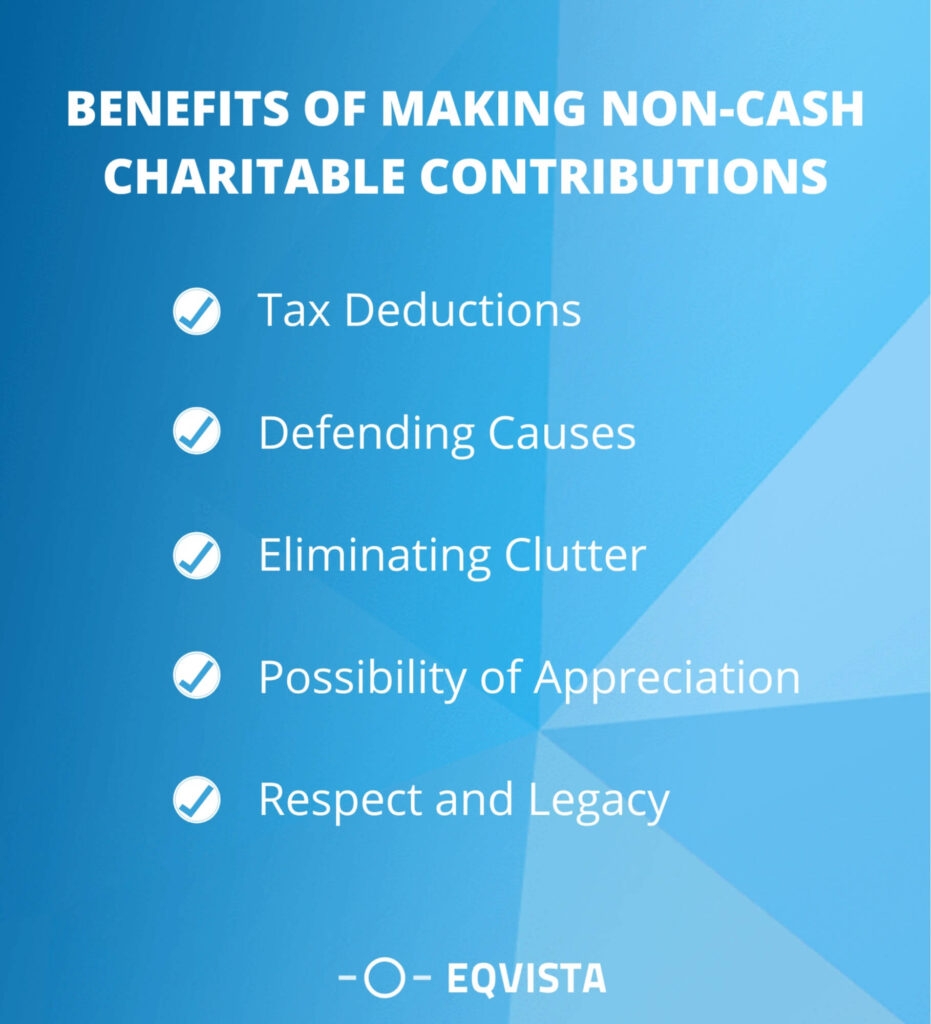

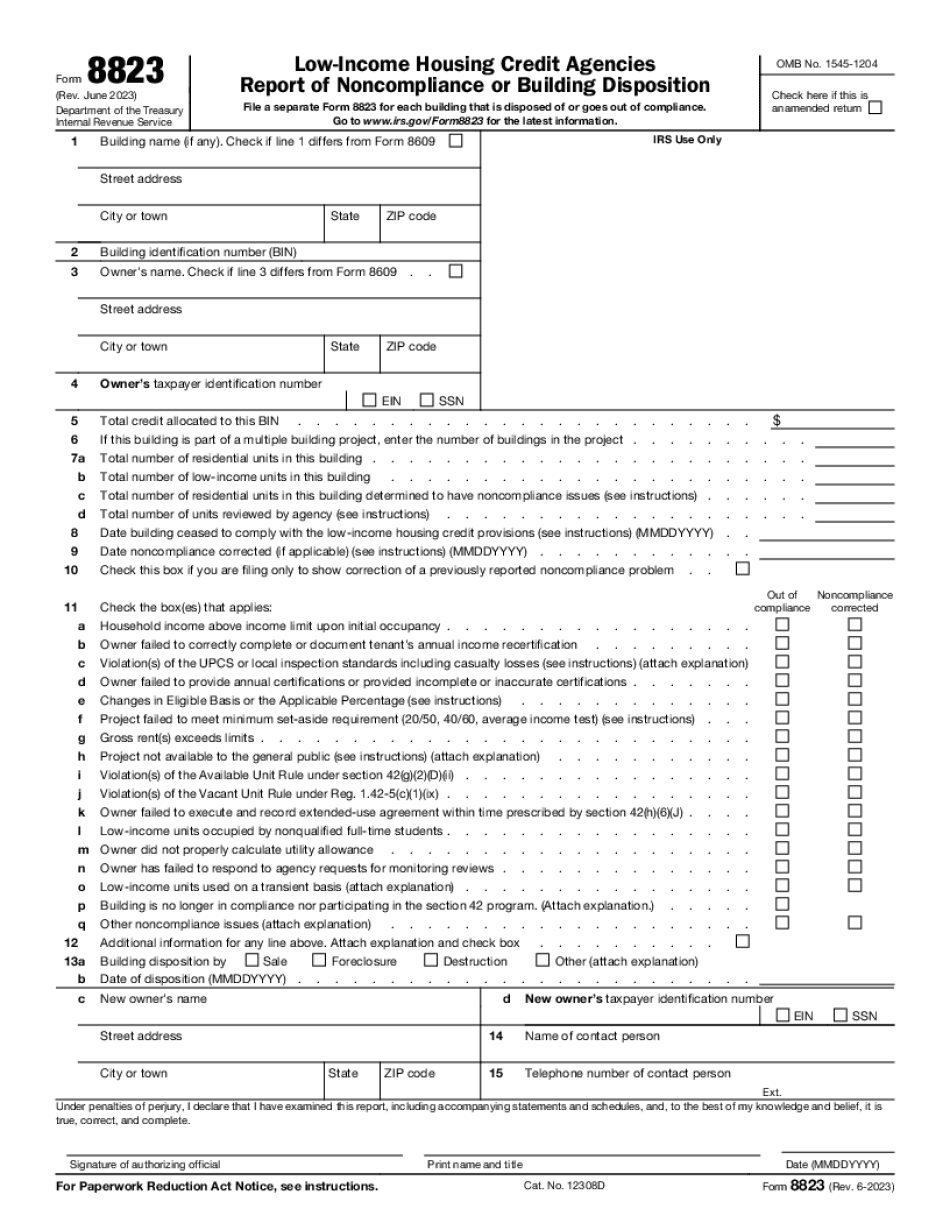

As we approach tax season in 2024, it’s important to familiarize yourself with the various forms and documents that may be required for filing. One such form is the IRS Form 8283, which is used to report noncash charitable contributions. This form is essential for anyone who has made donations of property, such as clothing, furniture, or vehicles, to a qualified charitable organization.

