As tax season approaches, it’s important to be aware of the necessary forms you may need to file your taxes accurately. One such form is the IRS 1099 form, which is used to report various types of income other than wages, salaries, and tips. For the year 2025, the IRS has made available the printable version of the 1099 form to make it easier for taxpayers to report their income.

Whether you are a freelancer, independent contractor, or receive income from sources other than traditional employment, you may need to file a 1099 form. This form is essential for accurately reporting income to the IRS and avoiding any potential penalties for underreporting. The printable version of the form for the year 2025 can be easily accessed and filled out online, making the process more convenient for taxpayers.

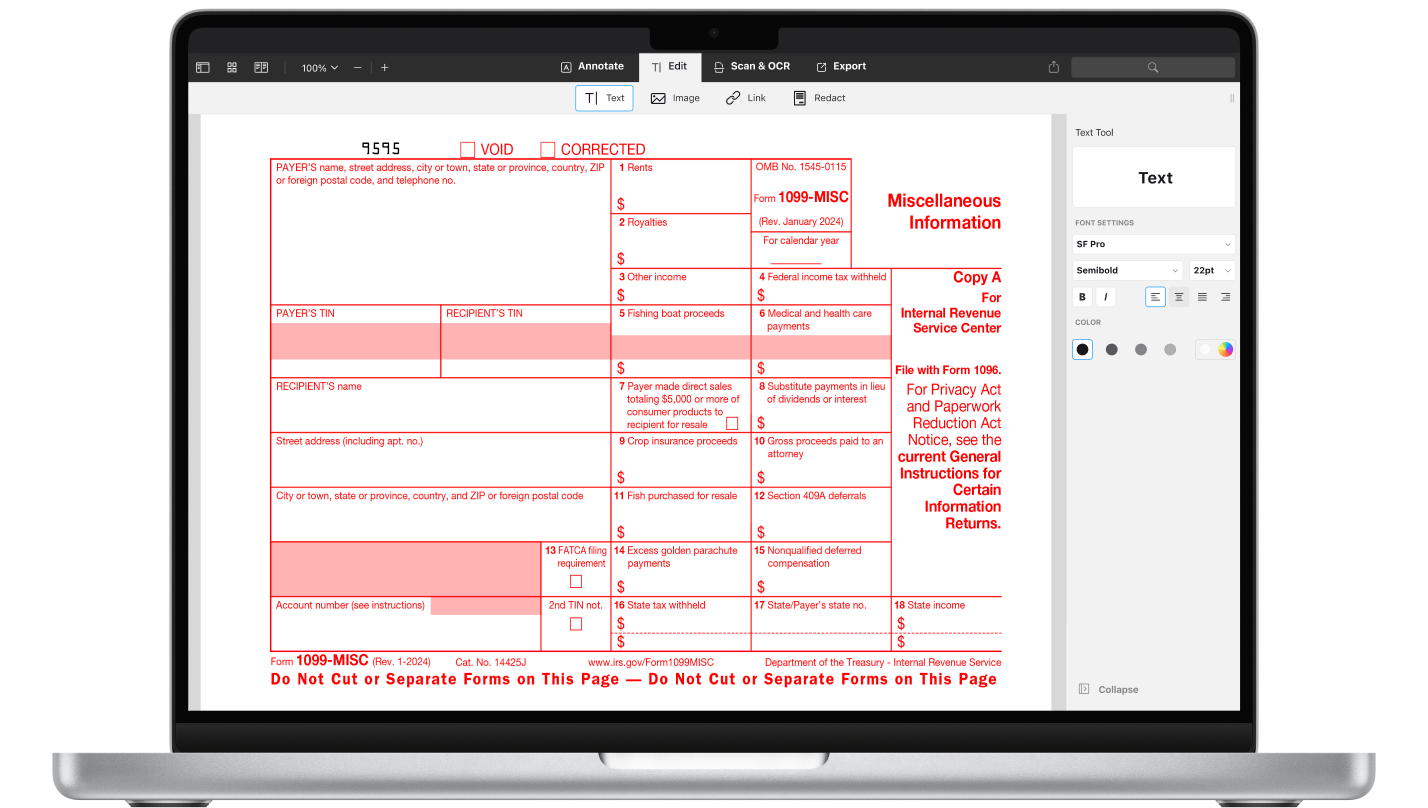

When filling out the IRS 1099 form for 2025, it’s important to ensure that all the information is entered correctly to avoid any discrepancies in your tax return. You will need to provide details such as your name, address, taxpayer identification number, and the amount of income earned from the specified source. Double-checking your entries and reviewing the form before submission can help prevent any errors that could lead to delays in processing your tax return.

Additionally, it’s crucial to keep accurate records of any income reported on the 1099 form throughout the year. This will make it easier to complete the form when tax season rolls around and ensure that you are reporting all income sources accurately. By staying organized and maintaining detailed records, you can streamline the tax filing process and potentially reduce the risk of being audited by the IRS.

Overall, the IRS 1099 form for 2025 is a vital document for individuals who receive income from various sources outside of traditional employment. By utilizing the printable version of the form, taxpayers can easily report their income and comply with IRS regulations. Taking the time to accurately fill out the form and keep detailed records can help simplify the tax filing process and ensure that you are meeting your tax obligations.

Make sure to download and fill out the IRS 1099 form 2025 printable version to accurately report your income and stay compliant with tax regulations. By being diligent in completing this form, you can avoid potential penalties and ensure a smooth tax filing process.