Filing taxes can be a daunting task, but with the right resources, it can be made easier. The IRS 1040 Form is a crucial document for individuals to report their income and taxes owed to the government. Understanding the instructions for this form is essential to ensure accuracy in filing.

For the year 2025, the IRS has provided printable instructions for the 1040 Form to assist taxpayers in completing their taxes correctly. These instructions outline the various sections of the form, including income, deductions, credits, and payments. It is important to carefully read through these instructions to avoid any errors or potential audits.

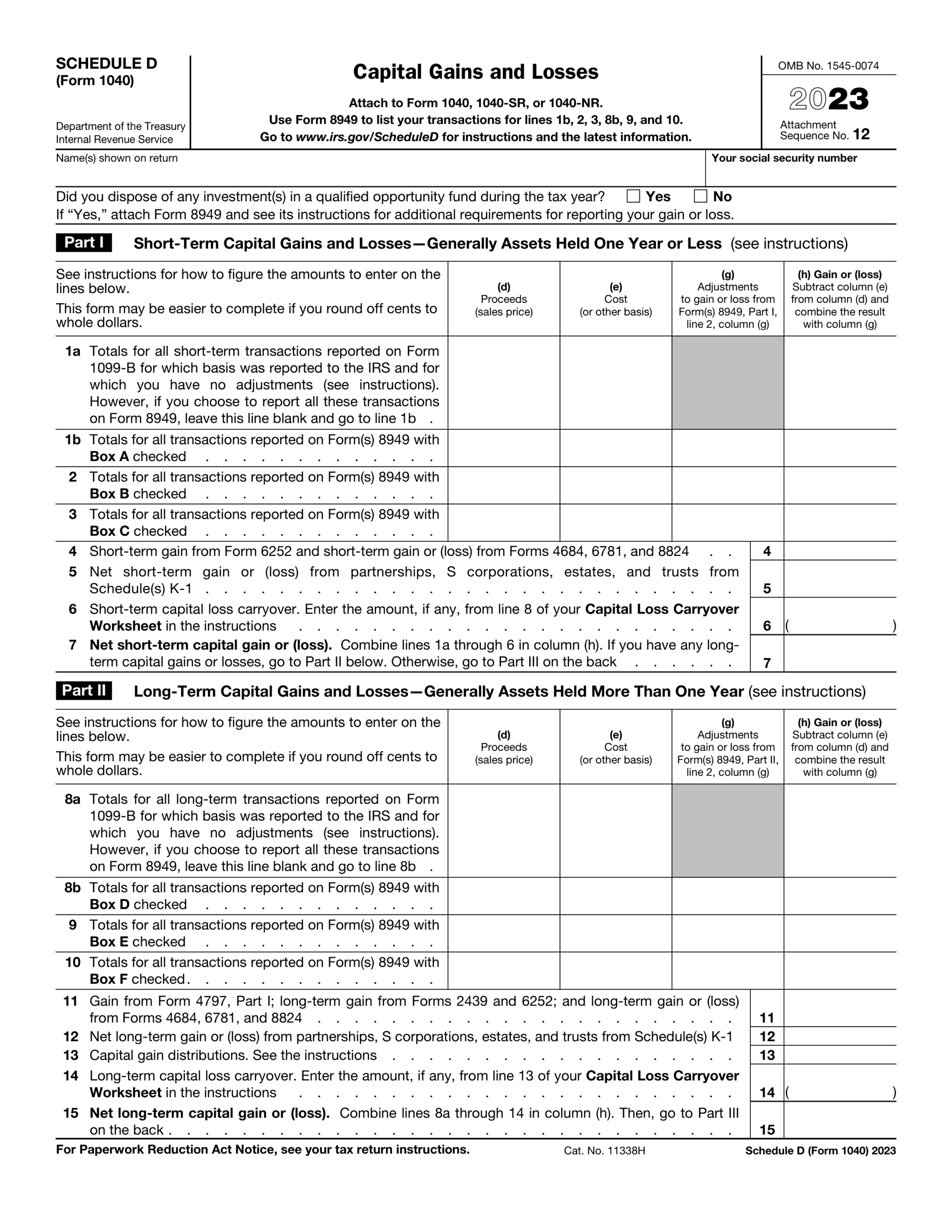

Irs 1040 Form 2025 Instructions Printable

Irs 1040 Form 2025 Instructions Printable

When filling out the 1040 Form, taxpayers must provide accurate information about their income, expenses, and any other relevant financial details. This includes reporting wages, self-employment income, investment earnings, and any other sources of income. Deductions and credits can also be claimed to reduce the amount of tax owed.

The IRS 1040 Form 2025 instructions provide detailed guidance on how to fill out each section of the form correctly. It is important to follow these instructions closely to avoid any mistakes that could lead to penalties or delays in processing your tax return. Additionally, taxpayers can use the printable instructions as a reference guide while completing their taxes.

In conclusion, the IRS 1040 Form 2025 instructions printable are a valuable resource for taxpayers to ensure they accurately report their income and taxes owed. By following these instructions carefully, individuals can avoid potential errors and ensure a smooth tax filing process. Be sure to utilize these instructions when preparing your taxes to stay compliant with IRS regulations.