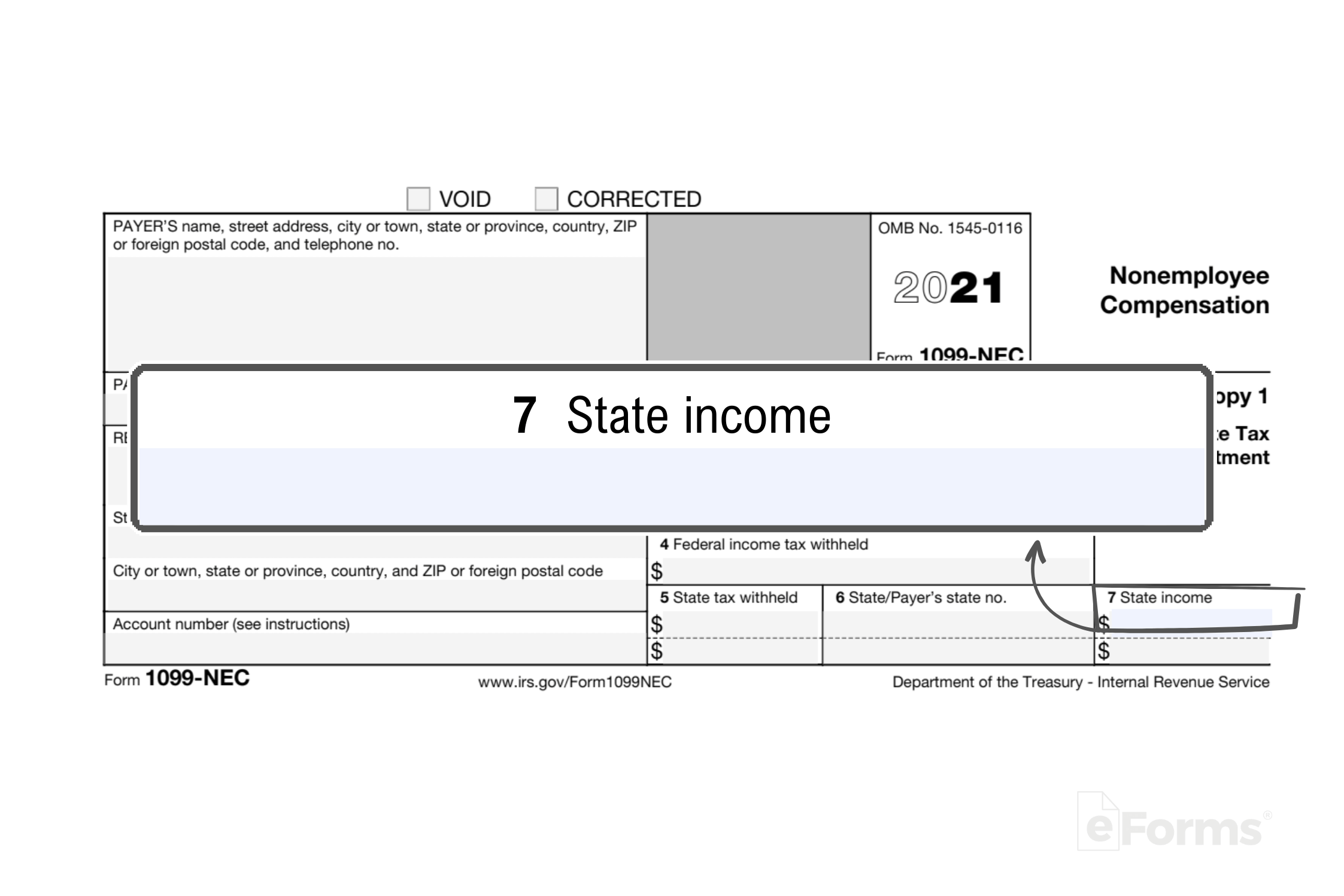

When filling out the IRS 1099 Form 2025, it’s important to provide accurate information about the income you received during the tax year. This includes details such as the amount of income earned, the type of income received, and the payer’s information. Failing to report income accurately can result in penalties from the IRS, so it’s crucial to take the time to fill out the form correctly.

Once you have completed the IRS 1099 Form 2025, you can submit it to the IRS along with your tax return. The information provided on the form will be used by the IRS to verify your income and ensure that you have paid the appropriate amount of taxes. By submitting the form in a timely manner, you can avoid potential penalties and ensure that your tax return is processed efficiently.

In conclusion, the IRS 1099 Form 2025 is a vital document for individuals and businesses who have received income from sources other than wages. By downloading the form in PDF format and printing it out, you can easily fill it out and submit it to the IRS. Providing accurate information on the form is essential for avoiding penalties and ensuring that your tax return is processed properly.