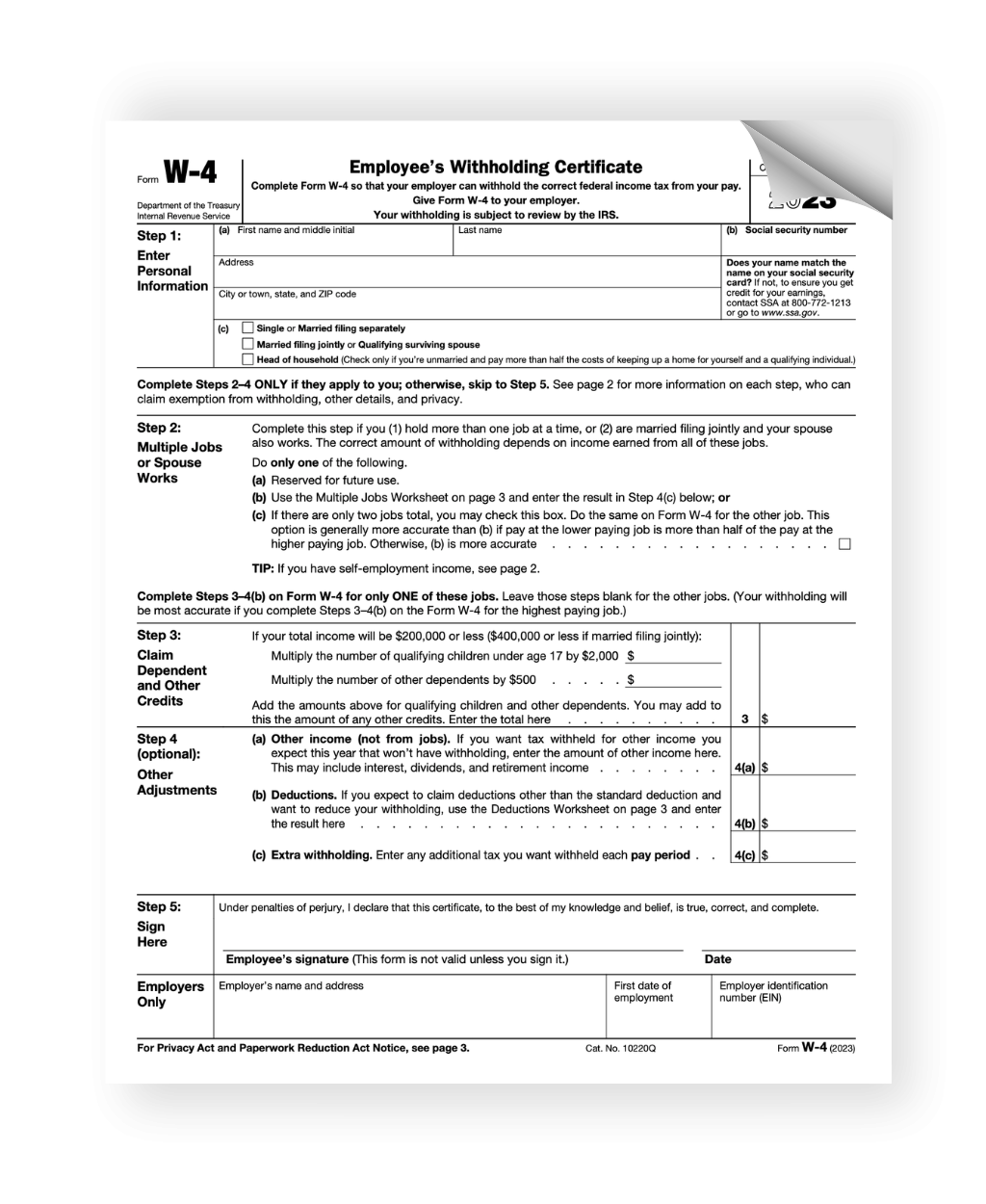

When it comes to filing your taxes, having the necessary forms is crucial. Thankfully, the IRS provides a convenient way to access and print the forms you need right from their website. Irs.gov Printable Forms is a valuable resource for individuals and businesses alike who need to file their taxes accurately and on time.

One of the key benefits of using Irs.gov Printable Forms is the convenience it offers. Instead of having to track down physical copies of forms at a local IRS office or wait for them to be mailed to you, you can simply visit the IRS website and download the forms you need in a matter of minutes. This saves you time and ensures that you have access to the most up-to-date versions of the forms.

Another advantage of using Irs.gov Printable Forms is the ability to fill them out electronically before printing. This can help reduce errors and make the filing process smoother. Additionally, many of the forms come with instructions and guidelines to help you accurately complete them, making the whole process less daunting.

Whether you’re an individual filing a simple tax return or a business owner with more complex tax needs, Irs.gov Printable Forms has a wide range of forms available to meet your requirements. From income tax forms to business tax forms, you can find everything you need in one convenient location.

In addition to providing printable forms, the IRS website also offers resources such as tax calculators, FAQs, and information on tax credits and deductions. This can be helpful for those who are unsure about certain aspects of their taxes and need guidance on how to proceed.

In conclusion, Irs.gov Printable Forms is a valuable tool for anyone who needs to file their taxes. With its convenience, accuracy, and wealth of resources, it’s no wonder why so many individuals and businesses rely on the IRS website for their tax filing needs. So next time you’re getting ready to file your taxes, be sure to check out Irs.gov Printable Forms for all the forms and information you need.