The IRS 1040-SR form is designed for individuals who are aged 65 or older. This form allows seniors to report their income, deductions, and credits to determine their tax liability for the year. It is similar to the standard 1040 form, but it includes specific provisions for senior taxpayers.

For the year 2025, the IRS has released a printable version of the 1040-SR form to make it easier for seniors to file their taxes. This form can be filled out manually or electronically, depending on the preference of the taxpayer. It is important for seniors to carefully review the instructions and requirements for this form to ensure accurate reporting.

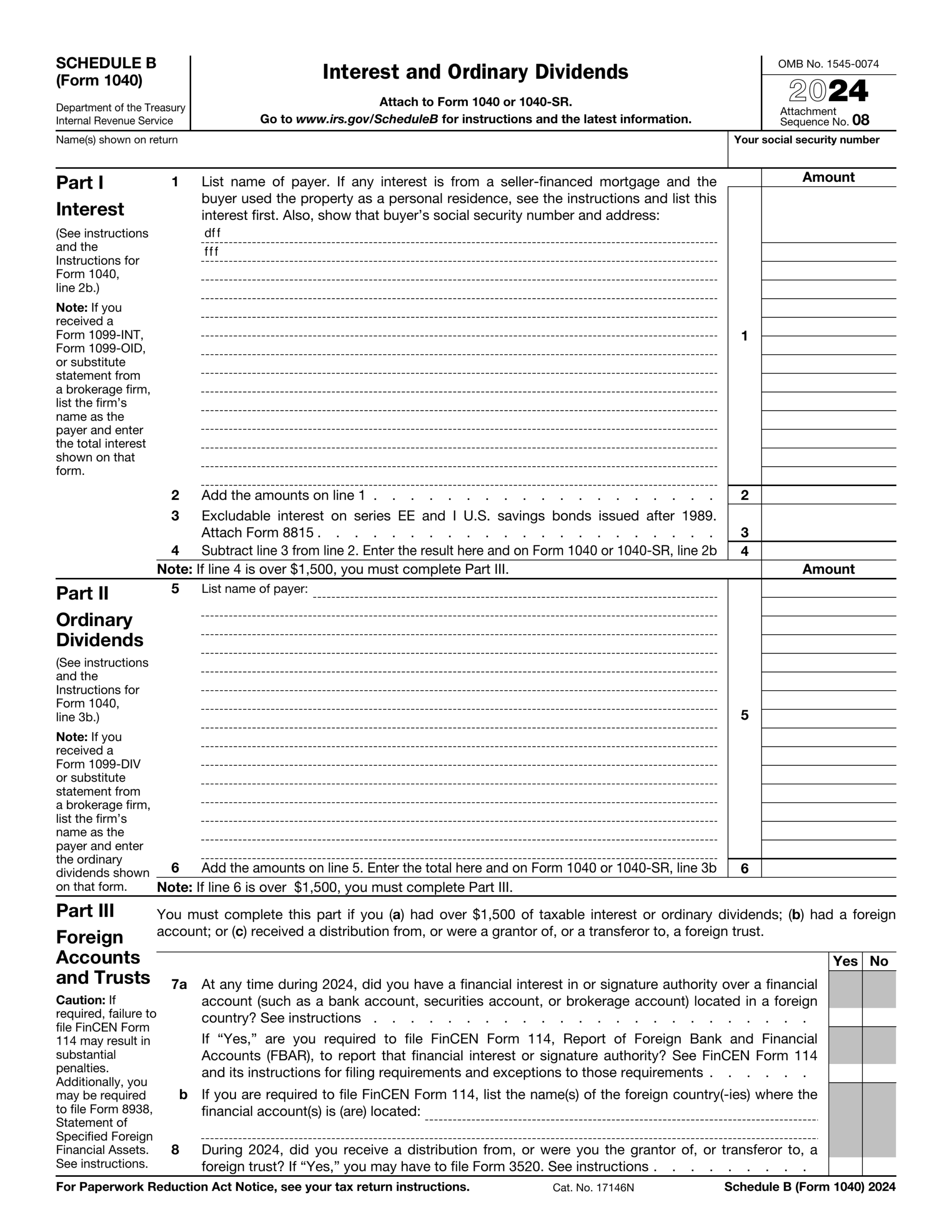

Irs 1040-Sr Form 2025 Printable

Irs 1040-Sr Form 2025 Printable

When completing the IRS 1040-SR form, seniors will need to provide information about their income sources, deductions, and any credits they may be eligible for. This form is used to calculate the amount of tax owed or the refund due to the taxpayer. Seniors should gather all necessary documents, such as W-2s, 1099s, and receipts, to accurately report their financial information.

It is recommended that seniors consult with a tax professional or use tax preparation software to ensure that they are accurately completing the IRS 1040-SR form. This can help prevent errors and potential audits from the IRS. Additionally, seniors may be eligible for certain tax breaks or credits that they are not aware of, so seeking professional advice can be beneficial.

After completing the IRS 1040-SR form for the year 2025, seniors can file their taxes by the deadline, which is usually April 15th. If additional time is needed, seniors can request an extension to file their taxes later in the year. It is important to file taxes on time to avoid penalties and interest on any unpaid tax liability.

In conclusion, the IRS 1040-SR form for the year 2025 is a valuable tool for seniors to report their income and taxes accurately. By carefully reviewing the instructions and seeking professional advice if needed, seniors can ensure that they are fulfilling their tax obligations in a timely and accurate manner.