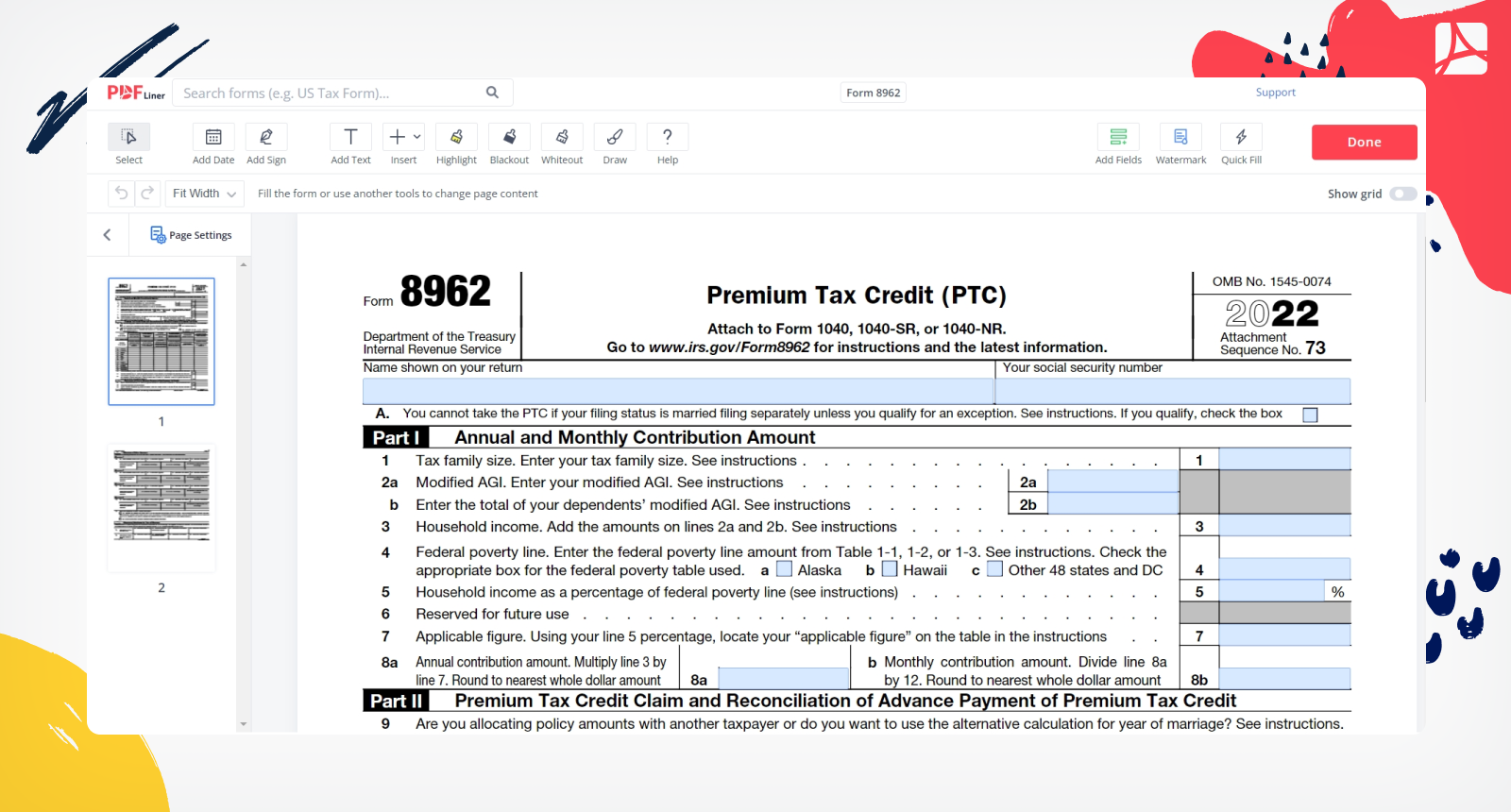

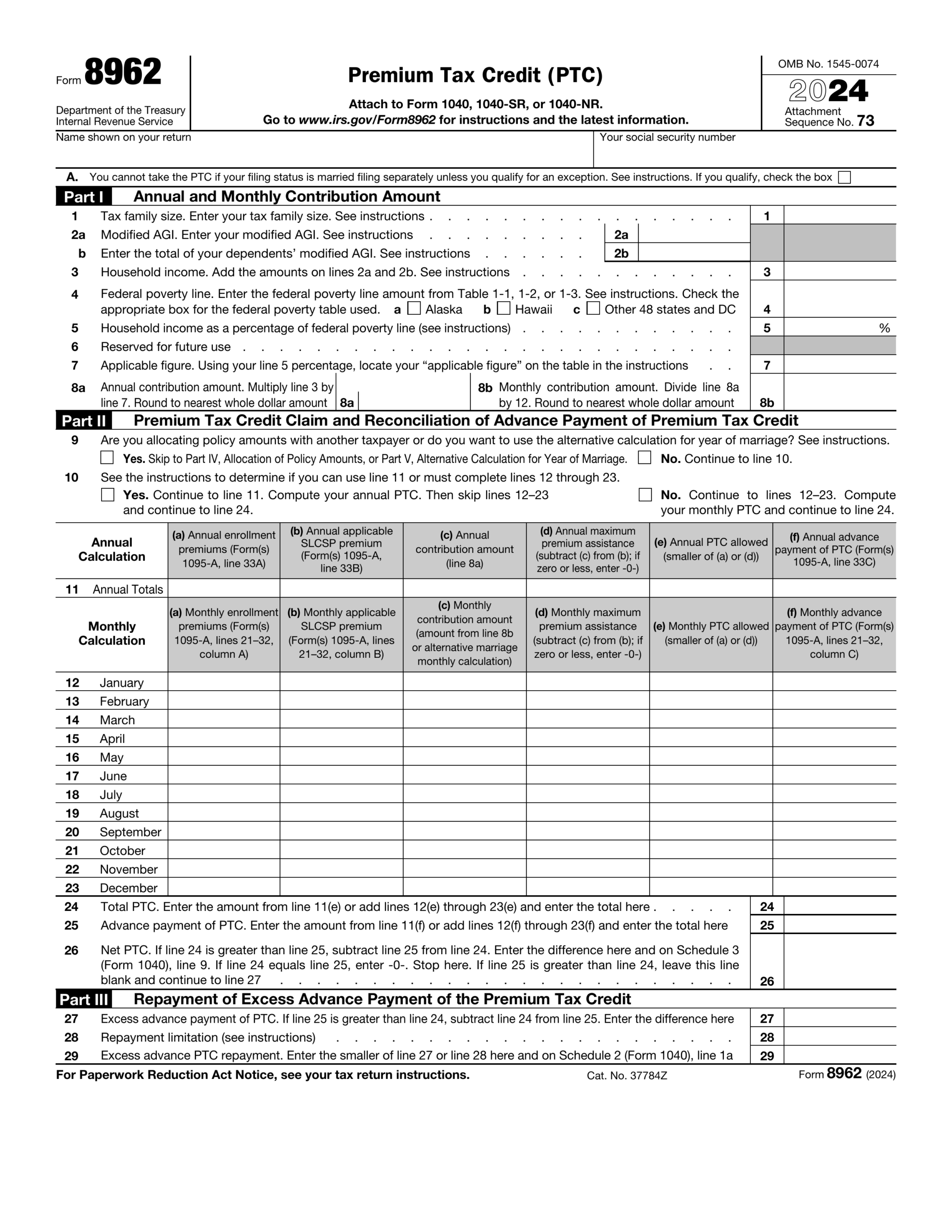

As tax season approaches, it’s important to be aware of the various forms and documents you may need to file your taxes accurately. One such form is IRS Form 8962, which is used to claim the Premium Tax Credit (PTC) for those who have purchased health insurance through the Health Insurance Marketplace. For the year 2025, the IRS has made the Form 8962 printable and available on their website for easy access.

Form 8962 is essential for individuals and families who have received advance payments of the Premium Tax Credit to help lower their monthly insurance premiums. This form reconciles the amount of credit you received in advance with the actual amount you were eligible for based on your income and family size. By filling out Form 8962, you can ensure that you are claiming the correct amount of credit and avoid any potential discrepancies with the IRS.

