As tax season approaches, many individuals and businesses are gearing up to file their annual tax returns. One important form that may be required is the IRS 1099 Form, used to report various types of income. With the convenience of online resources, taxpayers can easily access and print the necessary forms to fulfill their tax obligations.

For the year 2025, the IRS has made the 1099 Form available for online printing. This allows taxpayers to quickly obtain the form without having to wait for it to be mailed or pick it up in person. By utilizing the online printable version, individuals and businesses can streamline the tax preparation process and ensure they meet the necessary deadlines.

Irs 1099 Form 2025 Online Printable

Irs 1099 Form 2025 Online Printable

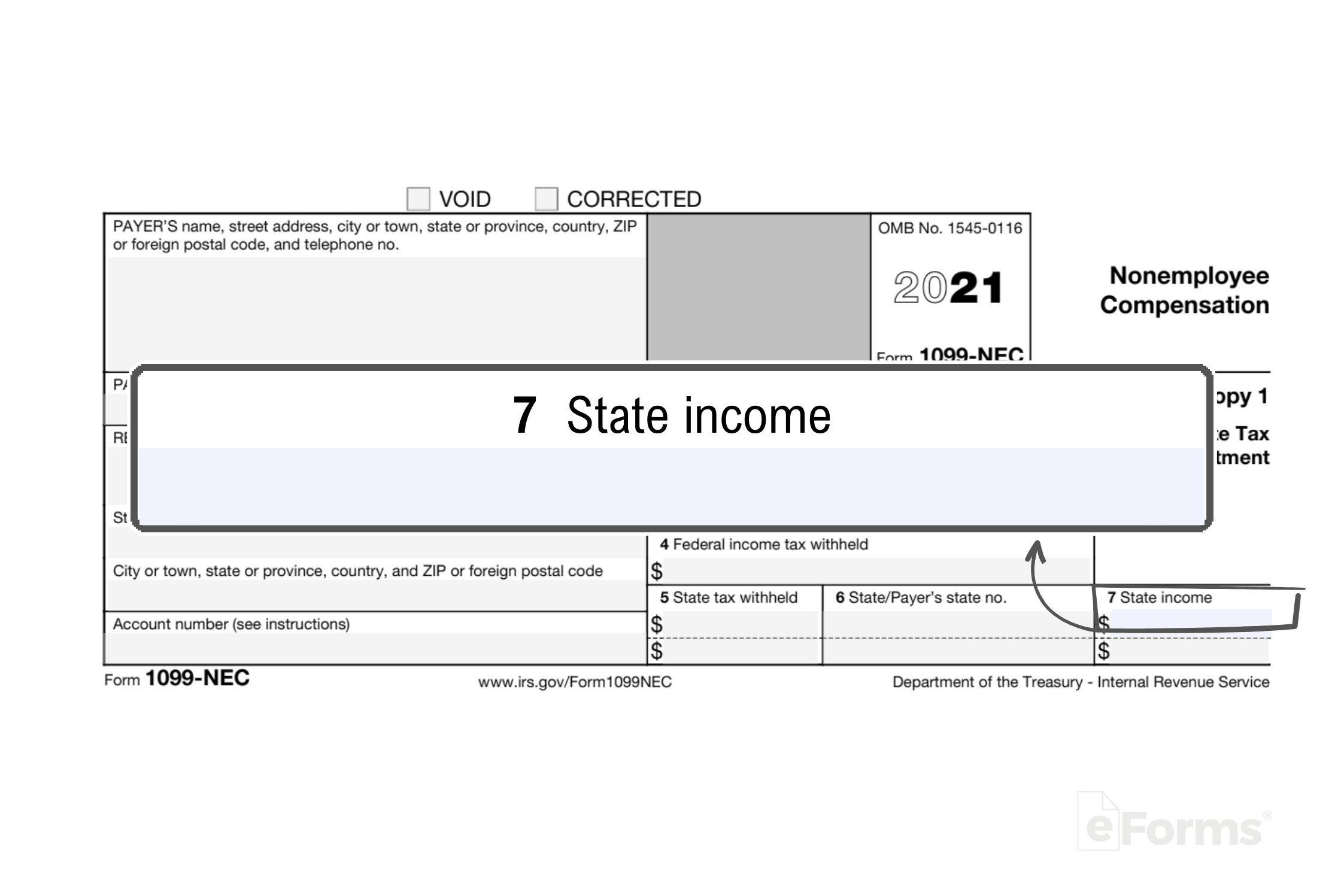

When accessing the IRS 1099 Form 2025 online, taxpayers should ensure they have all the relevant information ready to accurately fill out the form. This may include details about income received, tax identification numbers, and any deductions or credits that apply. By being organized and thorough, individuals can avoid errors or delays in their tax filing.

In addition to printing the form, taxpayers can also utilize online resources to learn more about the IRS 1099 Form and how it pertains to their specific tax situation. There are numerous guides and tutorials available to help individuals navigate the complexities of tax reporting and ensure they are in compliance with the law.

Overall, the availability of the IRS 1099 Form 2025 online printable version offers a convenient and efficient option for taxpayers to fulfill their tax obligations. By taking advantage of this resource, individuals and businesses can easily access the necessary forms and information needed to accurately report their income and comply with tax laws.

As tax season approaches, individuals and businesses can benefit from utilizing the IRS 1099 Form 2025 online printable option to streamline their tax preparation process. By accessing the form online, taxpayers can conveniently obtain the necessary documents and information to accurately report their income and fulfill their tax obligations.