When tax season rolls around, it’s important to have all the necessary forms in order to file your taxes accurately and on time. The Internal Revenue Service (IRS) provides a variety of printable tax forms on their website for individuals and businesses to use. These forms cover everything from income tax returns to deductions and credits, making it easy for taxpayers to navigate the complex world of taxation.

With the convenience of being able to access and print these forms online, taxpayers can save time and hassle by having everything they need at their fingertips. Whether you’re a first-time filer or a seasoned tax pro, IRS Gov Printable Tax Forms are a valuable resource for ensuring that you are in compliance with federal tax laws.

Irs Gov Printable Tax Forms

One of the most commonly used IRS printable tax forms is the Form 1040, which is used by individuals to report their annual income and calculate their tax liability. This form comes in various versions depending on your filing status and whether you have any additional income or deductions to report.

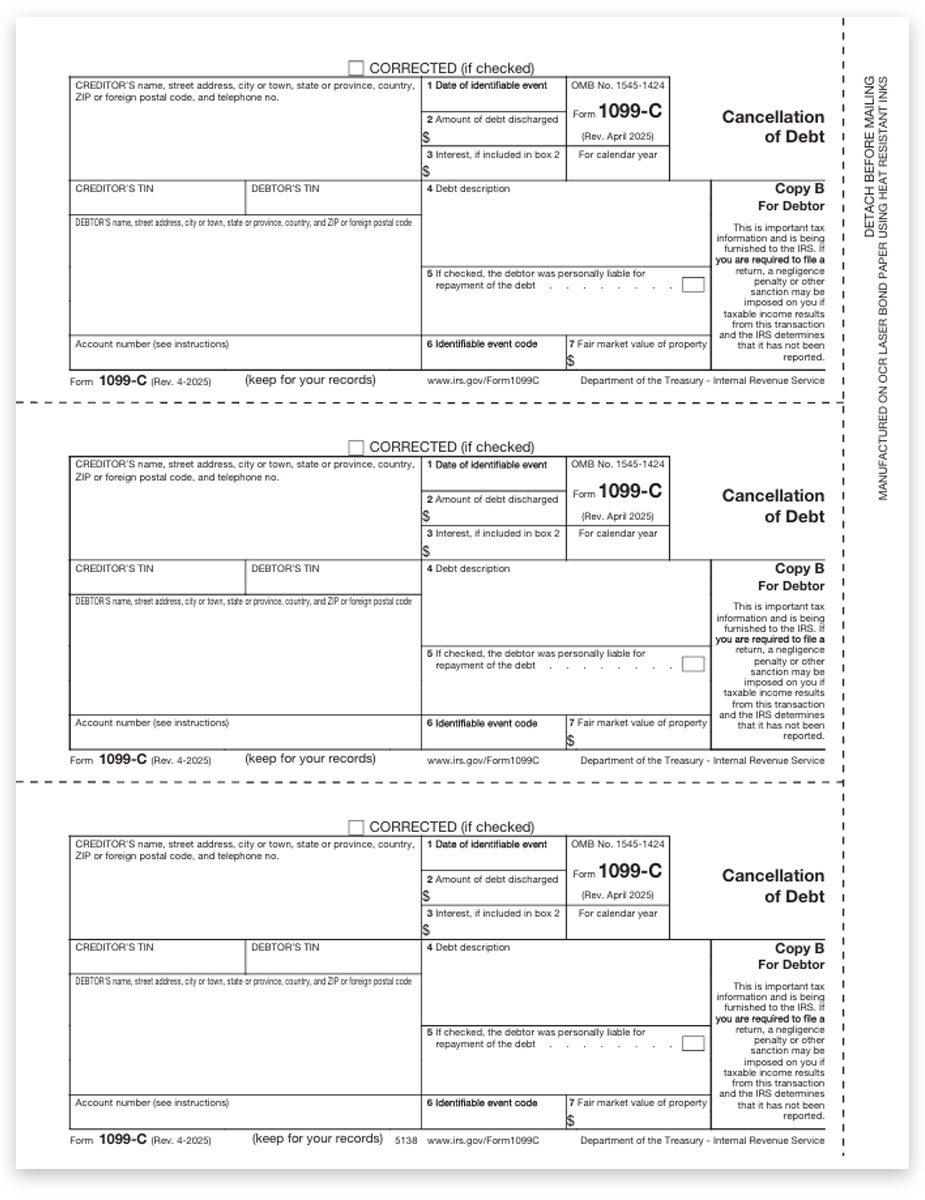

In addition to the Form 1040, there are a multitude of other IRS printable tax forms available for different purposes. For example, Form W-2 is used by employers to report wages paid to employees, while Form 1099 is used to report income from sources other than wages, such as freelance work or investments. There are also forms for claiming deductions and credits, reporting self-employment income, and much more.

It’s important to note that not all taxpayers will need to use every form available on the IRS website. The forms you need will depend on your individual tax situation, so it’s a good idea to familiarize yourself with the different forms and their purposes before filing your taxes.

Overall, IRS Gov Printable Tax Forms are a valuable resource for taxpayers who prefer to file their taxes on paper or who need access to specific forms for their tax situation. By utilizing these forms, taxpayers can ensure that they are accurately reporting their income and deductions and avoiding any potential penalties for non-compliance with tax laws.

So next time you’re getting ready to file your taxes, be sure to check out the IRS website for all the printable tax forms you need to get the job done right.