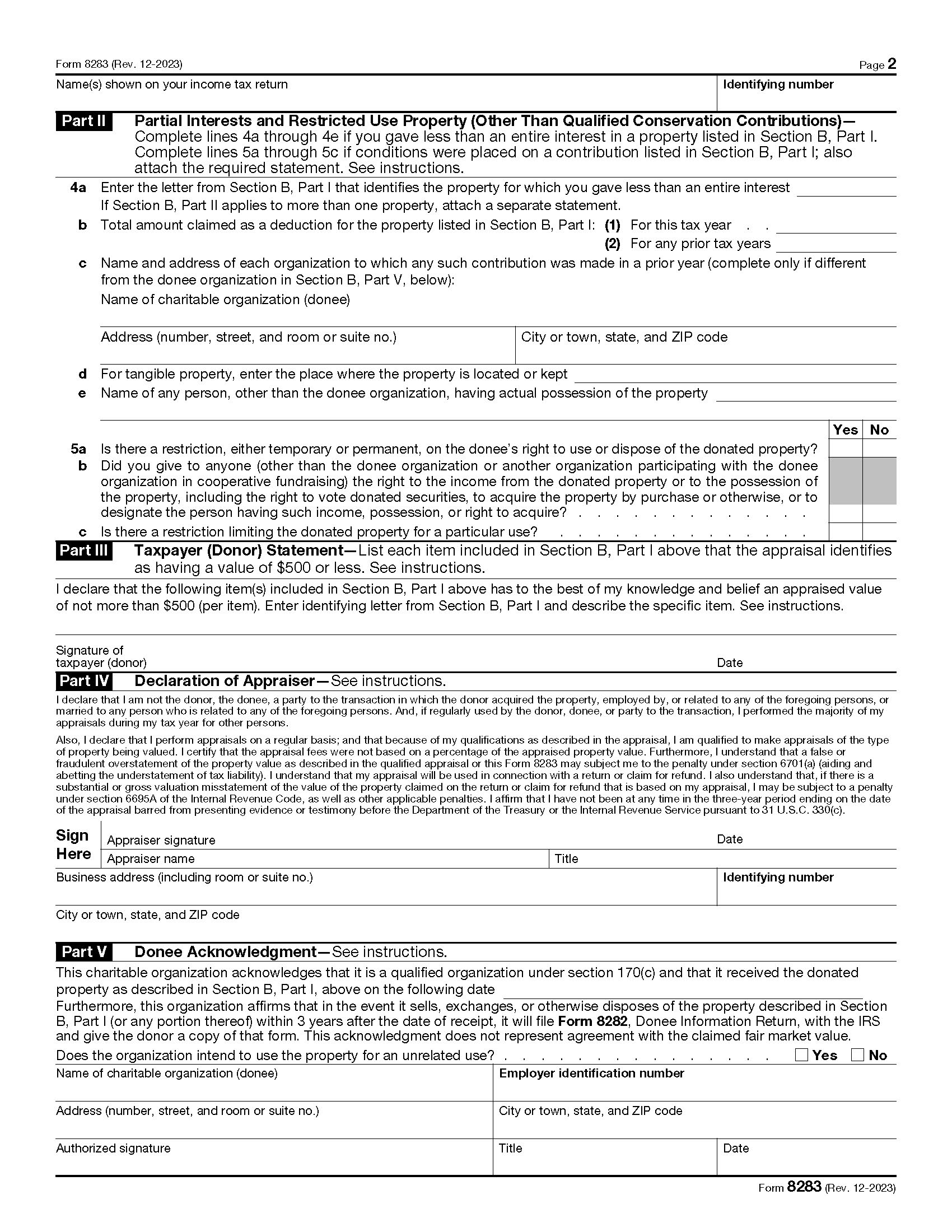

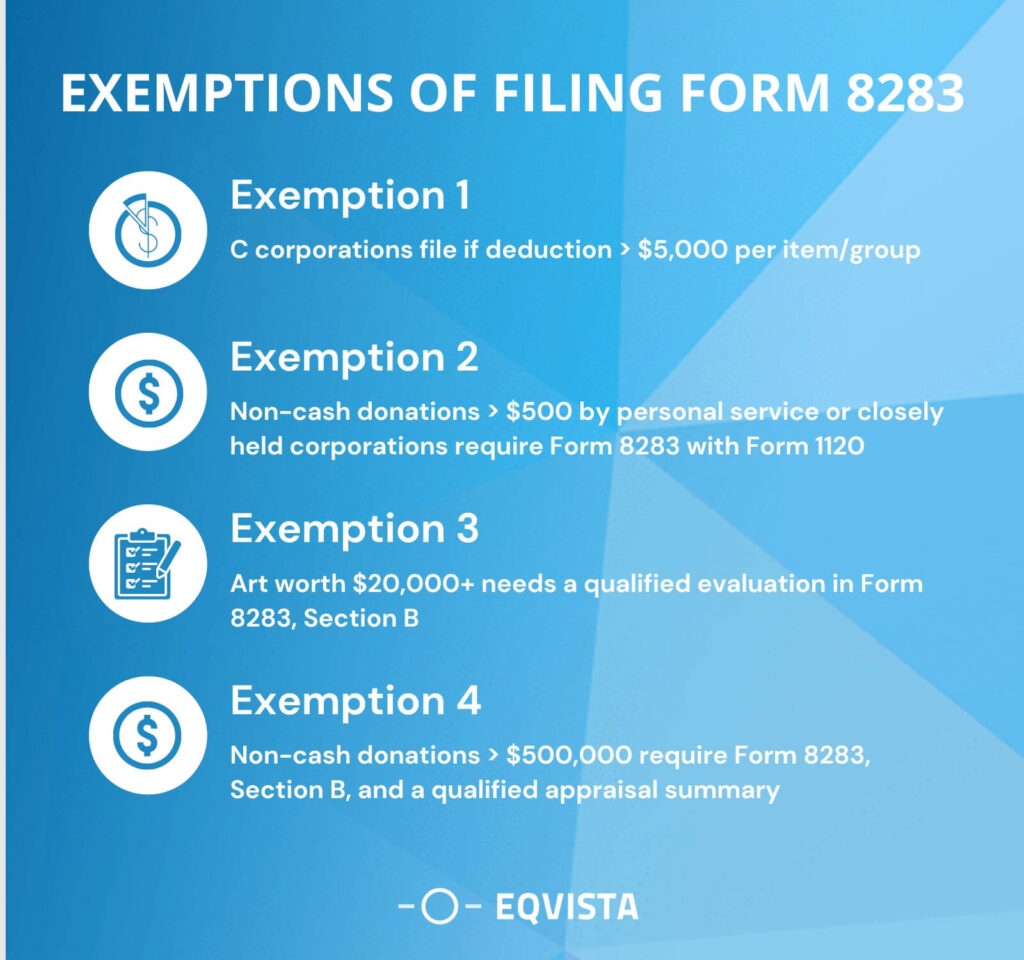

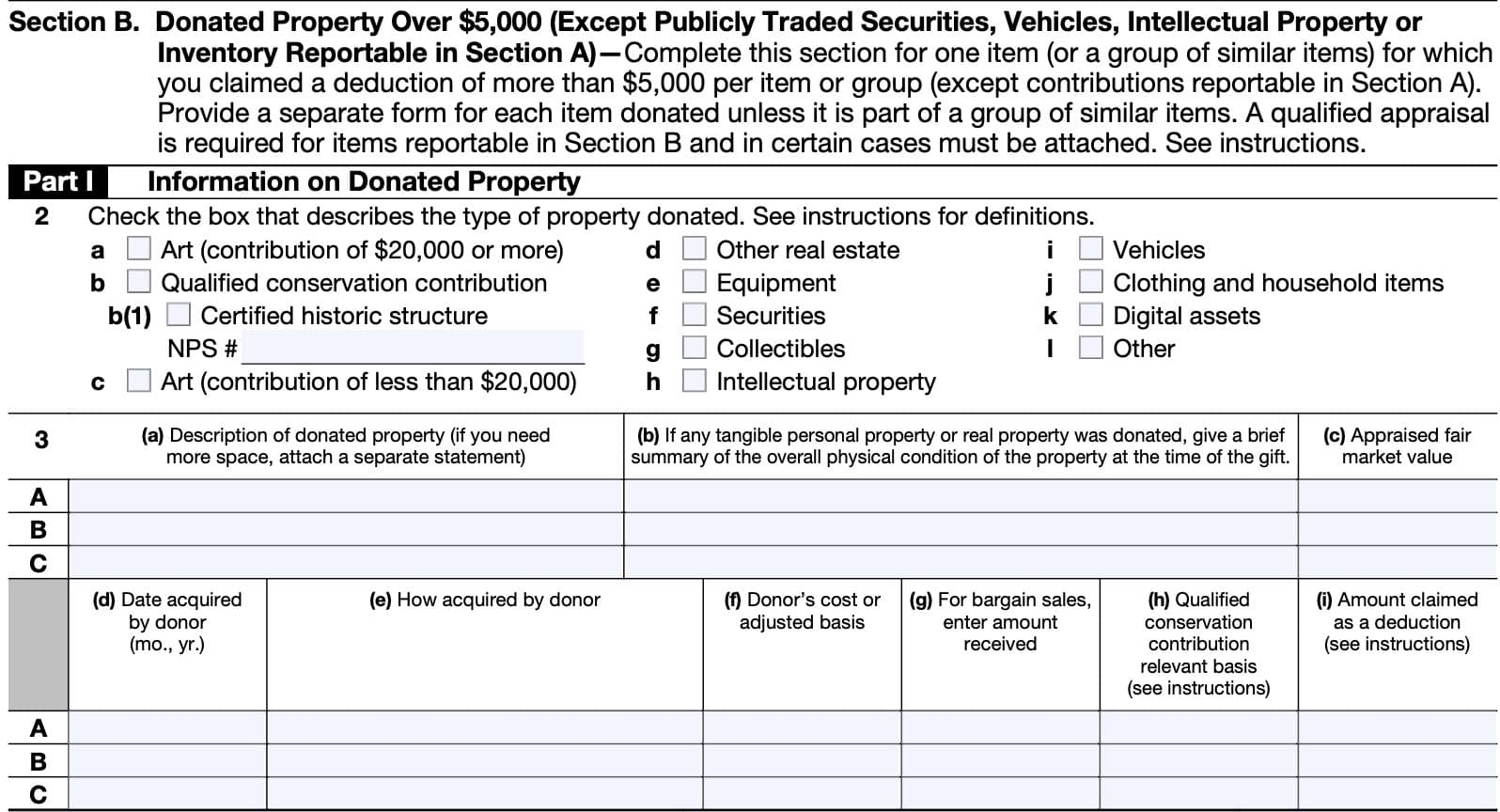

When completing Form 8283 for 2024, it’s crucial to ensure that all the necessary information is accurately provided. This includes details about the donated property, the fair market value of the donation, and the recipient organization. The form must be filed with your tax return if the total deduction for all noncash gifts exceeds $500.

Irs Form 8283 For 2024 Printable

Irs Form 8283 For 2024 Printable

For those looking to access a printable version of IRS Form 8283 for 2024, it can easily be found on the IRS website. Simply navigate to the forms section and search for Form 8283. Once you locate the form, you can download and print it for your records. It’s important to fill out the form neatly and legibly to avoid any delays or complications with your tax return.

