As tax season approaches, it’s important to be prepared with all the necessary forms and documents. One key form that many individuals and businesses need to be aware of is the 1099 IRS Form 2025. This form is used to report various types of income, such as freelance earnings, rental income, and more. It is crucial to have this form filled out correctly to avoid any issues with the IRS.

For those who need to report income that falls under the categories specified by the IRS, the 1099 Form 2025 is essential. This form helps to ensure that individuals and businesses are accurately reporting their income and paying the appropriate amount of taxes. By having this form filled out correctly and submitted on time, you can avoid potential penalties and audits from the IRS.

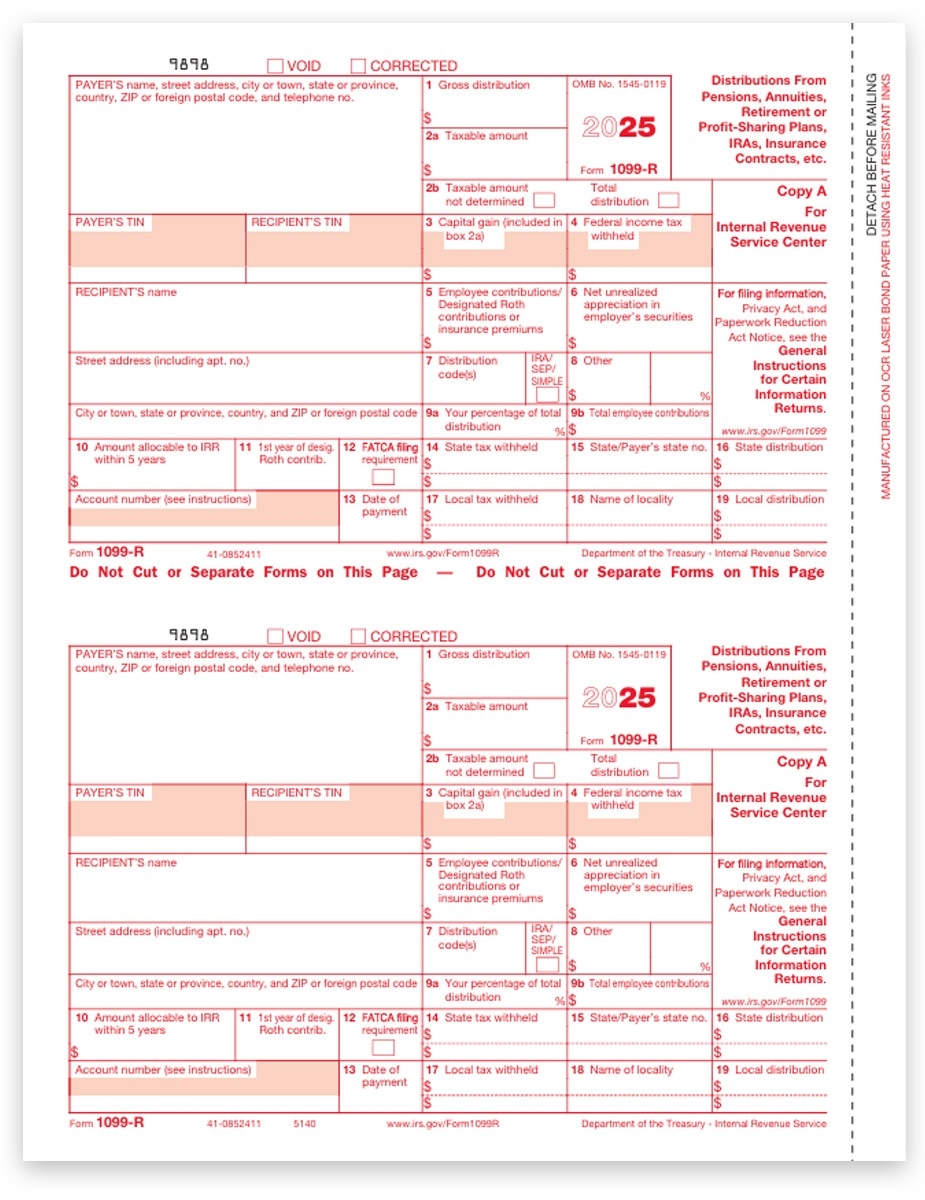

When filling out the 1099 Form 2025, it’s important to gather all the necessary information, such as your name, address, and taxpayer identification number. You will also need to provide details about the income you received, including the amount and the type of income it is. Once you have all the information gathered, you can easily fill out the form and submit it to the IRS.

There are various ways to access the 1099 Form 2025, including online resources and tax preparation software. Many websites offer printable versions of the form, making it easy to fill out and submit. It’s important to double-check all the information on the form before submitting it to ensure accuracy and avoid any potential issues with the IRS.

Overall, the 1099 IRS Form 2025 is a crucial document for reporting various types of income to the IRS. By filling out this form correctly and submitting it on time, you can avoid potential penalties and ensure that you are in compliance with tax laws. Make sure to gather all the necessary information and use reliable resources to access and print the form for a smooth tax season.

As tax season approaches, make sure you are prepared with all the necessary forms, including the 1099 IRS Form 2025. By staying organized and filling out this form accurately, you can ensure a smooth tax filing process and avoid any potential issues with the IRS. Take the time to gather all the information you need and access printable versions of the form to make the process as easy as possible.