The IRS 1040 Form is a crucial document for taxpayers in the United States. It is used to report an individual’s annual income and calculate the amount of tax owed to the government. The IRS updates the form annually to reflect any changes in tax laws or regulations.

For the year 2025, taxpayers can expect to see some updates to the IRS 1040 Form. It is important to stay informed about these changes to ensure accurate reporting and compliance with tax laws.

Irs 1040 Form 2025 Printable Pdf

Irs 1040 Form 2025 Printable Pdf

IRS 1040 Form 2025 Printable PDF

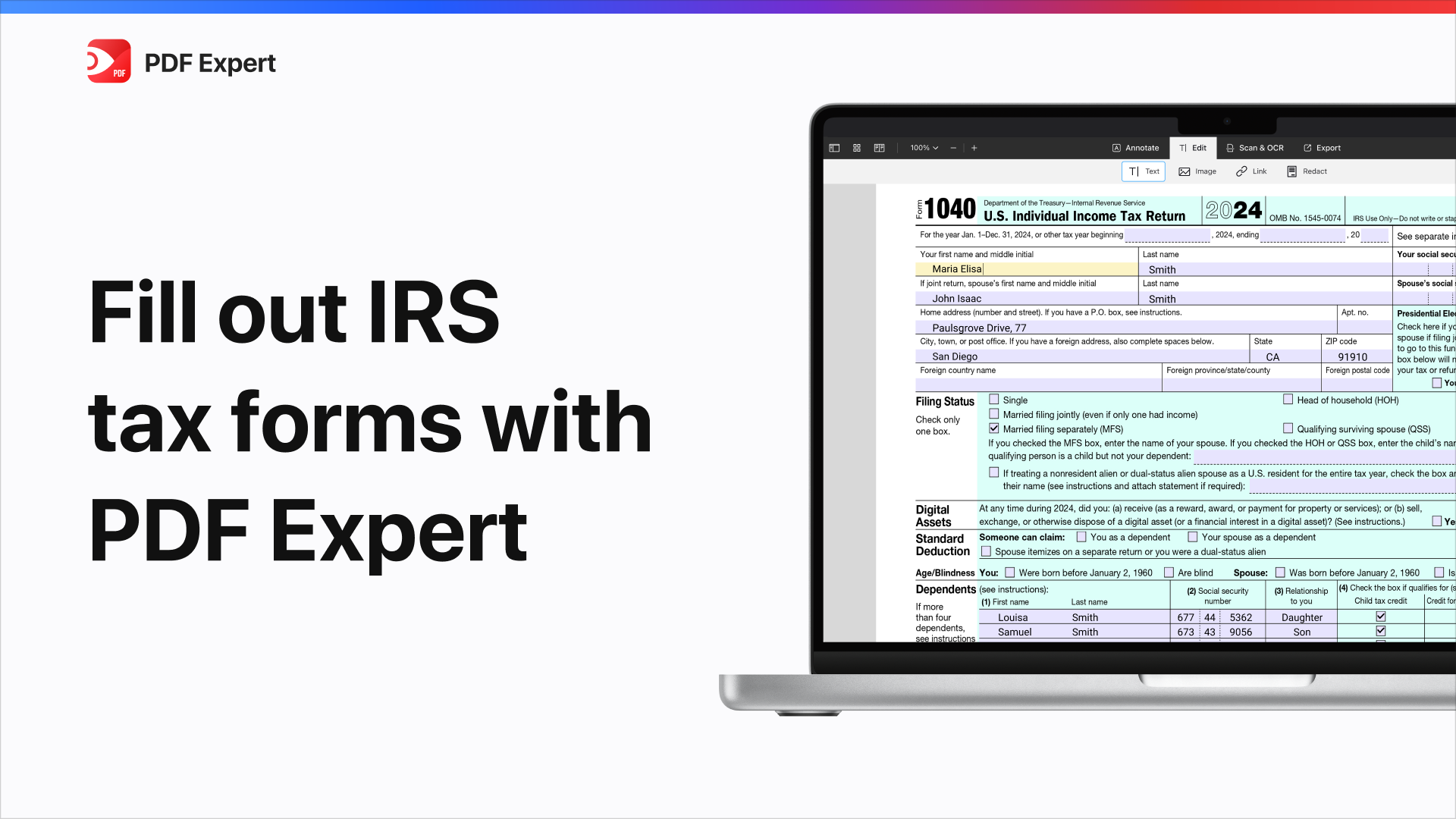

The IRS 1040 Form for 2025 will be available in a printable PDF format for easy access and filing. Taxpayers can download the form from the IRS website or obtain a physical copy from a local tax office. The PDF version allows for convenient printing and filling out by hand, or it can be completed electronically using tax software.

When filling out the IRS 1040 Form for 2025, taxpayers will need to provide information about their income, deductions, credits, and any taxes already paid. It is important to double-check all entries for accuracy and completeness to avoid any errors or delays in processing.

One of the key changes for the 2025 tax year is the updated tax brackets and rates. Taxpayers will need to refer to the updated IRS 1040 Form instructions to determine their tax liability based on their income level. It is important to be aware of any changes to avoid underpaying or overpaying taxes.

In addition to the IRS 1040 Form, taxpayers may also need to file additional forms or schedules depending on their specific financial situation. It is important to review the instructions carefully and gather all necessary documentation to ensure compliance with tax laws.

In conclusion, the IRS 1040 Form for 2025 is an essential document for taxpayers to report their income and calculate their tax liability. By staying informed about any updates or changes to the form, taxpayers can ensure accurate reporting and compliance with tax laws. The printable PDF version of the form makes it easy to access and file, either manually or electronically. Be sure to review the instructions carefully and seek assistance if needed to navigate the tax filing process successfully.