When tax season rolls around, one of the most important things to have on hand are IRS tax forms. These forms are necessary for individuals and businesses to report their income and calculate the amount of taxes owed to the government. While some people prefer to file their taxes electronically, others may still opt for the traditional method of filling out paper forms. For those who fall into the latter category, having printable IRS tax forms can be incredibly convenient.

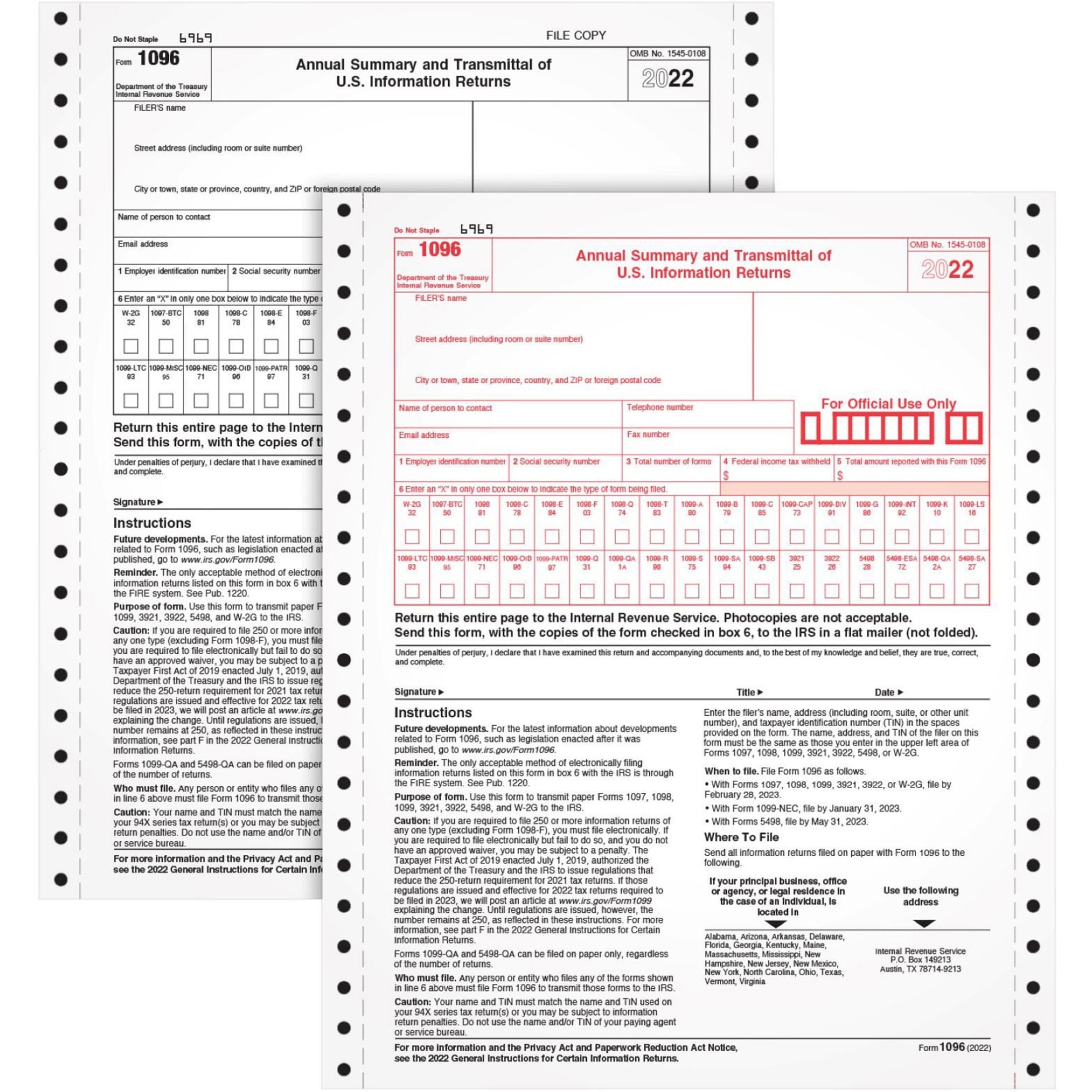

Printable IRS tax forms are readily available on the official IRS website, making it easy for taxpayers to access and download the forms they need. Whether you are looking for Form 1040 for individual income tax returns, Form 941 for employer’s quarterly federal tax return, or any other tax form, you can find them all in printable format online. This allows you to fill out the forms at your own pace and convenience, without having to rush to the post office or wait for forms to arrive in the mail.

One of the benefits of using printable IRS tax forms is the ability to save a copy for your records. By downloading the forms and filling them out on your computer, you can easily save the completed forms as PDF files and store them on your computer or print them out for safekeeping. This can come in handy in case you need to refer back to your tax information in the future or if you are ever audited by the IRS.

Another advantage of printable IRS tax forms is the flexibility they offer. You can work on your tax returns at your own pace, filling out the forms whenever you have free time. Additionally, you can easily make corrections or updates to your forms without having to start over from scratch. This can save you time and frustration, especially if you have a complex tax situation that requires multiple forms to be filled out.

In conclusion, printable IRS tax forms are a convenient and efficient way to file your taxes. Whether you prefer to file your taxes on paper or simply want a backup copy of your tax information, having access to printable forms can make the process much smoother. So next time tax season rolls around, be sure to visit the IRS website and download the forms you need to stay organized and compliant with tax laws.