Irs Form 8962 For 2025 Printable

Irs Form 8962 For 2025 Printable

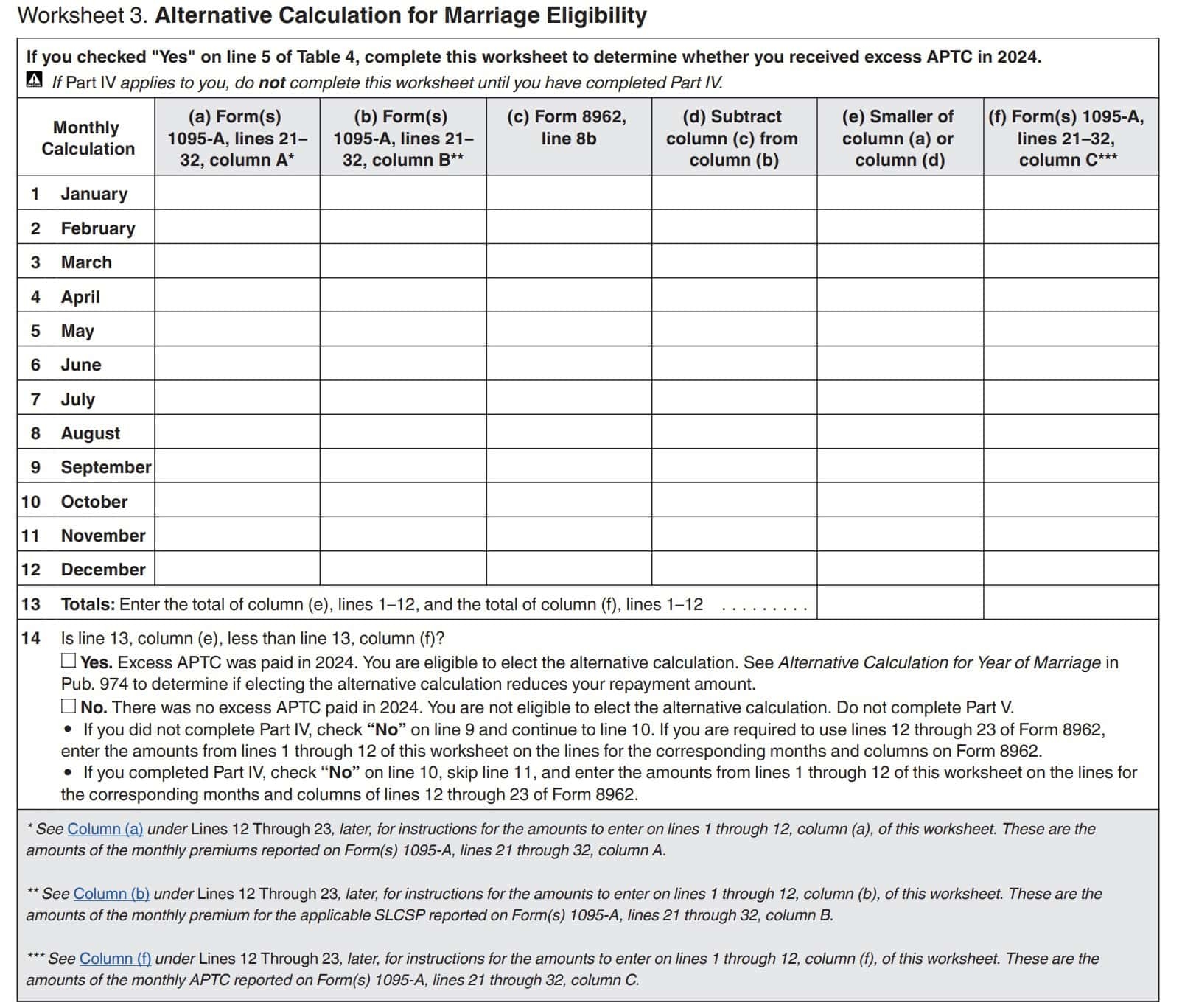

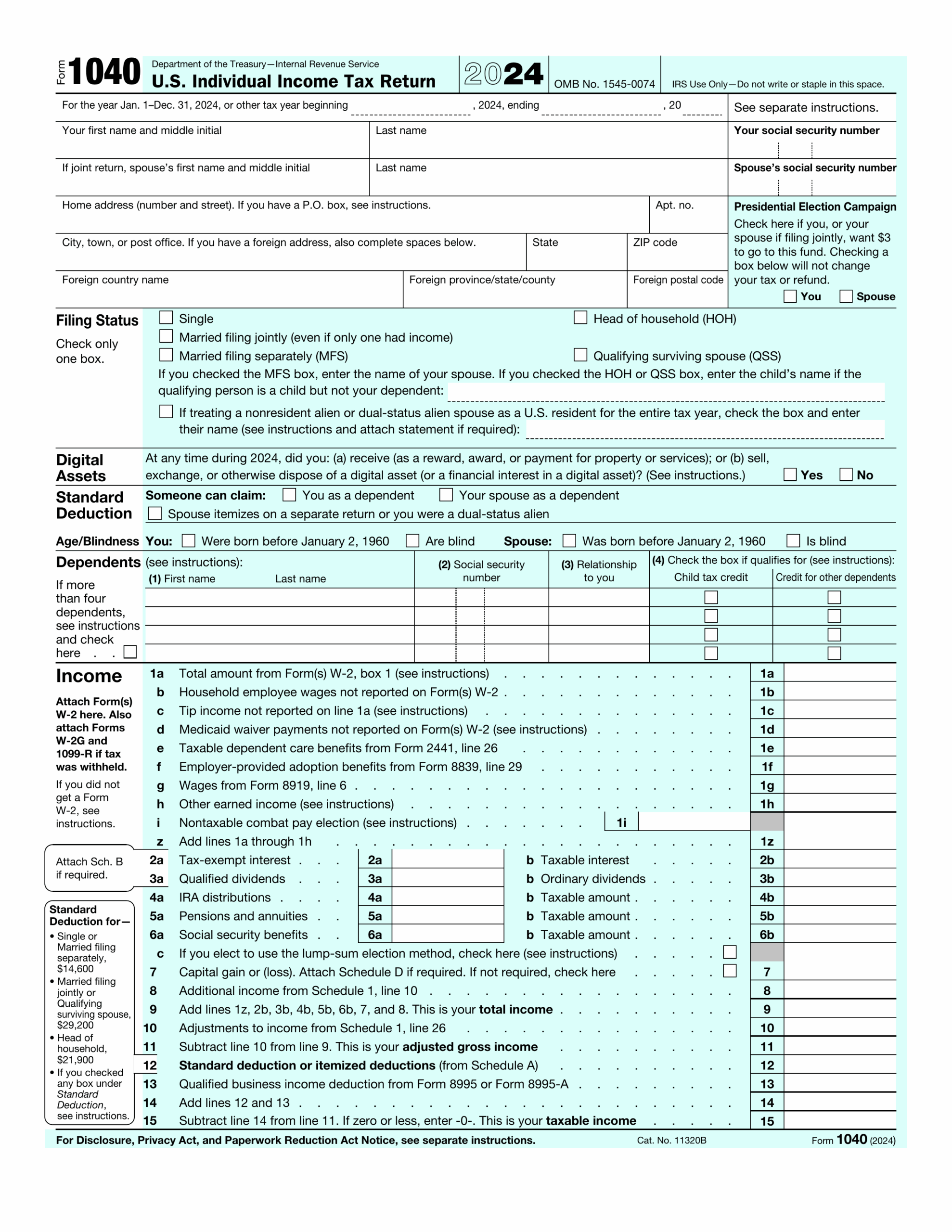

When completing Form 8962 for 2025, you will need to provide information about your household income, the number of individuals in your household, the amount of premium tax credit you received in advance, and any changes in your circumstances that may affect your eligibility for the credit. It’s important to gather all necessary documentation, such as your Form 1095-A from the Marketplace, before filling out the form to ensure accuracy.

After completing Form 8962, you will need to attach it to your tax return when filing with the IRS. The information provided on this form will help determine whether you owe additional taxes or are eligible for a refund based on your Premium Tax Credit eligibility. It’s crucial to double-check your entries and calculations to avoid any errors that could delay the processing of your tax return.

Overall, IRS Form 8962 for 2025 is a vital document for individuals and families who have received advance payments of the Premium Tax Credit. By filling out this form accurately and submitting it along with your tax return, you can ensure that you are claiming the correct amount of credit and avoid any potential issues with the IRS. Be sure to utilize the printable version of Form 8962 provided by the IRS to make the filing process as smooth and efficient as possible.

As tax season approaches, it’s crucial to stay informed about the various forms needed for accurate tax filing. IRS Form 8962 for 2025 is a key document for individuals who have received advance payments of the Premium Tax Credit and should be filled out carefully to avoid any discrepancies with the IRS. Utilize the printable version of Form 8962 available on the IRS website to streamline the filing process and ensure that you are claiming the correct amount of credit.

