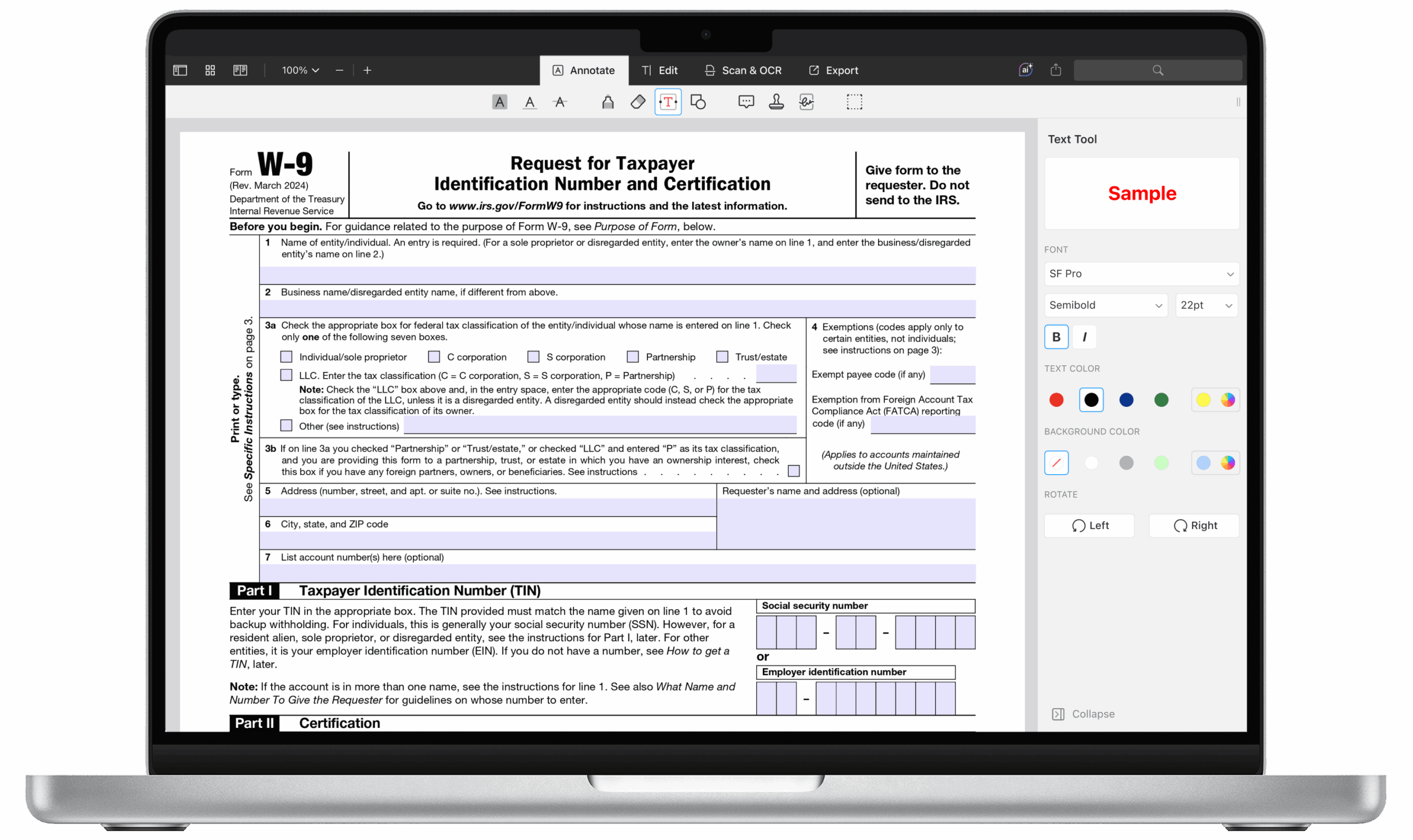

A Printable W-9 Form IRS is a document used by businesses to request information from independent contractors or vendors for tax purposes. The form is provided by the Internal Revenue Service (IRS) and is used to collect the contractor’s taxpayer identification number (TIN) or Social Security number (SSN), as well as other important information.

The Printable W-9 Form IRS is a crucial document for businesses that hire independent contractors or vendors. It helps ensure that the business has accurate information for tax reporting purposes and that the contractor is properly classified as an independent contractor.

When a business hires an independent contractor, they are required to provide them with a W-9 form to fill out. The contractor must include their name, address, TIN or SSN, and certify that the information provided is correct. The business then uses this information to report payments made to the contractor to the IRS.

Having a Printable W-9 Form IRS on hand is essential for businesses to stay compliant with tax laws and avoid penalties for misclassification of workers. It also helps ensure that the business can accurately report payments made to contractors and vendors for tax purposes.

Overall, the Printable W-9 Form IRS is a vital tool for businesses to gather necessary information from independent contractors and vendors for tax reporting purposes. By using this form, businesses can ensure they have accurate information and stay in compliance with IRS regulations.

Conclusion

In conclusion, the Printable W-9 Form IRS is an important document for businesses that hire independent contractors or vendors. By using this form, businesses can collect essential information for tax reporting purposes and stay in compliance with IRS regulations. It is crucial for businesses to have a Printable W-9 Form IRS on hand to ensure they have accurate information and avoid penalties for misclassification of workers.