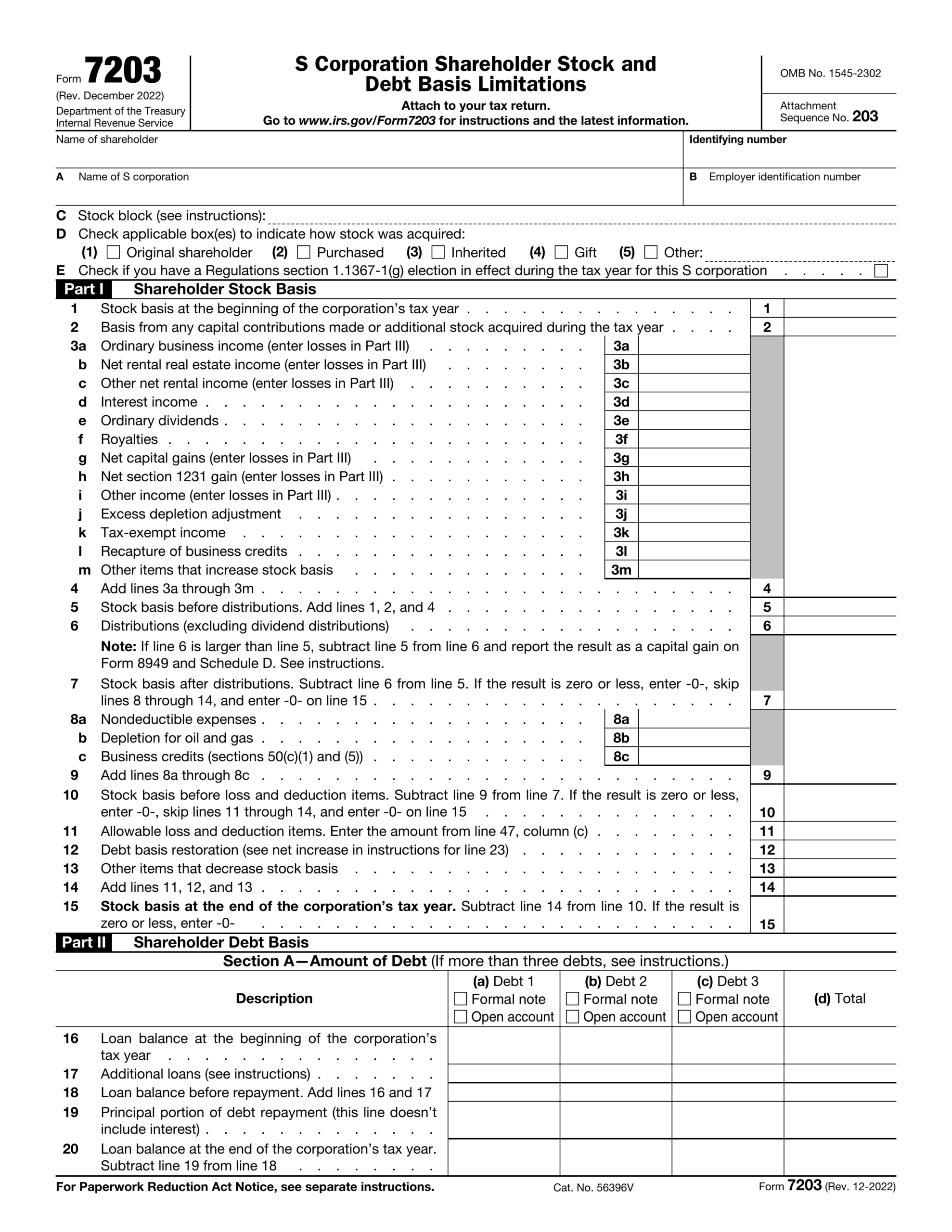

When completing Form 8283, it’s important to keep in mind that there are specific guidelines and requirements that must be followed. For example, if the total deduction for noncash gifts exceeds $5,000, you may be required to obtain a qualified appraisal of the donated property. Failure to comply with these guidelines could result in penalties or potential audit by the IRS.

Overall, IRS Form 8283 for 2024 is a crucial document for anyone who has made noncash charitable contributions during the tax year. By familiarizing yourself with the form and ensuring that it is accurately completed, you can help streamline the tax filing process and potentially maximize your deductions. Be sure to consult with a tax professional if you have any questions or concerns about completing Form 8283.

In conclusion, IRS Form 8283 for 2024 is an essential document for reporting noncash charitable contributions on your tax return. By understanding the requirements and guidelines for completing the form, you can ensure that your donations are properly documented and that you receive the appropriate tax benefits. Remember to keep a copy of the completed form for your records and consult with a tax professional if needed.

Get and Print Irs Form 8283 For 2024 Printable

Payroll template are ideal for businesses that prefer non-digital systems or need printed versions for employee records. Most forms include fields for employee name, pay period, total earnings, withholdings, and net pay—making them both detailed and easy to use.

Take control of your payroll process today with a trusted printable payroll form. Save time, reduce errors, and stay organized—all while keeping your employee payment data clear.

Form 8283 And Non Cash Charitable Contribution Eqvista

Form 8283 And Non Cash Charitable Contribution Eqvista

Fill Form 7203 2024 2025 Create Edit Forms Online

Fill Form 7203 2024 2025 Create Edit Forms Online

Form 8283 Fill Online Printable Fillable Blank

Form 8283 Fill Online Printable Fillable Blank

IRS Form 8283 Instructions Noncash Charitable Contributions

IRS Form 8283 Instructions Noncash Charitable Contributions

Handling staff wages doesn’t have to be complicated. A payroll template offers a fast, reliable, and user-friendly method for tracking wages, work time, and deductions—without the need for digital systems.

Whether you’re a startup founder, payroll manager, or sole proprietor, using aprintable payroll template helps ensure accurate record-keeping. Simply download the template, produce a hard copy, and fill it out by hand or edit it digitally before printing.