Download and Print Irs Form 8962 For 2025 Printable

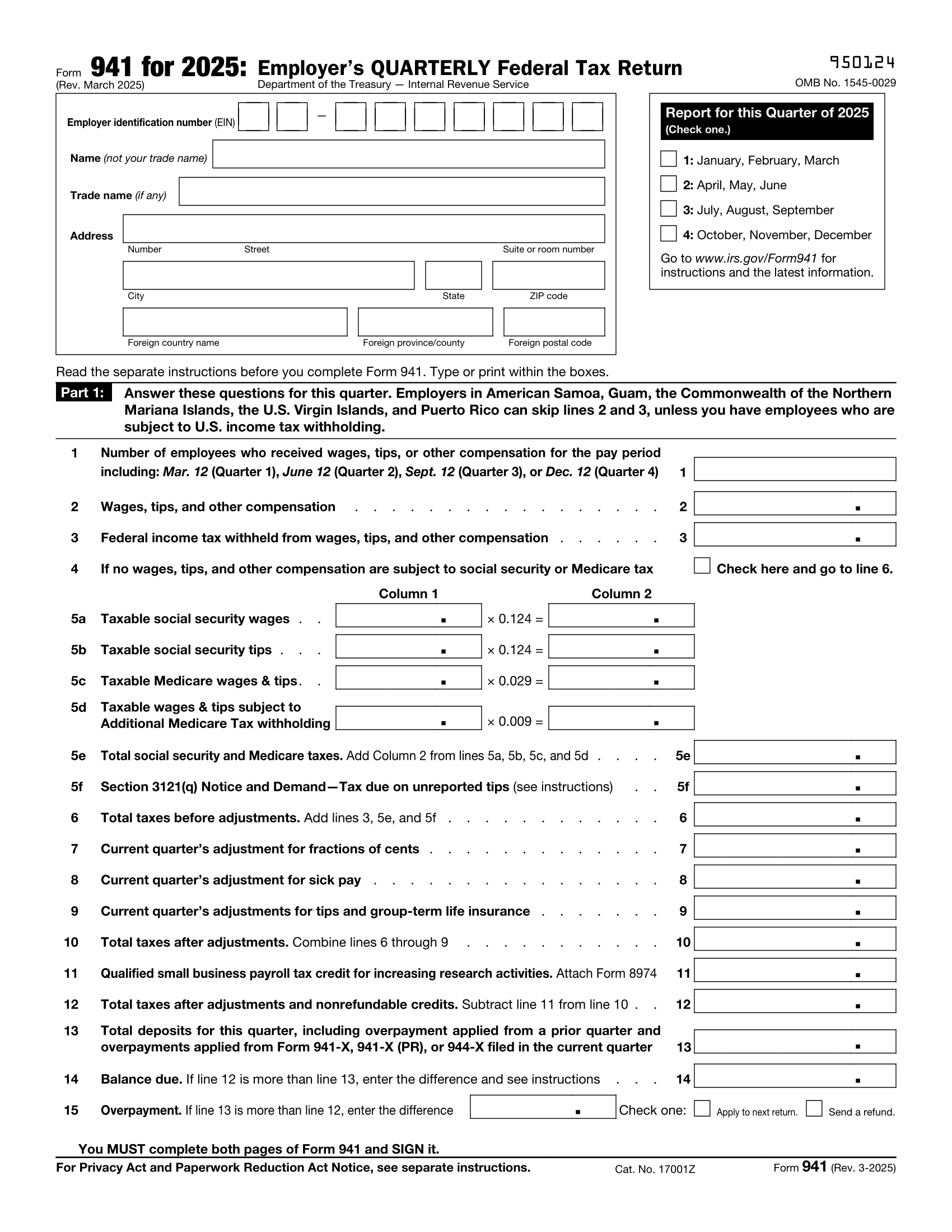

Printable payroll template are ideal for businesses that prefer paper documentation or need hard copies for staff files. Most forms include fields for staff name, date range, total earnings, withholdings, and final salary—making them both complete and user-friendly.

Begin streamlining your payroll system today with a trusted printable payroll form. Save time, reduce errors, and maintain clear records—all while keeping your payroll records clear.

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

How To Get IRS Form 8962 Two Quick Ways

How To Get IRS Form 8962 Two Quick Ways

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

IRS Form 8962 Instructions Premium Tax Credit

IRS Form 8962 Instructions Premium Tax Credit

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

Form 8962 For 2024 2025 Fill Edit And Download PDF Guru

Managing staff wages doesn’t have to be difficult. A printable payroll template offers a quick, dependable, and user-friendly method for tracking salaries, hours, and withholdings—without the need for digital systems.

Whether you’re a small business owner, HR professional, or sole proprietor, using aprintable payroll template helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or type directly into the file before printing.